Shooting Star Chart Pattern

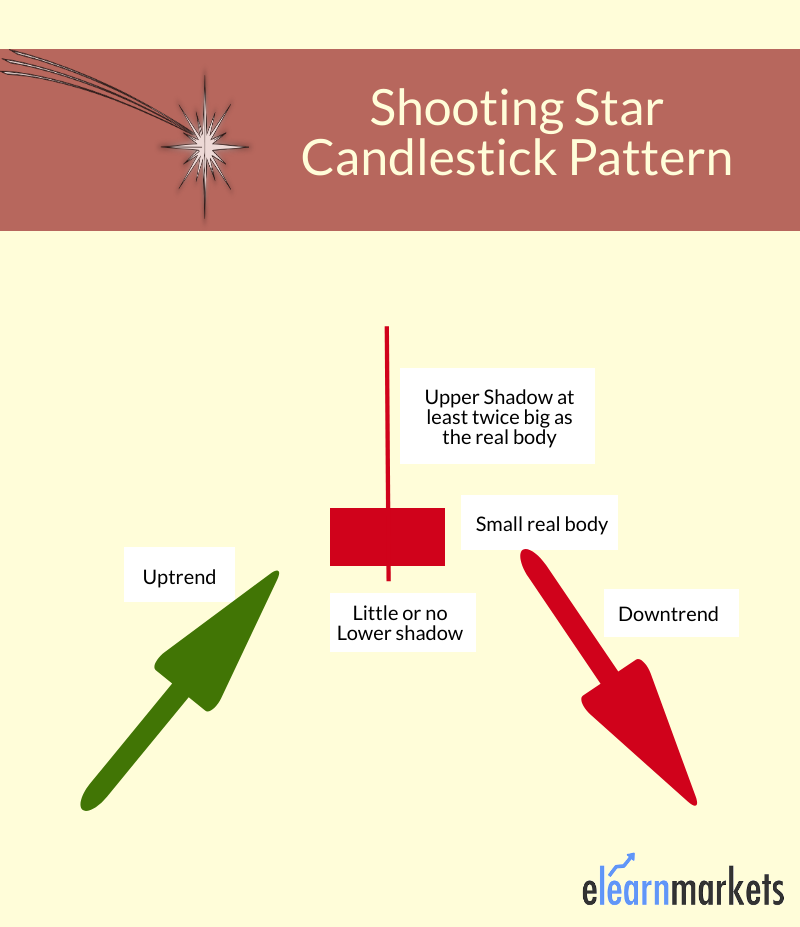

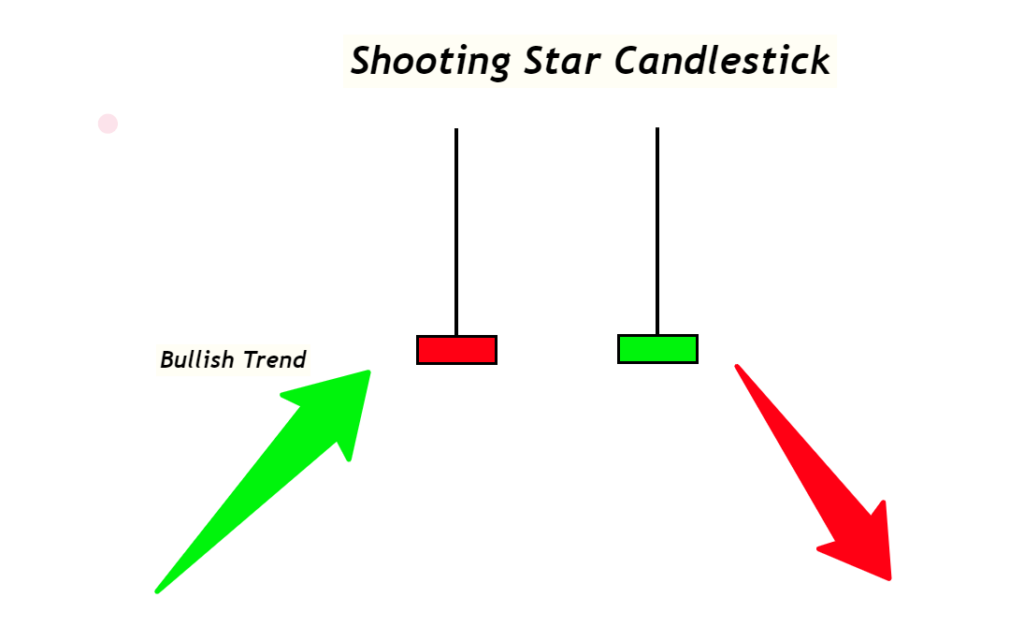

Shooting Star Chart Pattern - Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind a. Trading is often about spotting changes in momentum as early as possible and being able to recognize and trade shooting stars gives you an edge in detecting when buyers are losing steam and sellers may be gaining control. A shooting star candlestick is typically found at the peak of an uptrend or near resistance levels. They are commonly formed by the opening, high,. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. With their clear and colorful way of representing market action, candlestick charts have come to dominate among new traders who wish to spot patterns in the market. Web the image illustrates a classic shooting star trading example. Web the shooting star is a powerful chart pattern that signals potential price reversals. It is considered to be one of the most useful candlestick patterns due to its effectiveness. Web the first candlestick in the shooting star must be supportive of the uptrend and, hence, must be light in color and must have a relatively large real body. Web the shooting star candlestick pattern is a bearish reversal pattern. It occurs when the price of an asset is significantly pushed up, but then rejected and closed near the open. It occurs when the price of an asset is significantly pushed up, but then rejected and closed near the open price. Original music by marion lozano , elisheba ittoop. Produced by nina feldman , clare toeniskoetter and rikki novetsky. And always use a daily chart aggregation. The emergence of a shooting star on a chart is a signal for potential. Cooper flagg will play at duke next season, then is expected to be the top prospect in the 2025 nba draft. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind a. Web the aspects of a candlestick pattern. Web traders who spot shooting star patterns in the candlestick price charts, wait. Web a shooting star candlestick pattern is a chart formation. Original music by marion lozano , elisheba ittoop. They are commonly formed by the opening, high,. Produced by nina feldman , clare toeniskoetter and rikki novetsky. Web developing a trading strategy around the shooting star pattern is like steering a vessel through a sudden shift in the winds, demanding sharp. Web a shooting star candlestick pattern is a chart formation. Web a shooting star formation is a bearish reversal pattern that consists of just one candle. This pattern is formed when a security’s price advances significantly during the trading session but relinquishes most of its gains to close near the open. It is formed when the price is pushed higher. It consists of a small body with a long upper shadow indicating the price increase and a short or no lower shadow indicating the price drop. Web identify a bullish uptrend. It occurs when the price of an asset is significantly pushed up, but then rejected and closed near the open price. When this pattern appears in an ongoing uptrend,. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. Web the shooting star signifies a potential price top and reversal. This makes a long upper wick, a small lower wick and a small body. In addition, we can observe a small. A shooting star candlestick is typically found at the peak of an uptrend or near resistance levels. This creates a long upper wick, a small lower wick and a small body. Web developing a trading strategy around the shooting star pattern is like steering a vessel through a sudden shift in the winds, demanding sharp judgment and timely response. Trading. The patterns are calculated every 10 minutes during the trading day using delayed daily data, so the pattern may not be visible on an intraday chart. The emergence of a shooting star on a chart is a signal for potential market changes, guiding traders to make strategic choices about when to enter and exit trades. It occurs when the price. Web the shooting star is a powerful chart pattern that signals potential price reversals. Web traders who spot shooting star patterns in the candlestick price charts, wait for the following pattern the next day. Web by ben golliver. Web the shooting star pattern is one of the most common and popular candlestick patterns. Traders also make trading decisions based on. Web identify a bullish uptrend. An inverted shooting star pattern is more commonly known as an inverted hammer candlestick. (rob kinnan/usa today sports) portland. This makes a long upper wick, a small lower wick and a small body. This pattern is formed when a security’s price advances significantly during the trading session but relinquishes most of its gains to close near the open. Produced by nina feldman , clare toeniskoetter and rikki novetsky. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. It has no lower wick or sometimes has a smaller wick. The trading analysis starts with identifying the upward trend in price. Web the image illustrates a classic shooting star trading example. After we short apple, the price enters a downtrend. Web the aspects of a candlestick pattern. This is how it went. The second candlestick is the star, which is a candlestick with a short real body that gaps away from the real body of the preceding candlestick. Web a shooting star candlestick pattern is a chart formation. Shooting star candlesticks consist of a smaller real body with a longer upper wick and no lower shadow.

Shooting Star Candlestick Pattern How to Identify and Trade

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Shooting Star Candlestick Pattern How to Identify and Trade

Shooting Star Chart Pattern

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

What Is Shooting Star Candlestick With Examples ELM

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

It Has A Bigger Upper Wick, Mostly Twice Its Body Size.

Web Shooting Star Pattern Meaning.

It Can Be Recognized From A Long Upper Shadow And Tight Open, Close, And Low Prices — Just Like The Shooting.

Before Trading A Shooting Star Pattern, It’s Essential To Wait For Confirmation.

Related Post: