Stock Flag Patterns

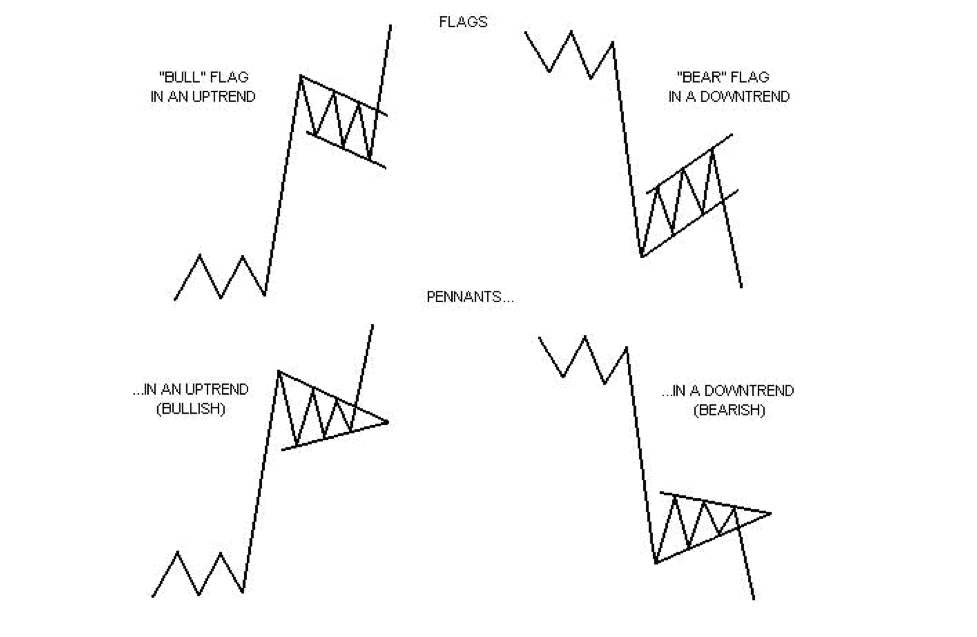

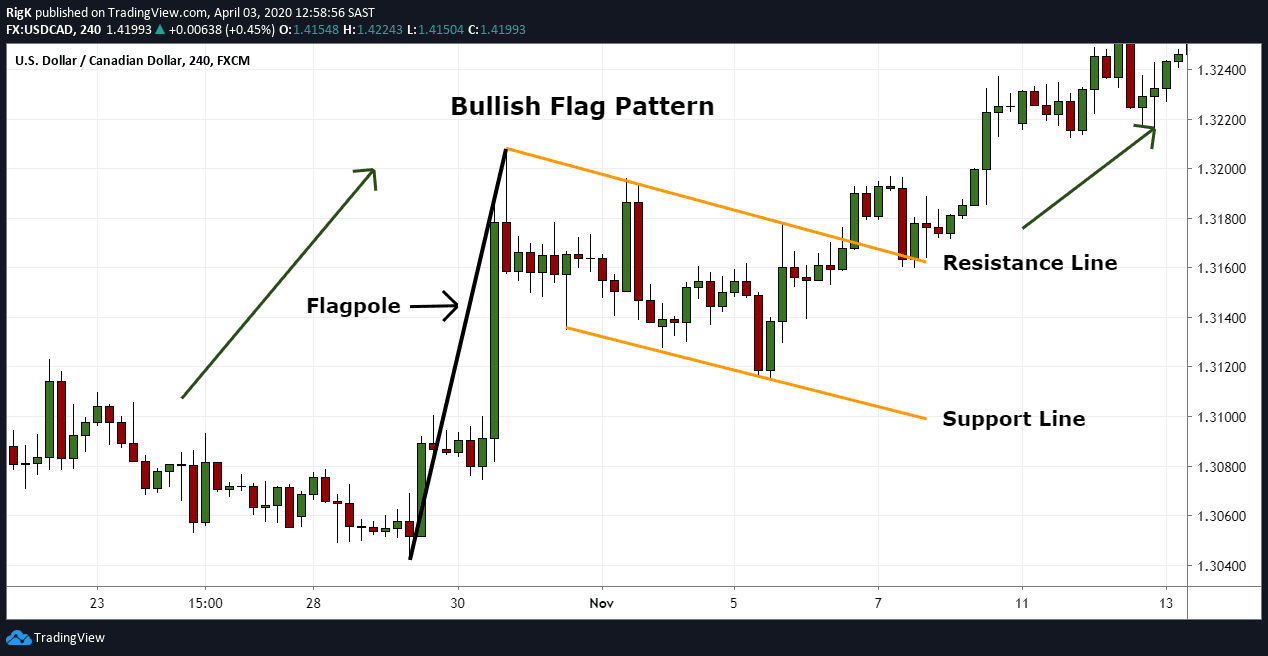

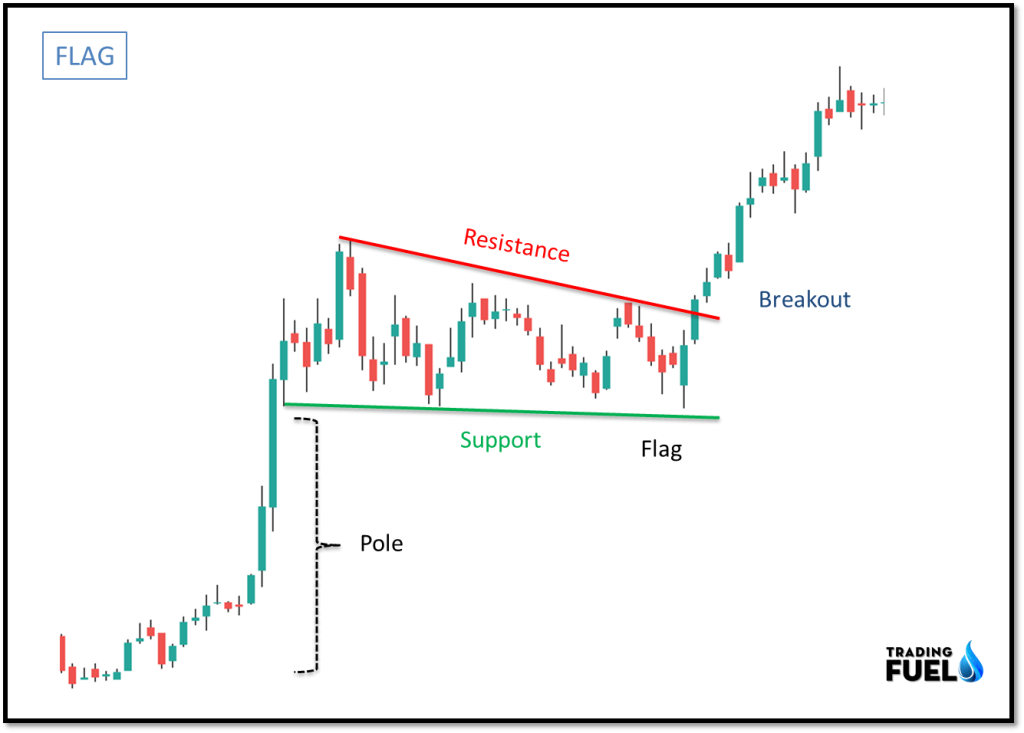

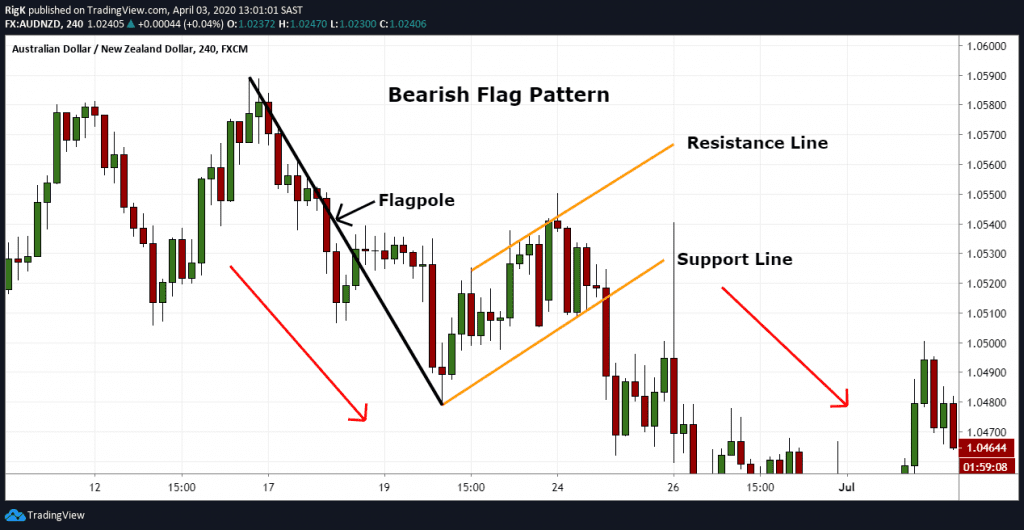

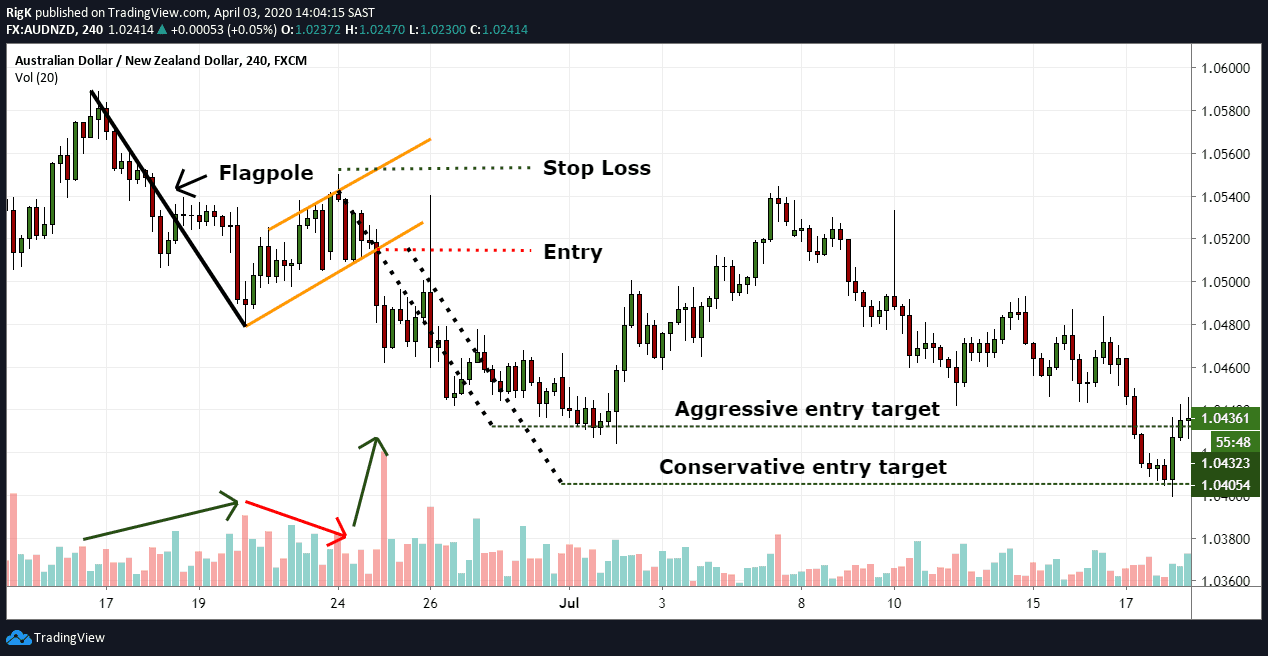

Stock Flag Patterns - We start by discussing what flag patterns are and how they are presented on a chart. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the. Web what is a flag pattern? Once these patterns come to an end, the resulting move. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Web a flag pattern is formed when the price of a stock or asset rises rapidly in a short period of time called the flagpole. What is a bullish flag? Flags can be seen in any time frame but normally consist of. A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Flags are categorized as continuation processes and represent. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web bull flags represent one of the most powerful and dynamic patterns in. Web bullish and bearish flag patterns can be used to buy stocks on pullbacks and help traders plan better entries. We start by discussing what flag patterns are and how they are presented on a chart. Web a flag pattern is formed when the price of a stock or asset rises rapidly in a short period of time called the. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. A bull flag chart pattern happens when a stock is in a strong uptrend but then has a slight consolidation period. In technical analysis, a pennant is a type of. Web bull flags represent one of the most powerful and dynamic. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. The move after the flag. Web how to read stock charts and trading patterns. Recognized by a distinct flagpole and. A bull flag chart pattern happens when a stock is in a strong uptrend but then has a slight consolidation period. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web there are certain. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. They are identifiable patterns in trading. It is an area of consolidation. Learn how to read. Learn how to read stock charts and analyze trading chart patterns, including spotting trends,. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the. Web a flag. Recognized by a distinct flagpole and. The move after the flag. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. We start by discussing what flag patterns are and how they are presented on a chart. Web what is a flag pattern? Recognized by a distinct flagpole and. Web stock chart patterns (or crypto chart patterns) help traders gain insight into potential price trends, whether up or down. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. What is a bullish flag? Flags can be seen in any time frame. They are identifiable patterns in trading. It is an area of consolidation. Web updated december 10, 2023. A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Flags are categorized as continuation processes and represent. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Learn how to read stock charts and analyze trading chart patterns, including spotting trends,. Web this technical analysis guide teaches you about flag chart patterns. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web a flag pattern is formed when the price of a stock or asset rises rapidly in a short period of time called the flagpole. Web what is a flag pattern? Think of the pattern as the bulls waving a flag before the next charge, because a bull flag is often a brief. Flags are categorized as continuation processes and represent. Web bullish and bearish flag patterns can be used to buy stocks on pullbacks and help traders plan better entries. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the. Web updated december 10, 2023. Recognized by a distinct flagpole and. A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web how to read stock charts and trading patterns. Flags can be seen in any time frame but normally consist of.

Stock Trading Training Flag Patterns

Flag Pattern Full Trading Guide with Examples

What Is Flag Pattern? How To Verify And Trade It Efficiently

Chart Patterns Flags TrendSpider Learning Center

How To Trade Bullish And Bearish Flag Patterns Daily Price Action

How to use the flag chart pattern for successful trading

Triangle Pattern, Flag Pattern & More.. (Continuation Chart Pattern

Flag Pattern Full Trading Guide with Examples

Flag Pattern Full Trading Guide with Examples

Bull Flag Chart Patterns The Complete Guide for Traders

In Technical Analysis, A Pennant Is A Type Of.

Here Are Some Of The Most Common Types Of Flags:

They Are Identifiable Patterns In Trading.

We Start By Discussing What Flag Patterns Are And How They Are Presented On A Chart.

Related Post: