Options Trading Patterns

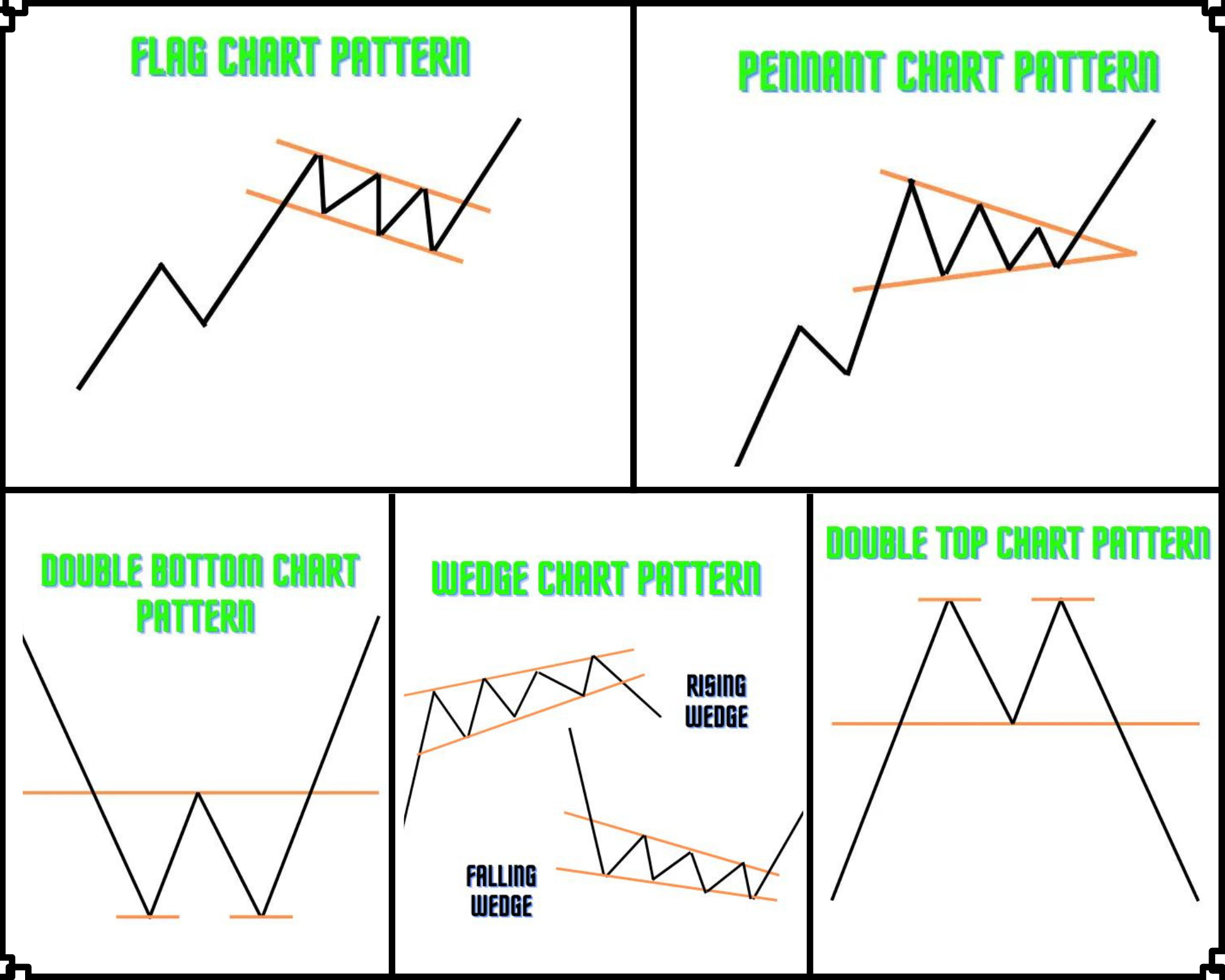

Options Trading Patterns - When you see bullish patterns,. This is when looking at charts may help. Examples include the moving average, relative strength index and. See 34 examples of bullish, bearish, and neutral patterns with. Web the pattern day trading rule prevents people with less than $25,000 in their investment accounts from engaging in day trading. Web how to read stock charts and trading patterns. Explore classic chart patterns, technical indicators, and market timing techniques with. This guide covers the basics of. Web an option is a contract between two parties giving the taker (buyer) the right, but not the obligation, to buy or sell a security at a predetermined price on or before a predetermined. Updated may 08, 2024, 7:01 am edt / original may 08, 2024, 2:00 am edt. Web learn how to use candlestick patterns to identify entry and exit signals for options trading. See 34 examples of bullish, bearish, and neutral patterns with. Web the pattern day trading rule prevents people with less than $25,000 in their investment accounts from engaging in day trading. Explore different types of patterns, such as head. Web top 5 option trading. Updated may 08, 2024, 7:01 am edt / original may 08, 2024, 2:00 am edt. Web options expiration 8 pattern day trader (pdt) 9 options terminology 10. See 34 examples of bullish, bearish, and neutral patterns with. 4.5/5 (3,885 reviews) When you see bullish patterns,. Web learn how to identify and use chart patterns to predict future price movements of an asset and choose the right options strategy. 3 www.simpleoptionstrategies.com long call consists of buying calls for investors. Bullish patterns are chart patterns that suggest a potential upward movement in the price of an asset. Web learn how to use candlestick patterns to identify entry. Examples include the moving average, relative strength index and. Web how to read stock charts and trading patterns. Bullish patterns are chart patterns that suggest a potential upward movement in the price of an asset. This guide covers the basics of. Web options expiration 8 pattern day trader (pdt) 9 options terminology 10. Bullish patterns are chart patterns that suggest a potential upward movement in the price of an asset. Learn how to trade options with different strategies that limit risk and maximize return. Examples include the moving average, relative strength index and. Explore different types of patterns, such as head. Web when should you place the trade? Web learn how to use technical analysis to identify opportunities and trends in options trading. See 34 examples of bullish, bearish, and neutral patterns with. Bullish patterns are chart patterns that suggest a potential upward movement in the price of an asset. Maybe you see a reversal candlestick pattern, such as a bullish engulfing or dark cloud. Learn how to. Web learn how to use technical analysis to identify opportunities and trends in options trading. Web 9 rules for trading options in a changing market. Many misunderstand the rule, however, and it. Explore different types of patterns, such as head. Web learn how to read options charts, understand candlesticks, patterns, and indicators, and apply them to your trading strategies. Web top 5 option trading chart patterns are listed and explained in this section. Web an option is a contract between two parties giving the taker (buyer) the right, but not the obligation, to buy or sell a security at a predetermined price on or before a predetermined. Many misunderstand the rule, however, and it. When you see bullish patterns,.. Its important to note that option trading requires accuracy, momentum, sound risk. Web 9 rules for trading options in a changing market. Explore classic chart patterns, technical indicators, and market timing techniques with. This guide covers the basics of. Web learn how to use candlestick patterns to identify entry and exit signals for options trading. Web when should you place the trade? 4.5/5 (3,885 reviews) Web learn how to use technical analysis to identify opportunities and trends in options trading. Web learn how to identify and use chart patterns to predict future price movements of an asset and choose the right options strategy. Its important to note that option trading requires accuracy, momentum, sound risk. See 34 examples of bullish, bearish, and neutral patterns with. This is when looking at charts may help. Technical analysis primarily studies historical market data. Examples include the moving average, relative strength index and. Today, we have a special treat for you, a candlestick pattern cheat sheet. Web learn how to identify and use chart patterns to predict future price movements of an asset and choose the right options strategy. Explore different types of patterns, such as head. Updated may 08, 2024, 7:01 am edt / original may 08, 2024, 2:00 am edt. Its important to note that option trading requires accuracy, momentum, sound risk. Web learn how to use candlestick patterns to identify entry and exit signals for options trading. Maybe you see a reversal candlestick pattern, such as a bullish engulfing or dark cloud. Web learn how to read options charts, understand candlesticks, patterns, and indicators, and apply them to your trading strategies. Web on a very basic level, stock chart patterns are a way of viewing a series of price actions that occur during a stock trading period. This guide covers the basics of. Web how to read stock charts and trading patterns. Web options expiration 8 pattern day trader (pdt) 9 options terminology 10.

Best Option Trading Chart Patterns Dhan Blog

How to trade breakout. Breakout patterns for OANDAEURUSD by DeGRAM

Chart Patterns Cheat Sheet Trading charts, Stock chart patterns

How to Trade Chart Patterns The Basics Complete Guide How To

Chart Patterns Cheat Sheet in 2022 Trading charts, Trading quotes

Triangle Pattern Characteristics And How To Trade Effectively How To

Technical Analysis Candlestick Patterns Chart digital Download Etsy

Stock Option Trading Strategy Candlestick chart patterns, Candlestick

Option Trading Chart Patterns 5 Best Chart Patterns For Option Trading

Cheat Sheet Chart Pattern 7thongs

Web The Pattern Day Trading Rule Prevents People With Less Than $25,000 In Their Investment Accounts From Engaging In Day Trading.

Web When Should You Place The Trade?

Many Misunderstand The Rule, However, And It.

Web Technicians Also Look For Relationships Between Price/Volume Indices And Market Indicators.

Related Post: