Head And Shoulders Pattern Rules

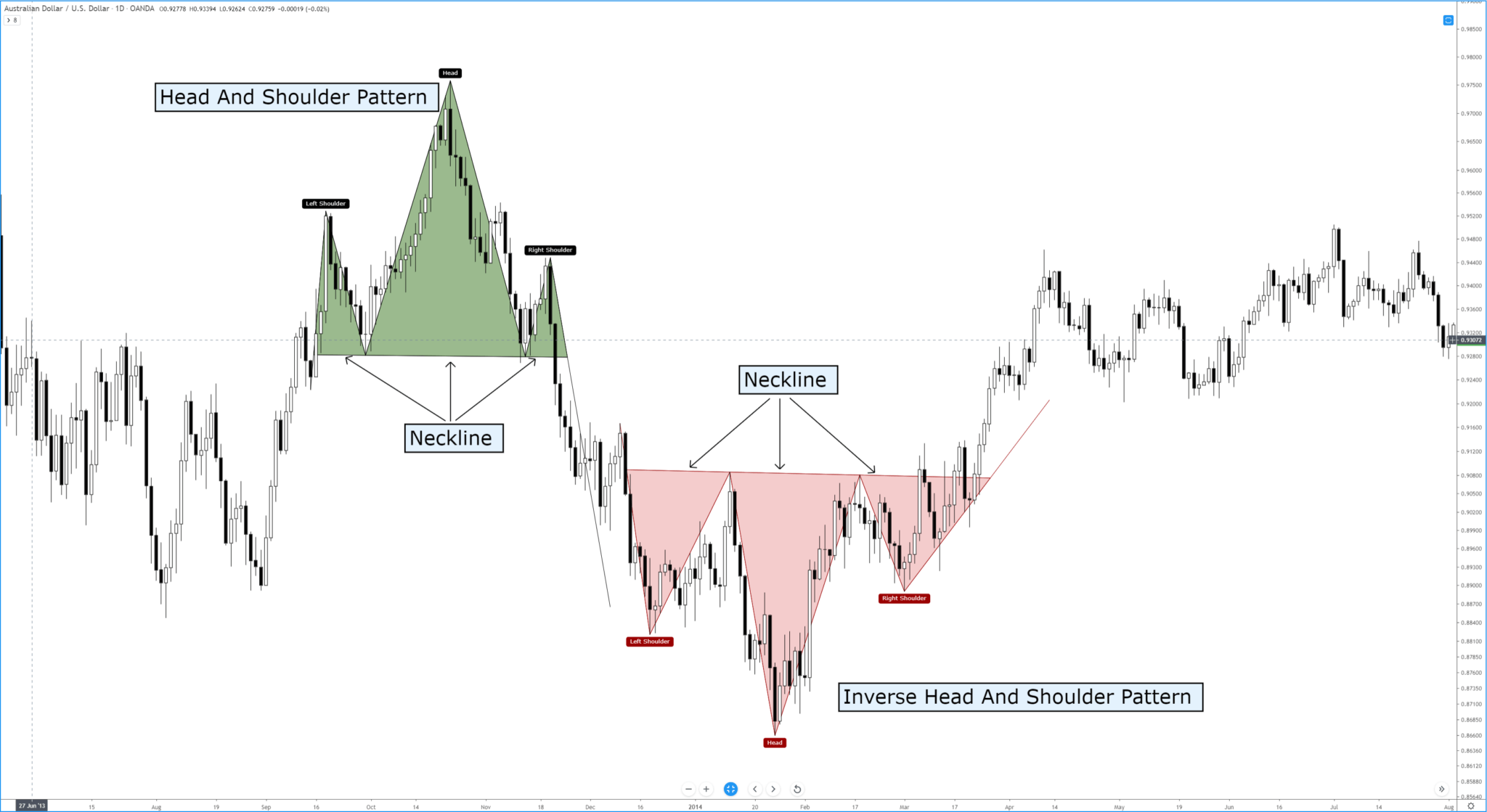

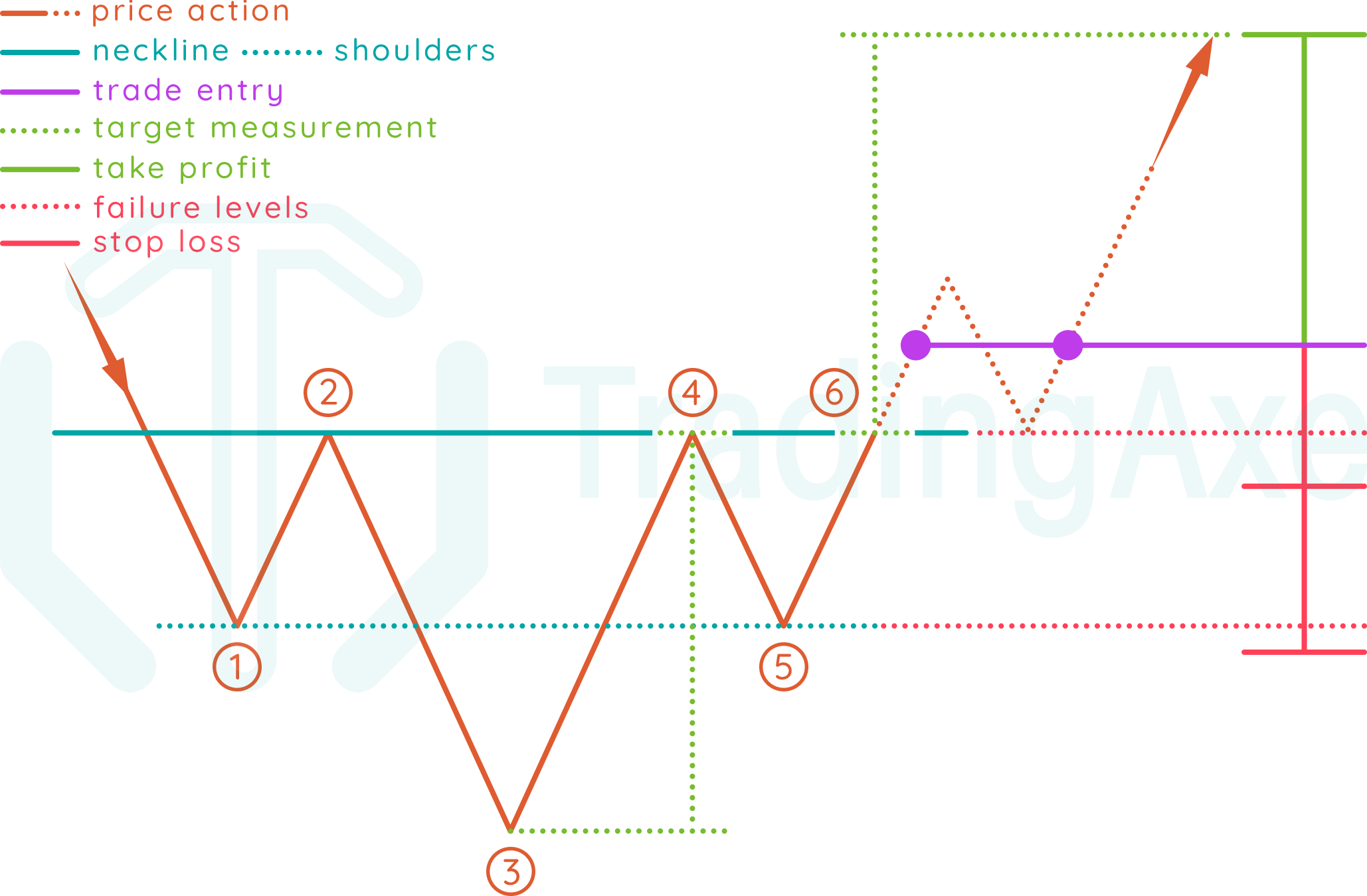

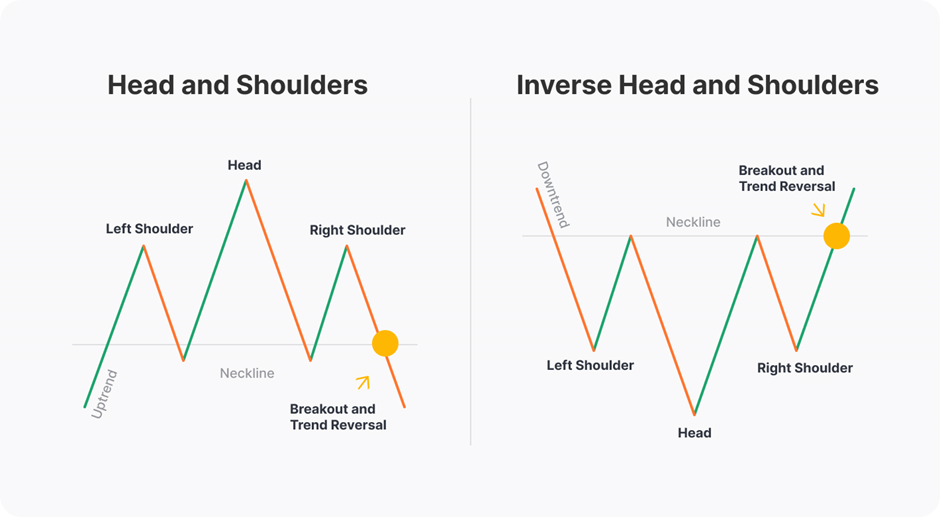

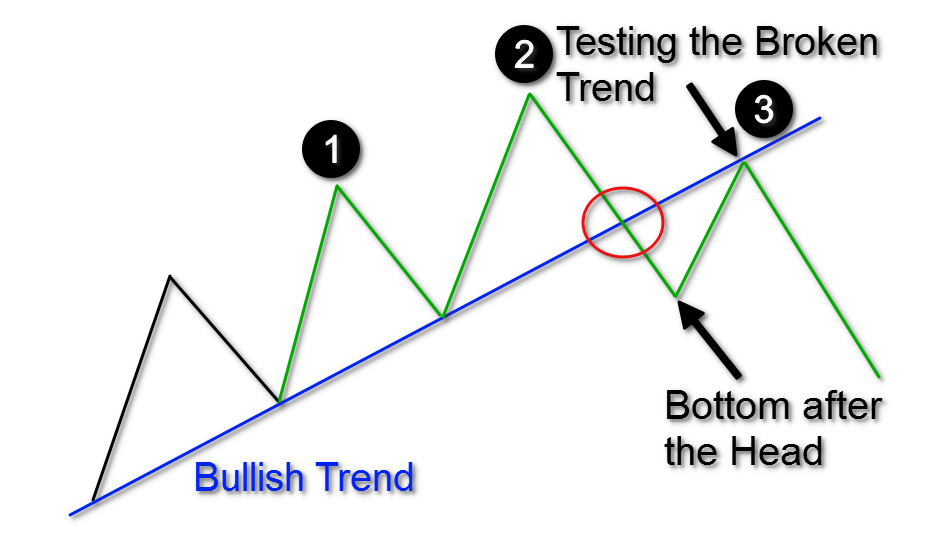

Head And Shoulders Pattern Rules - Below it, you will find a list elaborating on each aspect. What is a head and shoulders pattern? The second swing high in the pattern (the head) must be above the first and third peaks (left and right shoulders) a line joining the intervening swing lows becomes the neckline, which is considered a support level. We had a situation not unlike this in midweek. Head and shoulders pattern volume. Whether you are a seasoned trader or a beginner, it is one of the patterns you need to be conversant with. You don’t jump with your two arms in front of your face because. The left shoulder ( ls) appears above the right shoulder ( rs ). The pattern must form in a recognizable uptrend. | updated may 15, 2022 20:32. Web one commonly used rule is that the uptrend heading into the pattern should be at least twice as long as the distance between the shoulders. Head and shoulders pattern example. The left shoulder ( ls) appears above the right shoulder ( rs ). Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend. Trading the head and shoulders pattern. Web “berge heads the ball or tries to head the ball in front and it hits his arms. Does the head and shoulders pattern ring a bell? You have likely come across the pattern in your trading journey. Below it, you will find a list elaborating on each aspect. Web these are some of the rules that qualify a head and shoulders pattern: Web as a result, both beginner and experienced traders use it to their advantage to find new trading opportunities. The line connecting the 2 valleys is the neckline. Head and shoulders pattern example. One of the most recognizable trading patterns in the world is the head. The second swing high in the pattern (the head) must be above the first and third peaks (left and right shoulders) a line joining the intervening swing lows becomes the neckline, which is considered a support level. What is head and shoulders pattern? The left shoulder ( ls) appears above the right shoulder ( rs ). You have likely come. The left shoulder ( ls) appears above the right shoulder ( rs ). Where price closes below the neckline, a breakout. Web one commonly used rule is that the uptrend heading into the pattern should be at least twice as long as the distance between the shoulders. Web recommended by warren venketas. Inverted head and shoulders pattern. Web updated february 19, 2022. What is head and shoulders pattern? It typically forms at the end of a bullish trend. As a trader, being able to recognize these chart patterns can give you a huge advantage. Web as a result, both beginner and experienced traders use it to their advantage to find new trading opportunities. Trading the head and shoulders pattern. What is head and shoulders pattern? Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. The line connecting the 2 valleys is the neckline. Below it, you will find a list elaborating on each aspect. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Inverted head and shoulders pattern. A neckline shown in blue, joins the two armpits. Web the head is the second peak and is the highest point in the pattern. The head and shoulders pattern is. Web main talk points: It consists of 3 tops with a higher high in the middle, called the head. Head and shoulders pattern volume. Head and shoulders chart pattern: Whether you are a seasoned trader or a beginner, it is one of the patterns you need to be conversant with. But, the two shoulders appear symmetrical about the head. Web the inverse head and shoulders chart pattern consists of three (3) troughs: One of the most recognizable trading patterns in the world is the head and shoulders pattern. However, this pattern is mostly associated with shorting strategies based on a massive distribution pattern that looks like a. This diagram shows. The first and third troughs are roughly equal in depth and are known as shoulders, while the second trough is deeper. What is a head and shoulders pattern? It consists of 3 tops with a higher high in the middle, called the head. Does the head and shoulders pattern ring a bell? Head and shoulders chart pattern: It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in uptrends. Web these are some of the rules that qualify a head and shoulders pattern: The second swing high in the pattern (the head) must be above the first and third peaks (left and right shoulders) a line joining the intervening swing lows becomes the neckline, which is considered a support level. What is head and shoulders pattern? | updated may 15, 2022 20:32. Trading the head and shoulders pattern. If you want to up your trading game, you'll need to get familiar with how to spot this powerful formation. However, this pattern is mostly associated with shorting strategies based on a massive distribution pattern that looks like a. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web recommended by warren venketas. The middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders.

Chart Patterns The Head And Shoulders Pattern Forex Academy

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

The Head and Shoulders Pattern A Trader’s Guide

Head and Shoulders Pattern Psychology behind it How to Recognize

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

How to Trade with the Inverse Head and Shoulders Pattern Market Pulse

Head And Shoulders Pattern Your Guide To Massive Profits

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

The Pattern Is Shaped With Three Peaks, A Left Shoulder Peak, A Higher Head Peak, And A Right Shoulder Peak Similar In Height To The Left Shoulder.

Web One Commonly Used Rule Is That The Uptrend Heading Into The Pattern Should Be At Least Twice As Long As The Distance Between The Shoulders.

Head And Shoulders Pattern Volume.

This Pattern Is Formed When An Asset’s Price Creates A Low (The “Left Shoulder”), Followed By A Lower Low (The “Head”), And Then A Higher Low (The “Right Shoulder”).

Related Post: