M Pattern Stocks

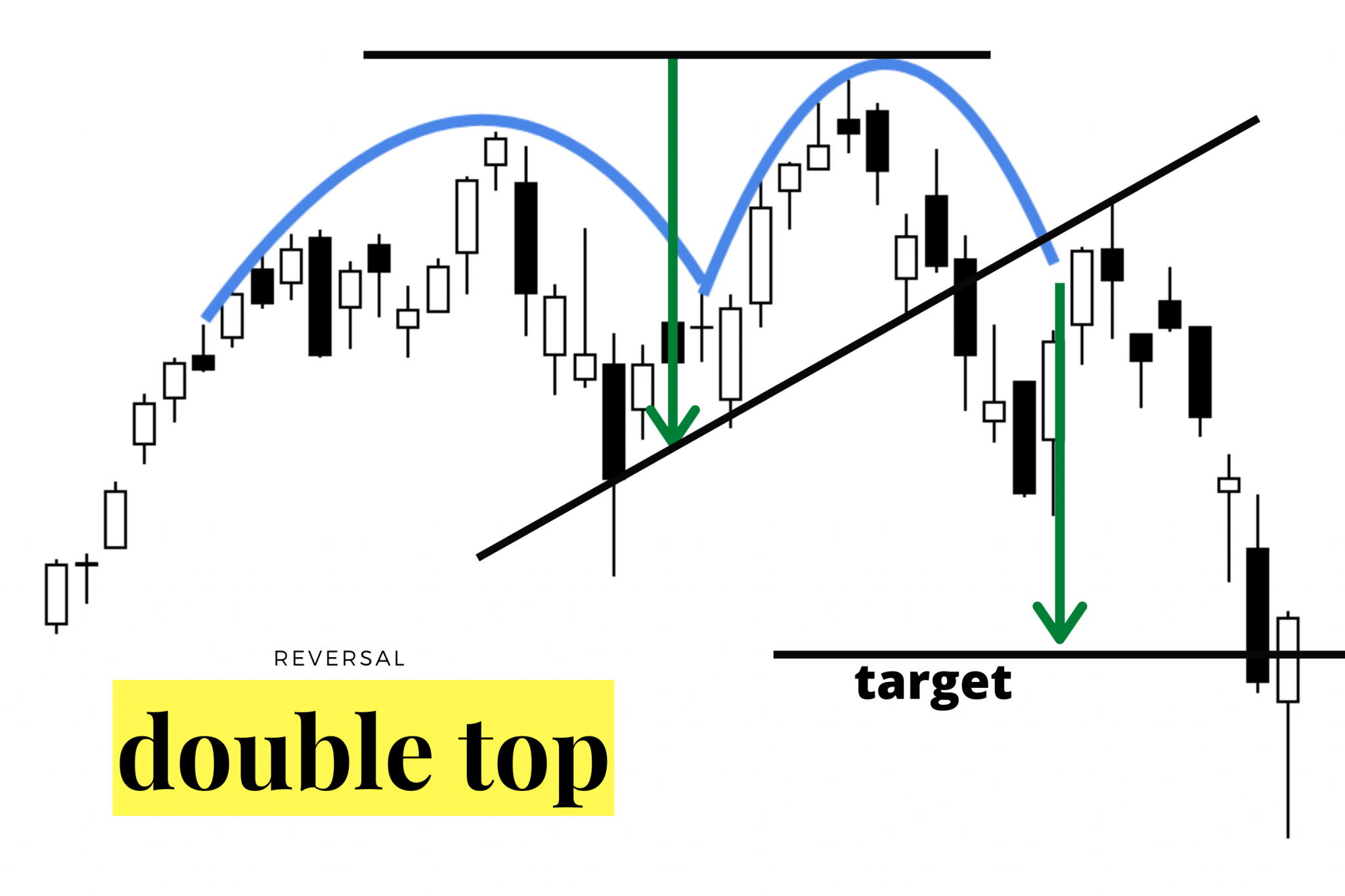

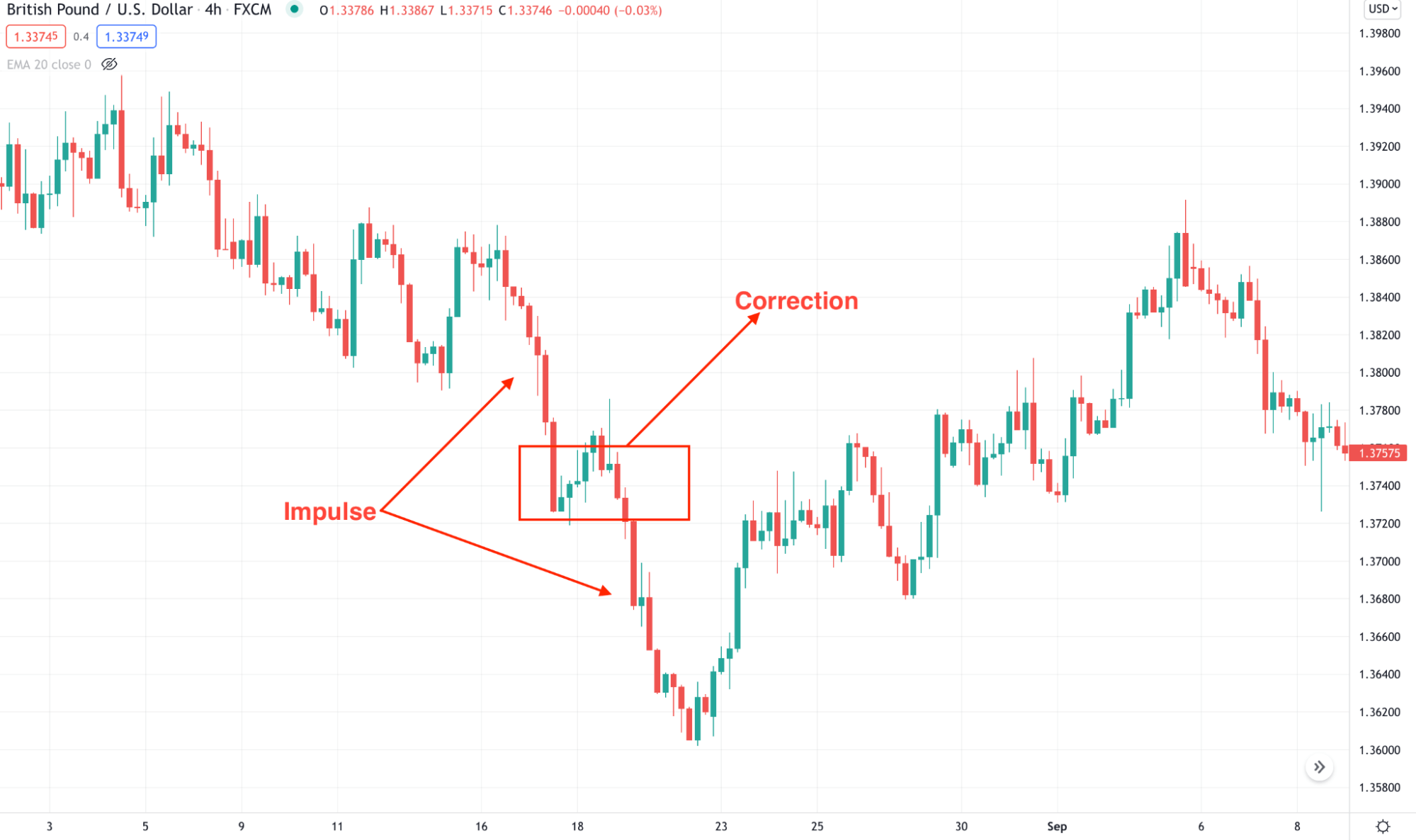

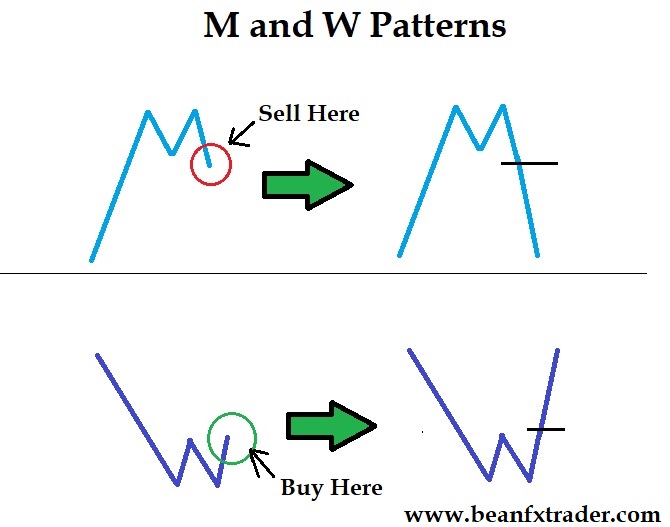

M Pattern Stocks - Liquidity levels are also included and can be used as targets/stops. Web in this video we take a look at the m and w shapes/patterns that form commonly in the market.we define what they are, their uses ,types and how they are form. Web the pattern looks like an m. Nep) stock price has been in a strong recovery this year as investors bought the dip. Web click on bars to view stock details filtered at the given time. The drop between the peaks of the double top is 10% to 20% or more, but be flexible. Double tops and double bottoms are both reversal patterns, indicating a major trend shift from one direction to the. It is the inverse of the w pattern. Web nextera energy partners (nyse: Web the pattern is created by two successive higher lows followed by a higher high. What is double top pattern? It typically occurs during a downtrend and signifies a potential reversal to an uptrend. Web inside outside with bollinger band technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web master pattern [luxalgo] luxalgo wizard jul 31, 2023. The drop between the. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. What is double top pattern? It refers to a chart formation that resembles the letter “m” and is also known as a double top pattern. The first step in mastering the m pattern is learning to identify. The first step in mastering the m pattern is learning to identify its key components. The first peak is formed after a strong uptrend and then retrace back to the neckline. A double top pattern occurs when the stock fails to continue the uptrend in its second attempt as it meets resistance pressure from sellers at its highs. Web double. These patterns are used by day traders and swing traders alike. This pattern is formed when the price of an asset reaches a high point, retraces slightly, rises to a similar high point. M pattern on daily chart technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.. Web the pattern is created by two successive higher lows followed by a higher high. Web in modern trading, it is similar to the wolfe’s waves or three indians pattern. In a market rally, sellers suddenly take control and push the price downward. It is the inverse of the w pattern. Web click on bars to view stock details filtered. To set the goal, draw a line through the first low and the second high. Web an m chart pattern happens near the end of an uptrend that has likely gone on for weeks or months.; Web nextera energy partners (nyse: The peaks represent the market’s failed attempts to push the price higher, while the trough acts as a support. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by a breakout above the consolidation level. Web an m formation is a bearish reversal pattern and its more popular name is the “double top”. Web the m pattern is a technical chart pattern that resembles the letter “m.”. M pattern on daily. After bottoming at $18.6 in december last year, it has soared to $30 and is now. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. This forms a “w” shape on the chart. Web the pattern is created by two successive higher lows followed by a. Web the peaks and troughs: It refers to a chart formation that resembles the letter “m” and is also known as a double top pattern. It is the inverse of the w pattern. The pattern resembles the letter ‘m’ and indicates a shift from an uptrend to a downtrend. What is double top pattern? The m trading pattern forms when the price makes two upward moves, followed by a downward correction that retraces a significant portion of the prior rise. Price begins to retreat to a level that is considered attractive for buyers. Web the m pattern is a technical chart pattern that resembles the letter “m.”. Web master pattern [luxalgo] luxalgo wizard jul. The m trading pattern forms when the price makes two upward moves, followed by a downward correction that retraces a significant portion of the prior rise. The first step in mastering the m pattern is learning to identify its key components. The m pattern, also known as the double top, indicates a bearish reversal, suggesting that a current uptrend may reverse into a downtrend. Web the pattern looks like an m. The peaks represent the market’s failed attempts to push the price higher, while the trough acts as a support level. Nep) stock price has been in a strong recovery this year as investors bought the dip. Double tops and double bottoms are both reversal patterns, indicating a major trend shift from one direction to the. Chart patterns in which the quote for the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). This pattern is formed with two peaks above a support level which is also known as the neckline. Web double top and bottom: This forms a “w” shape on the chart. Web we go over how to easily identify “w” and “m” patterns for profiting off of stocks in 2019. Web nextera energy partners (nyse: Web double top (m) chart pattern. The drop between the peaks of the double top is 10% to 20% or more, but be flexible. A big m shape with twin peaks and tall sides.M pattern and W pattern

M Chart Pattern New Trader U

Double Top (M) Chart Pattern for NSENIFTY by PrasantaP — TradingView India

M Chart Pattern New Trader U

Pattern Trading Unveiled Exploring M and W Pattern Trading

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

HOW TO IDENTIFY WEAK & STRONG M PATTERN?M PATTERN OR DOUBLE TOP

:max_bytes(150000):strip_icc()/dotdash_Final_Double_Top_and_Bottom_Feb_2020-01-568b13a6e22548a48c0f5251e2069db5.jpg)

Double Top and Bottom Patterns Defined, Plus How to Use Them

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-02-59df8834491946bcb9588197942fabb6.jpg)

Introduction to Stock Chart Patterns

M and W Price Patterns FX & VIX Traders Blog

The Master Pattern Indicator Is Derived From The Framework Proposed By Wyckoff And Automatically Displays Major/Minor Patterns And Their Associated Expansion Lines On The Chart.

Web In Modern Trading, It Is Similar To The Wolfe’s Waves Or Three Indians Pattern.

In A Market Rally, Sellers Suddenly Take Control And Push The Price Downward.

The Pattern Consists Of Two Distinct Peaks, Separated By A Trough In The Middle.

Related Post: