Falling Pattern

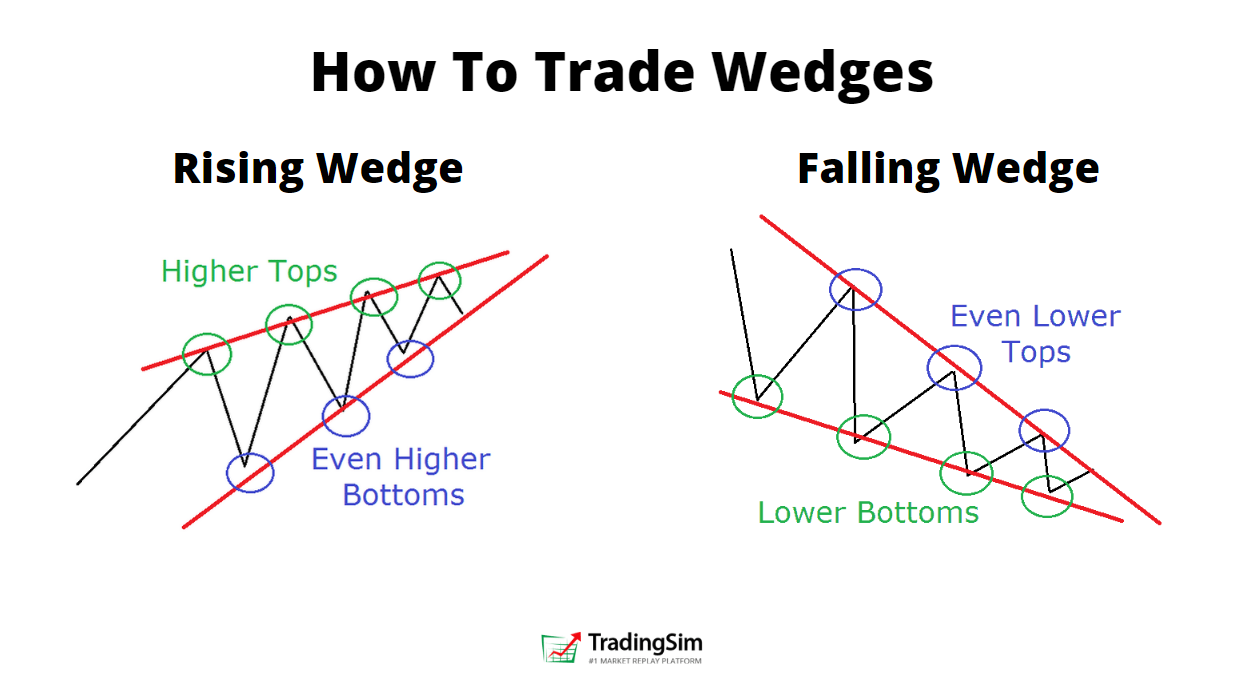

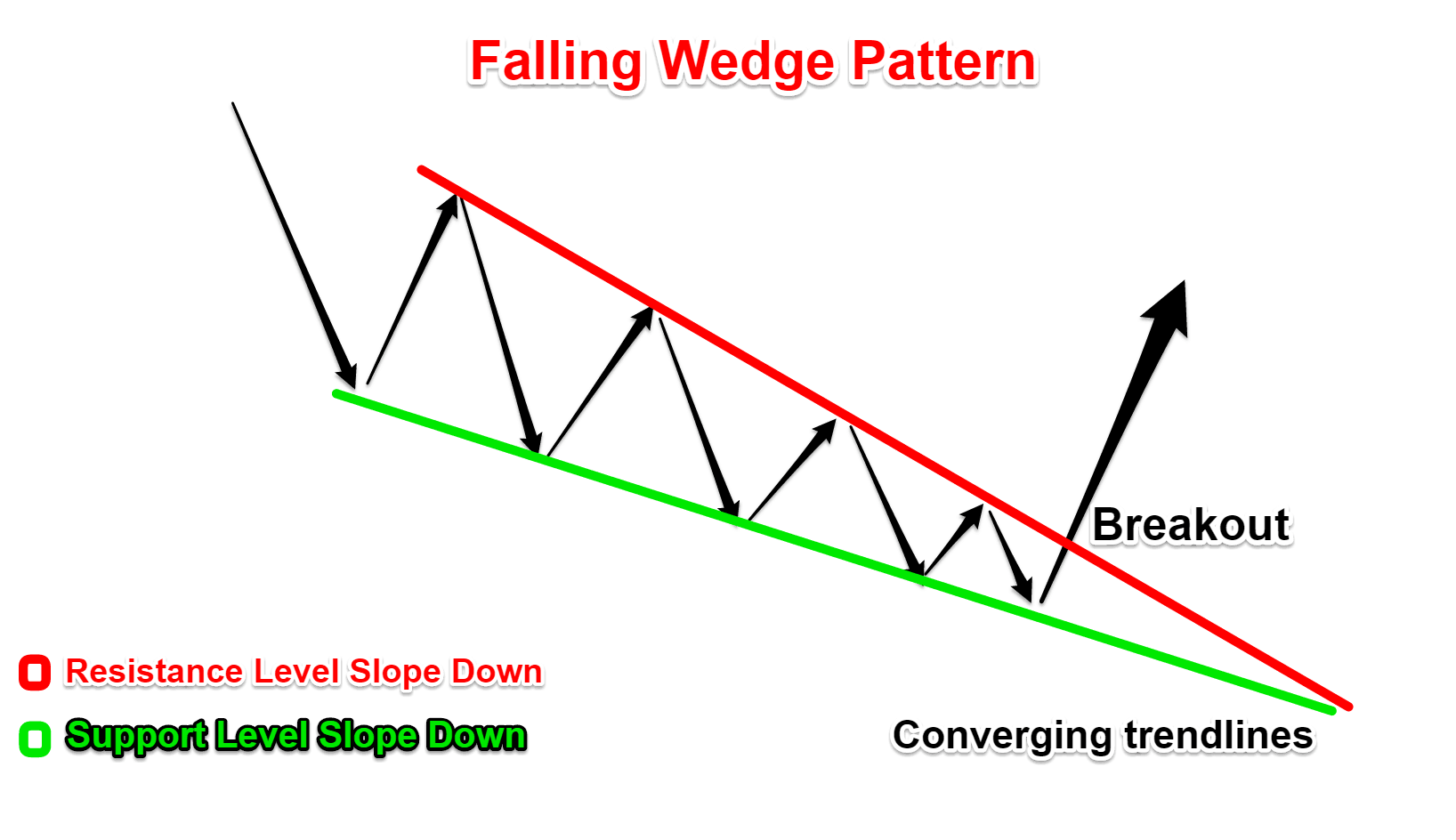

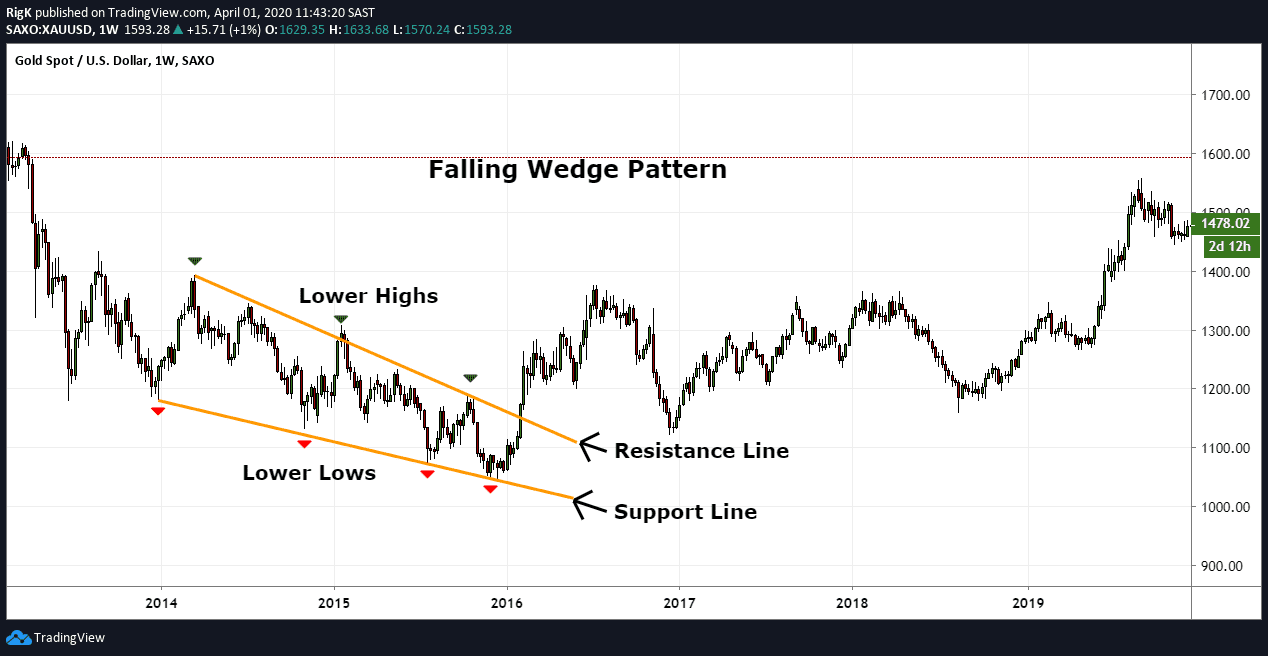

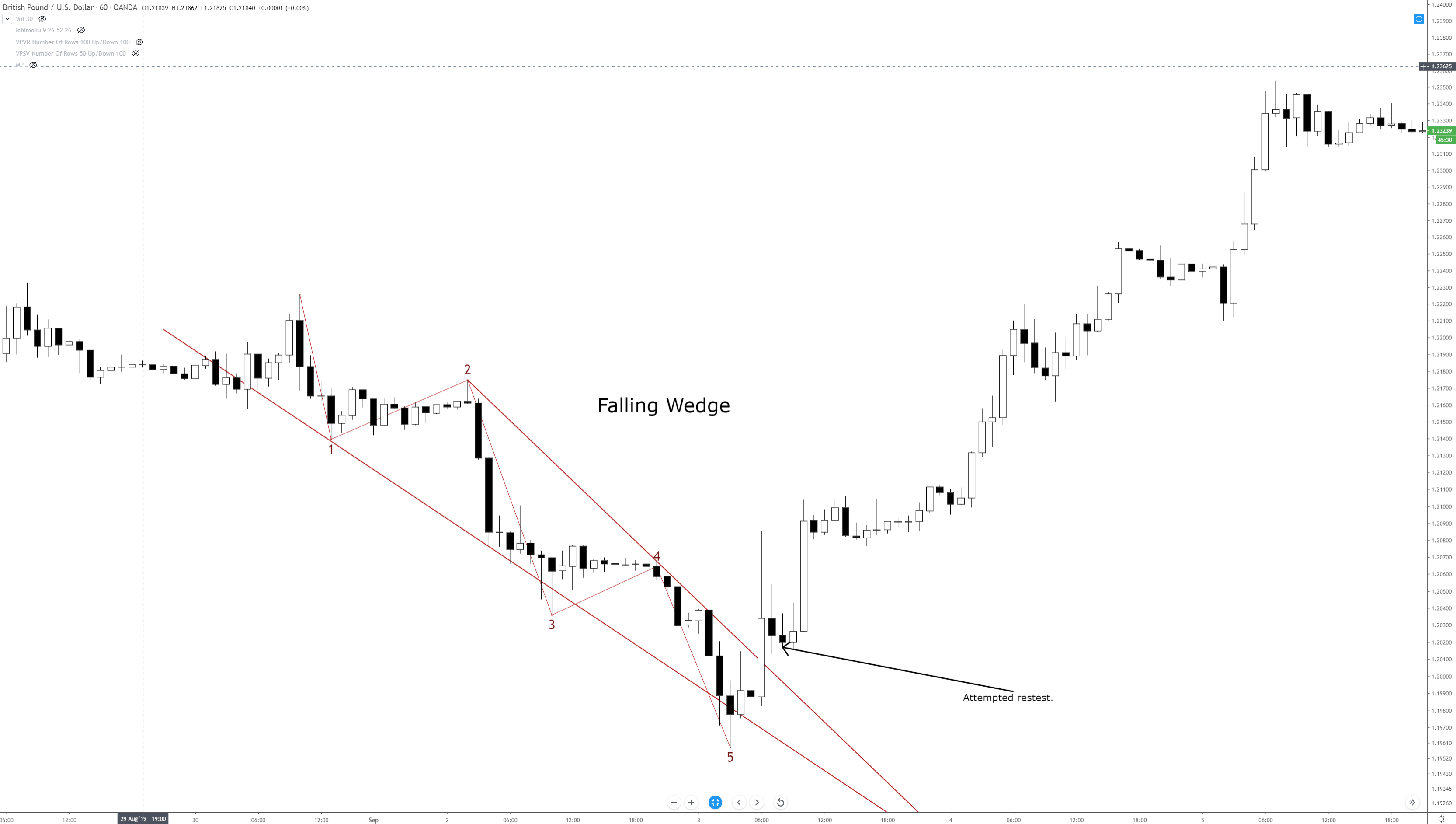

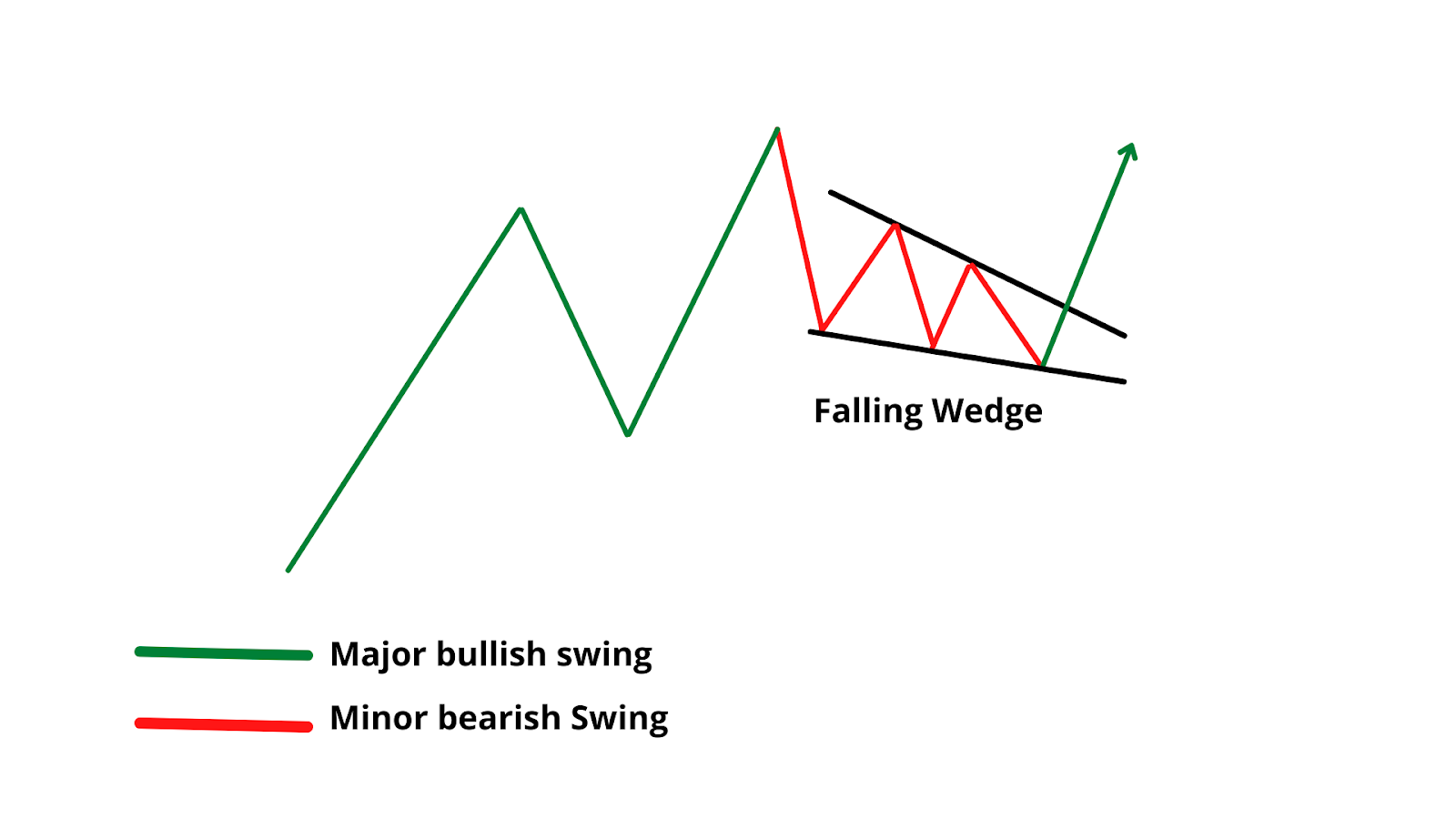

Falling Pattern - Web a falling wedge pattern is seen as a bullish signal as it reflects that a sliding price is starting to lose momentum, and that buyers are starting to move in to slow down the fall. It signals an impending breakout to the upside. Web the fall webworm (fww), h. The falling wedge pattern is followed by technical analysts because it typically signals a bullish reversal after a downtrend or a trend continuation during an established uptrend. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. Utah topped the list for a second consecutive year, ranking top 20. Web fall in love with over 20 ideas for sunflower quilt patterns. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Falling wedges are a continuation or reversal pattern. Web a falling wedge pattern is seen as a bullish signal as it reflects that a sliding price is starting to lose momentum, and that buyers are starting to move in to slow down the fall. Web ethereum fails to breakout of its falling channel pattern: Web the falling wedge chart pattern is a recognisable price move that is formed. Get inspired for your next quilt featuring the popular flower using golden yellow fabrics and these inspiring ideas, patterns and. Web the falling wedge is a bullish pattern that suggests potential upward price movement. It is drawn by connecting the lower highs and lower lows of a security's price with parallel trendlines. Web the backless look comes from the house's. The falling wedge pattern explained. This article explains the structure of a falling wedge formation, its importance as well as technical approach to trading this pattern. Identifying the falling wedge pattern in a downtrend. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and can help traders find trading opportunities. Developed in the 18th. Web a falling wedge is a very powerful bullish pattern. Web in general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend. News and world reports released its best states 2024 ranking on tuesday, which evaluates quality of life in the 50 states. Web the. Web a falling wedge pattern is a pattern in technical analysis that indicates bullish price trend movement after a price breakout. Web the backless look comes from the house's 2001 fall/winter collection and features long sleeves, a miniature train and crystals that form a delicate floral pattern. Falling wedges often form at the end of a bear move and generate. The pattern is characterized by two converging trendlines that slope downward, gradually narrowing the. It is similar to the western flag or pennant formations. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and can help traders find trading opportunities. Web the falling wedge is a bullish chart pattern that signals a buying opportunity. This article explains the structure of a falling wedge formation, its importance as well as technical approach to trading this pattern. It is similar to the western flag or pennant formations. The falling wedge pattern explained. Article includes performance statistics and more, written by internationally known author and trader thomas bulkowski. Web a falling wedge pattern is a technical formation. Web a falling wedge pattern is seen as a bullish signal as it reflects that a sliding price is starting to lose momentum, and that buyers are starting to move in to slow down the fall. Web the fall webworm (fww), h. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an. Developed in the 18th century, this method garnered popularity due to its ability to provide a visual representation of market trends. To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support. Falling wedges often form at the end of. Falling wedges often form at the end of a bear move and generate the confirmation swing higher low. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. The bearish candlestick pattern turns bullish when the price breaks out of wedge. The falling wedge pattern explained. Despite its name, the. Below are some common conditions that occur in the market that generate a falling wedge pattern. Web a falling wedge pattern consists of multiple candlesticks that form a big sloping wedge. Web the rising three methods refer to a situation whereby the pattern is formed during an uptrend, while a falling three methods pattern refers to a case whereby the pattern is formed during a downtrend. The falling wedge chart pattern is considered a bullish continuation pattern when it forms. Web one common chart pattern is the falling wedge. Web a falling wedge is a very powerful bullish pattern. Still, some traders choose to regard the pattern as a. Get inspired for your next quilt featuring the popular flower using golden yellow fabrics and these inspiring ideas, patterns and. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Web a falling wedge pattern is a technical analysis charting pattern that describes a narrowing price range in which prices consistently decline. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. For years now, the square toe had a hold on fashion’s “it. Understanding the invasion dynamics of invasive pests and identifying the critical factors that promote their spread is essential for devising practical and efficient strategies for their control and management. Despite its name, the three methods pattern usually consists of at five candlesticks but may be formed by four or more candlesticks. Rising and falling wedge trading pattern. It signals an impending breakout to the upside.

Rising and Falling Wedge Patterns How to Trade Them TradingSim

Falling Wedge and Rising Wedge Chart Patterns

Falling Wedge Pattern Definition, Formation, Examples, Screener

The Falling Wedge Pattern Explained With Examples

Forex Falling Wedge Pattern The Forex Chart Patterns Guide With Live

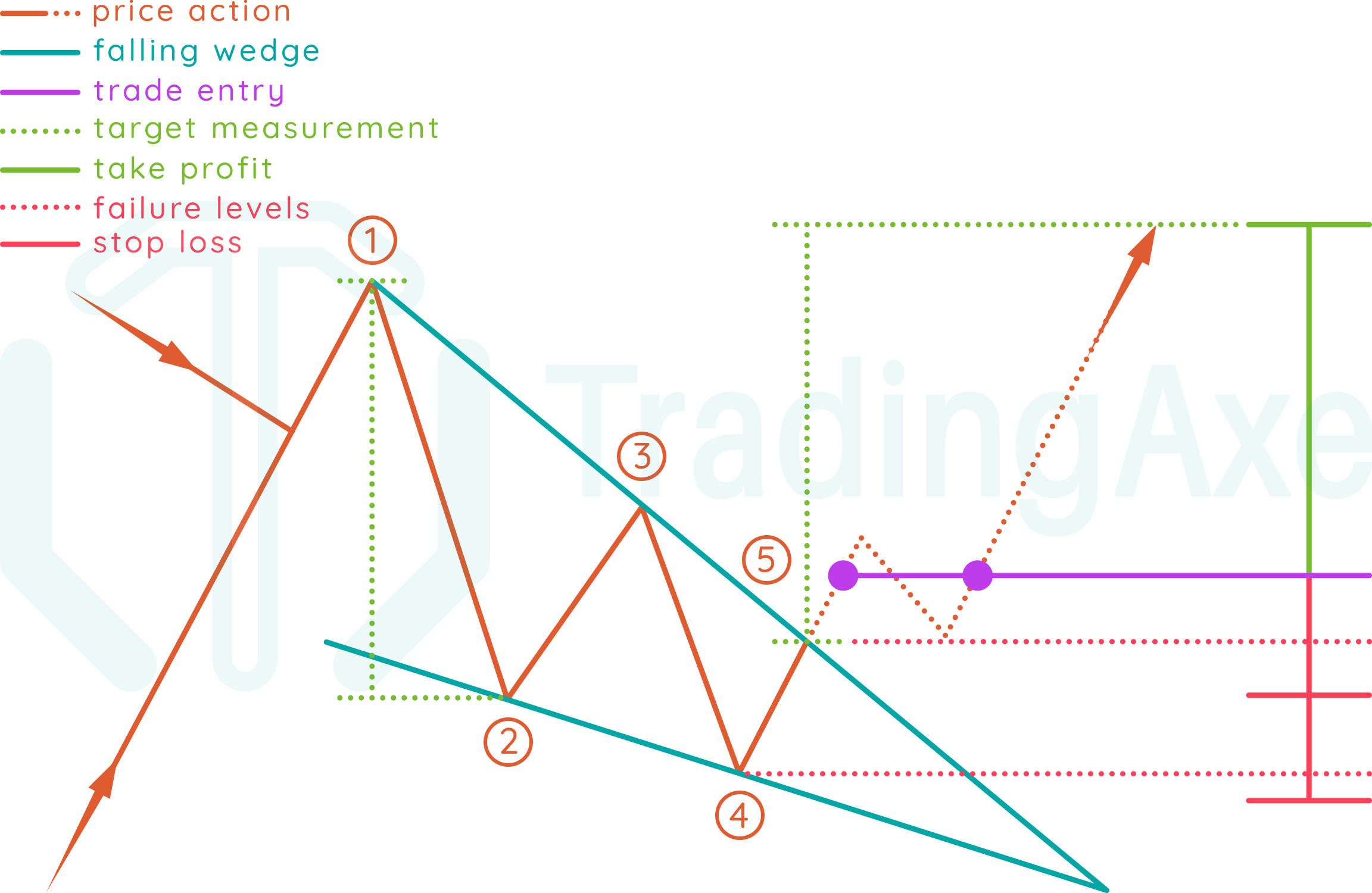

How To Trade Falling Wedge Chart Pattern TradingAxe

Trading the Falling Wedge Pattern Mint Dynasty

![Falling Wedge Pattern Ultimate Guide [2022] PatternsWizard](https://patternswizard.com/wp-content/uploads/2020/05/fallingwedge.png)

Falling Wedge Pattern Ultimate Guide [2022] PatternsWizard

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Falling Wedges Often Form At The End Of A Bear Move And Generate The Confirmation Swing Higher Low.

Web In An Uptrend It Is Called The Rising Three Methods Pattern And, In A Downtrend, It Is Called The Falling Three Methods Pattern.

Web Fall In Love With Over 20 Ideas For Sunflower Quilt Patterns.

The Pattern Is Characterized By Two Converging Trendlines That Slope Downward, Gradually Narrowing The.

Related Post: