Wyckoff Distribution Pattern

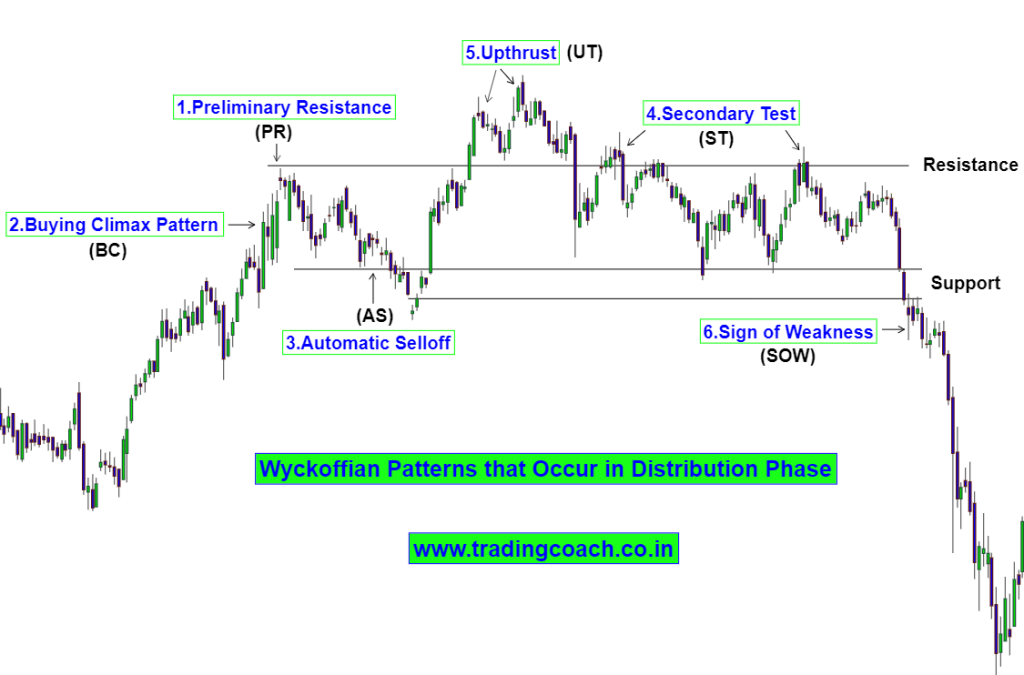

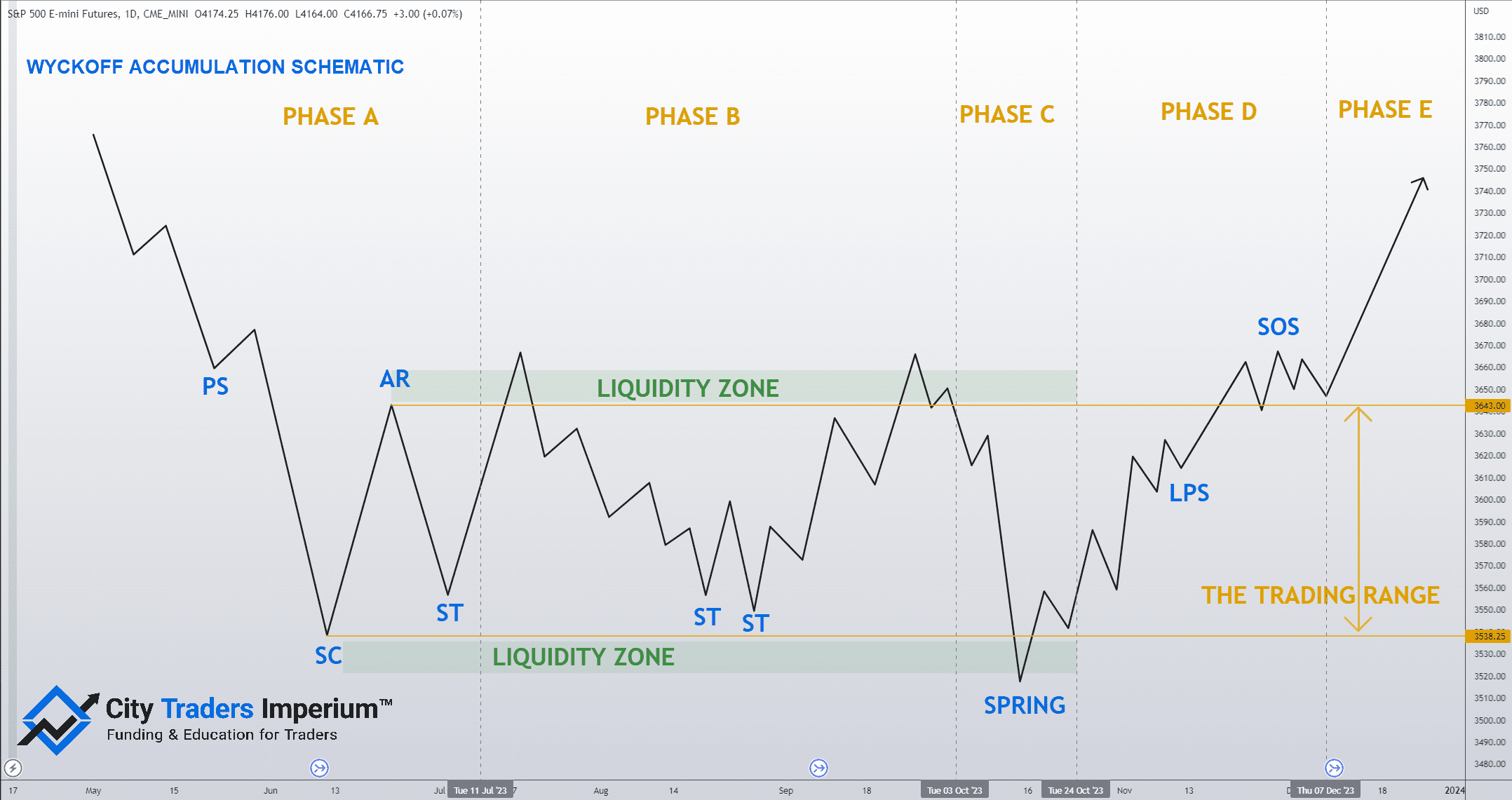

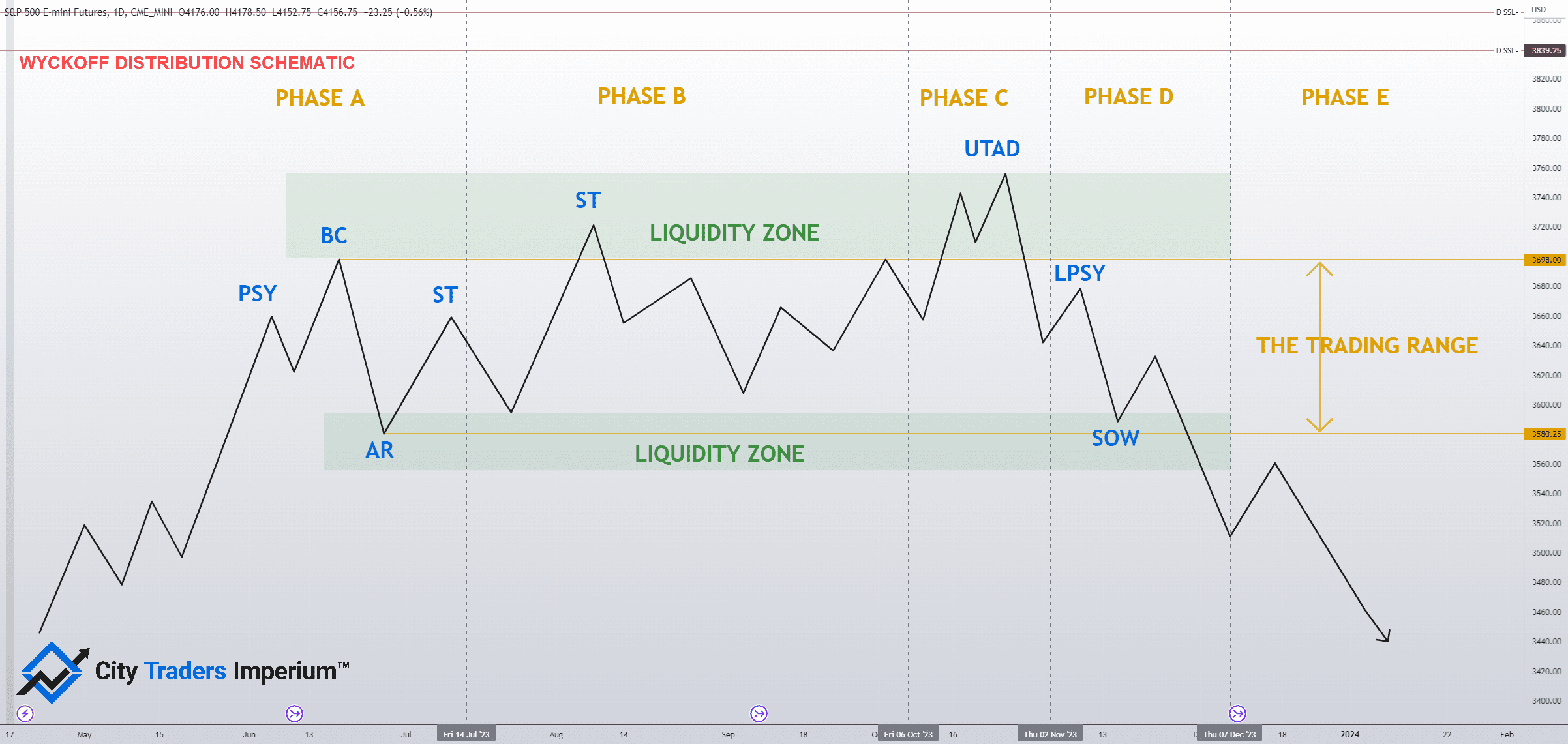

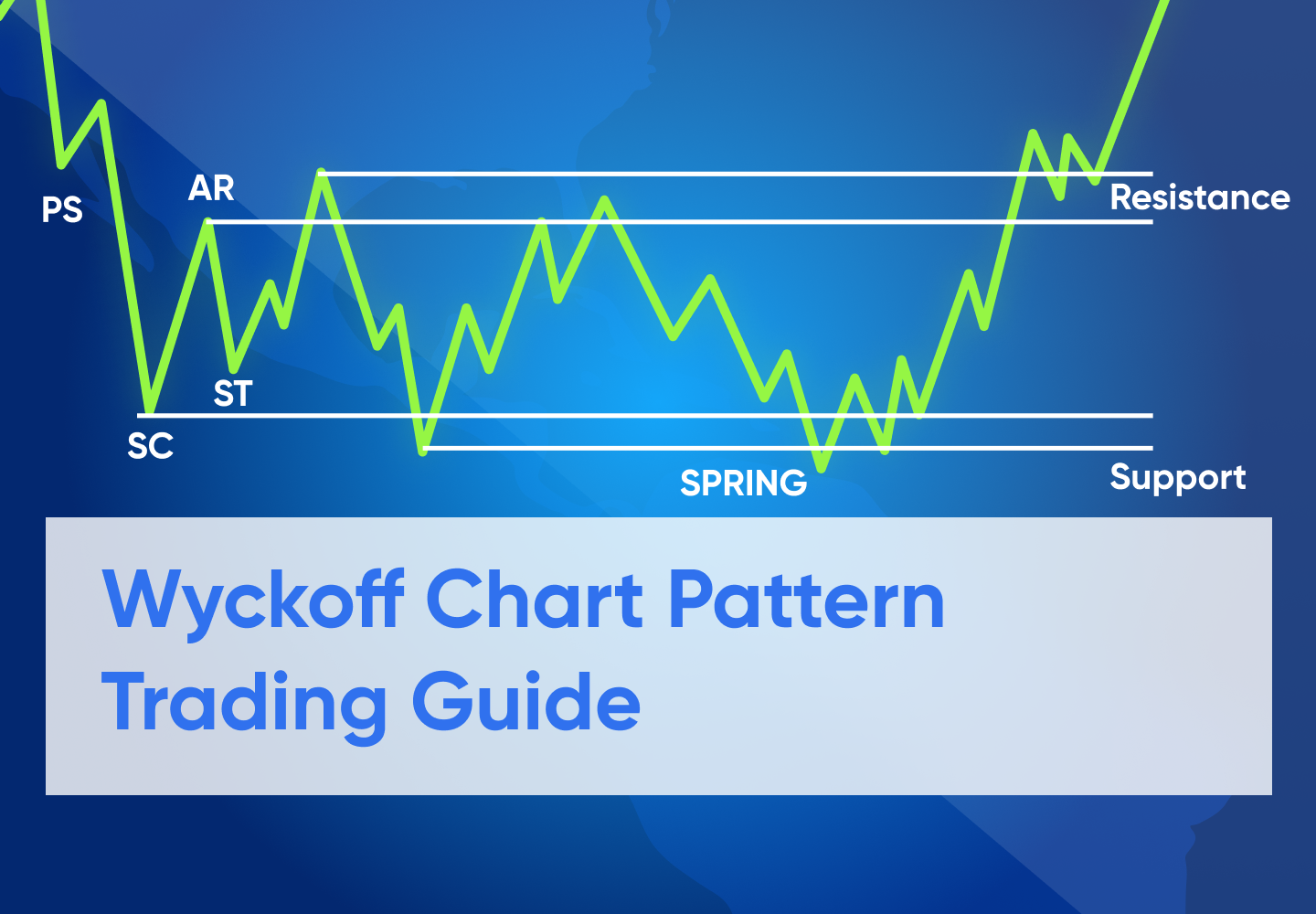

Wyckoff Distribution Pattern - The wyckoff method is a technical analysis approach that can help investors and traders identify the phases of price trend development and the rules to use in conjunction with them. Web learn how to use the wyckoff pattern, a technical analysis approach based on market cycles and price action, to identify accumulation and distribution. The wyckoff method explained that these. By understanding its key characteristics and components, traders can. The wyckoff method for understanding financial markets. Web the wyckoff accumulation pattern is a chart formation that indicates the accumulation phase of an asset. Web here are the 5 major wyckoffian patterns that occurs in accumulation phase: It covers the accumulation, markup, distribution, and markdown phases of the wyckoff market cycle, as well as the rules. Web learn the wyckoff method, a technical analysis approach that explains market structure and price movements through supply and demand, cause and effect, and effort. The law of effort and result. It covers the accumulation, markup, distribution, and markdown phases of the wyckoff market cycle, as well as the rules. Web the wyckoff distribution pattern consists of multiple sections: Get to know what wyckoff rules are. Web according to this method, a market cycle has four distinct phases: Web what is the wyckoff pattern definition? Web learn how to use the wyckoff pattern, a technical analysis approach based on market cycles and price action, to identify accumulation and distribution. Web what is the wyckoff pattern definition? Get to know what wyckoff rules are. The wyckoff method explained that these. Web the wyckoff distribution identifies the cause of price movements by studying the relationship between price. Web here are the 5 major wyckoffian patterns that occurs in accumulation phase: The “preliminary supply”, the “buying climax”, the automatic reaction, the secondary test, the spring, and. Web what is the wyckoff pattern definition? Web there are five parts of the wyckoff distribution phase: The wyckoff method is a technical analysis approach that can help investors and traders identify. Wyckoff's composite man wyckoff price cycle. It covers the accumulation, markup, distribution, and markdown phases of the wyckoff market cycle, as well as the rules. Web learn how to use the wyckoff pattern, a technical analysis approach based on market cycles and price action, to identify accumulation and distribution. What are the additional rules you need to know. Web there. The wyckoff method is a technical analysis approach that can help investors and traders identify the phases of price trend development and the rules to use in conjunction with them. Web wyckoff method explained: December 14, 2022 by constantin t. Web there are five parts of the wyckoff distribution phase: An objective of the wyckoff method of technical analysis is. Web the wyckoff distribution pattern consists of multiple sections: Web learn the wyckoff method, a technical analysis approach that explains market structure and price movements through supply and demand, cause and effect, and effort. Preliminary supply (psy), buying climax (bc), automatic reaction (ar), secondary test (st),. Web here are the 5 major wyckoffian patterns that occurs in accumulation phase: Web. Web learn how to use the wyckoff pattern, a technical analysis approach based on market cycles and price action, to identify accumulation and distribution. The wyckoff method with its accumulation and. Web learn how to apply the wyckoff method, a technical analysis approach based on the market behavior of the composite man, to identify trade candidates and entry. Get to. Web the wyckoff distribution pattern consists of multiple sections: The wyckoff method with its accumulation and. It covers the accumulation, markup, distribution, and markdown phases of the wyckoff market cycle, as well as the rules. Web learn how to apply the wyckoff method, a technical analysis approach based on the market behavior of the composite man, to identify trade candidates. Determine the present position and probable future. Web wyckoff trading method: Web wyckoff method explained: It covers the accumulation, markup, distribution, and markdown phases of the wyckoff market cycle, as well as the rules. December 14, 2022 by constantin t. Web the wyckoff distribution pattern consists of multiple sections: Web wyckoff method explained: An objective of the wyckoff method of technical analysis is to improve market timing when establishing a speculative position in. It covers the accumulation, markup, distribution, and markdown phases of the wyckoff market cycle, as well as the rules. Web learn how to use the wyckoff pattern,. By understanding its key characteristics and components, traders can. Web according to this method, a market cycle has four distinct phases: Preliminary support (ps) preliminary support or ps is a support level that forms after a. Web wyckoff trading method: December 14, 2022 by constantin t. The law of effort and result. Web the wyckoff distribution identifies the cause of price movements by studying the relationship between price and volume. Web the wyckoff distribution pattern consists of multiple sections: Web wyckoff method explained: Web the wyckoff accumulation pattern is a chart formation that indicates the accumulation phase of an asset. Web learn how to apply the wyckoff method, a technical analysis approach based on the market behavior of the composite man, to identify trade candidates and entry. Web what is the wyckoff pattern definition? Web distribution happens when an equilibrium has been reached in price after an uptrend, where price stalls and begins to form a range. Web learn how to use the wyckoff pattern, a technical analysis approach based on market cycles and price action, to identify accumulation and distribution. The wyckoff method explained that these. Determine the present position and probable future.

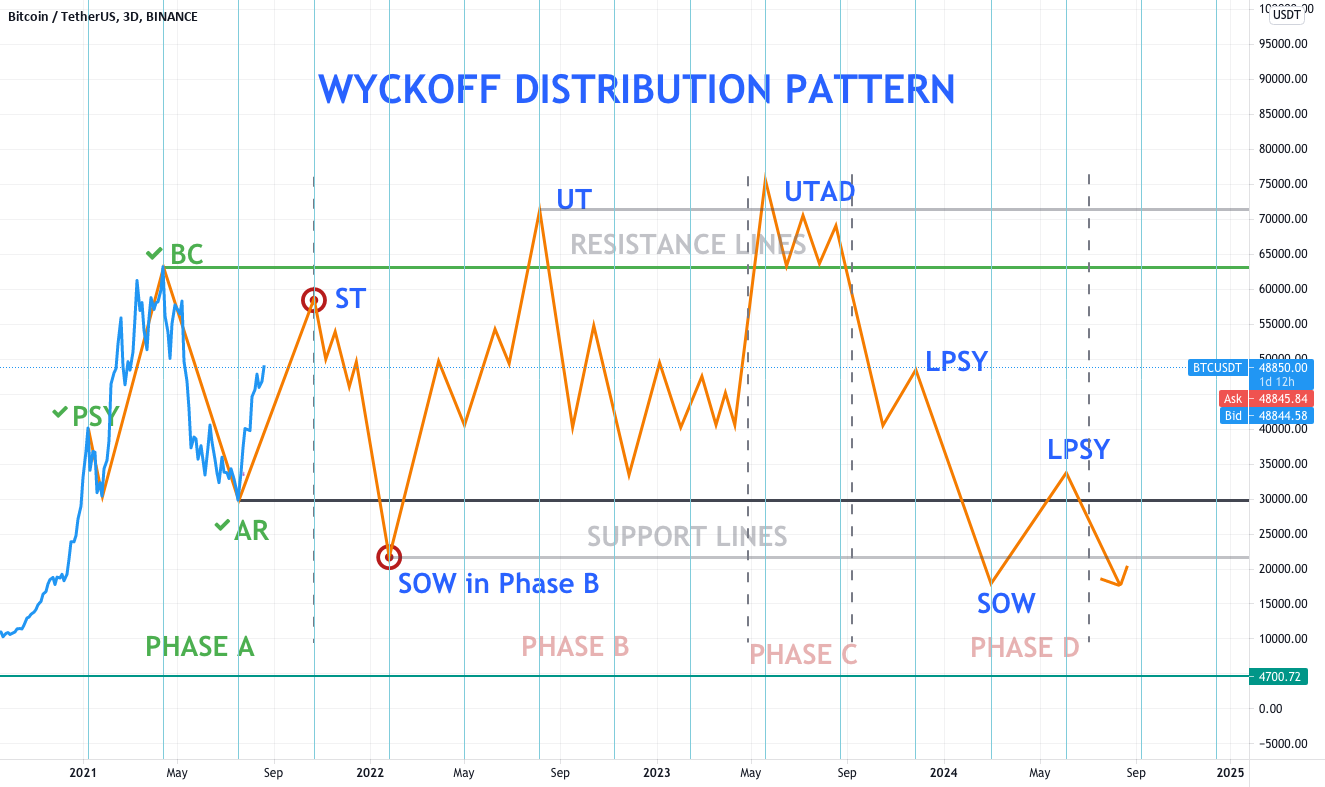

WYCKOFF DISTRIBUTION PATTERN (update) for BINANCEBTCUSDT by SPYvsGME

WyckoffMethode, Akkumulation, Pattern erklärt (2023)

Richard Wyckoff’s Accumulation and Distribution Phase Trading coach

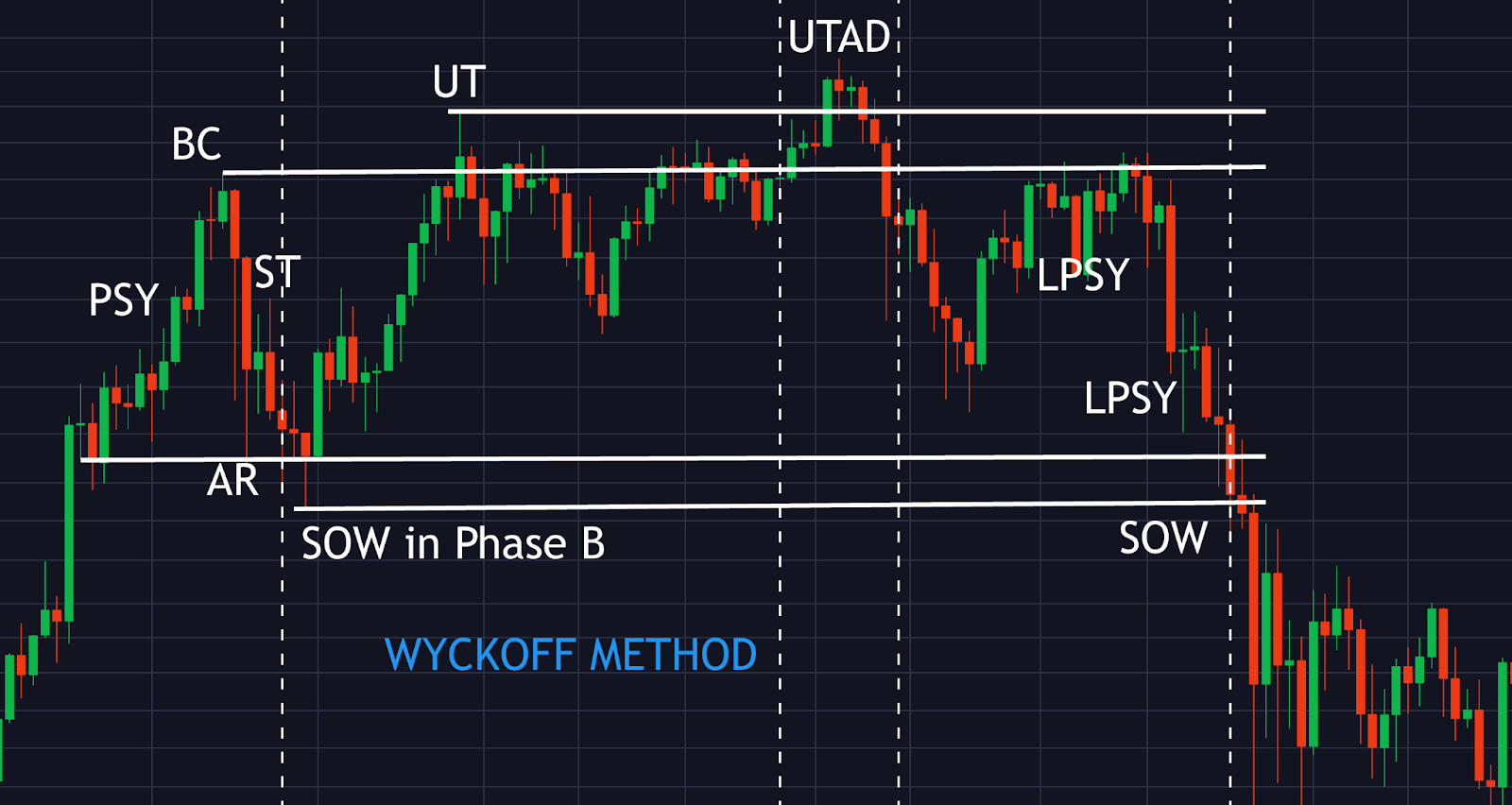

Chart Patterns Wyckoff Distribution TrendSpider Learning Center

Wyckoff Chart Patterns Explained What You Need To Know About Wyckoff

Wyckoff Theory Accumulation And Distribution Schematics

![The Wyckoff Method A Tutorial [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=market_analysis:the_wyckoff_method:wyckoffdistribution1.png)

The Wyckoff Method A Tutorial [ChartSchool]

Wyckoff Theory Accumulation And Distribution Schematics

Wyckoff Chart Patterns Explained What You Need To Know About Wyckoff

Wyckoff Accumulation and Distribution Phases Explained

It Covers The Accumulation, Markup, Distribution, And Markdown Phases Of The Wyckoff Market Cycle, As Well As The Rules.

Preliminary Supply (Psy), Buying Climax (Bc), Automatic Reaction (Ar), Secondary Test (St),.

Web There Are Five Parts Of The Wyckoff Distribution Phase:

The Wyckoff Method With Its Accumulation And.

Related Post: