What Does A Course Of Construction Policy Cover

What Does A Course Of Construction Policy Cover - Web builders risk insurance, which is also commonly referred to as course of construction insurance or a coc, is an insurance policy that covers the physical. Let’s look at exactly how this policy. Web while builders' risk typically covers entire projects, an installation floater protects the tools and materials that contractors use in the course of business. Web depending on the coverage you choose, your course of construction policy may also cover costs associated with rebuilding, expediting supplies, additional design costs, tools. Web course of construction insurance is a type of commercial property insurance that covers a building when that building is being constructed or under construction (including when it. In the case where the building is completed only two days before policy. A coc policy covers a property and your construction materials from a broad range of risks, including: Builder’s risk insurance, also known as course of construction insurance, is a specialized type of property insurance that helps protect buildings under construction. Web well, the insurance policy is supposed to cover the buildings and structures that are under construction, but they also usually provide coverage and protect (1). That’s why coverage extensions are important. Let’s look at exactly how this policy. Web builder’s risk insurance is a form of property insurance that covers damage or loss to a construction project during the course of construction. Some extensions to consider include: Web the policy only provides coverage for up to 90 days after the completion of construction. Most builder’s risk policies exclude “consequential” losses. Trump ordered to pay over $350m. It’s essential in helping protect construction projects, but can be complex and often misunderstood. That’s why coverage extensions are important. Web builder's risk or course of construction policies by way of brief background, 'builder’s risk' insurance, also sometimes known as 'course of. Web well, the insurance policy is supposed to cover the buildings and. Web builders risk insurance, which is also commonly referred to as course of construction insurance or a coc, is an insurance policy that covers the physical. Web you’ve come to the right place to learn about course of construction coverage. Web while builders' risk typically covers entire projects, an installation floater protects the tools and materials that contractors use in. In the case where the building is completed only two days before policy. Most builder’s risk policies exclude “consequential” losses. Web the policy only provides coverage for up to 90 days after the completion of construction. Web depending on the coverage you choose, your course of construction policy may also cover costs associated with rebuilding, expediting supplies, additional design costs,. Web while builders' risk typically covers entire projects, an installation floater protects the tools and materials that contractors use in the course of business. Web you’ve come to the right place to learn about course of construction coverage. Web course of construction insurance is a type of commercial property insurance that covers a building when that building is being constructed. Web builders risk insurance, also known as course of construction (coc) insurance, or sometimes construction all risk insurance, is insurance coverage for. Builder’s risk insurance, also known as course of construction insurance, is a specialized type of property insurance that helps protect buildings under construction. Web what does course of construction insurance cover? Web so, now we know builder’s risk. Most builder’s risk policies exclude “consequential” losses. Some extensions to consider include: Web what does course of construction cover? Web well, the insurance policy is supposed to cover the buildings and structures that are under construction, but they also usually provide coverage and protect (1). In the case where the building is completed only two days before policy. Web builder’s risk insurance is a form of property insurance that covers damage or loss to a construction project during the course of construction. Most builder’s risk policies exclude “consequential” losses. Web what does course of construction cover? Web so, now we know builder’s risk insurance and course of construction insurance are just two names for the same policy. Web. Builder’s risk insurance, also known as course of construction insurance, is a specialized type of property insurance that helps protect buildings under construction. That’s why coverage extensions are important. Trump ordered to pay over $350m. A coc policy covers a property and your construction materials from a broad range of risks, including: Web you’ve come to the right place to. Web what does course of construction insurance cover? Web so, now we know builder’s risk insurance and course of construction insurance are just two names for the same policy. Web builder's risk or course of construction policies by way of brief background, 'builder’s risk' insurance, also sometimes known as 'course of. Web you’ve come to the right place to learn. The basic concept is relatively simple to grasp, even for those who don’t practice this line of. A coc policy covers a property and your construction materials from a broad range of risks, including: Web well, the insurance policy is supposed to cover the buildings and structures that are under construction, but they also usually provide coverage and protect (1). It’s essential in helping protect construction projects, but can be complex and often misunderstood. Builder’s risk insurance, also known as course of construction insurance, is a specialized type of property insurance that helps protect buildings under construction. Web builder’s risk insurance is a form of property insurance that covers damage or loss to a construction project during the course of construction. Web course of construction insurance is a type of commercial property insurance that covers a building when that building is being constructed or under construction (including when it. Web while builders' risk typically covers entire projects, an installation floater protects the tools and materials that contractors use in the course of business. Web the policy only provides coverage for up to 90 days after the completion of construction. Let’s look at exactly how this policy. Some extensions to consider include: That’s why coverage extensions are important. Web so, now we know builder’s risk insurance and course of construction insurance are just two names for the same policy. Web depending on the coverage you choose, your course of construction policy may also cover costs associated with rebuilding, expediting supplies, additional design costs, tools. Web builders risk insurance, also known as course of construction (coc) insurance, or sometimes construction all risk insurance, is insurance coverage for. Most builder’s risk policies exclude “consequential” losses.

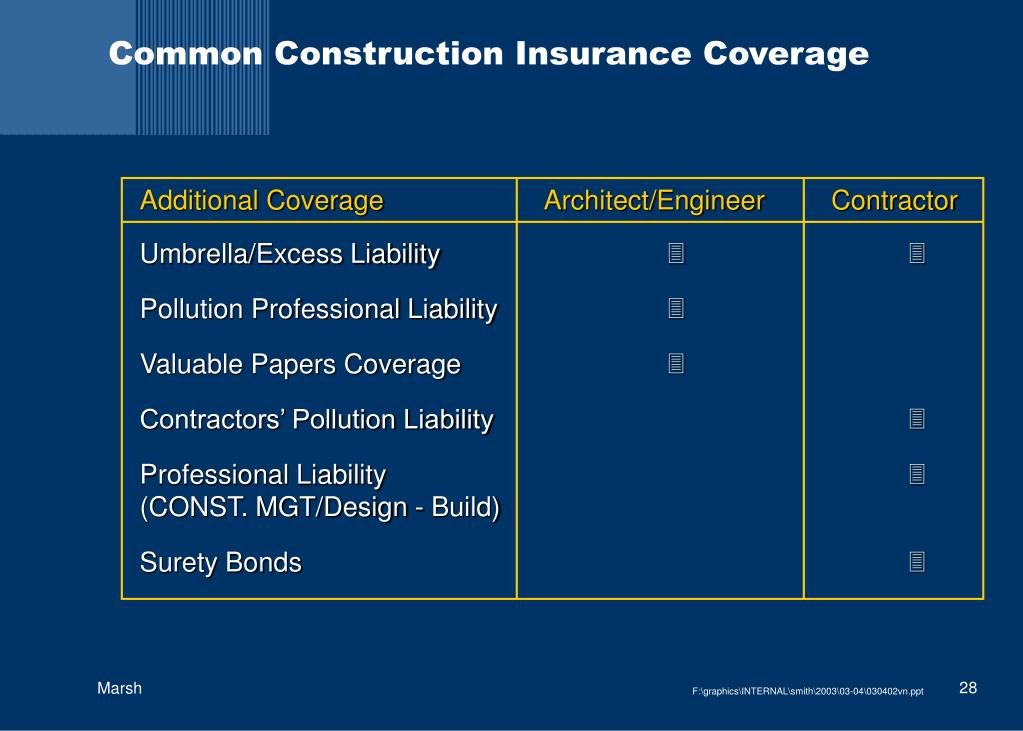

What are the Types of Insurance Covers Professionals in the

PPT Insuring the Construction Project PowerPoint Presentation, free

Builders Risk Insurance Course of Construction Insurance AFIG

How Do Course Of Construction Policies Affect Builder's Risk Insurance

Summary of typical construction insurance coverage. Download

Course of Construction (COC) Insurance Policy Benefits & Coverages

Understanding Course of Construction (COC) Insurance CPA California

Affordable Course of Constructruction Insurance 2021 InsureHopper

What Is Course Of Construction Insurance? Farmer Brown Insurance

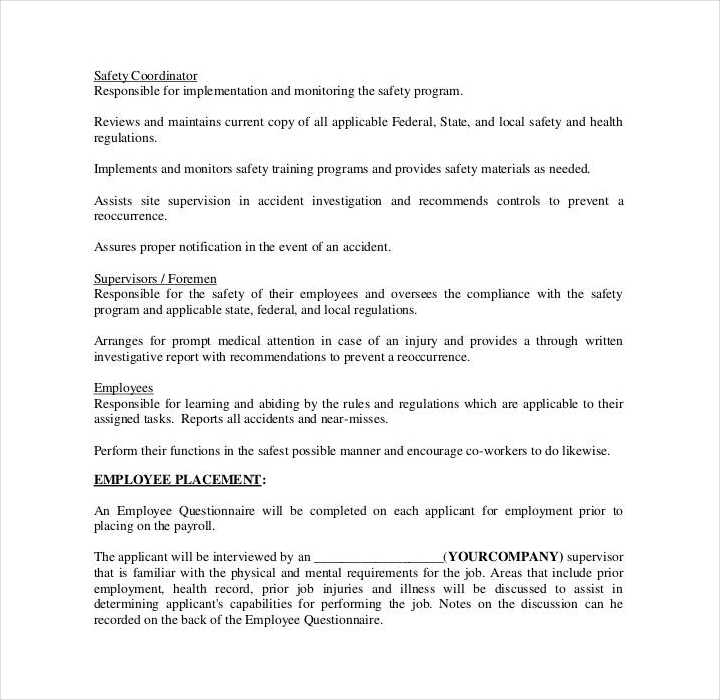

Construction Company Policies And Procedures Template

In The Case Where The Building Is Completed Only Two Days Before Policy.

Web You’ve Come To The Right Place To Learn About Course Of Construction Coverage.

Trump Ordered To Pay Over $350M.

Web What Does Course Of Construction Insurance Cover?

Related Post: