Wedge Patterns

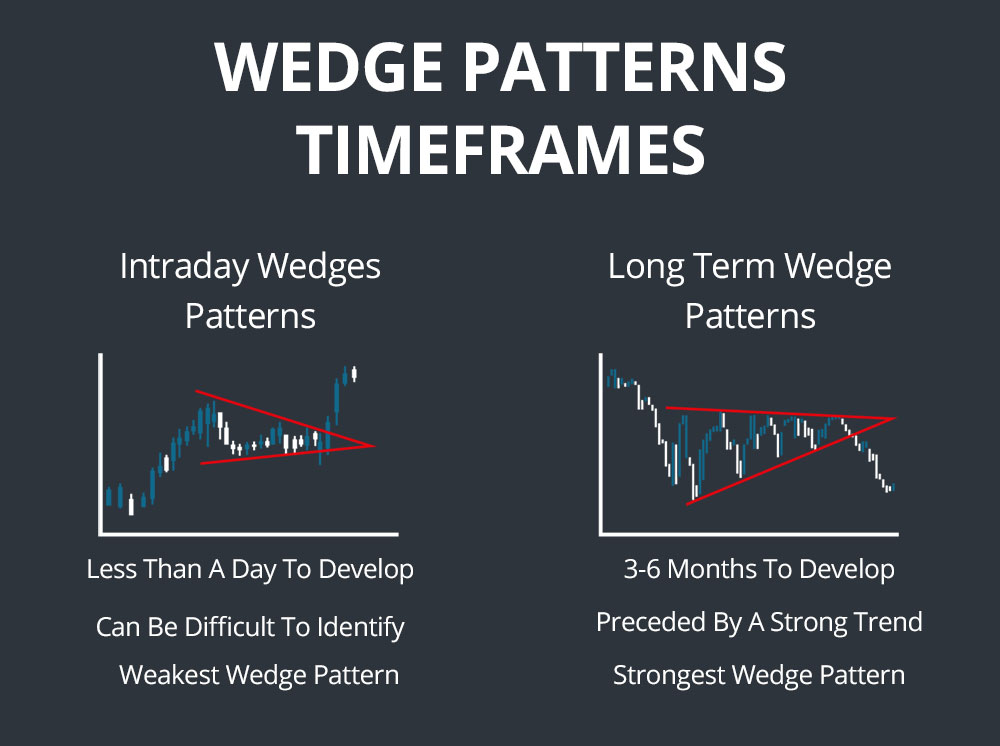

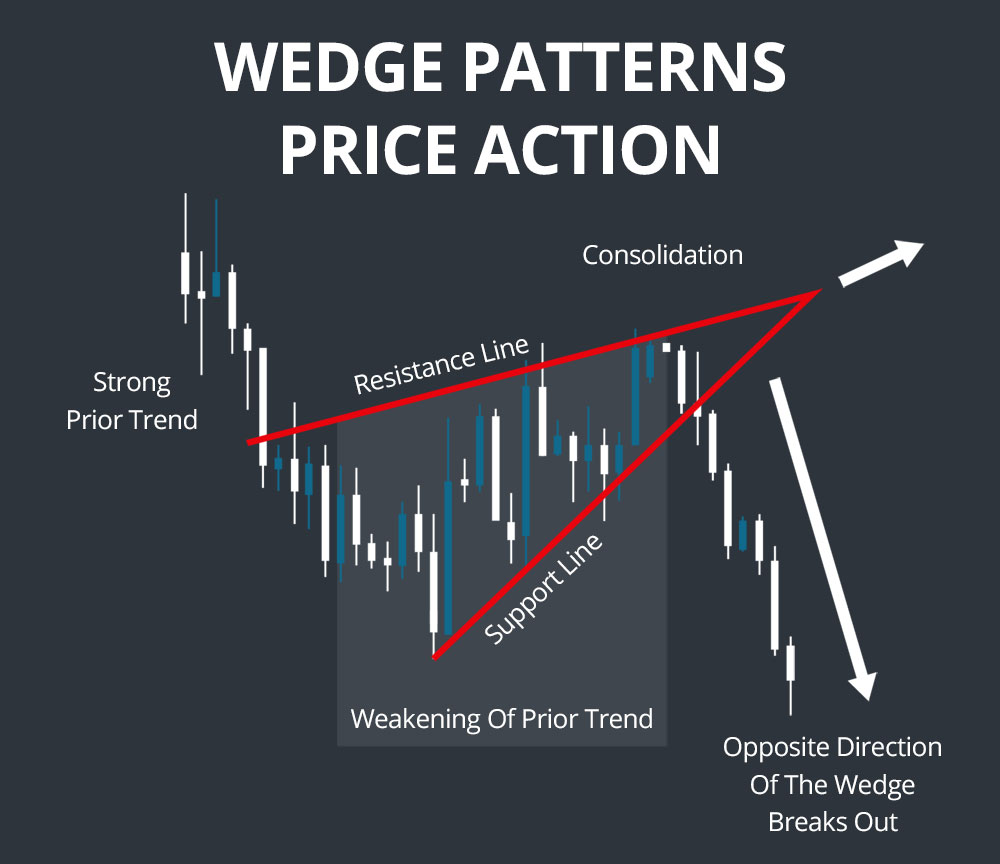

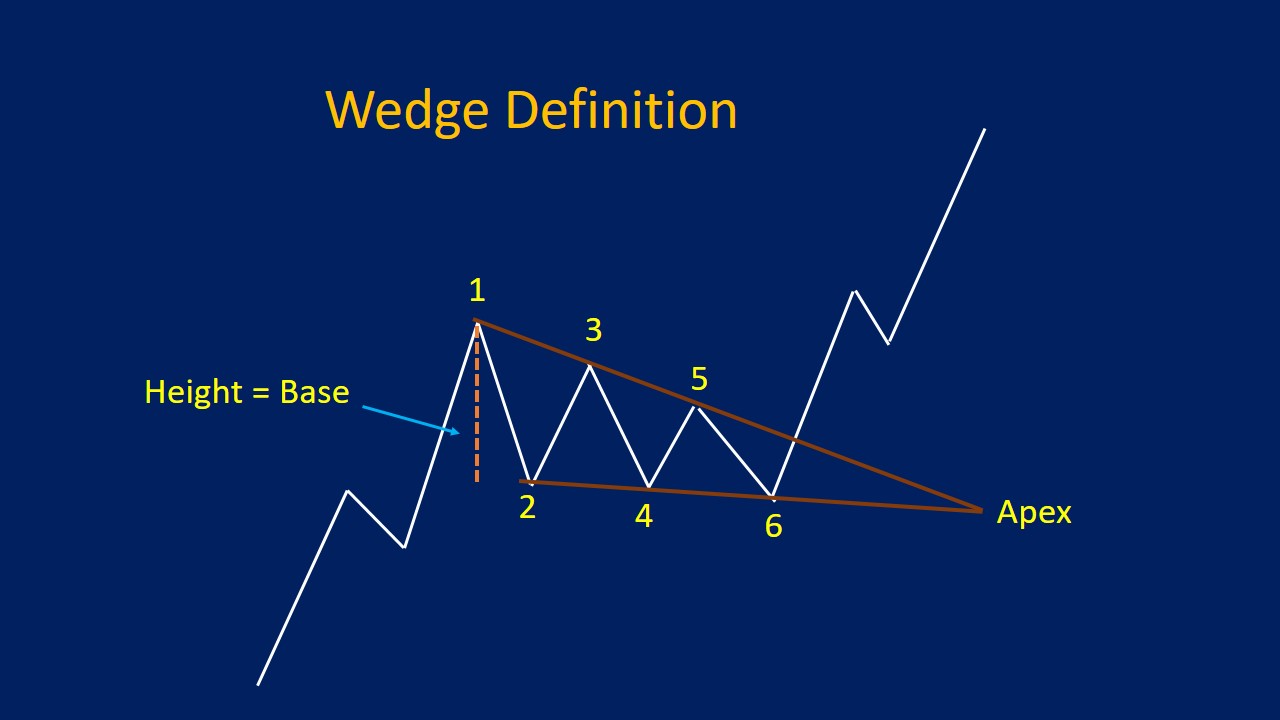

Wedge Patterns - 🚀 in this comprehensive guide, we'll dive into the intricacies of trading this powerful chart pattern and show you how to harness its potential for profitable gains. It means that the magnitude of price movement within the wedge pattern is decreasing. (chart examples of wedge patterns using commodity charts.) (stock charts.) futures and options trading carries significant risk and you can lose some, all or even more than your investment. Web wedge patterns are chart patterns similar to symmetrical triangle patterns in that they feature trading that initially takes place over a wide price range and then narrows in range as trading continues. A wedge pattern is a technical analysis chart formation that can occur in an uptrend or downtrend and signals a potential trend reversal. Web the falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. It’s the opposite of the falling (descending) wedge pattern (bullish). Web a wedge pattern is a technical analysis tool used by traders to identify potential trend reversals or continuations. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Web what is a wedge pattern? In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. It is a type of formation in which trading activities are confined within converging straight lines. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a bullish bias. Web ☑️what is the rising wedge pattern? (chart examples of wedge patterns using commodity charts.) (stock charts.) futures and options trading carries. They are also known as a descending wedge pattern and ascending wedge pattern. 🚀 in this comprehensive guide, we'll dive into the intricacies of trading this powerful chart pattern and show you how to harness its potential for profitable gains. It should take about 3 to 4 weeks to complete the wedge. Web a wedge pattern is a popular trading. Rising wedges typically signal a bearish reversal, while falling wedges suggest a bullish continuation. It signifies that a potential top might be in the offing. There are two main types of wedge patterns: A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. Web the falling wedge pattern is a continuation pattern formed. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. It signifies that a potential top might be in the offing. 🚀 in this comprehensive guide, we'll dive into the intricacies of trading this powerful chart pattern and show you how to harness its potential for profitable gains. Web a wedge. Although sloped in the same direction, one trendline has a greater slope than the other. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. It means that the magnitude of price movement within. The rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Web rising wedges put in a series of higher tops and higher bottoms. Web wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. It means that the magnitude of price movement within. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. It. Web what is a wedge pattern? Web what is a wedge pattern? Web wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. (chart examples of wedge patterns using commodity charts.) (stock charts.) futures and options trading carries significant risk and you can lose some, all or even more than your investment.. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. The rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Web what is a wedge pattern? A wedge pattern is a chart pattern that signals a future reversal. The rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Its unique shape resembles a triangle, with converging trend lines that slope either upward or downward. The two trend lines are drawn to connect the respective highs and lows of a price series over. Web what is a wedge pattern? 🚀 in this comprehensive guide, we'll dive into the intricacies of trading this powerful chart pattern and show you how to harness its potential for profitable gains. It is a type of formation in which trading activities are confined within converging straight lines which form a pattern. Wedges signal a pause in the current trend. The rising wedge and the falling wedge. It’s the opposite of the falling (descending) wedge pattern (bullish). It’s formed by drawing trend lines that connect a series of sequentially higher peaks and higher troughs for an uptrend, or lower peaks and lower troughs for a downtrend. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. As outlined earlier, falling wedges can be both a reversal and continuation pattern. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. 📊💰 understanding the rising wedge pattern 📈 the rising wedge. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations.

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Rising And Falling Wedge Patterns The Complete Guide

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Wedge Pattern Rising & Falling Wedges, Plus Examples

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns The Ultimate Guide For 2021

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

It Should Take About 3 To 4 Weeks To Complete The Wedge.

Web A Wedge Pattern Is A Technical Analysis Tool Used By Traders To Identify Potential Trend Reversals Or Continuations.

Web Are You Ready To Unlock The Secrets Of The Rising Wedge Pattern In The Thrilling World Of Forex Trading?

In Contrast To Symmetrical Triangles, Which Have No Definitive Slope And No Bullish Or Bearish Bias, Rising Wedges Definitely Slope Up And Have A Bearish Bias.

Related Post: