Wedge Pattern Stocks

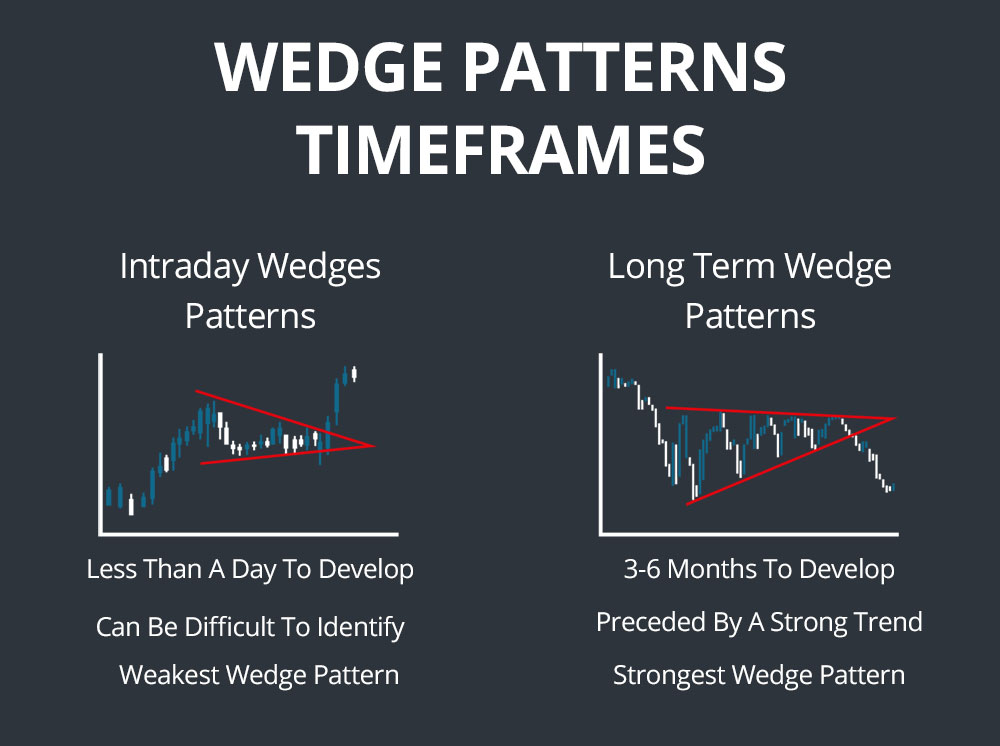

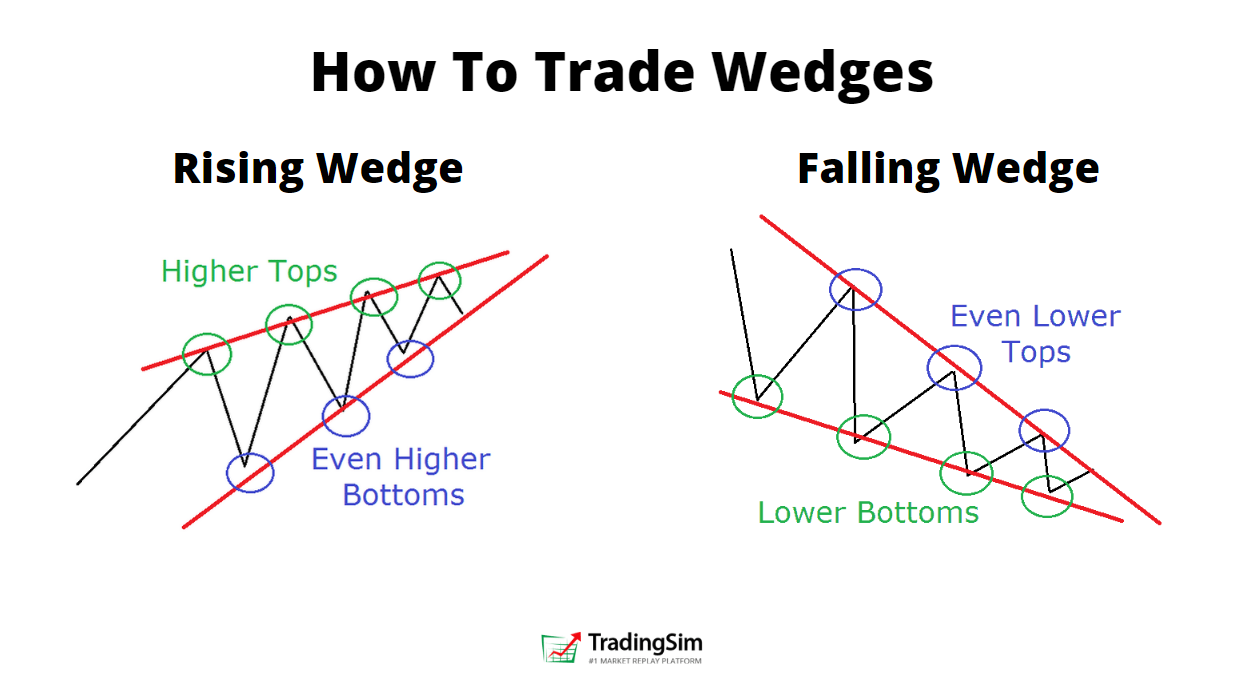

Wedge Pattern Stocks - Web learn how to identify and trade wedge patterns, which are continuation or reversal patterns formed by converging trend lines. Learn how to trade wedge patterns. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Web although many newbie traders confuse wedges with triangles, rising and falling wedge patterns are easily distinguishable from other chart patterns. In contrast to symmetrical triangles,. The breakout direction from the wedge determines whether. Web broadening wedges are one of a series of chart patterns in trading: The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. Wedge patterns are trend reversal patterns. Learn all about the falling wedge pattern and rising wedge pattern here, including how to. They are composed of the support and resistance trend lines that move in the same direction as the channel gets. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend. (chart examples of wedge patterns using commodity charts.) (stock charts.) futures and options trading carries. There are 6 broadening wedge patterns that we can separately identify on our charts and each. Rising wedges typically signal a bearish. Web wedge patterns are chart patterns that indicate a reversal of the prior trend, either bullish or bearish. Web a wedge pattern is. Web in the world of stock trading, the wedge chart pattern stands out as a versatile and reliable chart pattern for traders. Web wedge patterns are chart patterns that indicate a reversal of the prior trend, either bullish or bearish. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web. The pattern is characterized by a. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance of a. Web broadening wedges are one of a series of chart patterns in trading: Wedge patterns are trend reversal patterns. See examples, videos, scripts and. Web rising wedges put in a series of higher tops and higher bottoms. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows.. Rising wedges typically signal a bearish. Web wedge patterns are chart patterns that indicate a reversal of the prior trend, either bullish or bearish. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web rising wedges put in a series of higher tops and higher bottoms.. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web wedges are a common type of chart pattern that help traders to identify potential trends and reversals on a trading chart. Most importantly, the stock has formed a rising wedge pattern that is shown. As outlined. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging. The breakout direction from the wedge determines whether. Web wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. Learn how to trade wedge patterns. Web broadening wedges are one of a series of chart patterns in trading: It occurs when the price of. Web wedges can offer an invaluable early warning sign of a price reversal or continuation. Learn how to trade wedge patterns. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. Wedge patterns are trend reversal patterns. See examples, videos, scripts and. There are 6 broadening wedge patterns that we can separately identify on our charts and each. Web wedges are a common type of chart pattern that help traders to identify potential trends and reversals on a trading chart. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. Web wedges can offer an invaluable early warning sign of a price reversal or continuation. As outlined earlier, falling wedges can be both a. This article provides a technical. Web wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. Most importantly, the stock has formed a rising wedge pattern that is shown. In contrast to symmetrical triangles,. (chart examples of wedge patterns using commodity charts.) (stock charts.) futures and options trading carries. In this blog post, we’ll delve into the. Wedge patterns are trend reversal patterns. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. The pattern is characterized by a. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows.

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Rising And Falling Wedge Patterns The Complete Guide

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Rising and Falling Wedge Patterns How to Trade Them TradingSim

How to Trade the Rising Wedge Pattern Warrior Trading

Simple Wedge Trading Strategy For Big Profits

It Occurs When The Price Of.

They Are Composed Of The Support And Resistance Trend Lines That Move In The Same Direction As The Channel Gets.

Web Wedge Patterns Are A Subset Of Chart Patterns, Formed When An Asset’s Price Moves Within Converging Trend Lines, Resembling A Wedge Or Triangle.

Learn All About The Falling Wedge Pattern And Rising Wedge Pattern Here, Including How To.

Related Post: