W Pattern In Stocks

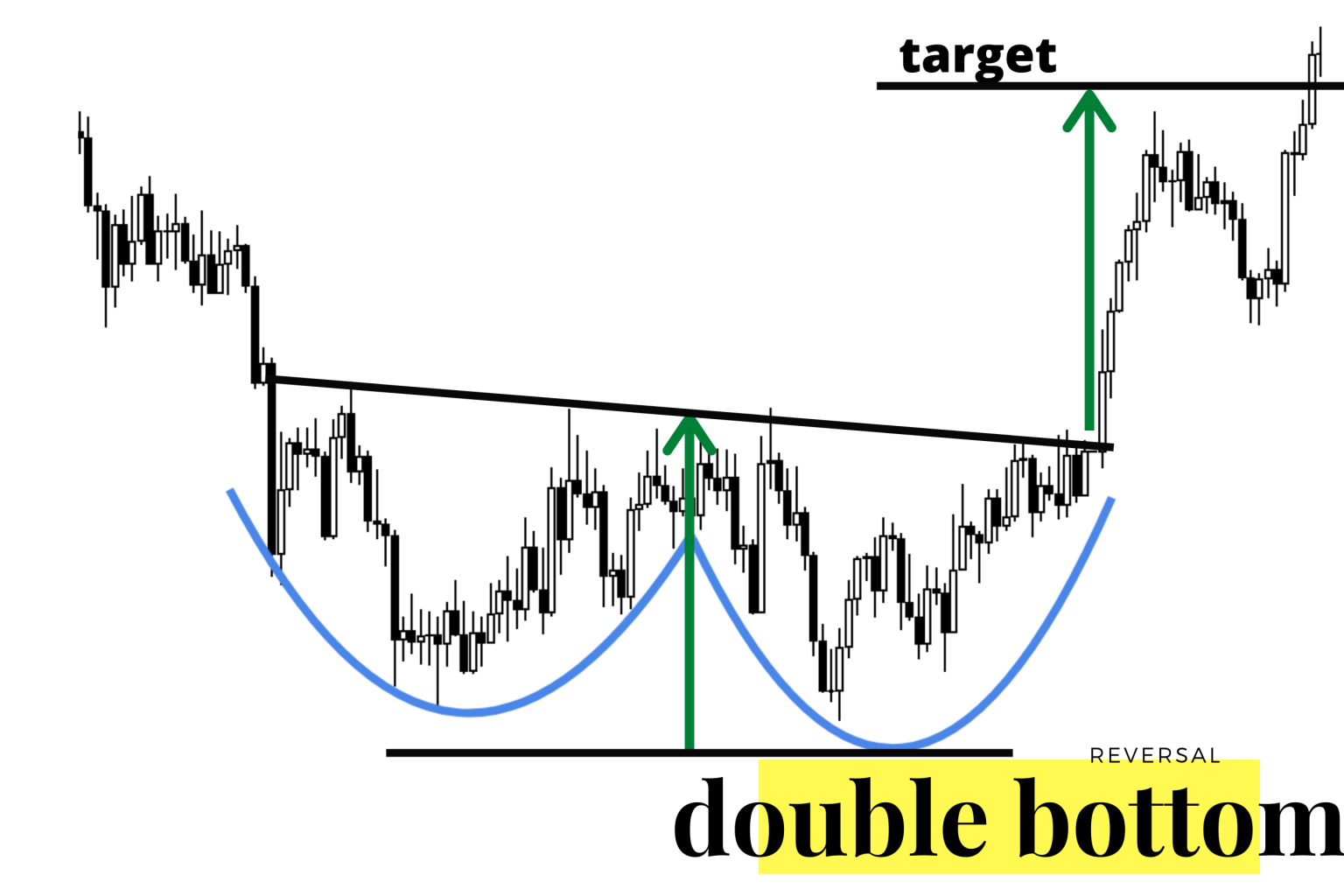

W Pattern In Stocks - Using double top and bottom patterns in a profitable way: Web these patterns, also known as double tops (m) and double bottoms (w), are reflected in the price charts of financial instruments like stocks, currencies, and commodities. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation. Web stock passes all of the below filters in futures segment: Web how to read stock charts and trading patterns. The first low point after an “elongated” price decline. It resembles the letter ‘w’ due to its structure formed by. Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described below. The lower low point where the second leg bottoms out. The double bottom pattern looks like the letter. The first low point after an “elongated” price decline. Web how to read stock charts and trading patterns. Technical analysts and chartists seek to identify. Renowned for its demonstrative signal of a bullish reversal, w in stock charts is. Completed w pattern in m onthlyrsi. Delayed data as of 11:04 am, get realtime scans in our. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a. Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described below. Web explore the power of the w pattern in this comprehensive chart analysis video. The w and m patterns trading. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock. What is double top and bottom? The w and m patterns trading. Web monthly completed w pattern. Web the “w” pattern is indicative of a corrective or reversal move. Web a w stock pattern contains four main price points to watch: Renowned for its demonstrative signal of a bullish reversal, w in stock charts is. Stock passes all of the below filters in cash segment: Web stock passes all of the below filters in futures segment: Double top and bottom patterns are chart. Web the w pattern, frequently observed in stock charts, offers invaluable insights into market behavior. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying. Web the w pattern,. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Scanner guide scan examples feedback. The lower low point where the second leg bottoms out. Stock passes all of the below filters in cash segment: Web a flag pattern is a technical analysis chart. Double top and bottom patterns are chart. Delayed data as of 11:04 am, get realtime scans in our. Web w tops are a bearish reversal chart pattern that can provide traders with valuable insights into the potential direction of a stock’s price movements. The w chart pattern is a reversal pattern that is bullish as. Stock passes all of the. What is double top and bottom? Using double top and bottom patterns in a profitable way: Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Wwwww pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book. Double top and bottom patterns are chart. Wwwww pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Web the “w” pattern is. Inside outside with bollinger band. Web the w pattern, frequently observed in stock charts, offers invaluable insights into market behavior. The lower low point where the second leg bottoms out. The w and m patterns trading. Its appearance suggests traders are increasingly uncertain, potentially leading to a reversal. It resembles the letter ‘w’ due to its structure formed by. Web the “w” pattern is indicative of a corrective or reversal move. Renowned for its demonstrative signal of a bullish reversal, w in stock charts is. Using double top and bottom patterns in a profitable way: A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying. The first low point after an “elongated” price decline. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Web these patterns, also known as double tops (m) and double bottoms (w), are reflected in the price charts of financial instruments like stocks, currencies, and commodities.

Pattern Trading Unveiled Exploring M and W Pattern Trading

Three Types of W Patterns MATI Trader

W Forex Pattern Fast Scalping Forex Hedge Fund

Wpattern — TradingView

Three Types of W Patterns MATI Trader

W Pattern Trading New Trader U

5 Chart Patterns Every Beginner Trader Should Know Brooksy

W pattern forex

W Pattern Trading The Forex Geek

W Pattern Trading YouTube

Scanner Guide Scan Examples Feedback.

What Is Double Top And Bottom?

Web Big W Is A Double Bottom Chart Pattern With Talls Sides.

Web A New W Pattern.

Related Post: