Unum Critical Illness Payout Chart

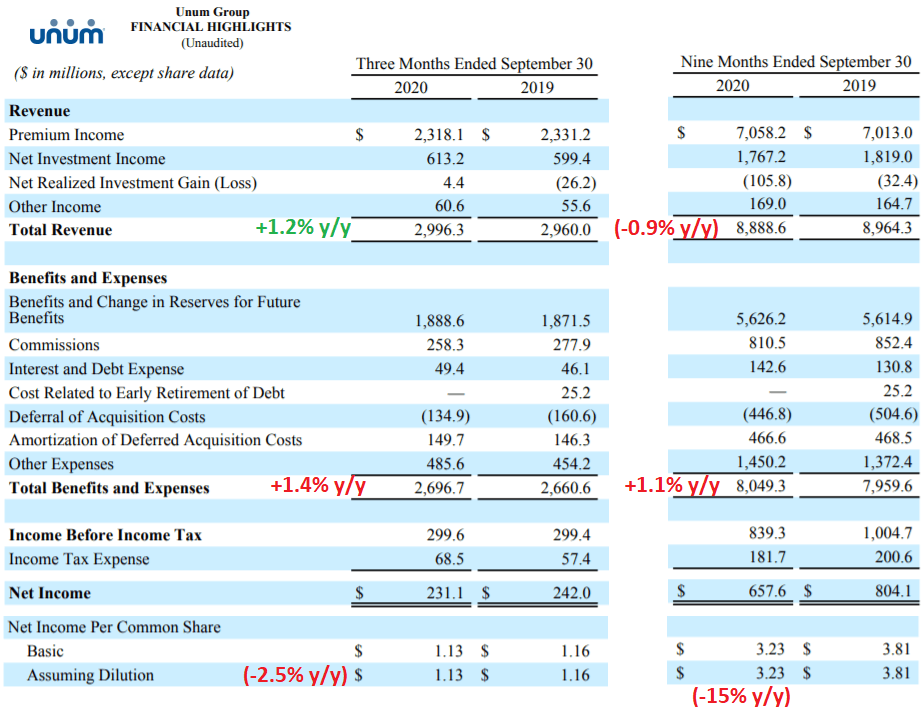

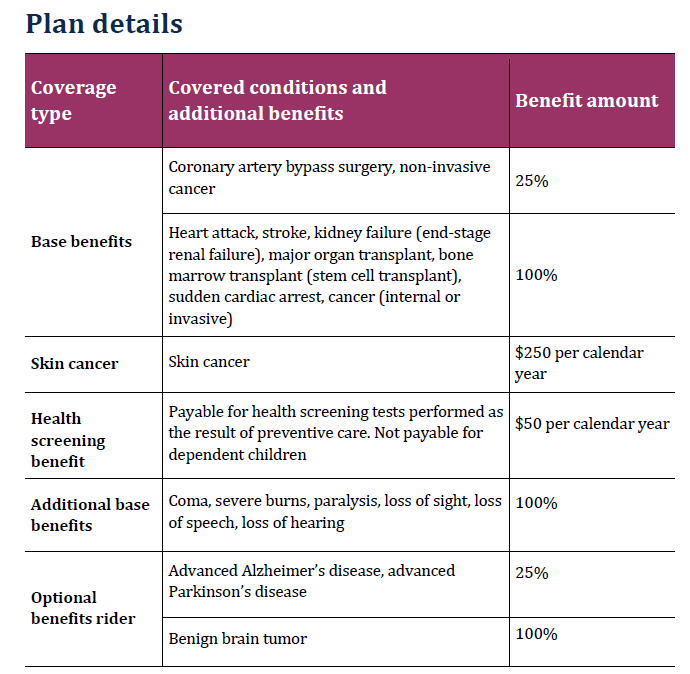

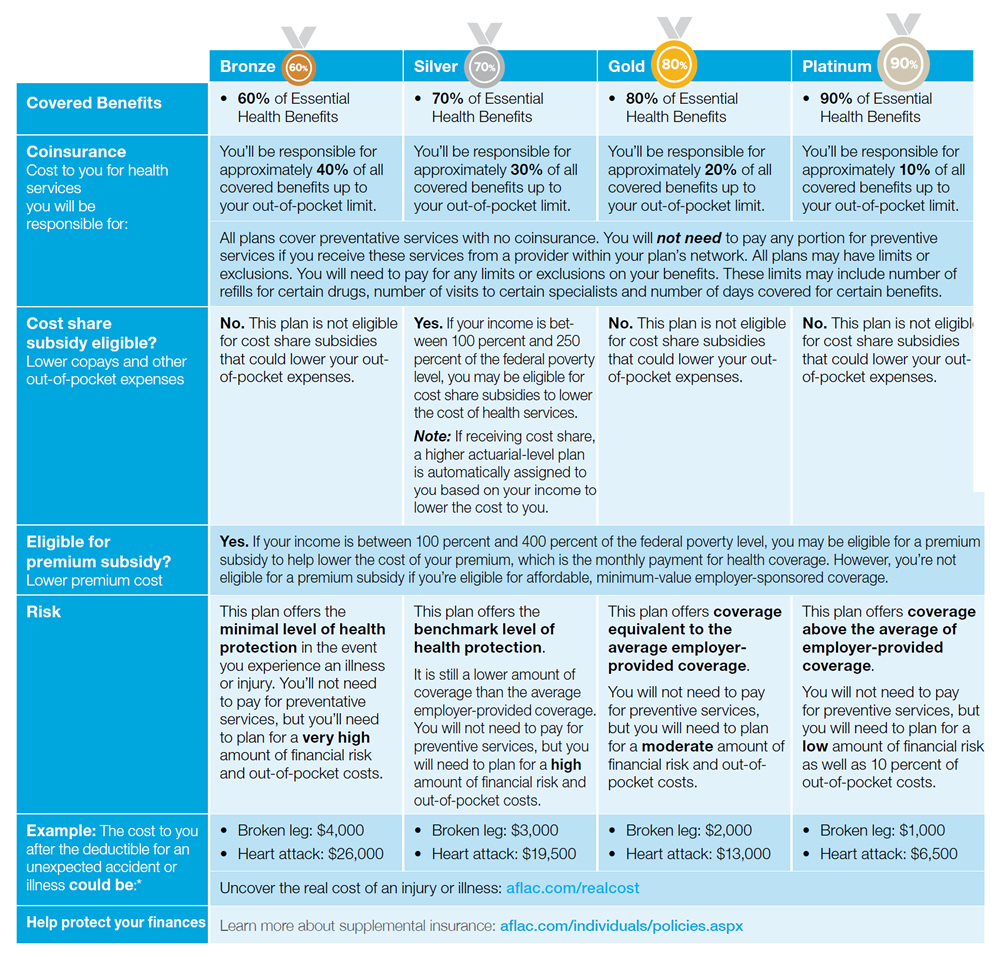

Unum Critical Illness Payout Chart - Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin. Diagnoses must be at least 180 days apart or the conditions can’t be related. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin. If you have a different condition later, you can receive another benefit. Web every year, each family member who has critical illness coverage can also receive $50 for getting a covered be well benefit screening test, such as: If you have a different condition later, you can receive another benefit. $5,000 or $10,000 as applied for. • annual exams by a physician. Web critical illness insurance who can get coverage? Web even after you receive a payout for one illness, you’re still covered for the remaining conditions. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions. Web critical illness insurance who can get coverage? In ca, ga and ma, insured individuals must be covered by. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical. • this insurance pays you once for each eligible illness. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the. Web every year, each family member who has critical illness coverage can also receive $50 for getting a covered be well benefit screening test, such as: • annual exams by a physician. However, the diagnoses must be at. You are considered in active employment if, on the day you apply for. Diagnoses must be at least 180 days apart or. Web a critical illness can be scary — and not just for medical reasons. Spouses can only get 50% of the employee coverage. However, the diagnoses must be at. Web every year, each family member who has critical illness coverage can also receive $50 for getting a covered be well benefit screening test, such as: Web even after you receive. Web a critical illness can be scary — and not just for medical reasons. Spouses can only get 50% of the employee coverage. Web unum limited is a member of the unum group of companies. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions. If you have a different condition later, you. Web absence due to illness or injury you can choose whether members who are absent due to illness or injury are covered until the cover cease age or for up to 3 years. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions. Web critical illness benefit coverage amount employee $10,000 or $20,000 as applied for by you and approved by unum. Spouses can only get 50% of the employee coverage. Web a critical illness can be scary — and not just for medical reasons. Web. Critical illness insurance is offered to all eligible employees ages 16 to 69 (64 in california) who are actively at work. Web absence due to illness or injury you can choose whether members who are absent due to illness or injury are covered until the cover cease age or for up to 3 years. It can also mean time without. Web every year, each family member who has critical illness coverage can also receive $50 for getting a covered be well benefit screening test, such as: Web choose $10,000, $20,000 or $30,000 of coverage with no medical underwriting to qualify if you apply during this enrollment. $5,000 or $10,000 as applied for. Web a critical illness can be scary —. If you have a different condition later, you can receive another benefit. If you have a different condition later, you can receive another benefit. Web absence due to illness or injury you can choose whether members who are absent due to illness or injury are covered until the cover cease age or for up to 3 years. Web critical illness. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin. Web every year, each family member who has critical illness coverage can also receive $50 for getting a covered be well benefit screening test, such as: It can also mean time without a paycheck and unexpected costs that health insurance doesn't cover. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions. In ca, ga and ma, insured individuals must be covered by. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin. Web a critical illness can be scary — and not just for medical reasons. Diagnoses must be at least 180 days apart or the conditions can’t be related. Web absence due to illness or injury you can choose whether members who are absent due to illness or injury are covered until the cover cease age or for up to 3 years. Web critical illness insurance who can get coverage? Spouses can only get 50% of the employee coverage. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions. $5,000 or $10,000 as applied for. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin. • annual exams by a physician. Web even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin.

Scoring systems in the critically ill uses, cautions, and future

What to look out for when buying critical illness insurance Life

What Is Unum Group Accident Insurance Cyber Insurance Panel

What Is A Claim Benefit Balance

Best Critical illness Insurance policy Comparison

World Cancer Day Know how a critical illness policy can ease treatment

Unum Accident Payout Chart

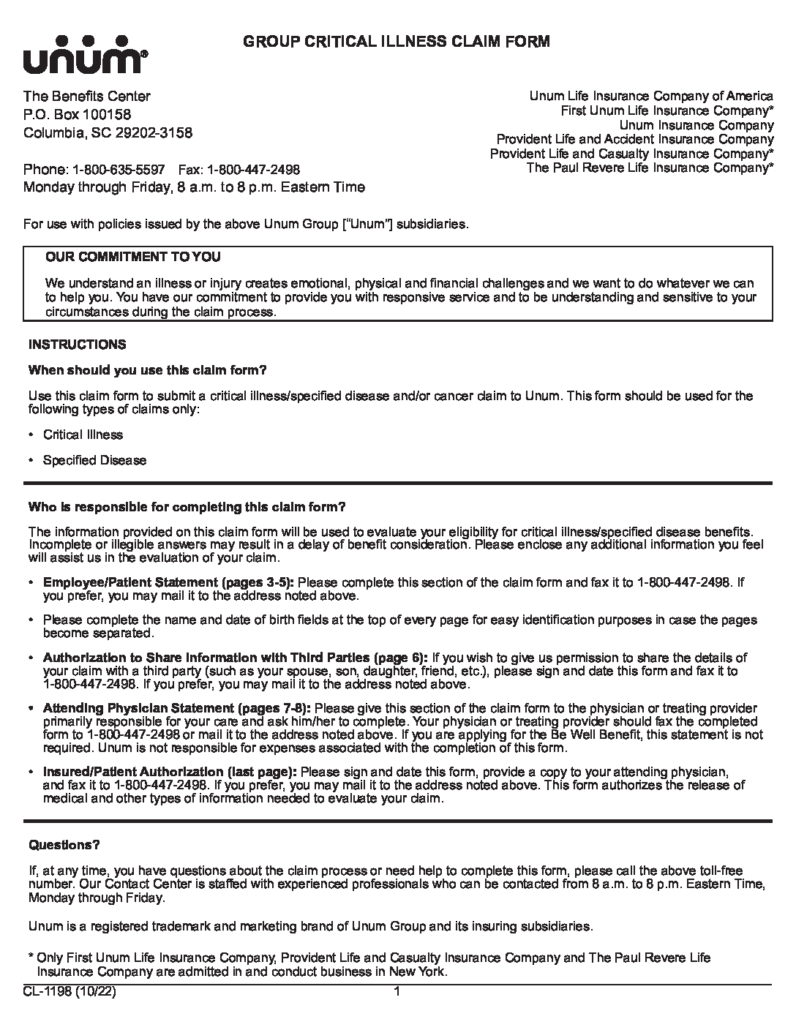

Unum Critical Illness Claim Form Grande Health & Wellness

Unum new benefit for accident and critical illness insurance Employee

Critical Illness Insurance

Group Critical Illness From Unum.

If You Have A Different Condition Later, You Can Receive Another Benefit.

However, The Diagnoses Must Be At.

You Are Considered In Active Employment If, On The Day You Apply For.

Related Post: