Triangle Pattern Forex

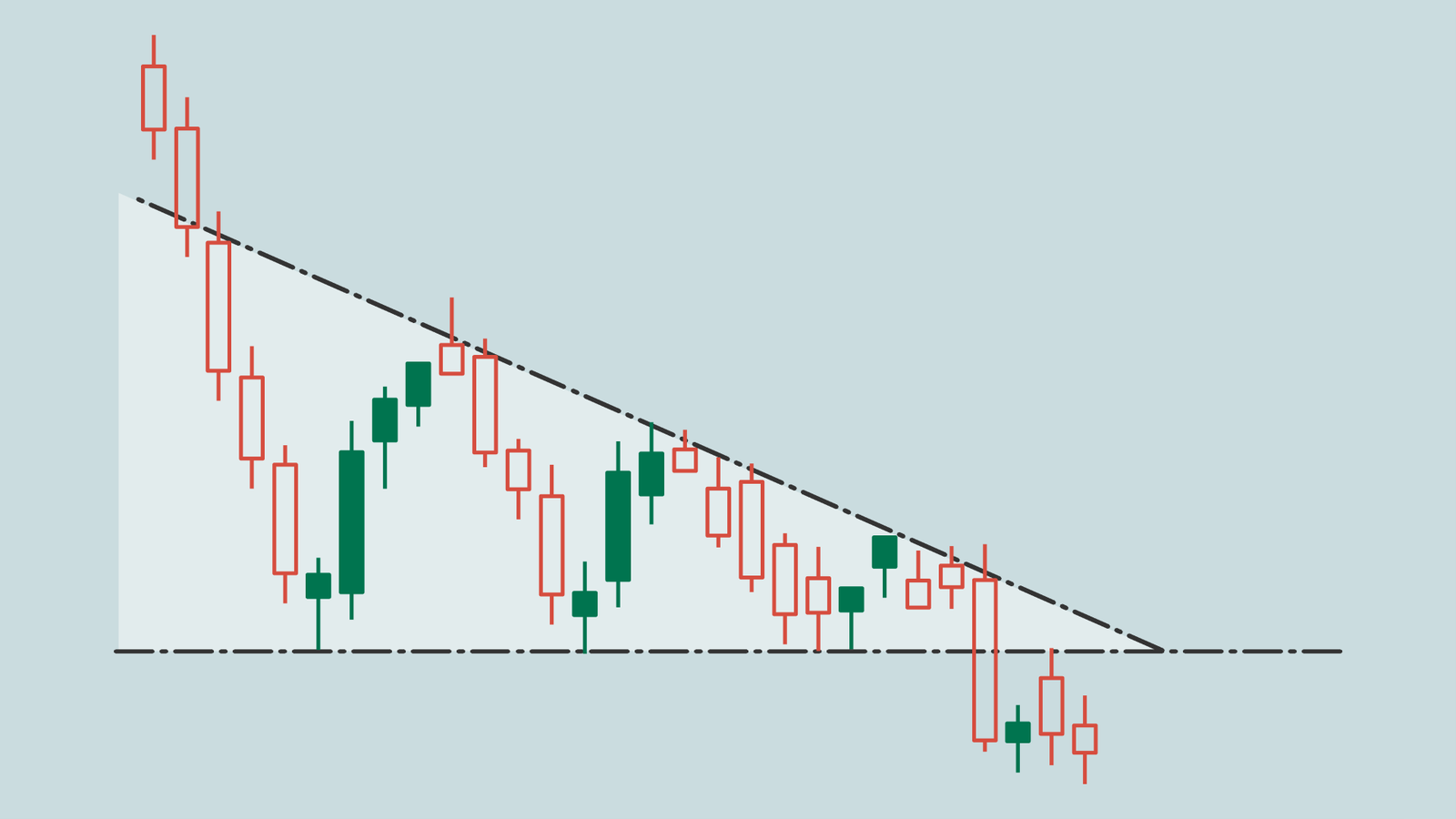

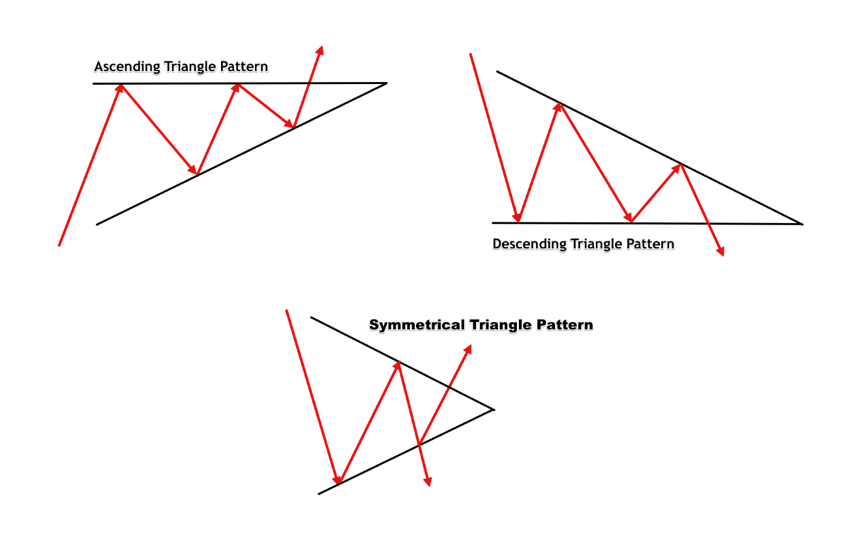

Triangle Pattern Forex - Technical analysis plays a crucial role in forex trading. The april employment change was more than 4 times higher than predicted and the unemployment rate was lower than predicted. Asset managers and large speculators were much quicker to close short bets last week than the week prior, with a notable drop in long bets seen last week as well. Web a triangle pattern is a chart formation that occurs when the price of a forex pair consolidates between two converging trendlines. Traders use various tools and patterns to predict price movements and make informed trading decisions. When the upper and the lower level of a triangle interact, traders expect an eventual breakout from the triangle. Web triangle chart patterns are used in technical analysis, which is a trading strategy that involves charts and patterns that help traders identify trends in the market to make predictions. Symmetrical triangle is an isosceles pattern that can break both up and down at the convergence point. All signal some combination of trader exhaustion and indecisiveness, pausing price momentum and giving the market a chance to catch its breath. It is a chart pattern that forms when the price of an asset moves within two converging trendlines and gets confined within a triangular shape. This guide explores the definition, importance, and variations of triangle patterns in the forex market. All signal some combination of trader exhaustion and indecisiveness, pausing price momentum and giving the market a chance to catch its breath. This pattern is straightforward to be traced on the price chart. Be mindful of the trend direction previous to the triangle formation. Web. The triangle chart pattern is formed by drawing two converging trendlines as price temporarily moves in a sideways direction. Understanding the different types and their significance. Description and execution of the wedge pattern. Slava loza forex trader & analyst. Technical analysis studies how prices have been changing in the past and predicts future prices based on them. Web a triangle pattern is a chart formation that occurs when the price of a forex pair consolidates between two converging trendlines. Slava loza forex trader & analyst. Web the triangle chart pattern is a common pattern that generates unique trading opportunities. Technical analysis studies how prices have been changing in the past and predicts future prices based on them.. Web learn to identify the various triangle patterns that can appear on a forex chart and how you can use them in trading. A clear pattern has emerged on japanese yen futures; Web what is the triangle pattern indicator? To trade the triangle pattern, you must first be able to identify it on your forex charts. The triangle pattern is. Each signal different market conditions. After all, fomc officials still seem to be making up their minds when it comes to picking between easing. Spotting chart patterns is a popular activity amongst traders of all skill levels, and one of the easiest patterns to spot is. Web the triangle pattern in forex is a price formation that signals a potential. In general, there are three types of triangle patterns: Each signal different market conditions. Learn to identify the various triangle patterns that can appear on a chart and how you can use them in trading. Types of the triangle and their execution. ♦ triple top and triple bottoms. Learn to identify the various triangle patterns that can appear on a chart and how you can use them in trading. Be mindful of the trend direction previous to the triangle formation. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. The triangle pattern. ♦ double top & double bottoms. Technical analysis assumes that price action follows a pattern and if we can find the patterns that appear the most often on the charts, we can increase our profits. Technical analysis studies how prices have been changing in the past and predicts future prices based on them. Types of the triangle and their execution.. Web the triangle chart pattern is a common pattern that generates unique trading opportunities. Exposure to it is being trimmed by bulls and bears. Web triangle chart patterns are used in technical analysis, which is a trading strategy that involves charts and patterns that help traders identify trends in the market to make predictions. A triangle pattern in forex is. Technical analysis assumes that price action follows a pattern and if we can find the patterns that appear the most often on the charts, we can increase our profits. Web the triangle chart pattern is a common pattern that generates unique trading opportunities. The set of shapes like triangle shape, rectangle shape, dual top, dual bottom, and many other shapes. Symmetrical triangle is an isosceles pattern that can break both up and down at the convergence point. These patterns provide traders with greater insight into future price movement and the possible. To trade the triangle pattern, you must first be able to identify it on your forex charts. When the upper and the lower level of a triangle interact, traders expect an eventual breakout from the triangle. Learn to identify the various triangle patterns that can appear on a chart and how you can use them in trading. Gold traders seem to be playing it safe ahead of this week’s u.s. Web the “triangle” pattern is a simple technical analysis tool in forex which is a series of falling tops and rising bottoms (4 points are required to draw the pattern). It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. Description and execution of the wedge pattern. It is a chart pattern that forms when the price of an asset moves within two converging trendlines and gets confined within a triangular shape. Understanding the different types and their significance. Web triangle chart patterns are used in technical analysis, which is a trading strategy that involves charts and patterns that help traders identify trends in the market to make predictions. The april employment change was more than 4 times higher than predicted and the unemployment rate was lower than predicted. Traders use various tools and patterns to predict price movements and make informed trading decisions. Be mindful of the trend direction previous to the triangle formation. ♦ triple top and triple bottoms.

Triangle Pattern Characteristics And How To Trade Effectively How To

3 Triangle Patterns Every Forex Trader Should Know LiteFinance

3 Triangle Patterns Every Forex Trader Should Know

Learn how to use triangle chart patterns to predict market trends and

Master Trading Triangle Patterns to Increase Your Win Rate in Forex

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

3 Triangle Patterns Every Forex Trader Should Know

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)

The Ascending Triangle Pattern What It Is, How To Trade It

Ascending & Descending Triangle Pattern Strategy Guide

3 Triangle Patterns Every Forex Trader Should Know IG Community Blog

Each Signal Different Market Conditions.

Spotting Chart Patterns Is A Popular Hobby Amongst Traders Of All Skill Levels, And One Of The Easiest Patterns To Spot Is A Triangle Pattern.

Web Triangle Patterns Have Three Main Variations And Appear Frequently In The Forex Market.

Web Learn To Identify The Various Triangle Patterns That Can Appear On A Forex Chart And How You Can Use Them In Trading.

Related Post: