Triangle Bullish Pattern

Triangle Bullish Pattern - Web this triangle pattern has lower highs and higher lows, which is a sign of declining volatility and price stability. Web faibik dec 21, 2021. The pattern shows either consolidation or increased volatility, depending on its orientation. The rising bottom is formed using trend lines connecting at least two to three higher lows. An ascending triangle is a bullish chart pattern used in technical analysis that is easily recognizable by the right triangle created by two trend lines. There are 3 types of triangle patterns, which we will present below. This pattern occurs within an established downtrend. There are instances when ascending triangles form as reversal patterns at the end of a downtrend, but they are typically continuation patterns. Like the ascending triangle pattern, its descending counterpart is produced by drawing two lines that converge to create the appearance of a triangle. Web stock pattern triangles can be either bullish, bearish, or even neutral. By analyzing volume and waiting for a confirmed breakout from the pattern, traders can integrate these patterns into their strategies to inform decisions on opening and closing positions. Web on the contrary, if the bears continue to hold power, the ripple token may fall toward its support level of $0.4790 by breaking down its triangle pattern. Whales are supporting this. Web often a bullish chart pattern, the ascending triangle pattern in an uptrend is not only easy to recognize but is. Cronos' price is looking to break out of a descending triangle reversal pattern that hints at a 37% rally. The descending triangle in which shib trades is a bearish pattern. An ascending triangle chart pattern is considered bullish. The. Web on the contrary, if the bears continue to hold power, the ripple token may fall toward its support level of $0.4790 by breaking down its triangle pattern. Web since triangles are typically continuation patterns, whether they are bullish or bearish will generally depend on what direction the market was moving in prior to the formation of the triangle. Web. A symmetrical triangle (highs sloping down and right coupled with lows sloping up and right) is considered neutral. Traders look for an increase in trading volume as an indication that new highs will form. By analyzing volume and waiting for a confirmed breakout from the pattern, traders can integrate these patterns into their strategies to inform decisions on opening and. So traders should look for the pattern while prices are in an uptrend and. An ascending triangle is a bullish chart pattern used in technical analysis that is easily recognizable by the right triangle created by two trend lines. Web the triangle pattern is used in technical analysis. Web can shib invalidate bearish pattern? The lower line must connect two. With continuation patterns, the best strategy is to buy straight away with the breakout. Web see the ascending triangle chart below: Web at the same time, bitcoin’s price has rebounded from a recent low of $56,000, which many analysts believe was the local bottom for this cycle. A descending triangle is considered bearish. Firstly, shib has created what resembles a. Web an ascending triangle pattern consists of several candlesticks that form a rising bottom and at least two to three peak levels that form a flat top due to horizontal resistance. A chart pattern used in technical analysis that is easily recognized by the distinct shape created by two converging trendlines. The lower line must connect two price lows. The. This pattern is created with two trendlines. The pattern shows either consolidation or increased volatility, depending on its orientation. Web stock pattern triangles can be either bullish, bearish, or even neutral. The pattern consist of 2 main elements: Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for. Web an ascending triangle pattern consists of several candlesticks that form a rising bottom and at least two to three peak levels that form a flat top due to horizontal resistance. The first trendline is flat along the top of the triangle and acts as a resistance point which—after price successfully breaks above it—signals. Buy as soon as we break. These patterns are formed when the upper trendline, representing resistance, remains flat while the lower trendline, representing support, slopes upwards. Determine if it’s a bullish triangle or a bearish triangle pattern. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern,. Web this provides clues on the likely breakout direction. Web types of triangle charts. The pattern is identified by drawing two. A chart pattern used in technical analysis that is easily recognized by the distinct shape created by two converging trendlines. An ascending triangle is a bullish chart pattern that occurs during an uptrend. A bullish signal is created once the price breaks out of the triangle and. The entry point for traders is when the price breaks. The lower line must connect two price lows. However, there are signs pointing to the contrary. With continuation patterns, the best strategy is to buy straight away with the breakout. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. Web this triangle pattern has lower highs and higher lows, which is a sign of declining volatility and price stability. An ascending triangle pattern will take about four weeks or so to form and will. Determine if it’s a bullish triangle or a bearish triangle pattern. Web a descending triangle pattern is a price chart formation used in technical analysis. The rising bottom is formed using trend lines connecting at least two to three higher lows.

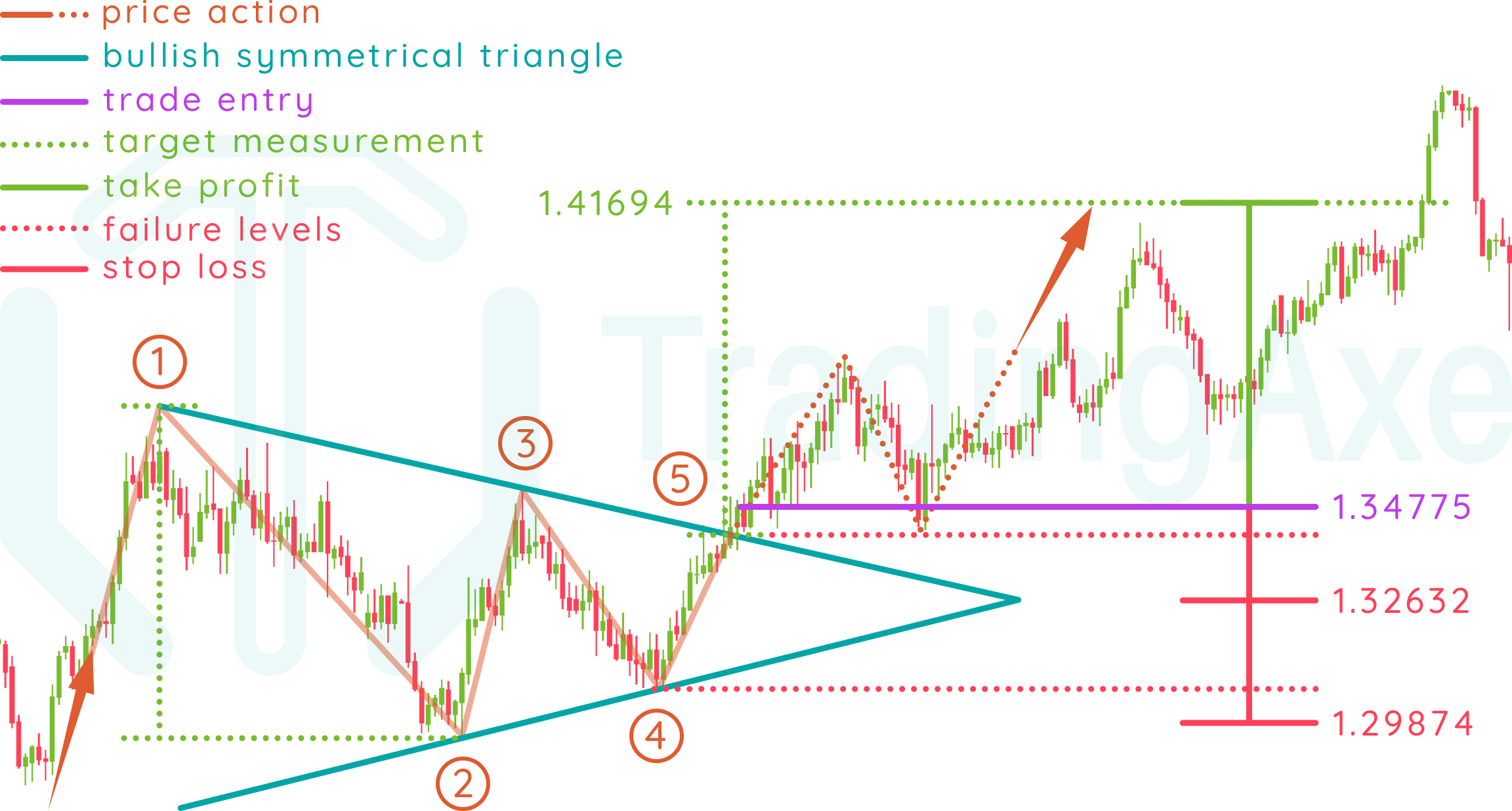

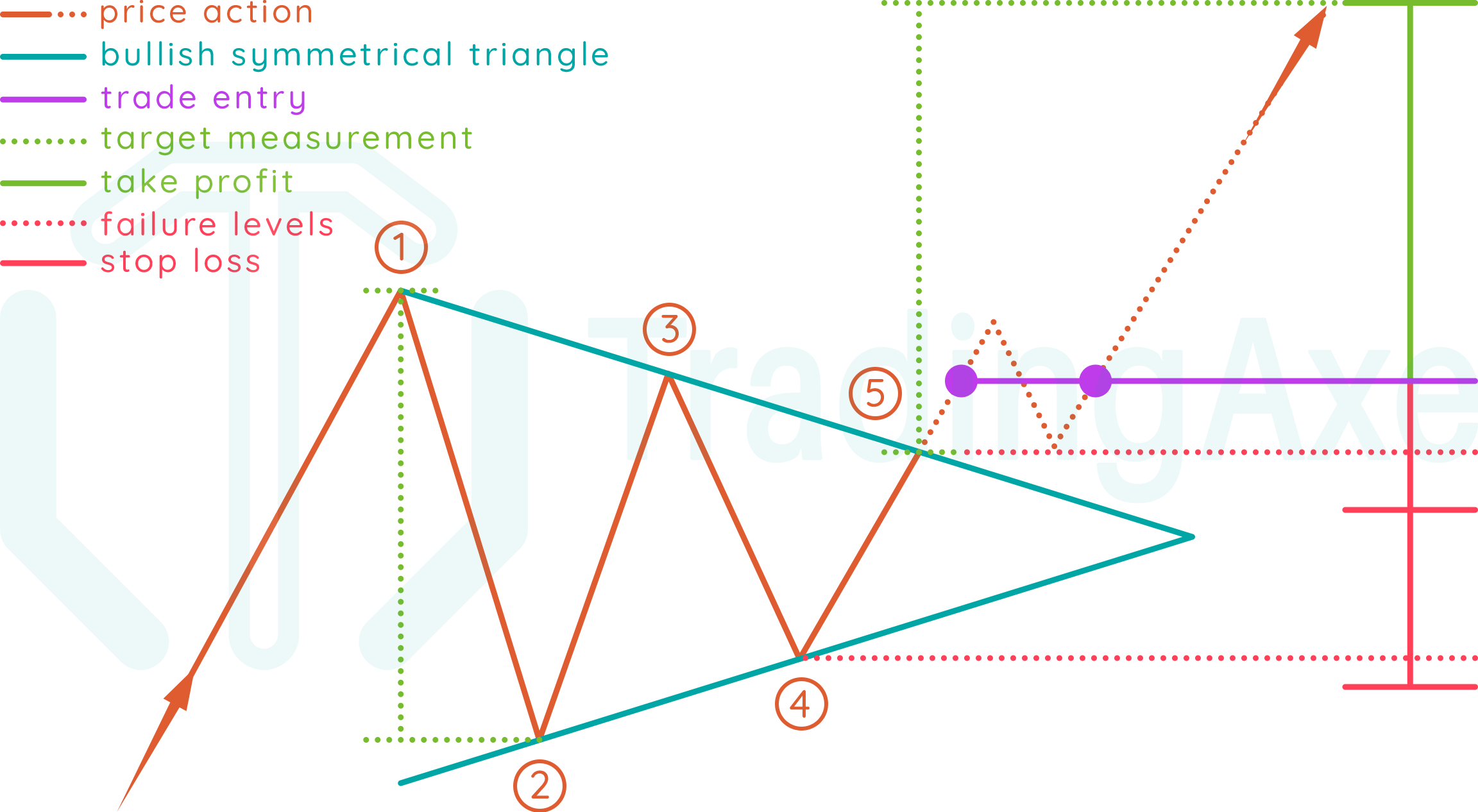

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

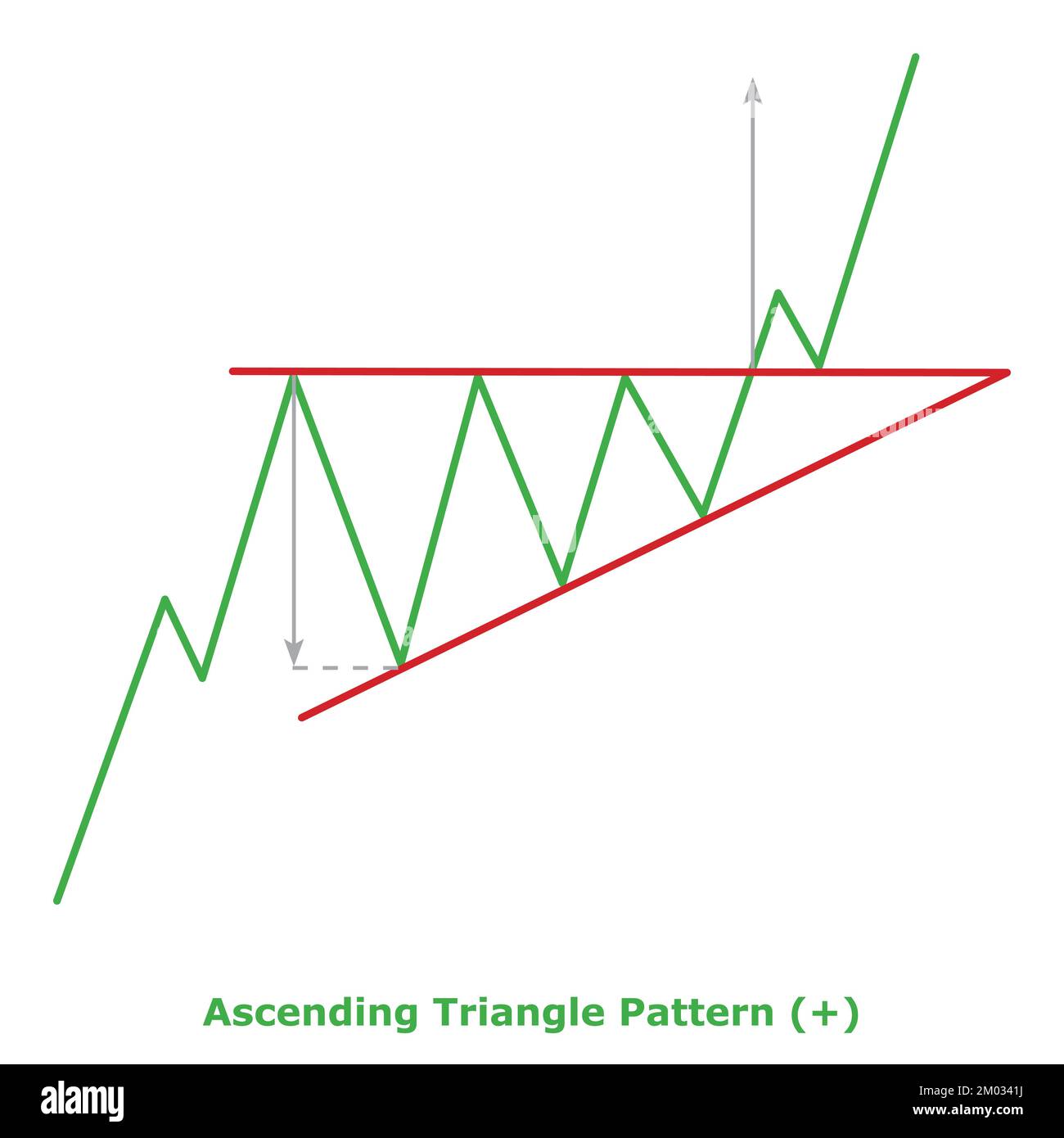

Ascending Triangle Pattern Bullish (+) Small Illustration Green

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

![]()

Bullish Chart Patterns Cheat Sheet Crypto Technical Analysis

Candlestick Chart Patterns, Candle Stick Patterns, Stock Chart Patterns

Triangle Chart Patterns Complete Guide for Day Traders

Bullish Triangle Pattern The Forex Geek

Bullish Pennant Patterns A Complete Guide

The Pattern Shows Either Consolidation Or Increased Volatility, Depending On Its Orientation.

This Pattern Is Created With Two Trendlines.

Web Stock Pattern Triangles Can Be Either Bullish, Bearish, Or Even Neutral.

There Are Instances When Ascending Triangles Form As Reversal Patterns At The End Of A Downtrend, But They Are Typically Continuation Patterns.

Related Post: