Trading Patterns Chart

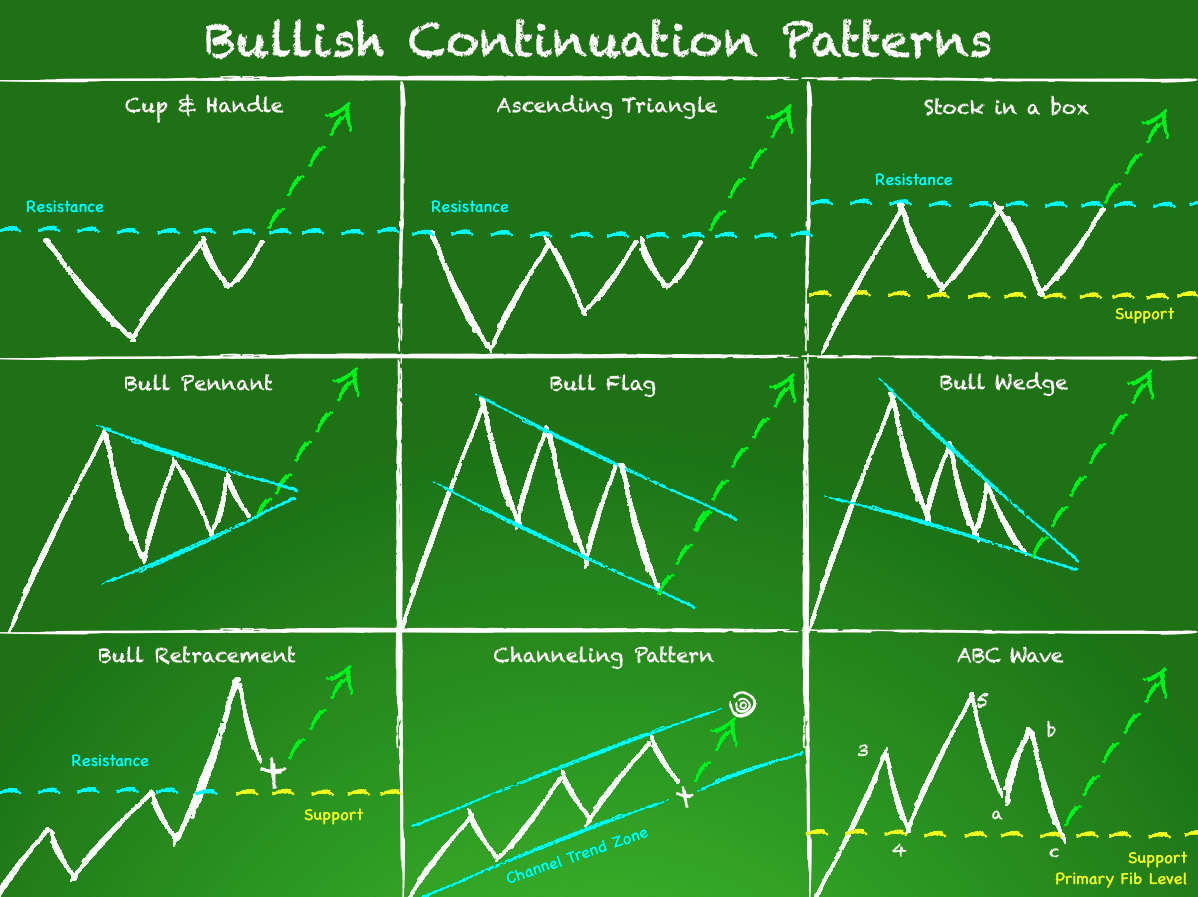

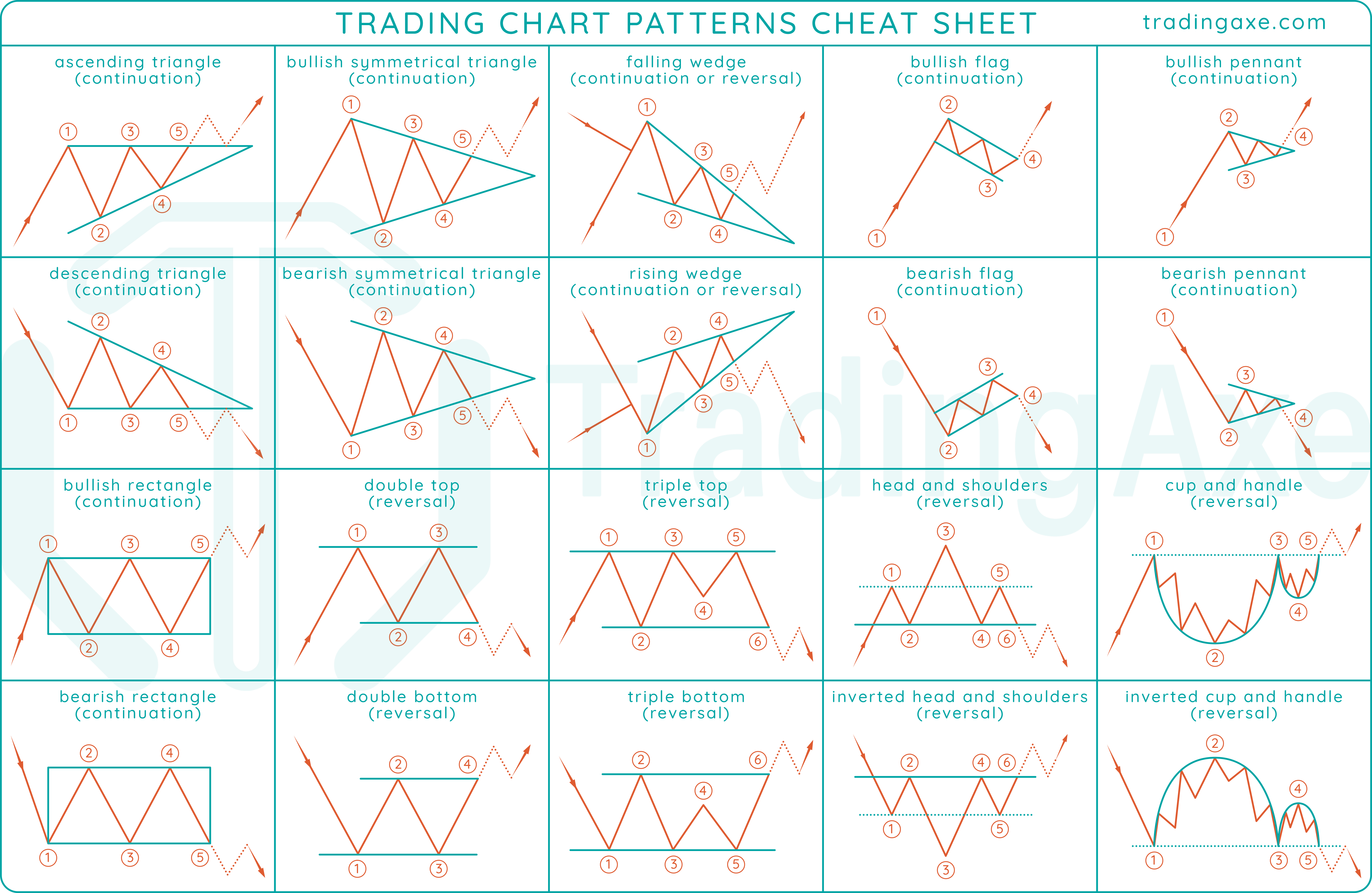

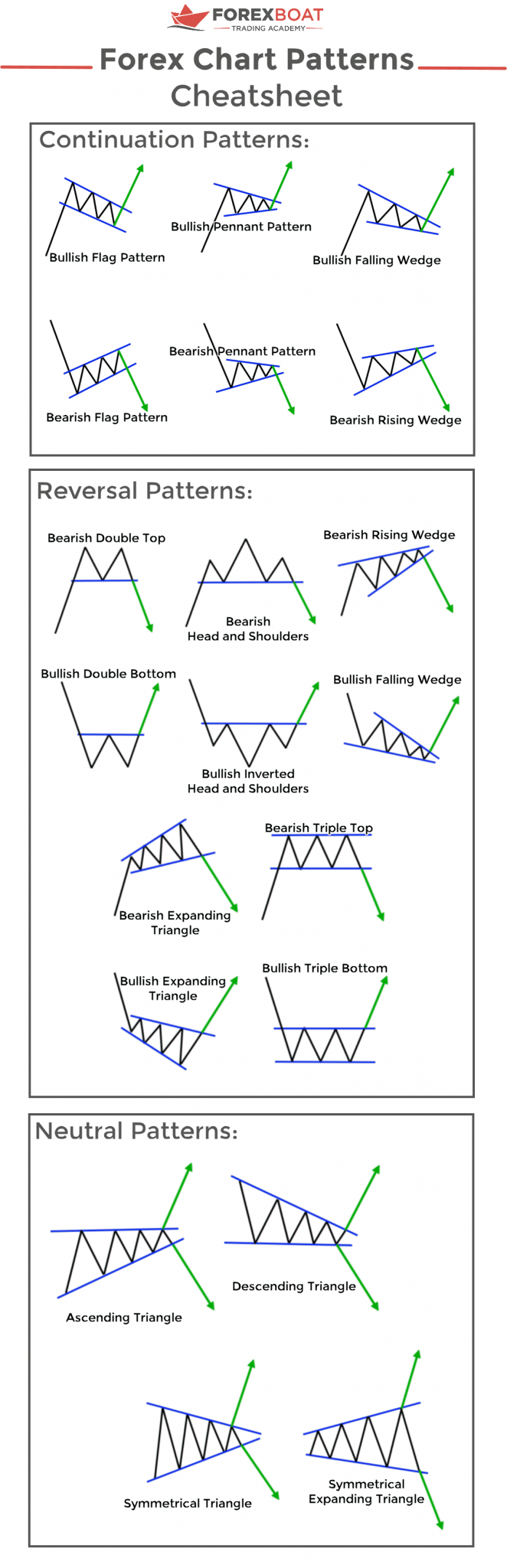

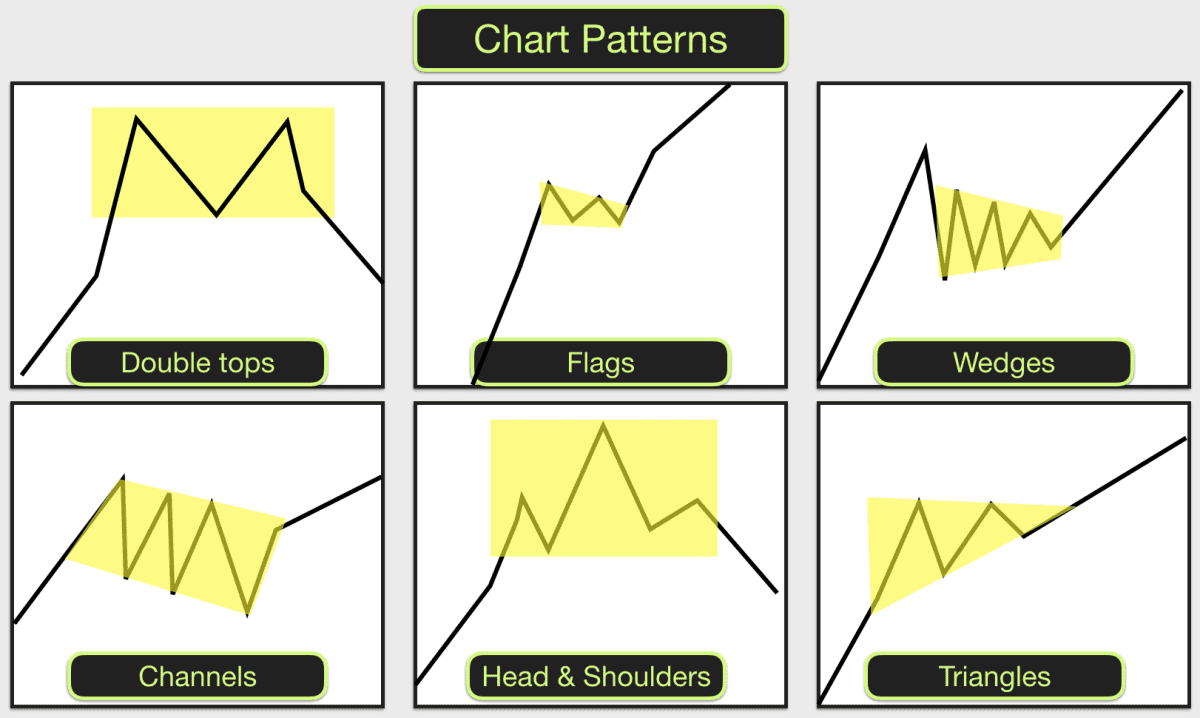

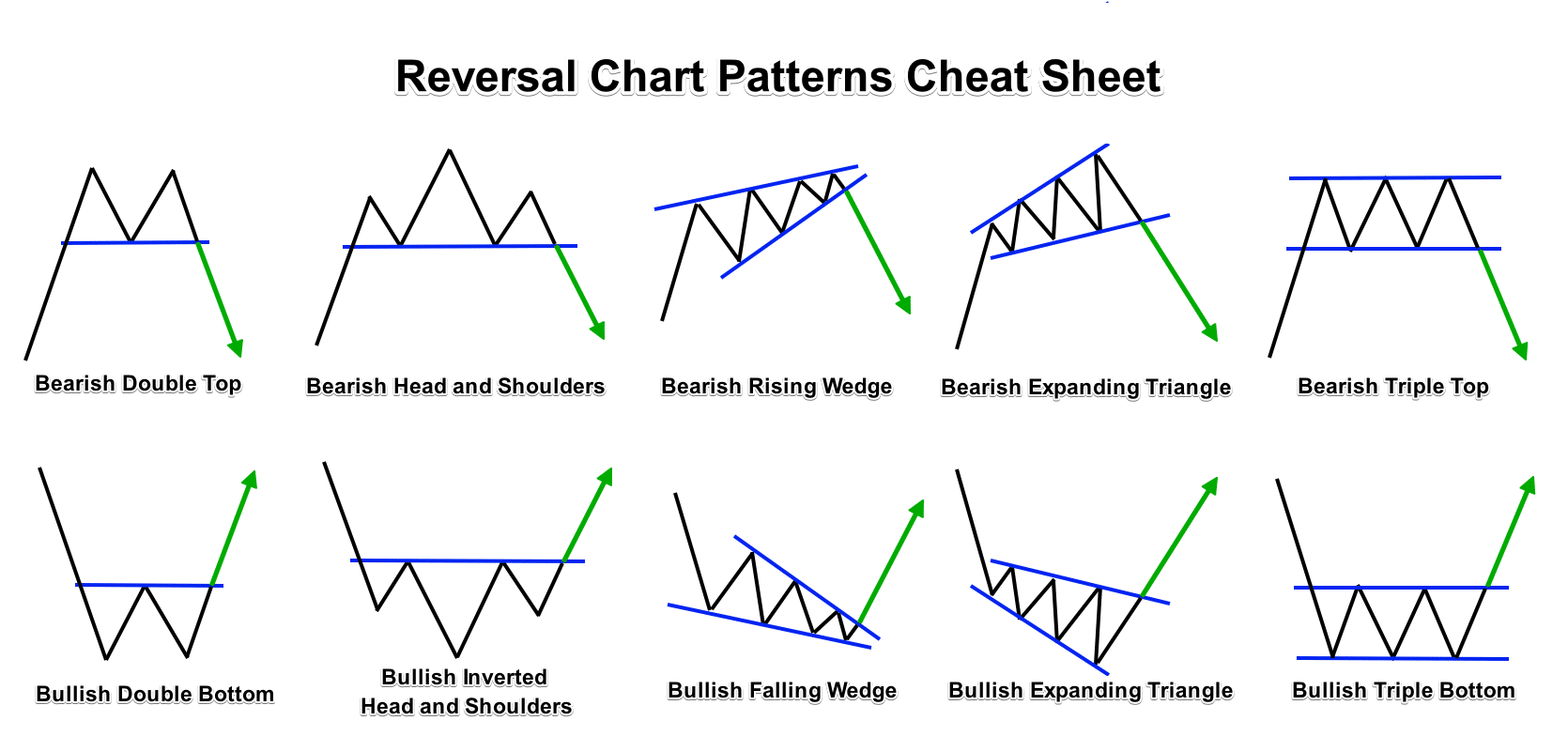

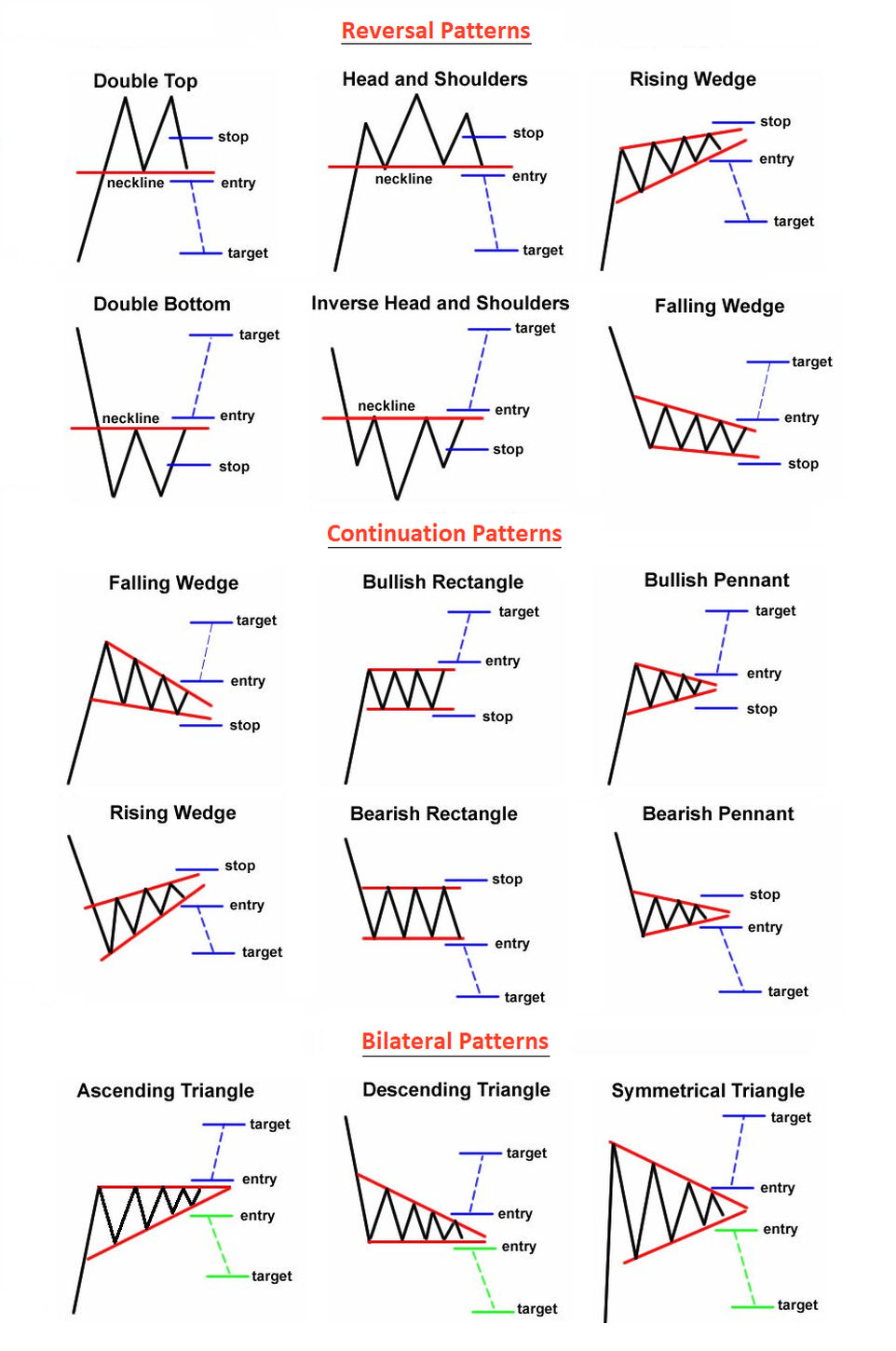

Trading Patterns Chart - Chart patterns are the foundational building blocks of technical analysis. Reversal chart patterns indicate that a trend may be about to change direction. These basic patterns appear on every timeframe and can, therefore, be used by scalpers, day traders, swing traders, position traders and investors. More trading guides in this section: Continuation patterns, reversal patterns and bilateral patterns. Web learn how to identify and trade the top 20 technical patterns in the financial markets with this cheat sheet. Reversal patterns are chart formations that indicate a change in direction from a bearish to a bullish market trend and vice versa. When reading stock charts, traders typically use one or more of. Learn how to recognize some of the key price patterns. The patterns are identified using a series of trendlines or curves. When reading stock charts, traders typically use one or more of. Whether you are a beginner or an expert, this cheat sheet will help you improve your trading skills and strategies. Bilateral chart patterns let traders know that the price could. Web types of chart patterns. Stock chart patterns can signal shifts between rising and falling trends and suggest the. Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Continuation patterns, reversal patterns and bilateral patterns. Chart patterns are visual representations of price movements in financial markets that traders use to identify potential trends and make informed trading decisions. Trading a 95% reliable chart pattern. Chart. Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. More trading guides in this section: However, instead of creating a. When reading stock charts, traders typically use one or more of. A continuation signals that an ongoing trend will continue. Web cup and handle pattern: Web types of chart patterns. A continuation signals that an ongoing trend will continue. Chart patterns fall broadly into three categories: The megaphone top pattern is a visual representation of an asset’s price, indicating an uptrend followed by a volatile period. Learn how to recognize some of the key price patterns. Web finally, there are three groups of chart patterns: Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Bilateral chart patterns let traders know that the price could. They repeat themselves in the market time and. The megaphone top pattern is a visual representation of an asset’s price, indicating an uptrend followed by a volatile period. Chart patterns fall broadly into three categories: Reversal chart patterns indicate that a trend may be about to change direction. Learn how to recognize some of the key price patterns. Continuation patterns, reversal patterns and bilateral patterns. These trend reversal patterns are sort of price formations that appear before a new trend begins and signal that the price action. Whether you are a beginner or an expert, this cheat sheet will help you improve your trading skills and strategies. More trading guides in this section: It is marked by a series of higher highs and higher lows,. Reversal patterns are chart formations that indicate a change in direction from a bearish to a bullish market trend and vice versa. It is marked by a series of higher highs and higher lows, much like the cup and handle pattern. These patterns can be found on various charts, such as line charts, bar charts, and candlestick charts. However, instead. They repeat themselves in the market time and time again and are relatively easy to spot. Stock chart patterns can signal shifts between rising and falling trends and suggest the future. These basic patterns appear on every timeframe and can, therefore, be used by scalpers, day traders, swing traders, position traders and investors. These patterns can be found on various. Trading a 95% reliable chart pattern. These patterns can be found on various charts, such as line charts, bar charts, and candlestick charts. Web learn how to identify and trade the top 20 technical patterns in the financial markets with this cheat sheet. It is marked by a series of higher highs and higher lows, much like the cup and. The patterns are identified using a series of trendlines or curves. Web traders use stock charts and price patterns to get in and out of trading positions. Web cup and handle pattern: Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Chart patterns that will be shown in the chart. Web сhart patterns cheat sheet. Reversal chart patterns indicate that a trend may be about to change direction. Whether you are a beginner or an expert, this cheat sheet will help you improve your trading skills and strategies. Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). Reversal patterns are chart formations that indicate a change in direction from a bearish to a bullish market trend and vice versa. Trading a 95% reliable chart pattern. Bilateral chart patterns let traders know that the price could. Web finally, there are three groups of chart patterns: Learn how to recognize some of the key price patterns. Continuation patterns, reversal patterns and bilateral patterns. It is marked by a series of higher highs and higher lows, much like the cup and handle pattern.

How to Trade Chart Patterns with Target and SL FOREX GDP

Printable Chart Patterns Cheat Sheet

Stock Chart Patterns 13 stock chart patterns you should know a

Trading Chart Patterns Cheat Sheet TradingAxe

Printable Stock Chart Patterns Cheat Sheet

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

Chart patterns and how to trade them

How Important are Chart Patterns in Forex? Forex Academy

10 chart patterns every trader needs to know! for FXNZDUSD by DatTong

Chart Patterns Trading Charts Chart Patterns Stock Chart Patterns Images

Chart Patterns Fall Broadly Into Three Categories:

Chart Patterns Are The Foundational Building Blocks Of Technical Analysis.

When Reading Stock Charts, Traders Typically Use One Or More Of.

Stock Chart Patterns Can Signal Shifts Between Rising And Falling Trends And Suggest The Future.

Related Post: