Trading Candlestick Patterns

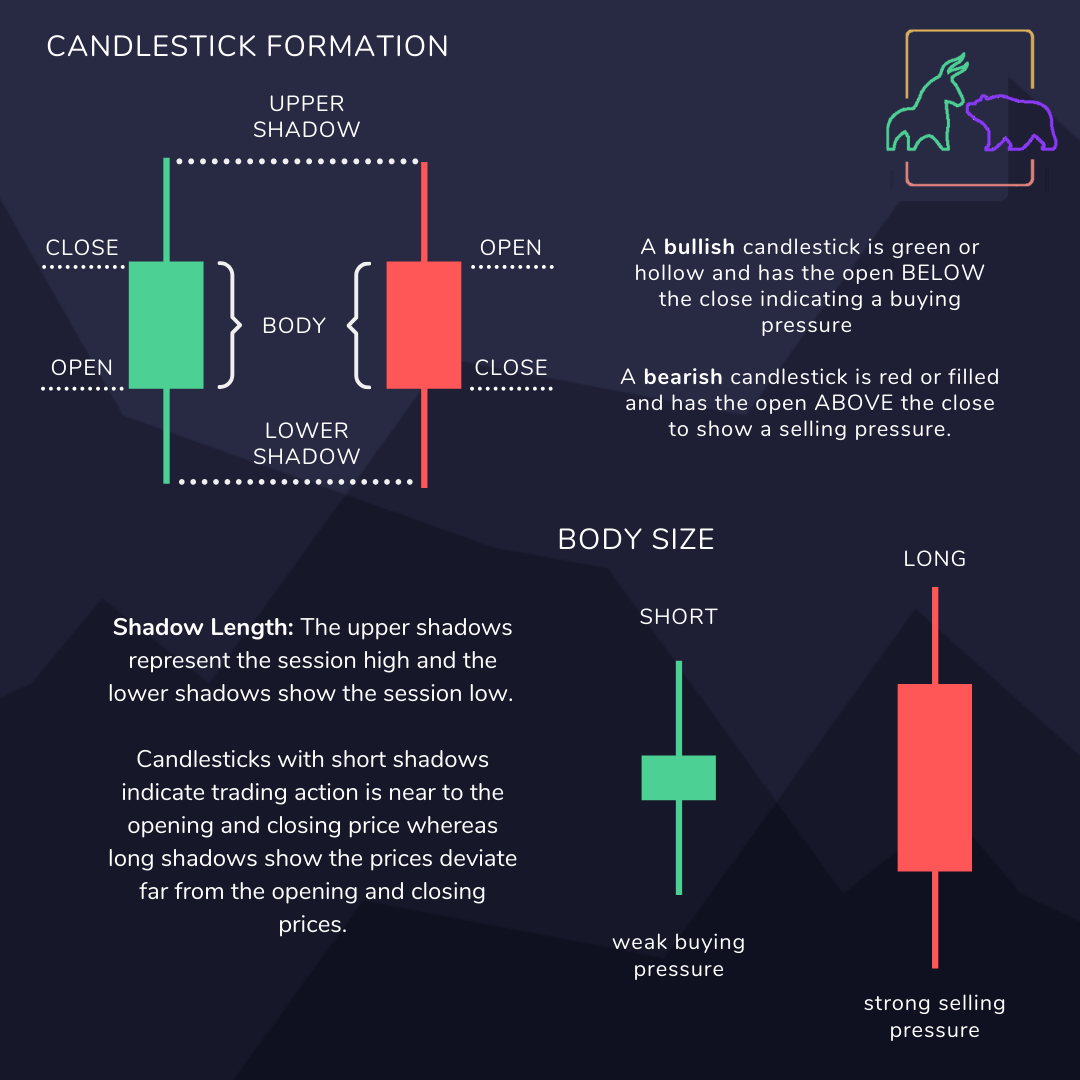

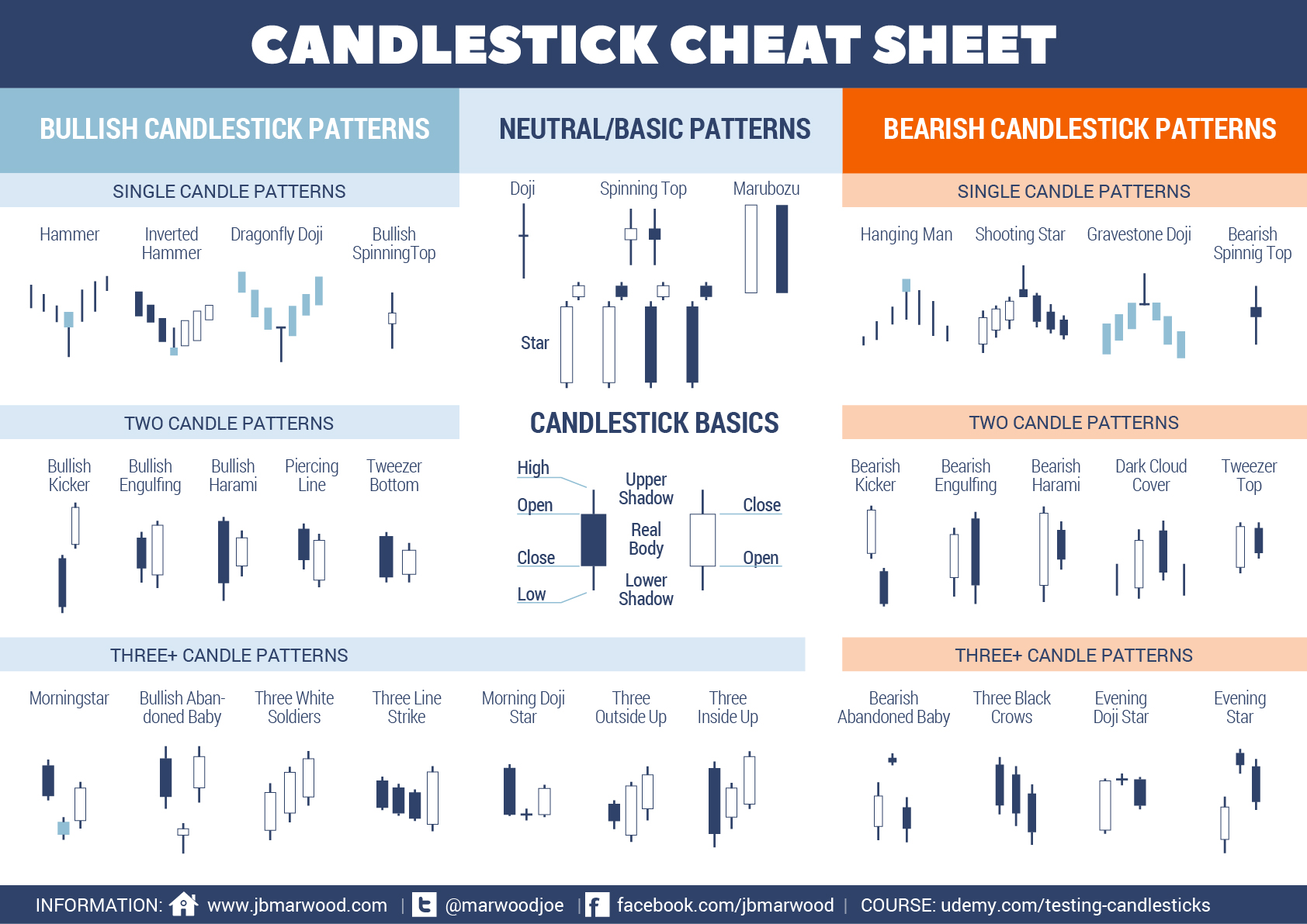

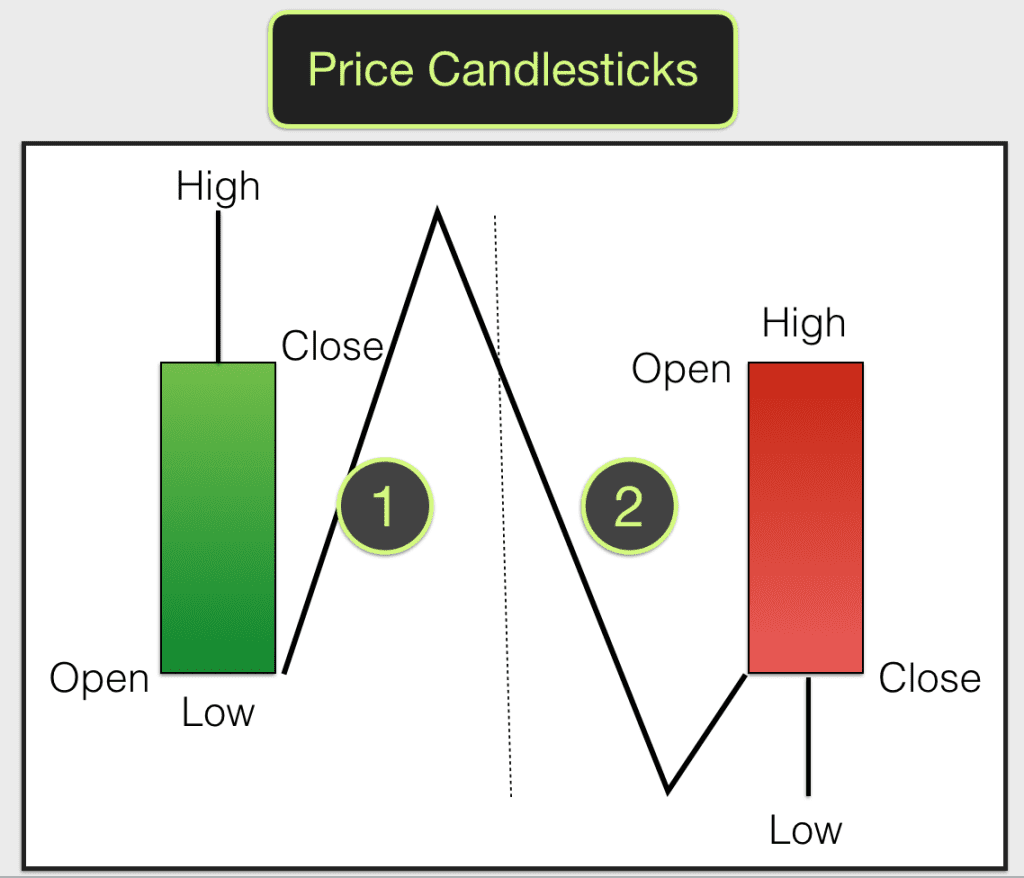

Trading Candlestick Patterns - Web the first candle must be bearish. Here is a long list of all the major reversal candlestick patterns: To that end, we’ll be covering the fundamentals of candlestick charting in this tutorial. Web each candlestick pattern has a distinct name and a traditional trading strategy. The first candle is a short red body that is completely engulfed by a larger green candle. Sure, it is doable, but it requires special training and expertise. A candlestick must meet the following. The second candle must be small compared to the others, like a doji or a spinning top. Morning star & evening star. The bullish engulfing pattern is formed of two candlesticks. More importantly, we will discuss their significance and reveal 5 real examples of reliable. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. The bullish engulfing pattern is formed. Here is a long list of all the major reversal candlestick patterns: Hammer pattern & shooting star. Sure, it is doable, but it requires special training and expertise. Web trading without candlestick patterns is a lot like flying in the night with no visibility. Bullish closing marubozu candlestick pattern. Web the first candle must be bearish. Web 16 candlestick patterns every trader should know. The third candle must be bullish. Here is a long list of all the major reversal candlestick patterns: A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. The second candlestick gaps up and has a narrow body. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Sure, it is doable, but it requires special training and expertise. A candlestick must meet the following. Web the first candle must be bearish. More importantly, we will discuss their significance and reveal 5 real examples of reliable. Bullish engulfing & bearish engulfing. Web candlestick trading is a form of technical analysis that uses chart patterns, as opposed to fundamental analysis, which focuses on the financial health of assets. Web 16 candlestick patterns every trader should know. Hammer pattern & shooting star. More importantly, we will discuss their significance and reveal 5 real examples of reliable. Web traders use candlestick charts to determine possible price movement based on past patterns. Morning star & evening star. Candlestick technical analysis doji pressure inverted hammer support and resistance. The illustrations and explanations will help you learn to evaluate essential candlestick patterns and make investment decisions. Here is a long list of all the major reversal candlestick patterns: A candlestick must meet the following. Hanging man & inverted hammer. Web traders use candlestick charts to determine possible price movement based on past patterns. Candlestick technical analysis doji pressure inverted hammer support and resistance. Web trading without candlestick patterns is a lot like flying in the night with no visibility. The illustrations and explanations will help you learn to evaluate essential candlestick patterns and make investment decisions about where prices may be heading next. The second candle must be small compared to the others, like a doji or a spinning top. An evening star. Let’s look at a single candle pattern named the bullish closing marubozu. The bullish engulfing pattern is formed of two candlesticks. Web 16 candlestick patterns every trader should know. Sure, it is doable, but it requires special training and expertise. An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. Hanging man & inverted hammer. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Candlesticks are useful when trading as they show four price points (open, close, high, and low. Web 16 candlestick patterns every trader should know. Here is a long list of all the major reversal candlestick patterns: There are dozens of different candlestick patterns with intuitive, descriptive names. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. The first candle is a short red body that is completely engulfed by a larger green candle. Hammer pattern & shooting star. The color of the second candle doesn’t matter. More importantly, we will discuss their significance and reveal 5 real examples of reliable. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Morning star & evening star. Candlesticks are useful when trading as they show four price points (open, close, high, and low. Web the first candle must be bearish. A candlestick must meet the following. Candlestick technical analysis doji pressure inverted hammer support and resistance. Bullish closing marubozu candlestick pattern. The second candlestick gaps up and has a narrow body. Ideally, the body of the second candle shouldn’t overlap with the bodies of the other two candles.Candlestick Patterns Every trader should know PART 1

Trading 101 Common Candlestick Patterns BullBear Blog

Trading 101 How to read candlestick patterns BullBear Blog

TRADE ENTRY POINT FX & VIX Traders Blog

Introduction to Technical Analysis Candlesticks & Candlestick

Candlestick Patterns Cheat Sheet New Trader U

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Candlestick Patterns The Definitive Guide (2021)

The best trading candlestick patterns

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

Though The Second Day Opens Lower Than The First, The Bullish Market Pushes The Price Up, Culminating In An Obvious Win For Buyers.

The Bullish Engulfing Pattern Is Formed Of Two Candlesticks.

Web Candlestick Trading Is A Form Of Technical Analysis That Uses Chart Patterns, As Opposed To Fundamental Analysis, Which Focuses On The Financial Health Of Assets.

Web Each Candlestick Pattern Has A Distinct Name And A Traditional Trading Strategy.

Related Post: