Three White Soldiers Candle Pattern

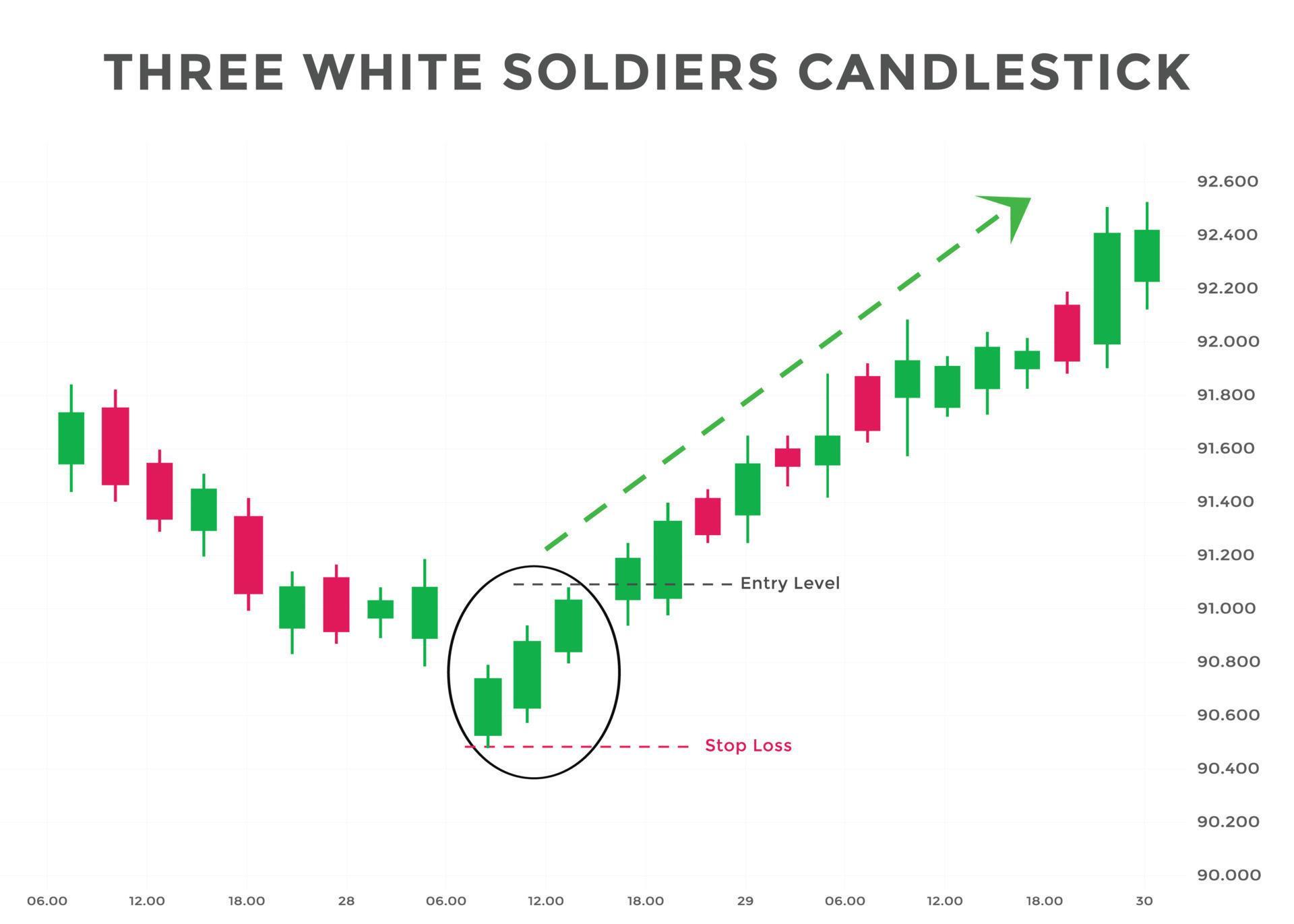

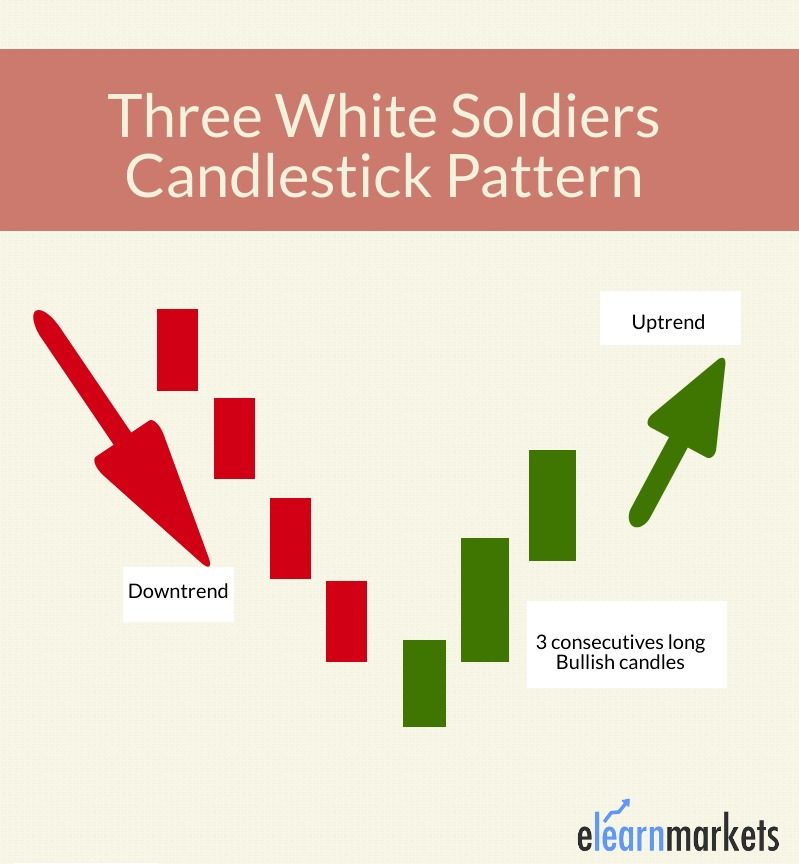

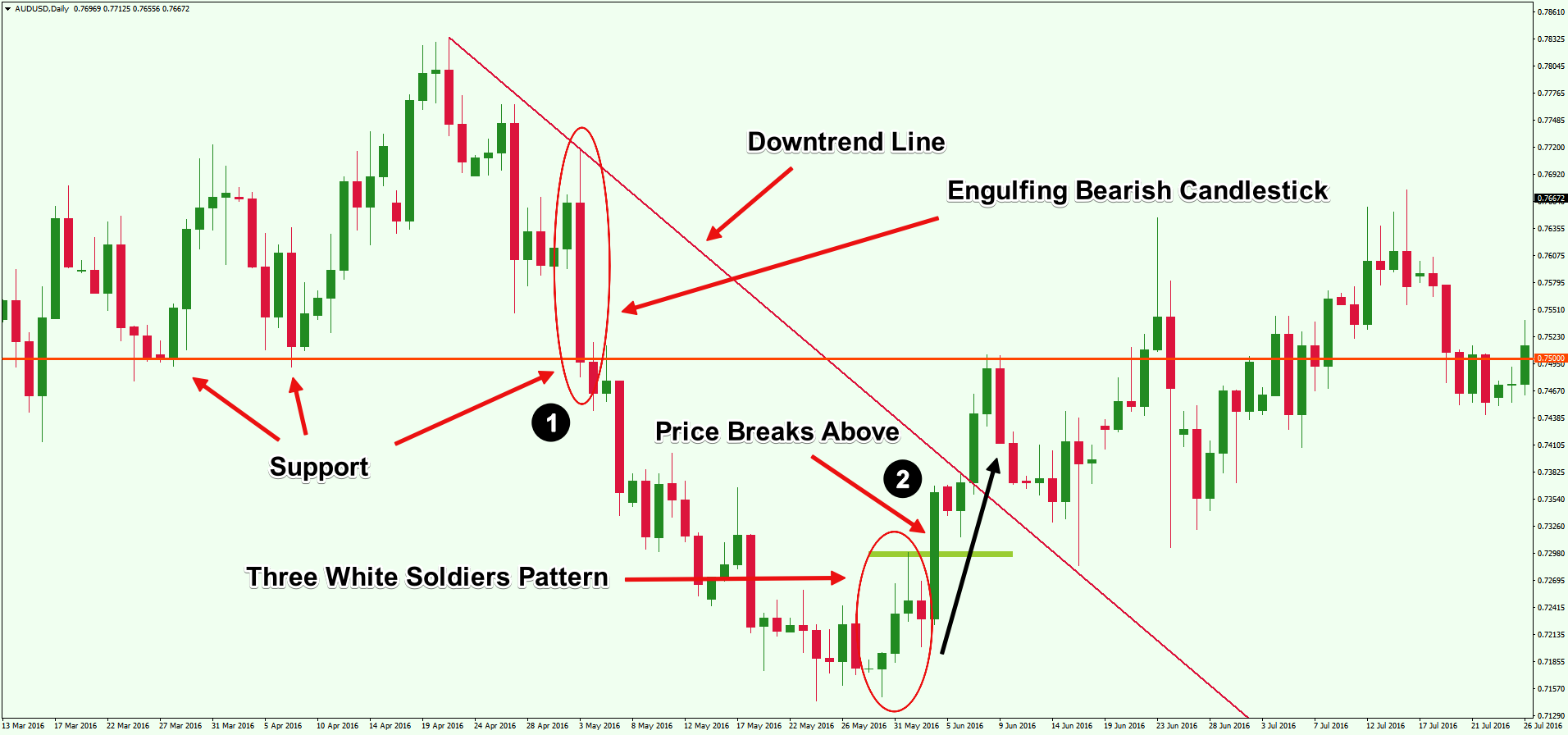

Three White Soldiers Candle Pattern - What that means is it is more likely to breakout upward (a close above the top of the highest candle) than it is to breakout downward (a close below the lowest of the three candles). Web the three white soldiers pattern is a popular bullish candlestick pattern. As the name suggests, this pattern consists of three candlesticks that are green in color. Web in trading, 3 white soldiers is the name for a japanese candlestick pattern that reverses from falling to rising in price. In addition, each candle must have a relatively long body and opening price above the closing price of the previous candle, ultimately creating a shape of the “v” letter. Each bullish candlestick has a close higher than its opening price and closes above the previous candle. The pattern suggests a reversal of a bearish trend. Web three white soldiers is a candlestick chart pattern in the financial markets.it unfolds across three trading sessions and represents a strong price reversal from a bear market to a bull market.the pattern consists of three long candlesticks that trend upward like a staircase; It consists of three consecutive tall bullish candles, all closing in the upper quarter of their range. Web the three white soldiers is a candlestick pattern that appears on trading charts. Web three advancing white soldiers example. Web three white soldiers candlestick pattern illustration. This candlestick pattern often appears at the troughs of the market. The name does help you remember this pattern’s purpose and the likely results. It consists of three consecutive tall bullish candles, all closing in the upper quarter of their range. This candlestick pattern signals an upcoming uptrend because of the strong buying pressure. The pattern identifies potential bullish reversals in a downtrend or a period of consolidation. This is a warning that the market will reverse and create an uptrend in the future. This pattern is often seen as a strong indicator of a reversal from a bearish trend to. Each should open above the previous day's open, ideally in the middle price. Just 593 out of 3,333 samples showed downward breakouts. Here are the characteristics of a strong bullish candle: As the name suggests, this pattern consists of three candlesticks that are green in color. Traders often use the pattern and other technical analysis tools, such as. Here’s an overview of its characteristics and implications: The name does help you remember this pattern’s purpose and the likely results. The reverse of the three white soldiers is called the three black crows. While initially, the price was moving lower, implying strong selling pressure, the emergence of three bullish candlesticks affirms that bulls have overpowered bears, and market momentum. Web the “three white soldiers” candlestick pattern is a bullish reversal pattern commonly observed in technical analysis of financial markets. These candlesticks do not have long. That is, the price has moved significantly to close higher than the opening price. The reverse of the three white soldiers is called the three black crows. Just 593 out of 3,333 samples showed. This pattern is represented by three consecutive red candlesticks that occur at the top of an uptrend. Web the three white soldiers pattern is a bullish reversal pattern formed by three consecutive candles, which are green (or white) in color. It generally occurs at the bottom of a market downtrend, indicating a reversal is about to break out. Web the. A close near the highs. It generally occurs at the bottom of a market downtrend, indicating a reversal is about to break out. Web the three white soldiers is a candlestick pattern that appears on trading charts. This candlestick pattern often appears at the troughs of the market. This is a warning that the market will reverse and create an. Web the three white soldiers pattern is a bullish reversal pattern formed by three consecutive candles, which are green (or white) in color. It generally occurs at the bottom of a market downtrend, indicating a reversal is about to break out. Web the three white soldiers candlestick pattern acts as a bullish reversal 82% of the time. Web the bullish. Web the three white soldiers candlestick pattern acts as a bullish reversal 82% of the time. Web the three white soldiers pattern is a popular bullish candlestick pattern. The pattern suggests a reversal of a bearish trend. Web three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend. Each bullish candlestick. Web three white soldiers is a candlestick chart pattern in the financial markets.it unfolds across three trading sessions and represents a strong price reversal from a bear market to a bull market.the pattern consists of three long candlesticks that trend upward like a staircase; As the name suggests, this pattern consists of three candlesticks that are green in color. While. Web the “three white soldiers” candlestick pattern is a bullish reversal pattern commonly observed in technical analysis of financial markets. That is, the price has moved significantly to close higher than the opening price. They are typically either green or white on a chart. Web the three white soldiers candlestick pattern suggests a significant change in market sentiment. A close near the highs. Web three white soldiers is a candlestick chart pattern in the financial markets.it unfolds across three trading sessions and represents a strong price reversal from a bear market to a bull market.the pattern consists of three long candlesticks that trend upward like a staircase; This pattern is often seen as a strong indicator of a reversal from a bearish trend to a bullish one. Moreover, in the right context it can signal a reversal of a trend. Each should open above the previous day's open, ideally in the middle price. Three white soldiers is a japanese candlestick pattern that consists of three green candles showing a bullish breakout. Web the three white soldiers is a bullish reversal pattern which occurs in a strong downtrend and signals a change in direction. Web the three white soldiers pattern is a bullish reversal pattern formed by three consecutive candles, which are green (or white) in color. As buyers and sellers enter the market, the price starts moving. It generally occurs at the bottom of a market downtrend, indicating a reversal is about to break out. In addition, each candle must have a relatively long body and opening price above the closing price of the previous candle, ultimately creating a shape of the “v” letter. This candlestick pattern signals an upcoming uptrend because of the strong buying pressure.

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

three white soldiers pattern candlestick chart pattern. Candlestick

Three White Soldiers Candlestick Pattern Example Bullish Reversal

What Are Three White Soldiers Candlestick Explained ELM

What Are Three White Soldiers Candlestick Explained ELM

Candlestick Patterns The Definitive Guide (2021)

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

Three White Soldiers Reversal Candlestick Pattern

05threewhitesoldierscandlestickpattern Forex Training Group

Three White Soldiers Bullish Candlestick Chart Pattern

The Pattern Suggests A Reversal Of A Bearish Trend.

Web The Three White Soldiers Candlestick Pattern Is Commonly Used In Technical Analysis By Traders And Analysts In The Stock Market, Forex Market, And Other Financial Markets.

Three White Soldiers Patterns, Aka Three Advancing Soldiers Patterns, Are Candlestick Patterns On Stock Charts.

Web Three Advancing White Soldiers Example.

Related Post: