Three Line Strike Pattern

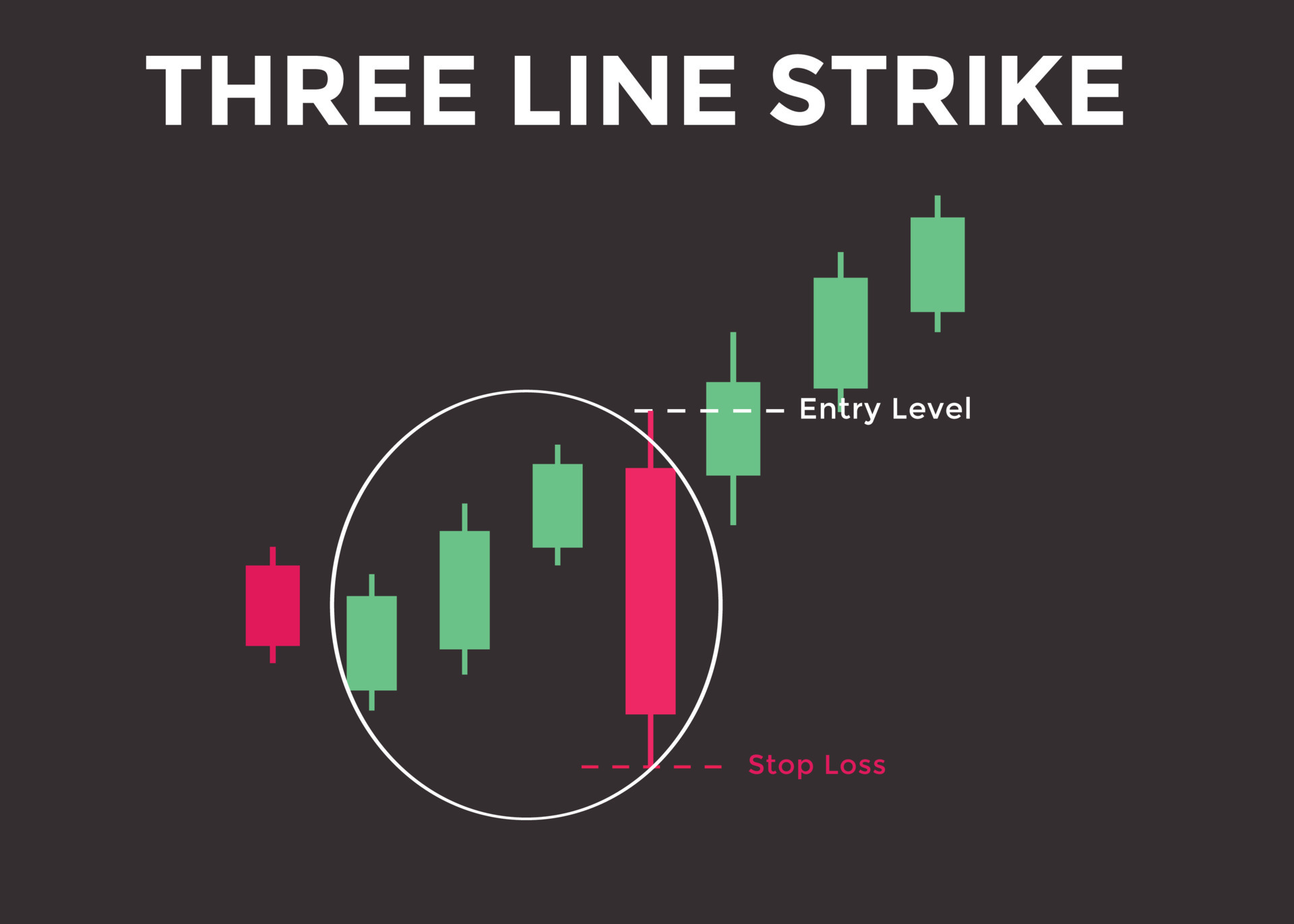

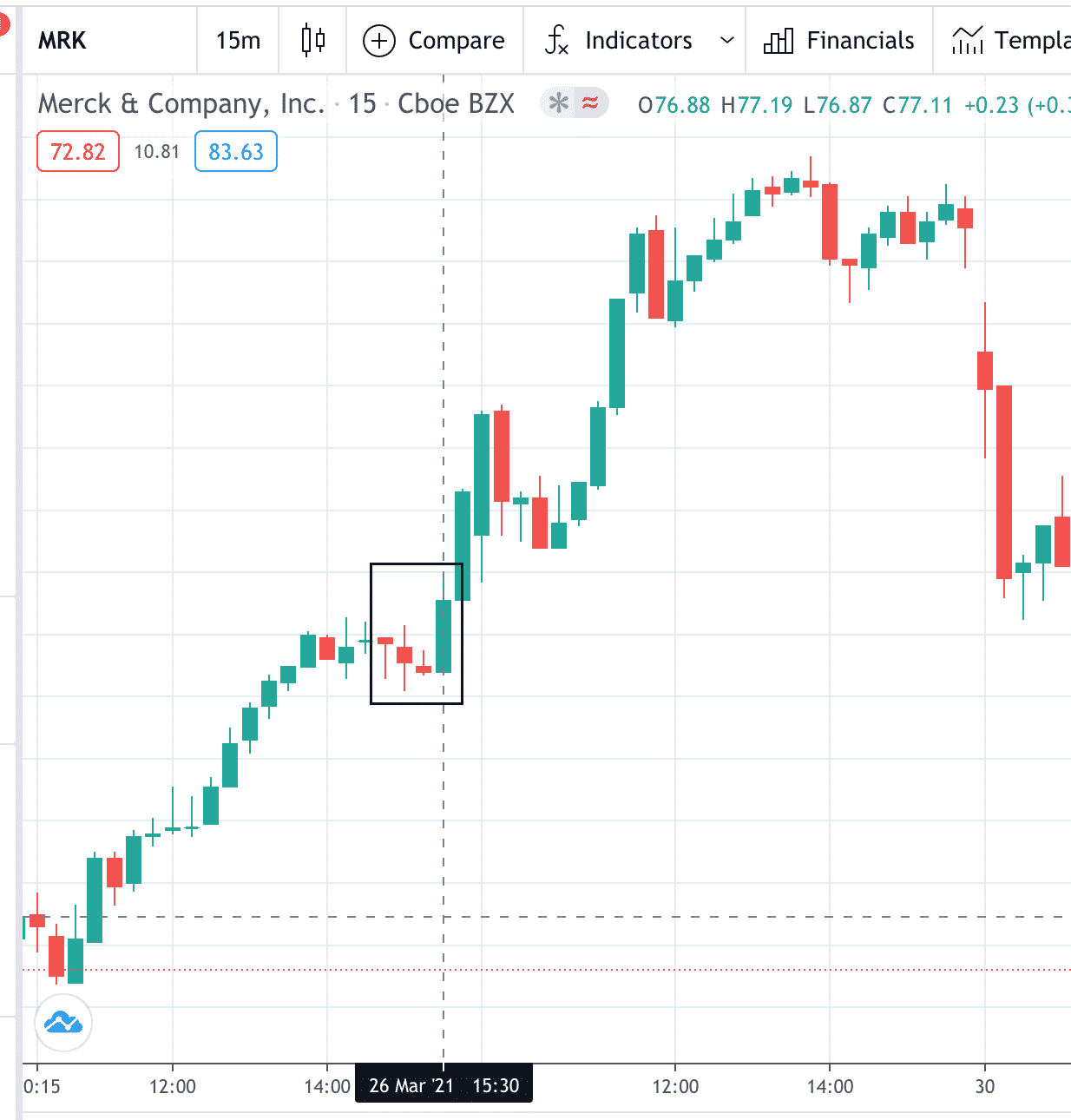

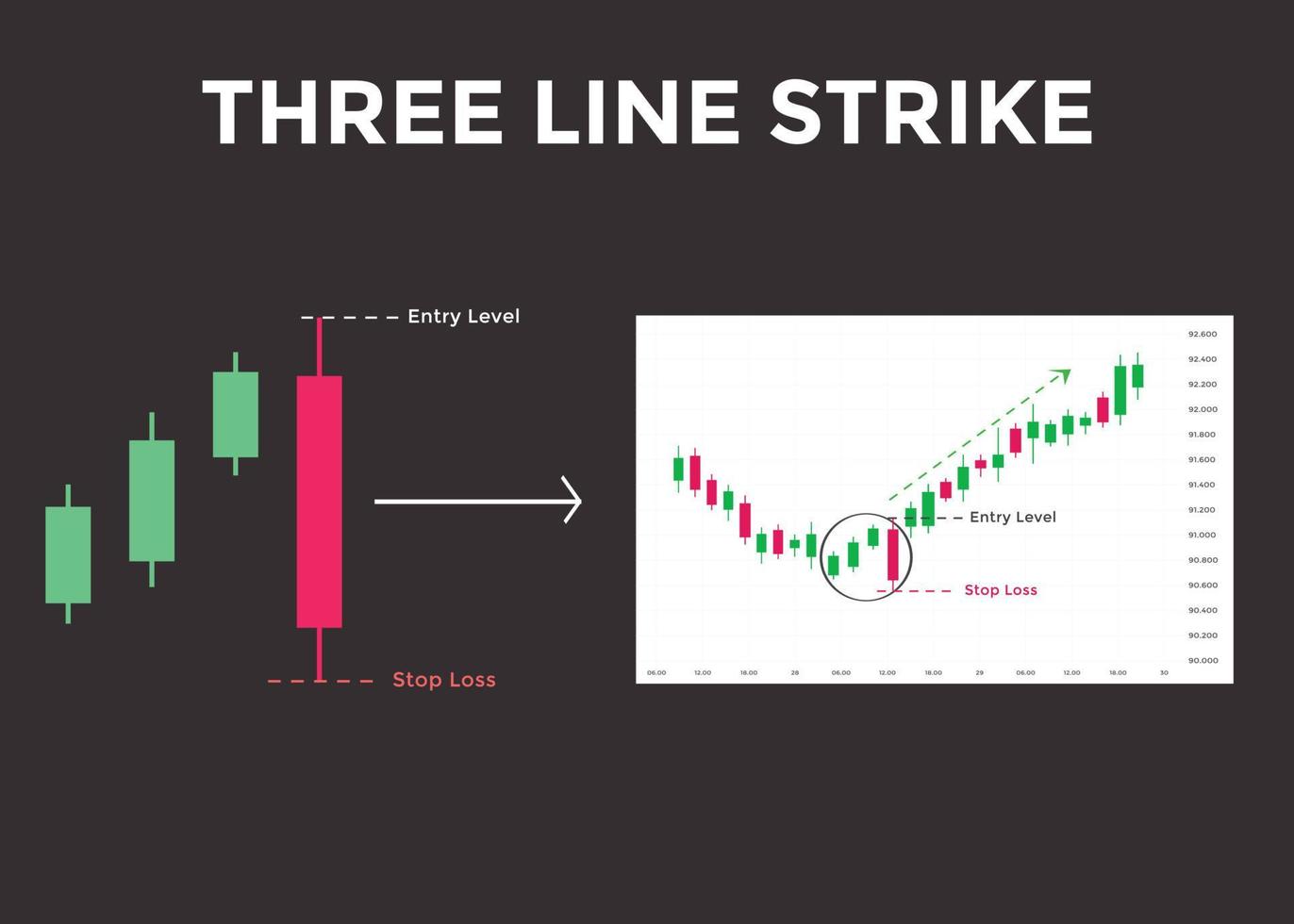

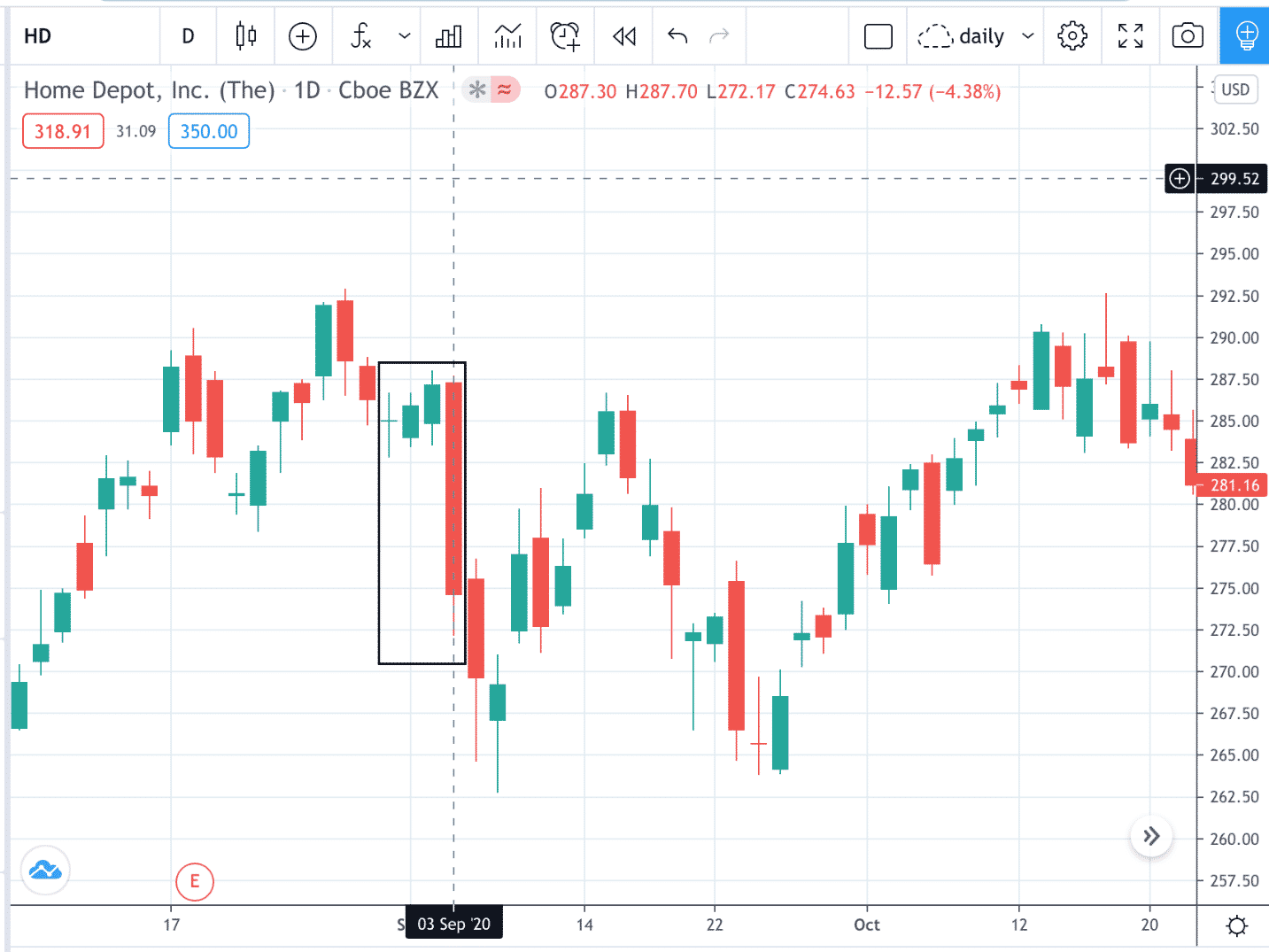

Three Line Strike Pattern - Timing your entry and exit points. Three first candles have black bodies. All of them are located within a downtrend. These are bearish and follow a descending price action, each with a lower close than the previous. Being able to identify and interpret patterns allows traders to make Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted. The bearish three line strike continuation is recognized if: The bearish three line strike continuation is recognized if: Web the 3 line strike indicator is a candlestick pattern used in technical analysis that predicts a reversal in the current price trend. Overall performance ranks first, too, meaning that once the trend reverses, it tends to continue trending. Updated on october 13, 2023. Web pattern recognition plays a crucial role in technical analysis within the forex market. Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted. The fourth candle is having white body and appears as a long line. Web the 3 line strike indicator is a candlestick pattern used in. All of them are located within a downtrend. Web the three line strike is a trend continuation candlestick pattern consisting of four candles. Timing your entry and exit points. It forms after an ascending price movement at the local highs of the chart. The bearish three line strike continuation is recognized if: Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted. The bearish three line strike continuation is recognized if: Web the three line strike is a trend continuation candlestick pattern consisting of four candles. Being able to identify and interpret patterns allows traders to make That places its performance rank at 2, where 1. Web the three line strike pattern is a powerful tool in a trader’s arsenal, offering valuable insights into market trends and potential price reversals. Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a valuable. Three line strike is a trend continuation candlestick pattern consisting of four candles. Types of three line strike. Web the three line strike candlestick pattern is a bullish reversal indicator that appears in a. The fourth candle is having white body and appears as a long line. These are bearish and follow a descending price action, each with a lower close than the previous. The bearish three line strike continuation is recognized if: Learn how to spot and interpret this pattern with definedge securities. All of them are located within a downtrend. Types of three line strike. That places its performance rank at 2, where 1 is the best performing. Web the three line strike pattern is a powerful tool in a trader’s arsenal, offering valuable insights into market trends and potential price reversals. They may be formed by any black candles except doji and form lower closes. These are bearish and. It consists of four candles: Being able to identify and interpret patterns allows traders to make Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a valuable. By understanding how to effectively interpret this pattern, traders can make informed decisions that may lead to profitable. The bearish three line strike continuation is recognized if: Web the bullish three line strike is a trend continuation pattern that occurs in an uptrend. Being able to identify and interpret patterns allows traders to make Overall performance ranks first, too, meaning that once the trend reverses, it tends to continue trending. Three first candles have black bodies. Updated on october 13, 2023. Three line strike is a trend continuation candlestick pattern consisting of four candles. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a valuable. Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted.. The bearish three line strike continuation is recognized if: By understanding how to effectively interpret this pattern, traders can make informed decisions that may lead to profitable outcomes. It is made up of three bullish candlesticks, each with a higher close than the previous one, followed by a fourth candlestick that pulls back to the start point. Types of three line strike. Three first candles have black bodies. Timing your entry and exit points. Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted. It consists of four candles: Learn how to spot and interpret this pattern with definedge securities. The bearish three line strike continuation is recognized if: That places its performance rank at 2, where 1 is the best performing. Web the three line strike is a trend continuation candlestick pattern consisting of four candles. All of them are located within a downtrend. In the bullish pattern, the first three candles are formed during a bull trend, while a bearish pattern leads to the formation of three bearish candles during a bear trend. Three line strike is a trend continuation candlestick pattern consisting of four candles. The fourth candle is having white body and appears as a long line.

Three Line Strike candlestick chart pattern. Candlestick chart Pattern

Make Crypto Trading Profits Using Forex Techniques The Three Line

Three Line Strike Candlestick Pattern

Three Link Strike Pattern What It Is, Indicates, and Examples

Bullish ThreeLine Strike Candlestick Pattern The Forex Geek

Three Line Strike candlestick chart pattern. Candlestick chart Pattern

Three Line Strike Candlestick Pattern Best Guide

ThreeLine Strike candlestick Pattern PDF Guide Trading PDF

Candlestick Patterns The Definitive Guide (2021)

Three Line Strike candlestick chart pattern. Candlestick chart Pattern

They May Be Formed By Any Black Candles Except Doji And Form Lower Closes.

Overall Performance Ranks First, Too, Meaning That Once The Trend Reverses, It Tends To Continue Trending.

Web Pattern Recognition Plays A Crucial Role In Technical Analysis Within The Forex Market.

Being Able To Identify And Interpret Patterns Allows Traders To Make

Related Post: