Three Black Crows Pattern

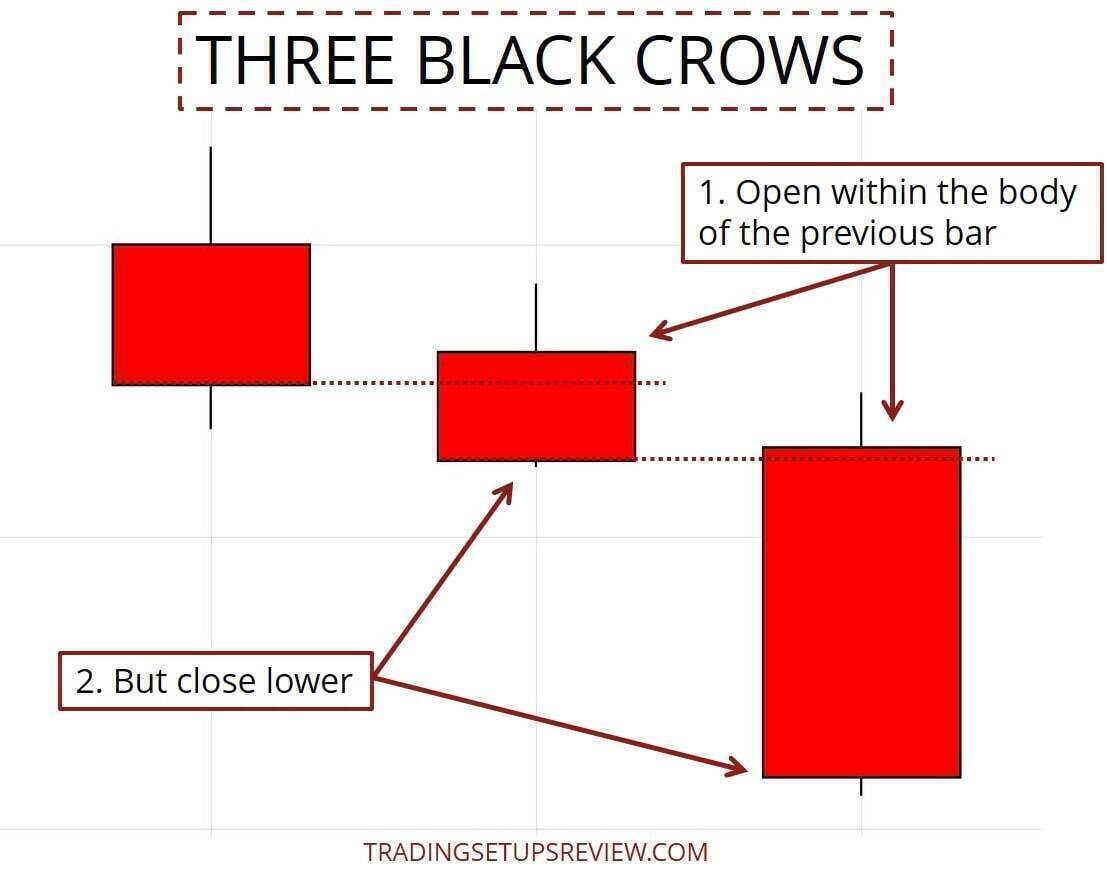

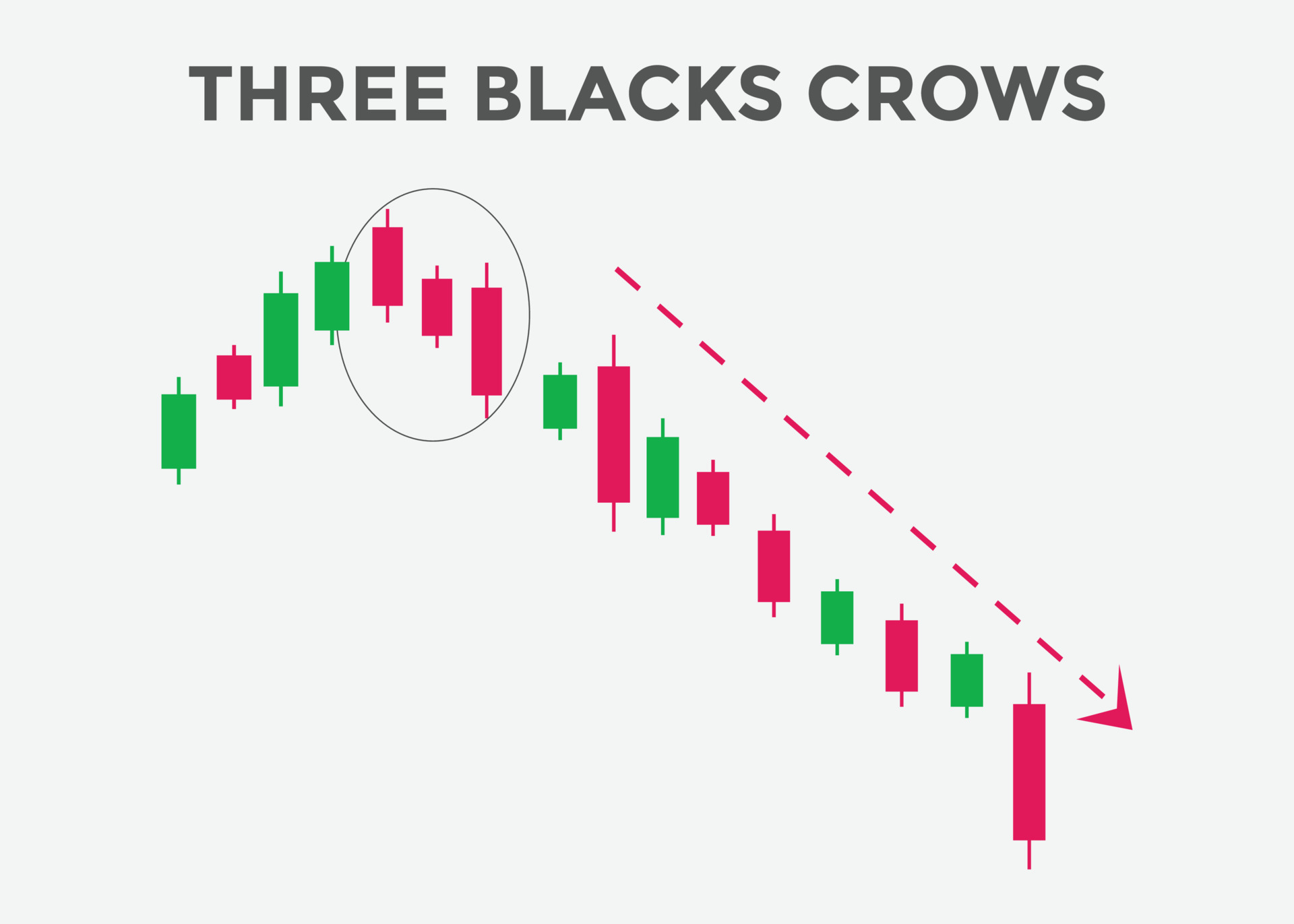

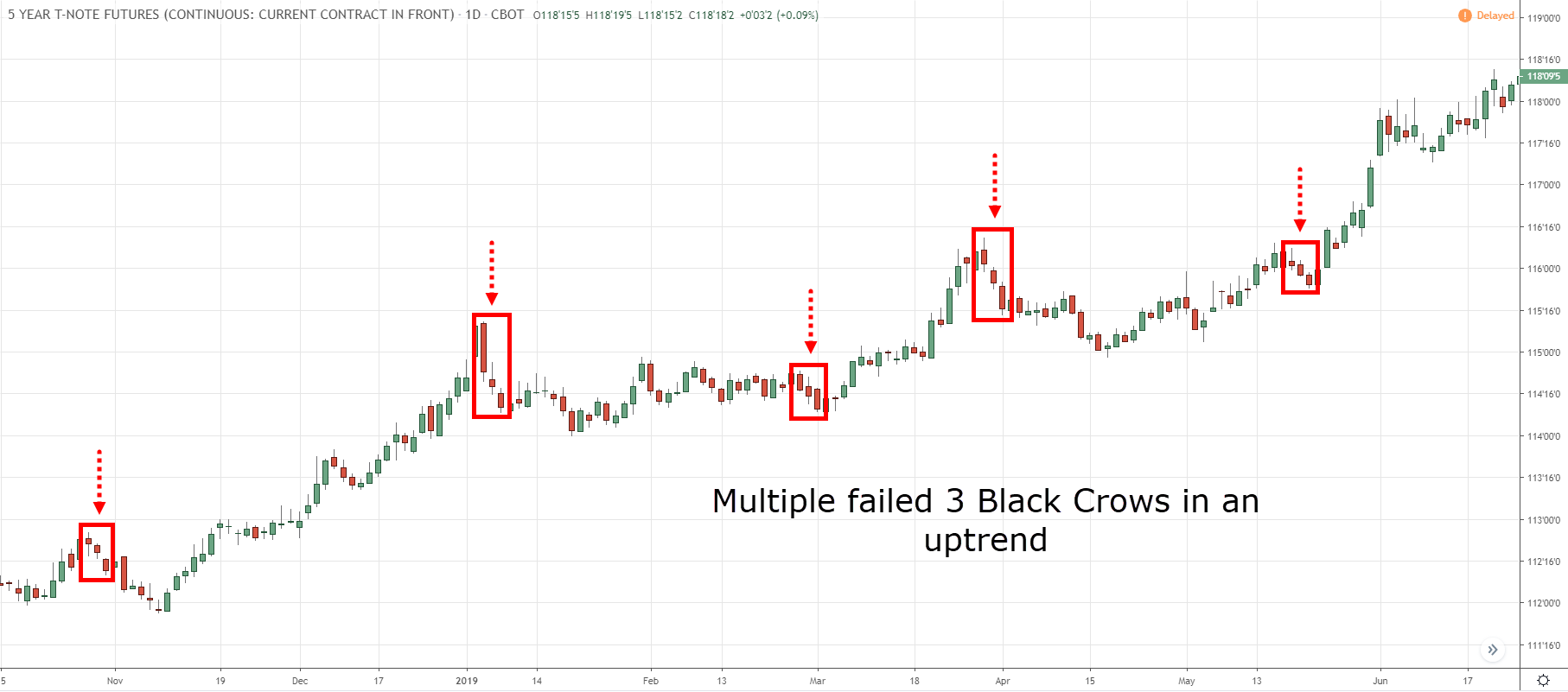

Three Black Crows Pattern - Web three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend. In technical analysis, interpreting the three black crows pattern is much like deciphering a complex narrative of market sentiment. The “three black crows” mean the three red candles that generate after a trend. Web the three black crows is a bearish candlestick pattern that serves as a strong indication of a potential trend reversal. The pattern indicates a strong price. The three black crows pattern is usually quite reliable, but it’s crucial to take factors like volume and trend momentum into account before making any trading decisions. Bearish reversal pattern in the gbp/usd. In many ways, they are seen as kill candles, effectively killing the prior uptrend of a move in stocks, crypto, forex, or other asset. It is created by three long bearish candlesticks that stair step downward. The cryptocurrency market is a perilous world of breathtaking volatility and adrenaline. Web the three black crows pattern generally represents an incoming downtrend. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. It consists of three consecutive long red candlesticks, each with open and close prices lower than the previous ones. One should note that these three candlesticks can be. Just because the market has closed lower 3 days in a row doesn’t mean the uptrend will reverse. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. Web a pattern opposite the three white soldiers is called three black crows. Web. In many ways, they are seen as kill candles, effectively killing the prior uptrend of a move in stocks, crypto, forex, or other asset. It is based on the candlestick charting method, formed by three consecutive black candles in a row. Up next, luxembourg is back in the competition after 31 years of absence. Web the three black crows is. Because the context of the market is more important than any. Web how a three black crows pattern is interpreted. Web three black crows is a bearish three candlestick chart pattern formed by price action closing lower than the open and below the previous day’s low for three days in row. It indicates a shift in market sentiment from bullish. Web the three black crows pattern generally represents an incoming downtrend. Three crows is a term used by stock market analysts to describe a market downturn. Web a few of the more common ratios used in the markets trading are 1:1, 1:2, 1:3, and 1:4. Thus, more prominent risk/reward ratios are feasible. This pattern is formed by three consecutive long. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. The “three black crows” mean the three red candles that generate after a trend. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of. The “three black crows” mean the three red candles that generate after a trend. Web september 7, 2022 zafari. Web the three black crows pattern is a bearish candlestick pattern that can be identified on stock charts. Web decoding the three black crows: The three black crows pattern exclusively identifies selling opportunities in the market. One should note that these three candlesticks can be bearish marubozu. Web may 11, 2024, 3:32 p.m. This pattern is formed by three consecutive long red candles, each opening within the body of the previous candle and closing near its low. As with the bullish formation, the three black crows consists of three consecutive bearish candles, preferably with long bodies,. It is based on the candlestick charting method, formed by three consecutive black candles in a row. Consider the broader market context, use confirmation. It appears on a candlestick chart in the financial markets. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. Web a few of the more. Bearish reversal pattern in the gbp/usd. Forex and crypto traders that care about statistical significance shouldn’t trade this pattern and instead select strong candlestick patterns. Candles can have little or no shadows. The three black crows pattern exclusively identifies selling opportunities in the market. The pattern will occur at major market tops when the market has been bullish for an. In many ways, they are seen as kill candles, effectively killing the prior uptrend of a move in stocks, crypto, forex, or other asset. It is characterized by three consecutive bearish candlesticks with similar characteristics, representing a shift in market sentiment from bullish to bearish. It is created by three long bearish candlesticks that stair step downward. Web the three black crows pattern is a bearish candlestick pattern that can be identified on stock charts. Web how a three black crows pattern is interpreted. This pattern is formed by three consecutive long red candles, each opening within the body of the previous candle and closing near its low. The 3 black crows’ meaning or significance is just a small part of your trading analysis. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. Web the three black crows is a bearish candlestick pattern that serves as a strong indication of a potential trend reversal. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. The “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. Three crows is a term used by stock market analysts to describe a market downturn. By understanding the characteristics and limitations of this pattern, traders can make informed decisions and enhance their trading strategies. It consists of three consecutive long red candlesticks, each with open and close prices lower than the previous ones. Despite this, the tiny country has won eurovision five times, matching the. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward.

Three Black Crows Pattern All You Need to Know Phemex Academy

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

Three Black Crows candlestick pattern. Powerful bearish Candlestick

How To Trade The Three Black Crows Pattern

Three Black Crows Hit & Run Candlesticks

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

What Are Three Black Crows Candlestick Patterns Explained ELM

The Three Black Crows Candlestick Pattern Premium Store

What Are Three Black Crows Patterns Explained ELM

These Candles Must Open Within The Previous Body Or Near The Closing Price.

Bearish Reversal Pattern In The Gbp/Usd.

Web May 11, 2024, 3:32 P.m.

Thus, More Prominent Risk/Reward Ratios Are Feasible.

Related Post: