Teacup Pattern Trading

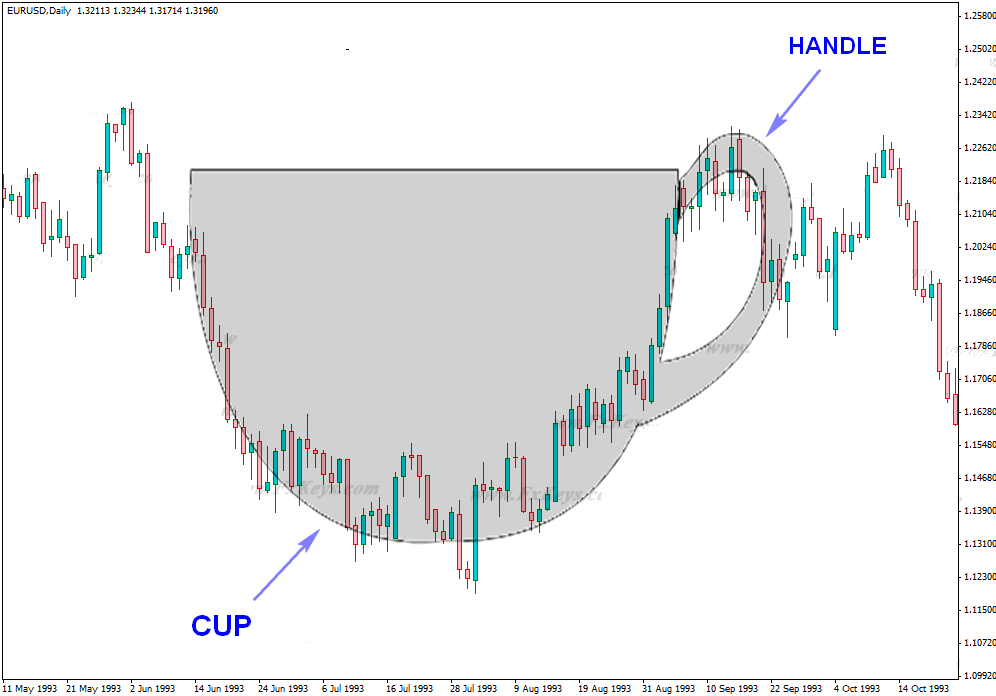

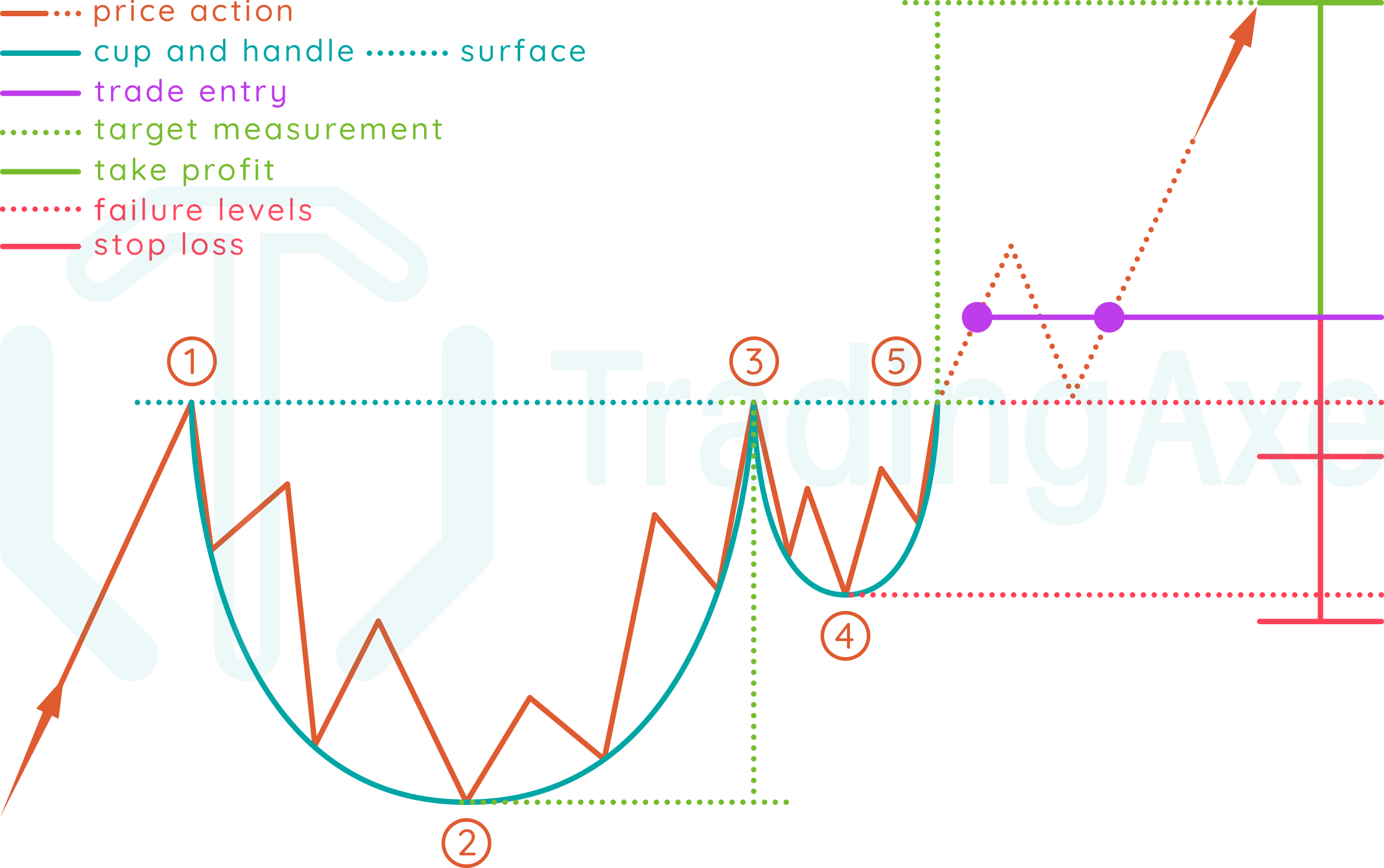

Teacup Pattern Trading - 30% bull run before reaching the first high. Web the teacup and handle pattern is a technical analysis tool that traders and investors use to identify potential bullish stock price movements. It is considered one of the key signs. It gets its name from the tea cup shape of the pattern. Web inverted cup and handle pattern trading strategy. Web the inverted cup and handle pattern can be either a reversal or continuation pattern. Web the cup and handle pattern in stock chart analysis is a breakout trading pattern. Once the pattern is complete, the stock should. The pattern starts the formation in an uptrend, creates the top, then reverses. Web the cup and handle pattern is a popular bullish chart pattern that, depending on its position on the price chart, could indicate a reversal or a continuation in price trend. There are two parts to the pattern: It gets its name from the tea cup shape of the pattern. Web inverted cup and handle pattern trading strategy. Once the pattern is complete, the stock should. Web the inverted cup and handle pattern can be either a reversal or continuation pattern. Web a cup and handle pattern trading strategy is the trailing 10ema breakout strategy. It is marked by a consolidation, followed by a breakout. It gets its name from the tea cup shape of the pattern. Web the teacup and handle pattern is a technical analysis tool that traders and investors use to identify potential bullish stock price movements. The. Once the pattern is complete, the stock should. 30% bull run before reaching the first high. Trading with the cup and handle pattern differs slightly when using it to trade forex and equities. It gets its name from the tea cup shape of the pattern. It is considered one of the key signs. Web the cup and handle pattern in stock chart analysis is a breakout trading pattern. Web the inverted cup and handle pattern can be either a reversal or continuation pattern. Web a cup and handle pattern trading strategy is the trailing 10ema breakout strategy. Watch for the price to hold the bottom of the upside. It gets its name from. Web cup and handle (for less volatile assets): Trading with the cup and handle pattern differs slightly when using it to trade forex and equities. Web inverted cup and handle pattern trading strategy. Web the cup and handle pattern in stock chart analysis is a breakout trading pattern. It is marked by a consolidation, followed by a breakout. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It is considered one of the key signs. It gets its name from the tea cup shape of the pattern. Web how to trade the cup & handle pattern. Scan for cup and handles in markets with bullish price trends of 8%+. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It is marked by a consolidation, followed by a breakout. It gets its name from the tea cup shape of the pattern. There are two parts to the pattern: It is considered one of the key signs. Once the pattern is complete, the stock should. It helps traders keep an eye on the candlestick chart pattern that resembles a u. It gets its name from the tea cup shape of the pattern. Web the cup and handle is a bullish continuation pattern. Web how to trade with the cup and handle pattern. There are two parts to the pattern: 30% bull run before reaching the first high. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It is considered one of the key signs. It is considered one of the key signs. It gets its name from the tea cup shape of the pattern. Once the pattern is complete, the stock should. Scan for cup and handles in markets with bullish price trends of 8%+. A cup and handle price pattern on a security's price chart is a technical indicatorthat resembles a cup with a handle, where the cup is in the. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Web how to trade the cup & handle pattern. Web the teacup and handle pattern is a technical analysis tool that traders and investors use to identify potential bullish stock price movements. Web inverted cup and handle pattern trading strategy. It helps traders keep an eye on the candlestick chart pattern that resembles a u. Web the cup and handle is a bullish continuation pattern. There are two parts to the pattern: It is considered one of the key signs. Once the pattern is complete, the stock should. Web the cup and handle pattern is a popular bullish chart pattern that, depending on its position on the price chart, could indicate a reversal or a continuation in price trend. A cup and handle price pattern on a security's price chart is a technical indicatorthat resembles a cup with a handle, where the cup is in the shape of a u and the handle has a slight downward drift. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Watch for the price to hold the bottom of the upside. Scan for cup and handles in markets with bullish price trends of 8%+. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Trading with the cup and handle pattern differs slightly when using it to trade forex and equities.

Teacup Pattern Forex A Complete Guide To Understanding And Trading It

Timing the Cup and Handle Pattern Using the Trix Indicator Forex Academy

Cup And Handle Pattern How To Verify And Use Efficiently How To

How To Trade Cup And Handle Chart Pattern TradingAxe

Teacup pattern yes its a real tradable pattern! for FXEURAUD by

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)

3 Line Break Trade Strategy Characteristics Of Cup And Saucer Pattern

All About Treasury

![]()

¿Qué es el patrón de comercio de Forex Taza y Mango? Educación Forex

Cup And Handle Pattern (Teacup Pattern) FOREX YouTube

It Gets Its Name From The Tea Cup Shape Of The Pattern.

30% Bull Run Before Reaching The First High.

It Gets Its Name From The Tea Cup Shape Of The Pattern.

It Is Considered One Of The Key Signs.

Related Post: