Swing Failure Pattern Investopedia

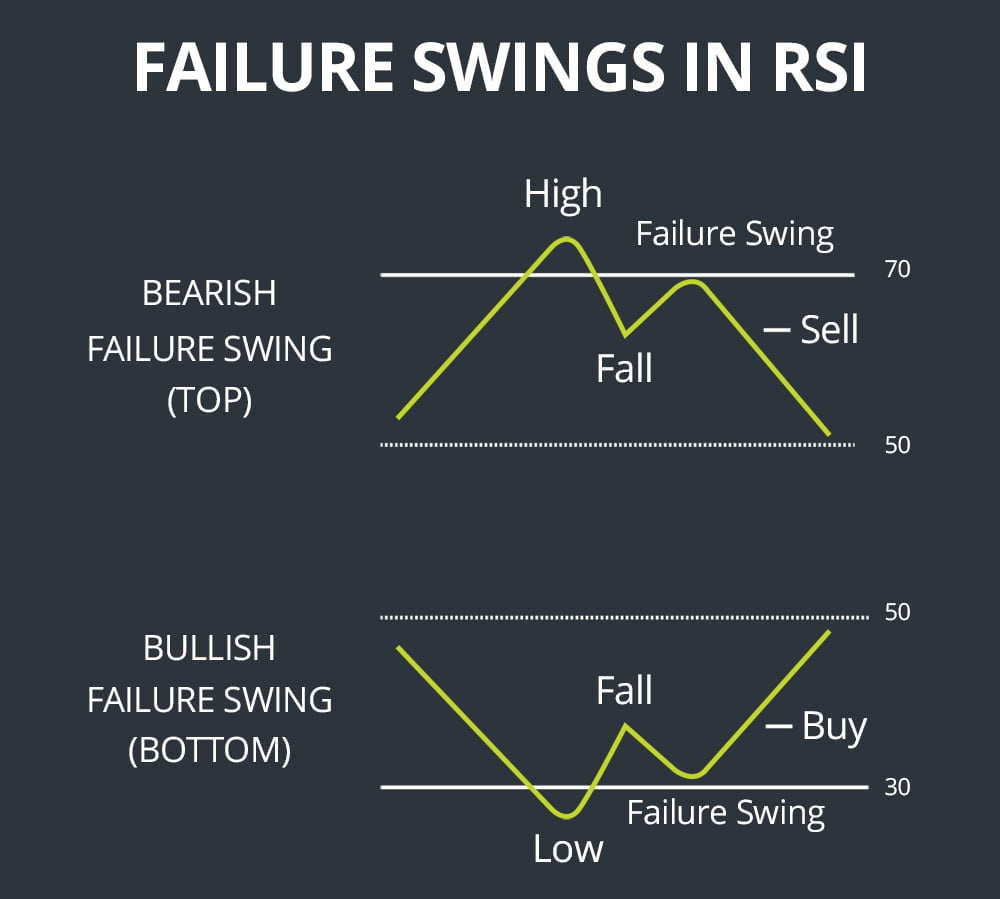

Swing Failure Pattern Investopedia - A swing can either refer to a type of trading strategy or a large fluctuation in the value of an asset, liability, or account that reverses a. Swing failures occur when a price swing fails to reach a new high or low, indicating that the current trend may be losing momentum. The goal of sfp is to create enough liquidity to change price direction. Web updated april 29, 2024. In this video i discuss what a swing. Web the swing failure pattern is a liquidity engineering pattern, generally used to fill large orders. This means, the sfp generally occurs when larger players push the price into liquidity pockets with the sole objective of filling their own positions. Advanced and beginner trading techniques made simple. Web swing failure patterns occur when candle wicks exceed (above/below) a recent swing level but close back below/above it, and occur from more significant market participants engineering liquidity. In a divergence scenario, both the price and the rsi show a deviation from each other, suggesting a loss of momentum in the current trend. Stock analysts read this pattern as an indication. Higher swing highs are associated with uptrends, and lower swing highs are associated with downtrends or. Want to learn how to trade swing failure patterns? Web what is swing failure. Essentially, this pattern emerges when there is a divergence between the price movement and an oscillator, such as the relative strength index. Want to learn how to trade swing failure patterns? Web failure swing top: Web an rsi failure swing is an advanced technique used to identify trading opportunities based on rsi divergences. The swing failure pattern (sfp) is a technical analysis concept that can help traders identify potential trend reversals in the market. Web the swing failure pattern (sfp)o aims to. Web swing failure patterns occur when candle wicks exceed (above/below) a recent swing level but close back below/above it, and occur from more significant market participants engineering liquidity. Web what is swing failure. An sfp forms when the price fails to break beyond a previously established swing high or low. They help you identify potential reversal zones in the market.. Web updated april 29, 2024. This type of failure swing occurs when the asset's price reaches a high point but the relative strength index drops below the most recent fail point (the recent swing. A swing can either refer to a type of trading strategy or a large fluctuation in the value of an asset, liability, or account that reverses. Web updated april 29, 2024. Web an island reversal is a price pattern that, on a daily chart, shows a grouping of days separated on either side by gaps in the price action. Higher swing highs are associated with uptrends, and lower swing highs are associated with downtrends or. A label and an accentuated wick line highlight the sfp (both. A label and an accentuated wick line highlight the sfp (both can be disabled). The goal of sfp is to create enough liquidity to change price direction. A failure swing top takes place when the price makes a higher high but rsi fails to make a higher high and falls below the recent swing low (fail point) of the indicator. This refers to situations where price surges, i.e there’s a big move in price, either to the upside or downside and then hits a point at which it can go no further and. The swing failure pattern (sfp) is a technical analysis concept that can help traders identify potential trend reversals in the market. An sfp forms when the price. Want to learn how to trade swing failure patterns? Swing low is a term used in technical analysis that refers to the troughs reached by a security’s price or an indicator during a given period of time,. Web what is swing failure. Web swing failure patterns (sfps) are one of the unique metrics offered by the smart money concepts toolkit.. Web an island reversal is a price pattern that, on a daily chart, shows a grouping of days separated on either side by gaps in the price action. Web a swing failure pattern refers to a type of technical analysis pattern that indicates a change in trend direction. 14k views 3 years ago how to trade: Master the sfp to. The goal of sfp is to create enough liquidity to change price direction. What is a swing low? Master the sfp to anticipate and potentially profit from market reversals. Web what is swing failure. This suggests a weakening trend and a. This refers to situations where price surges, i.e there’s a big move in price, either to the upside or downside and then hits a point at which it can go no further and. Higher swing highs are associated with uptrends, and lower swing highs are associated with downtrends or. Web what is swing failure. Web a swing failure pattern refers to a type of technical analysis pattern that indicates a change in trend direction. Master the sfp to anticipate and potentially profit from market reversals. Swing low is a term used in technical analysis that refers to the troughs reached by a security’s price or an indicator during a given period of time,. This suggests a weakening trend and a. Swing failures occur when a price swing fails to reach a new high or low, indicating that the current trend may be losing momentum. This means, the sfp generally occurs when larger players push the price into liquidity pockets with the sole objective of filling their own positions. Web swing failure patterns (sfps) are one of the unique metrics offered by the smart money concepts toolkit. Web failure swing top: This pattern can be indicative of a potential trend reversal. What is a swing low? Essentially, this pattern emerges when there is a divergence between the price movement and an oscillator, such as the relative strength index (rsi). A swing can either refer to a type of trading strategy or a large fluctuation in the value of an asset, liability, or account that reverses a. Advanced and beginner trading techniques made simple.

How to Trade Swing Failure Patterns (SFP Tutorial) YouTube

SWING FAILURE PATTERN for FXEURUSD by DeGRAM — TradingView

Swing Failure Pattern & RSI Divergence Strategy High Winrate YouTube

Swing Failure Pattern The Forex Geek

rsi failure swing 中文 Slobo

Teknik Swing Failure Pattern YouTube

Swing Failure Pattern Trading Strategy Explained The Best Price

Failure swing and Nonfailure swing and the Fan Principle as reversal

Swing Failure Pattern Trading UPDATED 2022 A Complete Guide Forex

RSI Failure Swing Strategy Explained!

Web The Indicator Detect To Swing Failure Pattern And Shows It.

Want To Learn How To Trade Swing Failure Patterns?

They Help You Identify Potential Reversal Zones In The Market.

Stock Analysts Read This Pattern As An Indication.

Related Post: