Stock Patterns Triangle

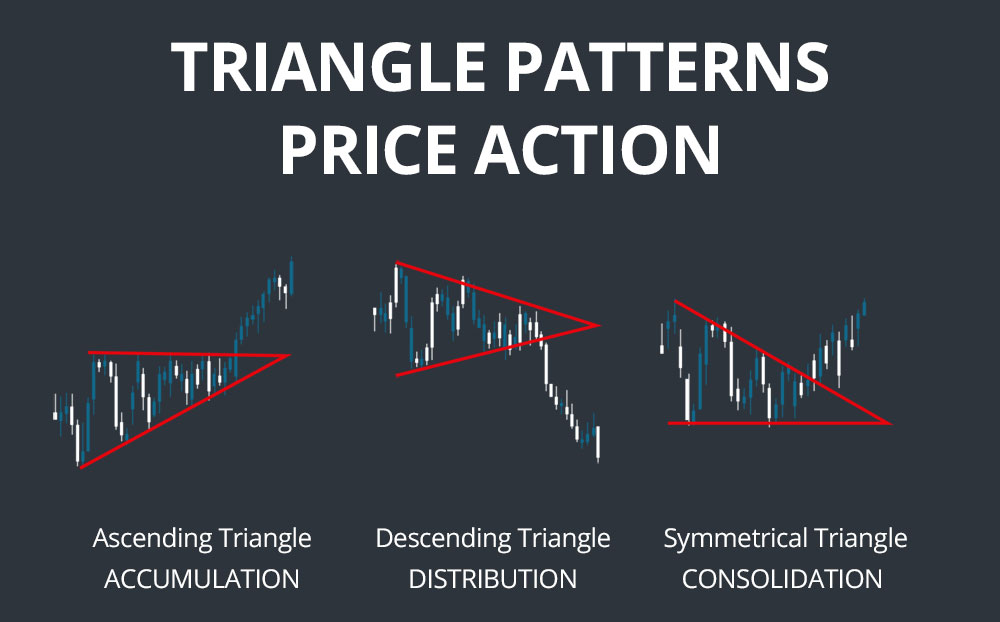

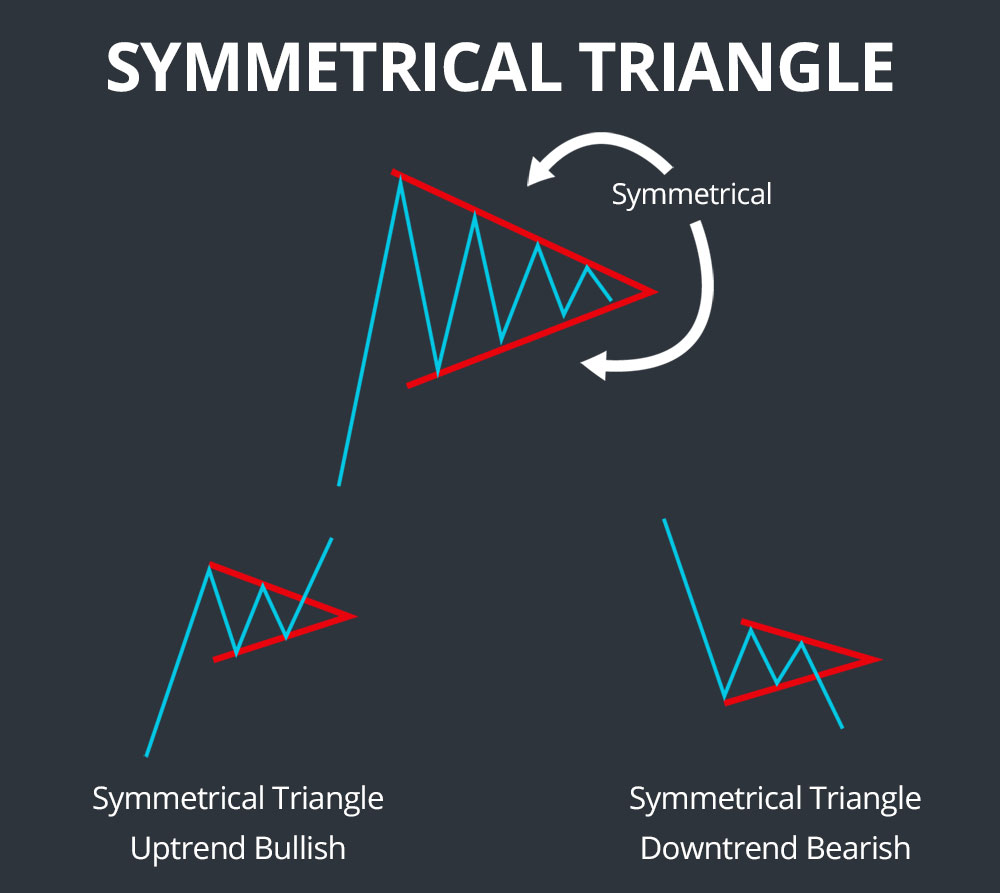

Stock Patterns Triangle - Web the triangle pattern, in its three forms, is one of the common stock patterns for day trading that you should be aware of. Web a triangle pattern is an example of a continuation pattern demonstrating this type of price action; They can be applied to all types of assets, from stocks and commodities to currencies and bonds. There are basically 3 types of triangles and they all point to price being in consolidation: The stock price moves in a sideways direction within a price channel, getting narrower. There are three potential triangle variations that can. Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or an uptrend. These patterns give traders more knowledge about upcoming price movements and the potential continuation of the present trend. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. They are named triangles as the upper and lower trend line eventually meet to form a tip and connecting the starting points of both trend lines completes a triangle shape. Web a symmetrical triangle chart pattern is a period of consolidation before the price is forced to break out or down. The pattern usually forms at the end of a downtrend or after a correction to the downtrend. Connecting the upper trendline’s starting point to the lower trendline’s start leads to the formation of the triangle. Web in the stock. The pattern usually forms at the end of a downtrend or after a correction to the downtrend. Web the descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. Less than 3 weeks ago. Web a symmetrical triangle chart pattern is a period of consolidation before the price is forced to break out or. They show a decrease in volatility that could eventually expand again. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a. Web an ascending triangle is a type of price action pattern, a chart of security’s price movement over time. Published research shows the most reliable and profitable stock chart patterns. Web the three most common types of triangles are symmetrical triangles, ascending triangles, and descending triangles. Less than 1 week ago. It is crucial to comprehend each triangle pattern separately because not all forms can be read similarly. There are three potential triangle variations that can. Triangle patterns are popular technical chart patterns that traders use to predict potential price. There are three potential triangle variations that can. Triangle patterns are popular technical chart patterns that traders use to predict potential price movements. Web the triangle pattern, in its three forms, is one of the common stock patterns for day trading that you should be aware of. Connecting the upper trendline’s starting point to the lower trendline’s start leads to. Stock chart patterns (or crypto chart patterns) help traders gain insight into potential price trends, whether up or down. The triangle’s tip emerges while the market keeps moving sideways, and the trading range gets smaller. Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. The. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. However, it can also occur as a consolidation in an uptrend as well. They can be applied to all types of assets, from stocks and commodities to currencies and bonds. Symmetrical (price is contained by 2 converging trend. The triangle is the widest when it first forms. Web stock passes all of the below filters in cash segment: There are basically 3 types of triangles and they all point to price being in consolidation: The triangle is one of my favorite chart patterns. Web triangle patterns are a chart pattern commonly identified by traders when a stock price’s. A breakdown from the lower trend line marks the start of a new bearish trend,. Ascending triangles are a continuation pattern, meaning they can be used to help confirm if the price of a security, like a stock, will continue moving in its current direction. Less than equal to 3 weeks ago. Less than 3 weeks ago. Web a triangle. Web triangle patterns are a chart pattern commonly identified by traders when a stock price’s trading range narrows following an uptrend or downtrend. Web the descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are. Web triangles are known as continuation patterns, meaning the trend stalls out to gather steam before the next breakout or breakdown. Web the triangle pattern, in its three forms, is one of the common stock patterns for day trading that you should be aware of. The triangle is one of my favorite chart patterns. The triangle’s tip emerges while the market keeps moving sideways, and the trading range gets smaller. These are important patterns for a number of reasons: However, it can also occur as a consolidation in an uptrend as well. There are basically 3 types of triangles and they all point to price being in consolidation: The pattern usually forms at the end of a downtrend or after a correction to the downtrend. Web a symmetrical triangle chart pattern is a period of consolidation before the price is forced to break out or down. Less than 3 weeks ago. These patterns give traders more knowledge about upcoming price movements and the potential continuation of the present trend. The stock price moves in a sideways direction within a price channel, getting narrower. They can be applied to all types of assets, from stocks and commodities to currencies and bonds. Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Web stock passes all of the below filters in cash segment: Web a triangle is simply a contraction in the price, but it must align with very specific criteria in order to be tradable.

How to Trade Triangle Chart Patterns FX Access

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Analyzing Chart Patterns Triangles

The Triangle Chart Pattern and Price Consolidation Opportunities

Triangle Chart Patterns Complete Guide for Day Traders

3 Triangle Patterns Every Forex Trader Should Know

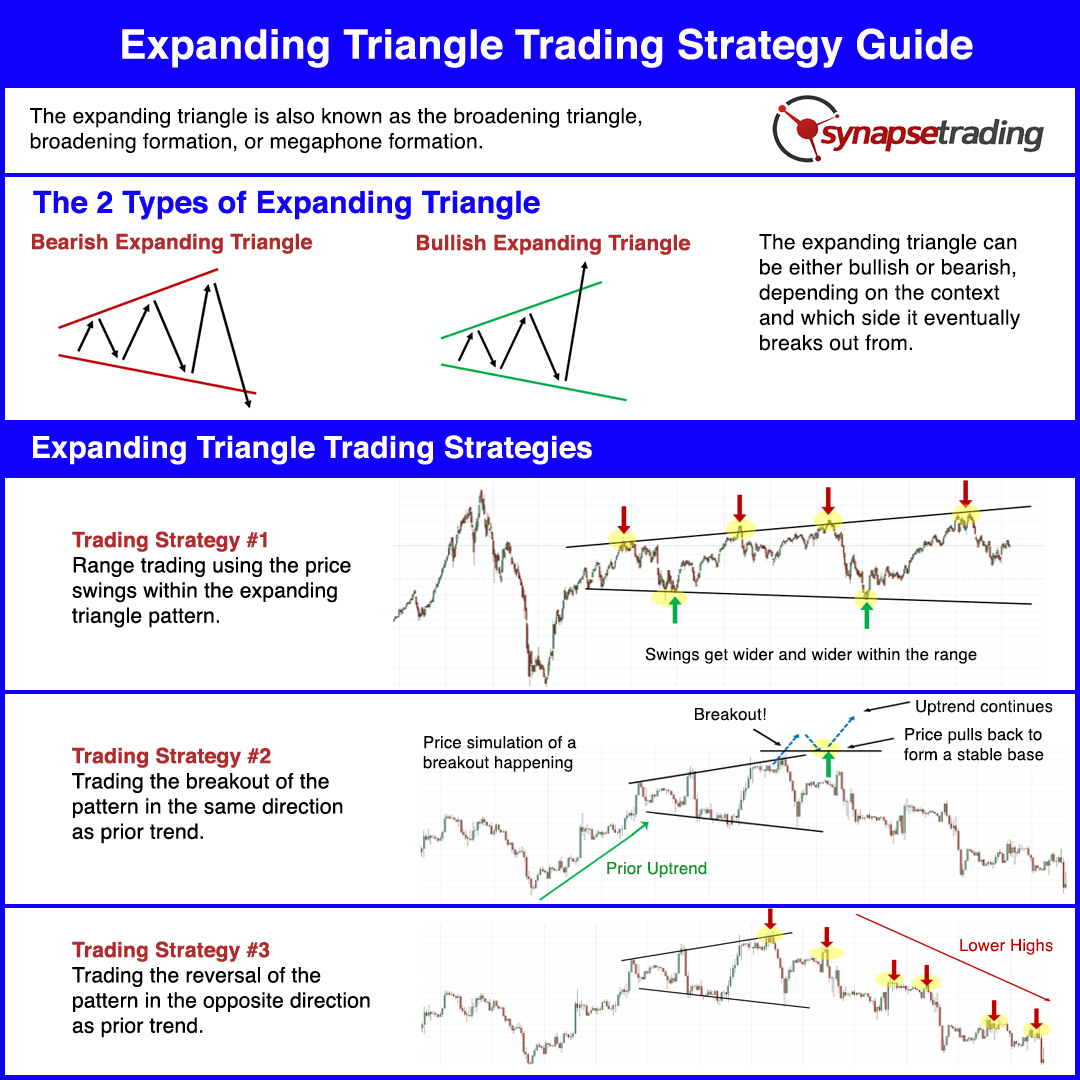

Price Chart Patterns Archives Synapse Trading

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Web A Triangle Pattern Is An Example Of A Continuation Pattern Demonstrating This Type Of Price Action;

Connecting The Upper Trendline’s Starting Point To The Lower Trendline’s Start Leads To The Formation Of The Triangle.

Web The Descending Triangle Is A Bearish Formation That Usually Forms During A Downtrend As A Continuation Pattern.

Web There Are Three Potential Triangle Variations That Can Develop As Price Action Carves Out A Holding Pattern, Namely Ascending, Descending, And Symmetrical Triangles.

Related Post: