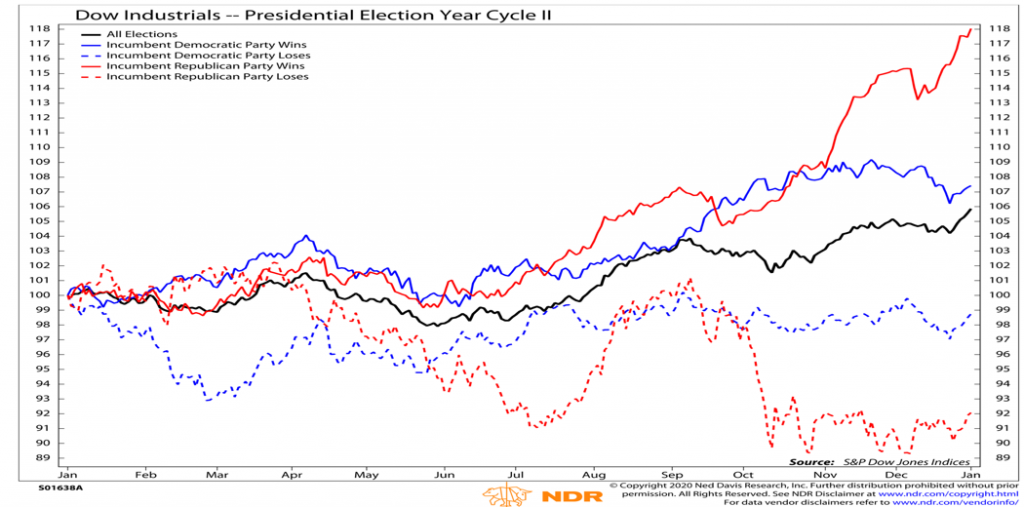

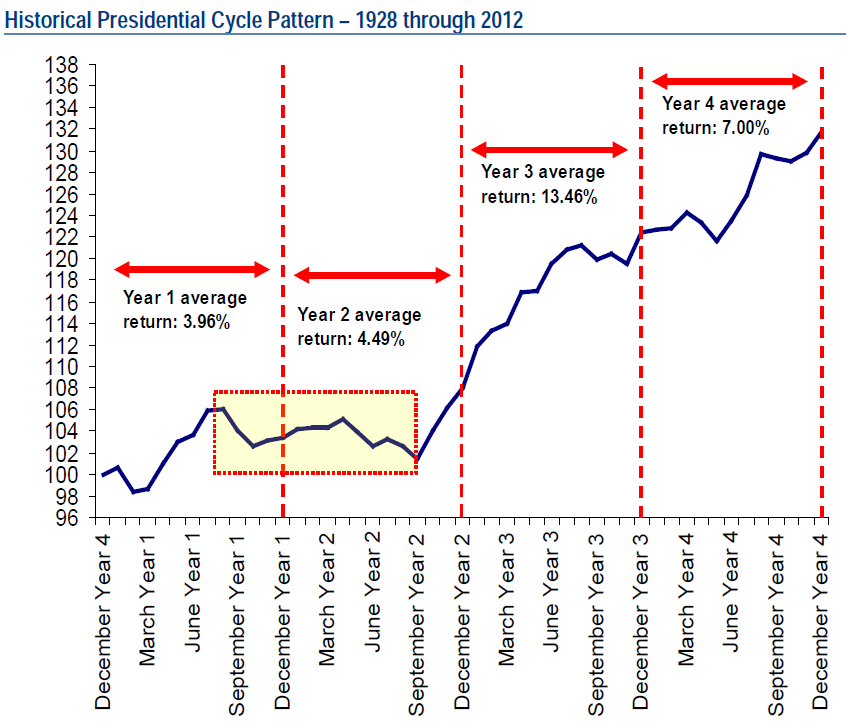

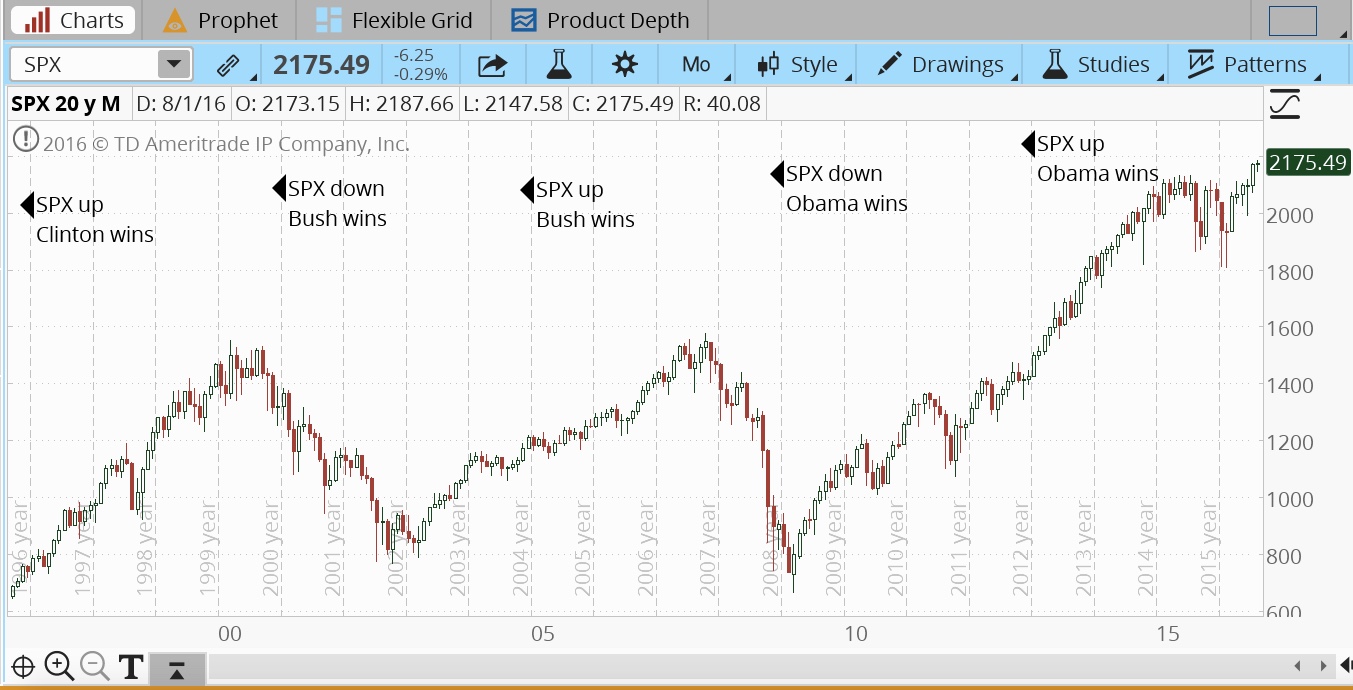

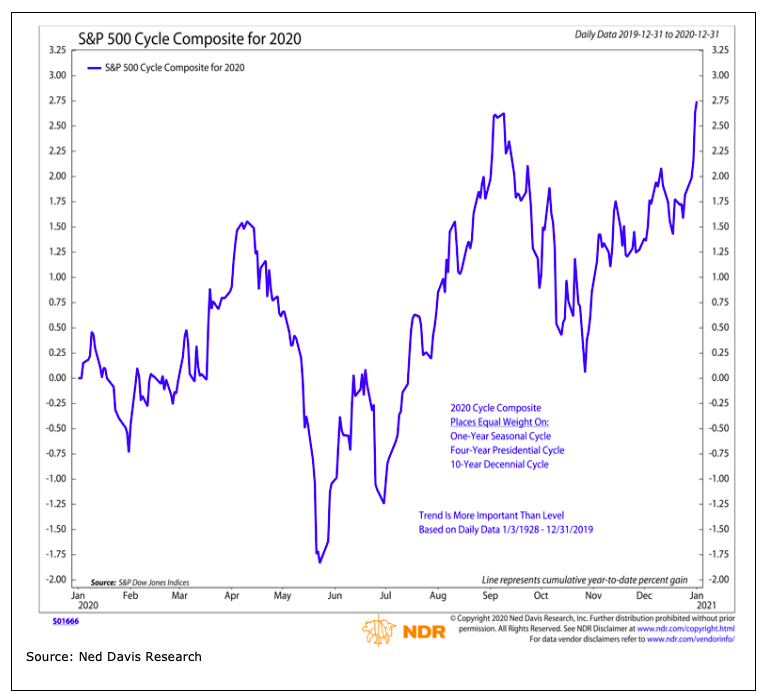

Stock Market Presidential Cycle Chart

Stock Market Presidential Cycle Chart - Democrat was elected, the total return for. “trifecta” is when a single party holds the presidency and majorities in both houses of congress. • 19 of the 23 years (83%) provided positive. • when a democrat was in office and a new. Only presidents who were elected (as opposed to vps who stepped in) are shown. The economy and stock market have thrived under both democratic and republican leadership. There are many stock market cycles, but some of the most common ones include the kondratiev wave, the juglar cycle, and the kuznets cycle. The year averaged 11.0% • when a democrat was in office and a. Web the presidential cycle is a theory that suggests that the united states stock market experiences a decline in the first year a new president takes office. This is the monthly returns with. Web this interactive chart shows the running percentage gain in the dow jones industrial average by presidential term. It suggests that the us presidential elections exert a predictable effect on the economy. Web this interactive chart shows the running percentage gain in the dow jones industrial average by presidential term. The presidential election cycle is a theory based on historical. Web this interactive chart shows the running percentage gain in the dow jones industrial average by presidential term. Each series begins in the month of election and runs to the election of the next president. Web why would the last two years of the presidential cycle show such a marked improvement in stock market returns? President’s term follows a predictable. What to expect from the s&p 500 during the presidential election. Although the stock market is not the economy, historically, both have played major. The charts begin and end on november 1st. What are stock market cycles? This phase occurs after the market has bottomed and the innovators (corporate insiders and a few value investors) and early adopters (smart money. Web presidential election cycle theory is a stock market performance theory that claims, based on historical data, that stock market performance in the first two years of a u.s. Democrat was elected, the total return for. Web the presidential election cycle theory posits that equity market returns follow a predictable pattern each time a new u.s. Each series begins with. Web these charts show how the several key market indexes performed during each president's four year term of office going back to 1900. There are many stock market cycles, but some of the most common ones include the kondratiev wave, the juglar cycle, and the kuznets cycle. I'm choosing to use a different definition of year than the normal calendar. I'm choosing to use a different definition of year than the normal calendar year starting on january 1. Web the presidential election cycle theory posits that equity market returns follow a predictable pattern each time a new u.s. Web this week's chart shows our presidential cycle pattern, which is an average of the s&p 500's behavior over the 4 years. Web why would the last two years of the presidential cycle show such a marked improvement in stock market returns? Web these charts show how the several key market indexes performed during each president's four year term of office going back to 1900. Web this interactive chart shows the running percentage gain in the dow jones industrial average by presidential. Stock market is one of the best predictors of whether the incumbent party will win a presidential election. There have been 23 elections since the s&p. I'm choosing to use a different definition of year than the normal calendar year starting on january 1. Web the presidential election cycle and s&p 500 returns. What are stock market cycles? Web this week's chart shows our presidential cycle pattern, which is an average of the s&p 500's behavior over the 4 years of each presidential term. Web this interactive chart shows the running percentage gain in the dow jones industrial average by presidential term. If an investor had decided their investments based on the political party in the white house,. See how the stock market has performed over the years during election cycles. Web these charts show how the several key market indexes performed during each president's four year term of office going back to 1900. Since 1928, the third year of the presidential cycle has produced positive s&p 500 returns 78% of the time, generating 13.5% average returns vs.. Web the stock market has yet to price in a potential outcome in the presidential election, a rematch between president joe biden and former president donald trump. Web the presidential election cycle theory posits that equity market returns follow a predictable pattern each time a new u.s. President’s term follows a predictable pattern. Blue (red) shades represents democrats (republicans) in white house. Since 1928, the third year of the presidential cycle has produced positive s&p 500 returns 78% of the time, generating 13.5% average returns vs. • 19 of the 23 years (83%) provided positive. A stock market cycle is a repeated trend in the prices of stocks over time. Web history shows the stock market and the economy are key indicators of who wins a presidential election. Stock market is one of the best predictors of whether the incumbent party will win a presidential election. Democrat was elected, the total return for. Only presidents who were elected (as opposed to vps who stepped in) are shown. Web this interactive chart shows the running percentage gain in the dow jones industrial average by presidential term. Web the presidential election cycle theory suggests that the stock market follows a pattern that correlates with a u.s. President’s term will likely outperform stock market performance in the last two years of a u.s. If an investor had decided their investments based on the political party in the white house, they might have missed out on significant growth opportunities. Web the presidential cycle is a theory devised by yale hirsch that suggests the stock market follows a pattern which correlates with a u.s.

Interested In the Election? Watch the Stock Market See It Market

US Presidential Cycle Stock Market Trend Forecast 2020 (5/6) YouTube

Three Takes on the Presidential Cycle ChartWatchers

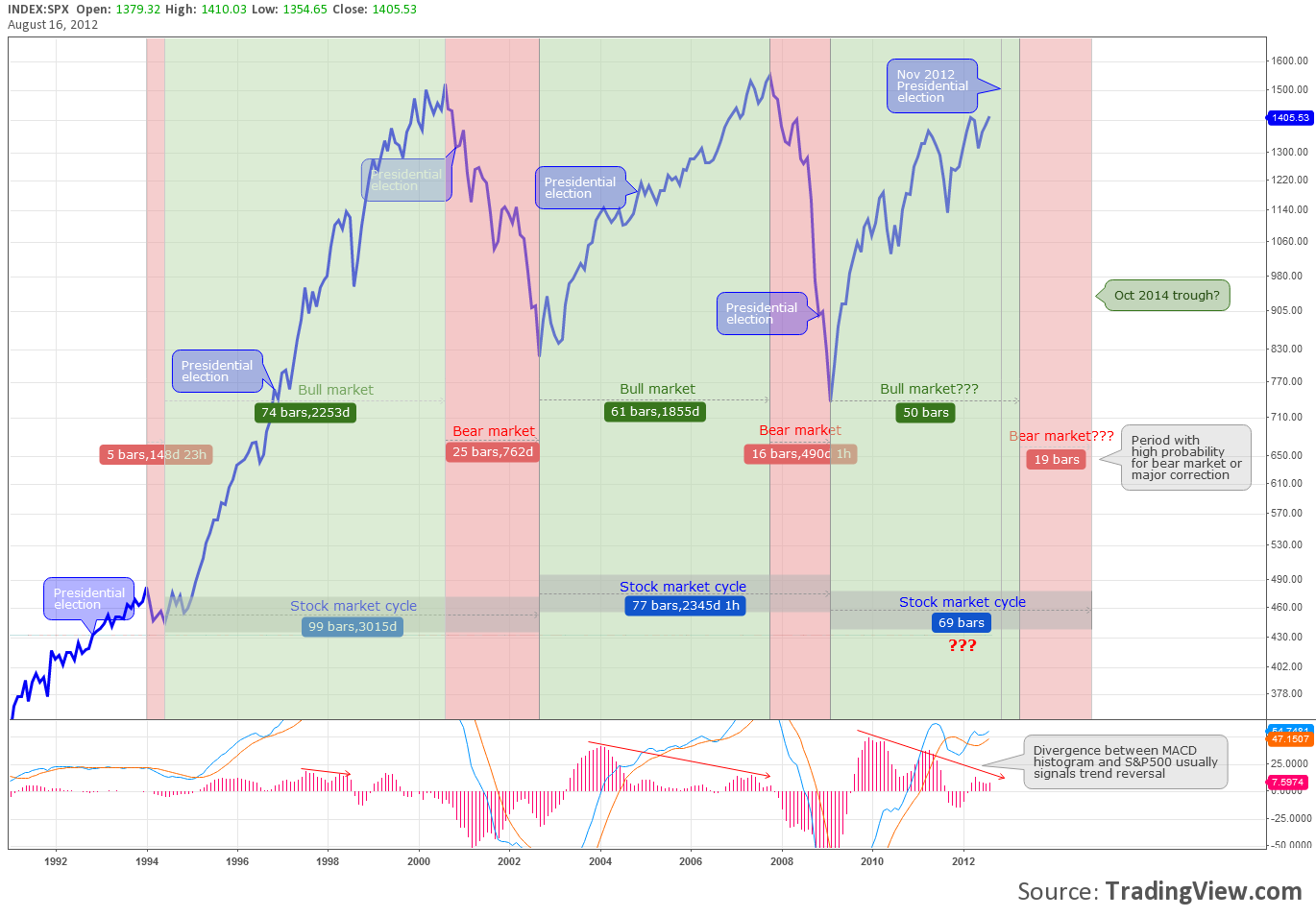

The 2016 Presidential Election And Stock Market Cycles Seeking Alpha

U.S. Presidential Election Cycle & Stock Market Performance Ticker Tape

Presidential Cycle Stock Market Chart

How 4Year Presidential Election Cycles Impact the Stock Market

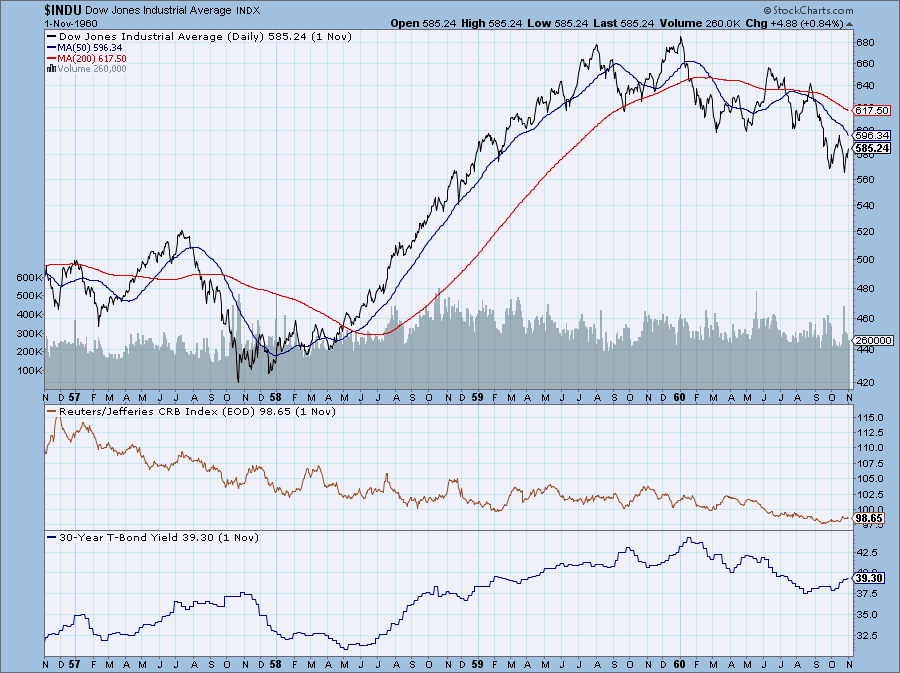

Presidential Cycles Historical Chart Gallery

Stock market and presidential cycle, what are the roles of stock

Three Takes on the Presidential Cycle ChartWatchers

Although The Stock Market Is Not The Economy, Historically, Both Have Played Major.

This Is The Monthly Returns With.

Web October 23, 2020 At 04:00 Pm.

Other Research By Yale Hirsch.

Related Post: