Spinning Top Candlestick Pattern

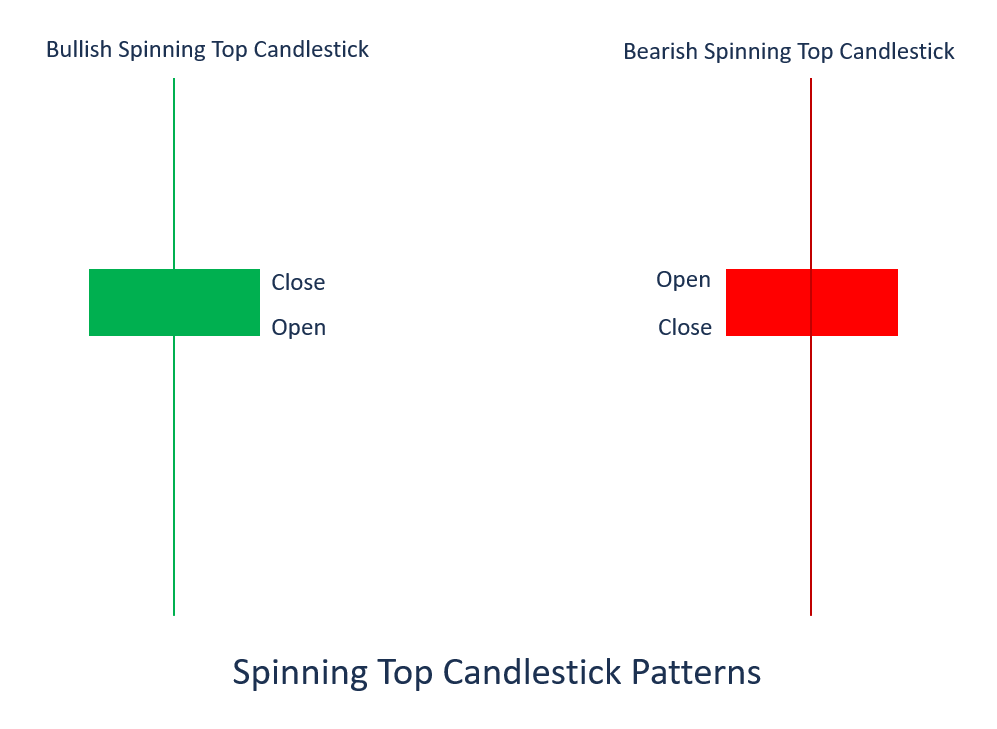

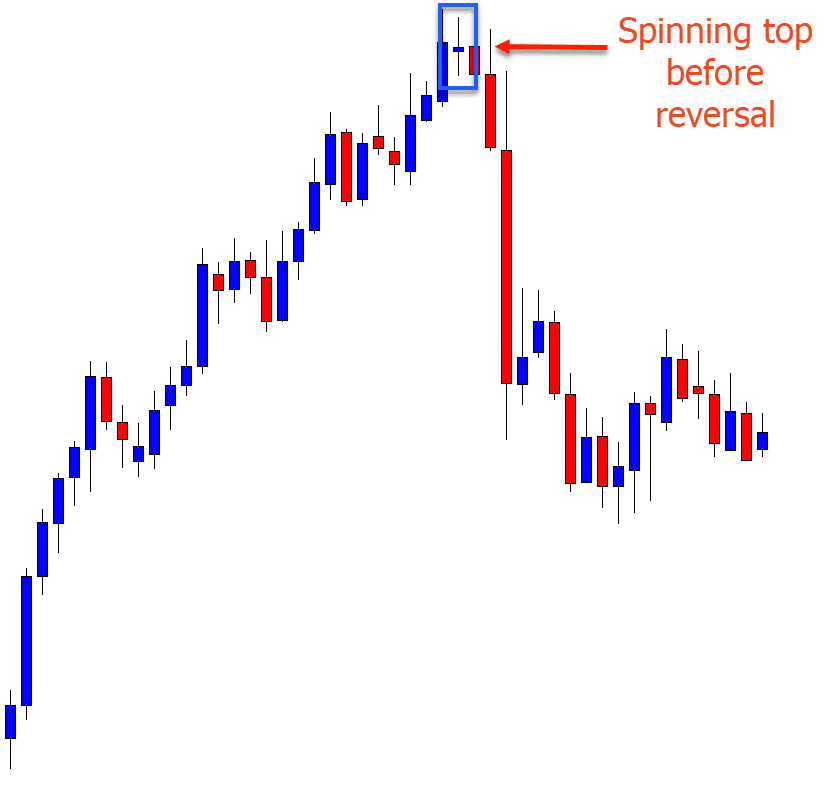

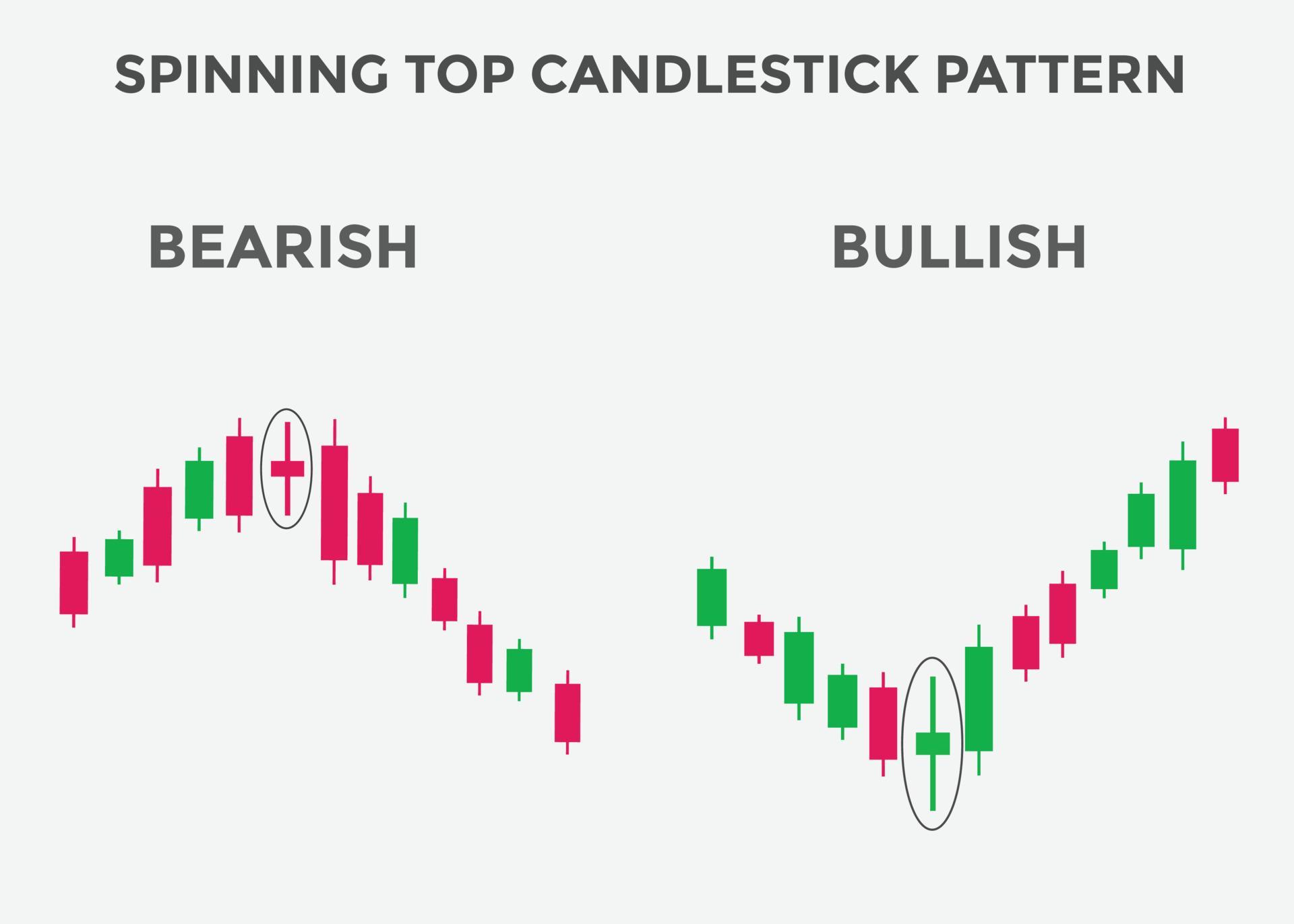

Spinning Top Candlestick Pattern - The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. The high and the low represent the opening and the closing prices. It results in equal opening and closing price units. Spinning top candlesticks are found on stock charts and could be a bullish or bearish reversal sign. A small real body means that the open price and close price are close to each other. Similarly, a spinning top candlestick pattern represents indecision. A spinning top pattern involves a single candle indicating uncertainty in the market. Web updated april 10, 2024. During the time period represented, neither the buyers nor the sellers had control. Free animation videos.find out today.learn finance easily.master the fundamentals. A candle you’ll find all over your charts, the spinning top is one of the most common candlesticks in forex. Fact checked by lucien bechard. Becca cattlin | financial writer, london. The high and the low represent the opening and the closing prices. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and lower shadows. The size of shadows can vary. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. The opening and closing prices of the. It often appears at the bottom of a downtrend, signalling potential bullish reversal. What is the spinning top candlestick? This is based on the number of sticks that make up the pattern. Because of this relatively small change in market direction, this candlestick is known as a continuation pattern. Web a spinning top is a single candlestick pattern which represents. A spinning top pattern involves a single candle indicating uncertainty in the market. Fact checked by lucien bechard. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. Explore amazon devicesfast shippingshop our huge selectionshop best sellers When you think of the spinning top candlestick pattern, think of a top toy. Candlestick charts are an important tool for technical analysis, and spinning top candles are a dime a dozen. Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Much like the doji candlestick. The spinning top candlestick is a unique pattern in technical trading. Web the inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signalling potential bullish reversal. The opening and closing prices of the. The market is indecisive regarding its trend. When you think of the spinning top candlestick pattern, think of a top toy. This subtle shift is usually called a continuation pattern in trading terminology. A spinning top pattern involves a single candle indicating uncertainty in the market. Understanding the spinning top candle. Web the spinning top candlestick chart pattern develops when buyers and sellers reach an equilibrium, leading to minimal changes between opening and closing prices. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. The spinning top candlestick is a unique pattern in technical trading. When you think of the spinning top candlestick pattern,. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. It results in equal opening and closing price units. It often appears at the bottom of a downtrend, signalling potential bullish reversal. The opening and closing prices of the particular asset should be equal or at least closer, regardless of which. The opening and closing prices of the particular asset should be equal or at least closer, regardless of which one is higher. Free animation videos.find out today.learn finance easily.master the fundamentals. Candlestick technical analysis doji pressure inverted hammer support and resistance. Explore amazon devicesfast shippingshop our huge selectionshop best sellers Let’s take a look at some popular examples. Free animation videos.find out today.learn finance easily.master the fundamentals. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. Candlestick charts are an important tool for technical analysis, and spinning top candles are a dime a dozen. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. Web a spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. This is based on the number of sticks that make up the pattern. Web the spinning top candlestick chart pattern develops when buyers and sellers reach an equilibrium, leading to minimal changes between opening and closing prices. The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Much like the doji candlestick pattern, spinning tops usually appear at the top or bottom of a trend and signal indecisiveness in the market and. Understanding the spinning top candle. Becca cattlin | financial writer, london. Find them a little confusing? Fact checked by lucien bechard. Web the spinning top candlestick. Let’s take a look at some popular examples.

THE SPINNING TOP CANDLESTICK PATTERN YouTube

Spinning Top Candlestick Pattern How To use Spinning Top candlestick

Bullish Spinning Top Candlestick Pattern Candle Stick Trading Pattern

The Definitive Guide To Spinning Top Candlestick Pattern

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)

Spinning Top Candlestick Definition

Spinning Top Candlestick Pattern Quick Trading Guide

Trading with the Spinning Top Candlestick

How to Trade with the Spinning Top Candlestick IG International

Spinning top candlestick pattern. Spinning top Bullish candlestick

A Small Real Body Means That The Open Price And Close Price Are Close To Each Other.

The Spinning Top Candlestick Is A Unique Pattern In Technical Trading.

Its Ability To Identify Market Indecision And Pauses In Price Movements Makes It A Truly Invaluable Tool In Your Trading Arsenal.

Web Spinning Top Candlestick Is A Pattern With A Short Body Between An Upper And A Lower Long Wick.

Related Post: