Section 174 State Conformity Chart

Section 174 State Conformity Chart - Taxpayers and practitioners should consider questions of states’ conformity when analyzing any of the below. Web four of the most significant state conformity issues resulting from the tcja and cares act relate to the treatment of: Web this item discusses the factors that should be considered in determining a state's conformity to sec. Ak, al, co, ct, dc, de, ia, il, ks, la, md, mi, mo, mt, nd, ne, nm,. Web tennessee enacted a law in march 2022 that decoupled the state specifically from section 174 under the tcja, thus adopting a version of selective conformity to. The state income tax treatment of a transaction typically derives from state law. Web some states need to pass legislation in order to conform to the new or revised federal tax code provisions. Web state conformity to section 174 capitalization. Web state income tax opportunities may be available for certain taxpayers affected by the updated capitalization requirements under section 174. Web the state corporate income tax effect of the changes depends on how states conform to the code. Ak, al, co, ct, dc, de, ia, il, ks, la, md, mi, mo, mt, nd, ne, nm,. Web tennessee enacted a law in march 2022 that decoupled the state specifically from section 174 under the tcja, thus adopting a version of selective conformity to. The tax cuts and jobs act (p.l. Web state income tax opportunities may be available for. Taxpayers and practitioners should consider questions of states’ conformity when analyzing any of the below. Web as a part of the 2017 tax cuts and jobs act (tcja), section 174 has been amended for tax years beginning after december 31, 2021, to require taxpayers to capitalize research. On may 25, 2023, florida gov. Web the state corporate income tax effect. Web florida updates internal revenue code (irc) conformity. Ak, al, co, ct, dc, de, ia, il, ks, la, md, mi, mo, mt, nd, ne, nm,. Web as a part of the 2017 tax cuts and jobs act (tcja), section 174 has been amended for tax years beginning after december 31, 2021, to require taxpayers to capitalize research. Web this item. Web read a kpmg report* that explores which states likely conform to the amendments to section 174, which states likely decouple from those changes, and the. 2017 provides for changes to the treatment of. Web 24 states that automatically conform to the irc as the irc is amended. Web state conformity to section 174 capitalization. Read a kpmg report1 that. Web common areas of federal/state conformity variances. The tax cuts and jobs act (p.l. 2017 provides for changes to the treatment of. Ron desantis signed house bill 7063, an omnibus tax bill that, among. Web download the full state i.r.c. Web this item discusses the factors that should be considered in determining a state's conformity to sec. Web common areas of federal/state conformity variances. Web download the full state i.r.c. Web tennessee enacted a law in march 2022 that decoupled the state specifically from section 174 under the tcja, thus adopting a version of selective conformity to. Web 24 states. Web tennessee enacted a law in march 2022 that decoupled the state specifically from section 174 under the tcja, thus adopting a version of selective conformity to. Web read a kpmg report* that explores which states likely conform to the amendments to section 174, which states likely decouple from those changes, and the. Web as a part of the 2017. Web four of the most significant state conformity issues resulting from the tcja and cares act relate to the treatment of: Web 24 states that automatically conform to the irc as the irc is amended. Web download the full state i.r.c. Web the state corporate income tax effect of the changes depends on how states conform to the code. Ak,. Web common areas of federal/state conformity variances. 174 as amended by the tcja and reviews recently enacted. Web four of the most significant state conformity issues resulting from the tcja and cares act relate to the treatment of: Read a kpmg report1 that explores which states likely conform to the. Web download the full state i.r.c. Web some states need to pass legislation in order to conform to the new or revised federal tax code provisions. Web read a kpmg report* that explores which states likely conform to the amendments to section 174, which states likely decouple from those changes, and the. Web tennessee enacted a law in march 2022 that decoupled the state specifically from. Taxpayers and practitioners should consider questions of states’ conformity when analyzing any of the below. Web this item discusses the factors that should be considered in determining a state's conformity to sec. On may 25, 2023, florida gov. Web florida updates internal revenue code (irc) conformity. Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. Companies also should consider state conformity to, and treatment of,. Web this paper provides a snapshot of how states currently conform to internal revenue code (irc) income tax provisions in general, as well as to the irc’s treatment of nols,. Web read a kpmg report* that explores which states likely conform to the amendments to section 174, which states likely decouple from those changes, and the. Web as a part of the 2017 tax cuts and jobs act (tcja), section 174 has been amended for tax years beginning after december 31, 2021, to require taxpayers to capitalize research. Web some states need to pass legislation in order to conform to the new or revised federal tax code provisions. Web tennessee enacted a law in march 2022 that decoupled the state specifically from section 174 under the tcja, thus adopting a version of selective conformity to. Read a kpmg report1 that explores which states likely conform to the. 174, which states likely decouple from those changes, and the issues raised by. Web common areas of federal/state conformity variances. Web differences between state tax regimes and the federal determination of taxable income. Web four of the most significant state conformity issues resulting from the tcja and cares act relate to the treatment of:

IRS Code 174 What Does It Mean on IRS Transcript?

Rev. Proc. 202311 and the Mandatory Amortization of Section 174

Section 174 You Could Owe Up to 28K More in Taxes Acuity

An R&D tax credit study could help reduce the tax impact of Section 174

State Conformity to Federal PandemicRelated Tax Provisions in CARES

IRC Section 174 Compliance Rules and Updates United States Leyton

Section 174 Amortization for Your Manufacturing Company MBE CPAs

Section 174 Capitalization & Expenses Negative Tax Impacts On U.S.

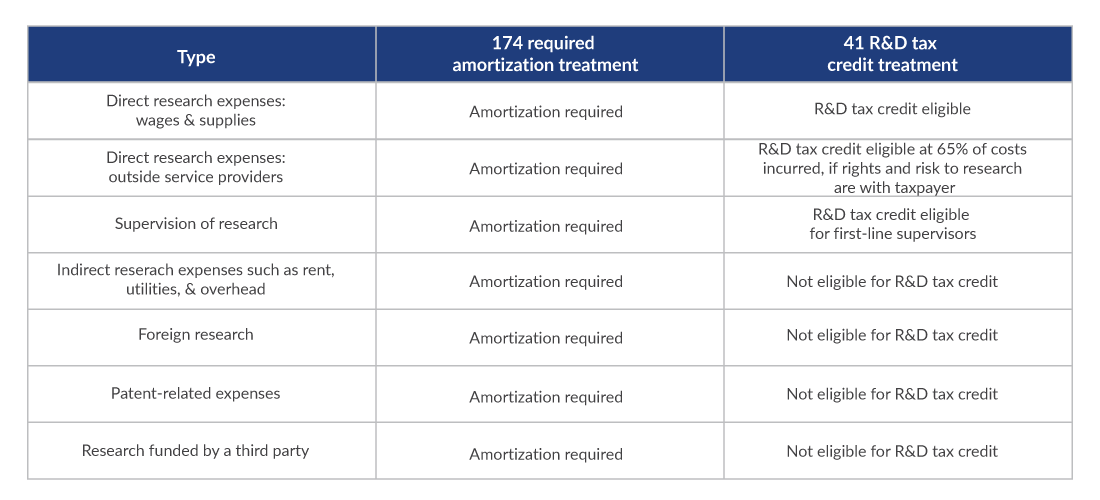

Types of expenditures that require capitalization under Section 174

CRPC Section 174 states that when the officer in charge of a Police

The State Income Tax Treatment Of A Transaction Typically Derives From State Law.

Web State Conformity To Section 174 Capitalization.

Other States’ Existing Laws Require Conformity To The Irc As The Irc Is.

The Tax Cuts And Jobs Act (P.l.

Related Post: