Rounding Pattern Stock

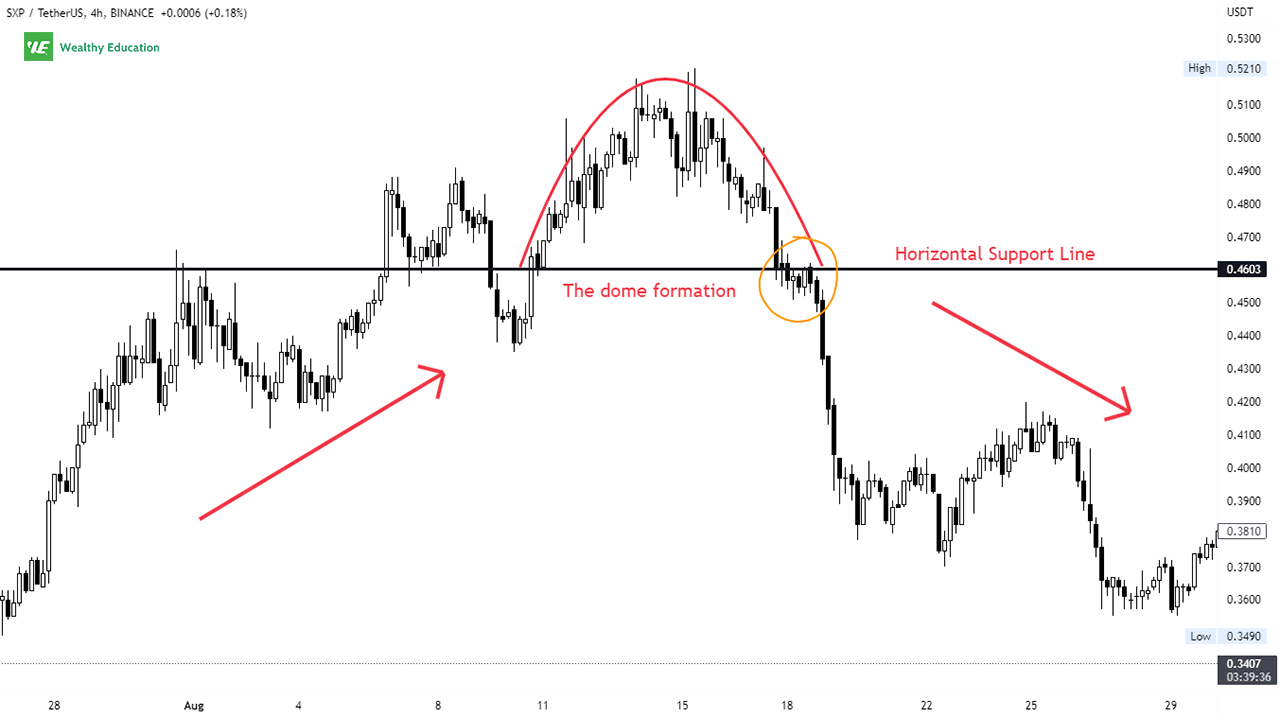

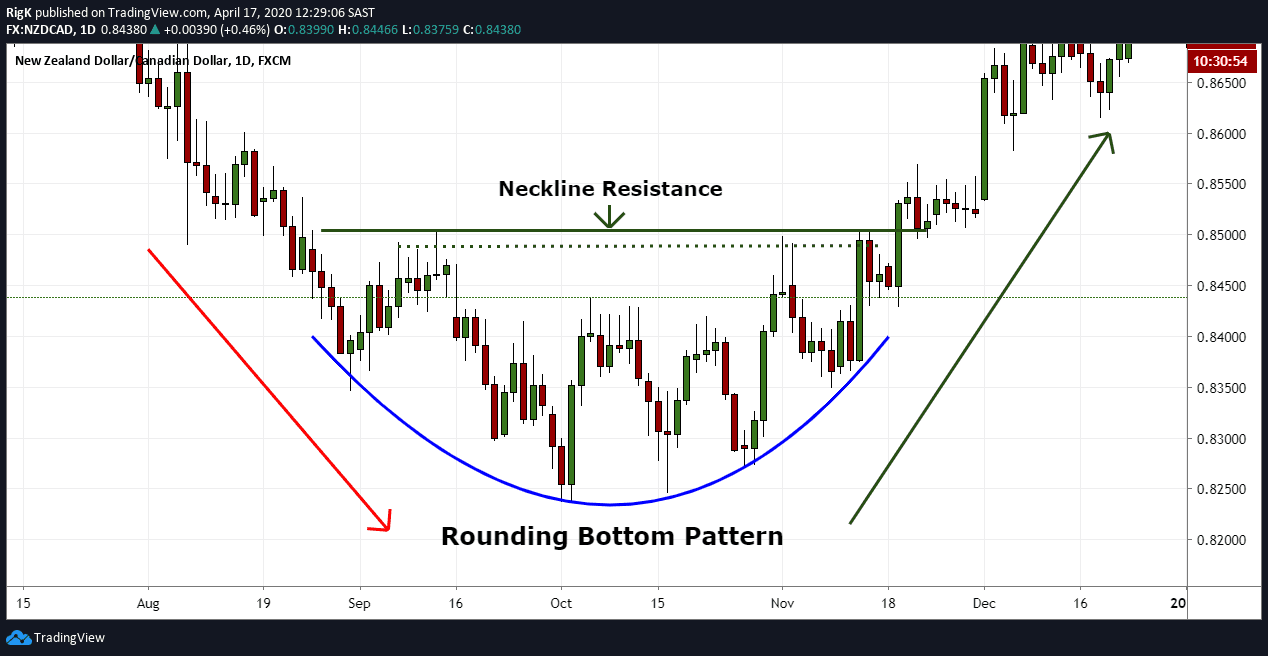

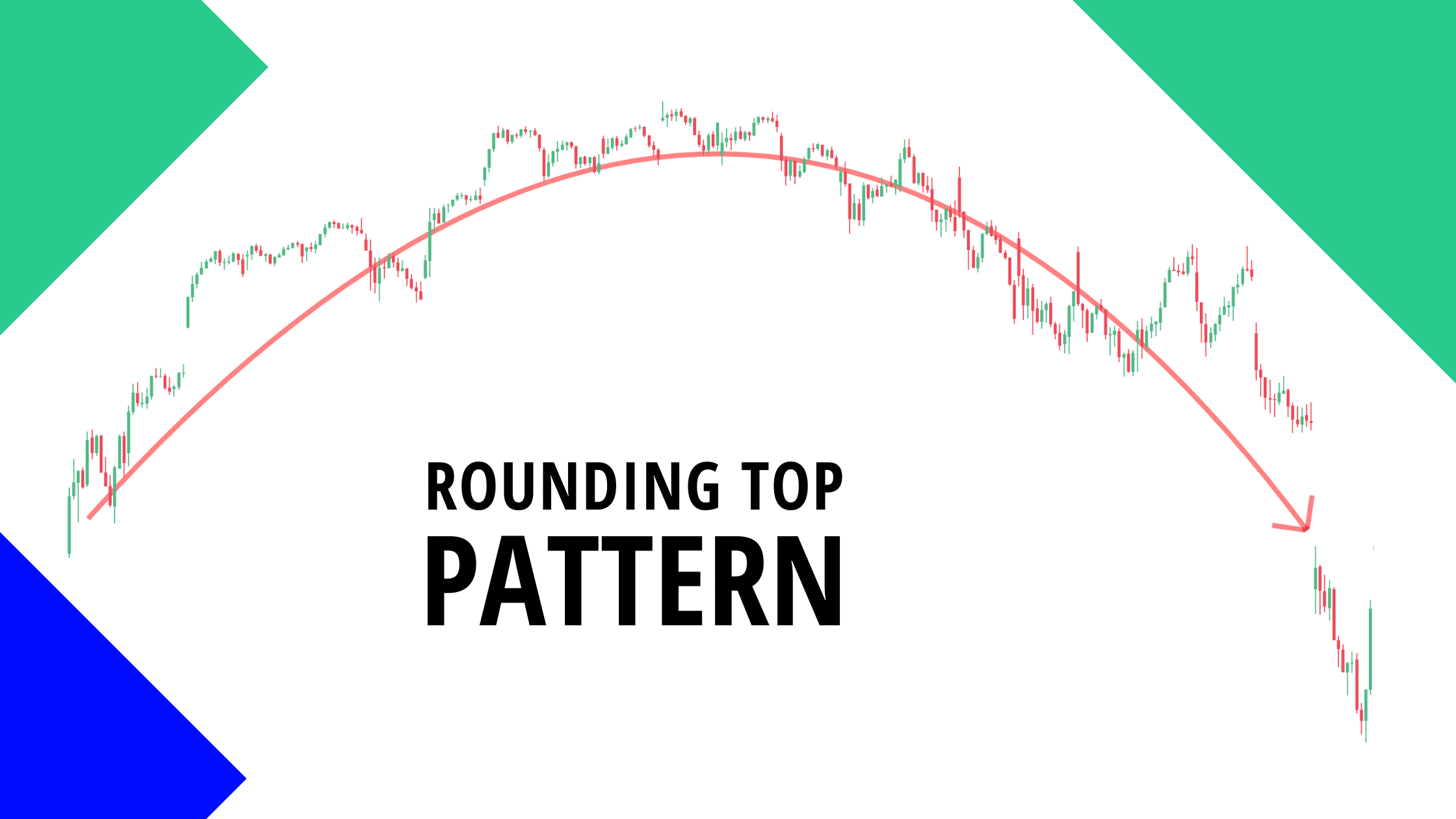

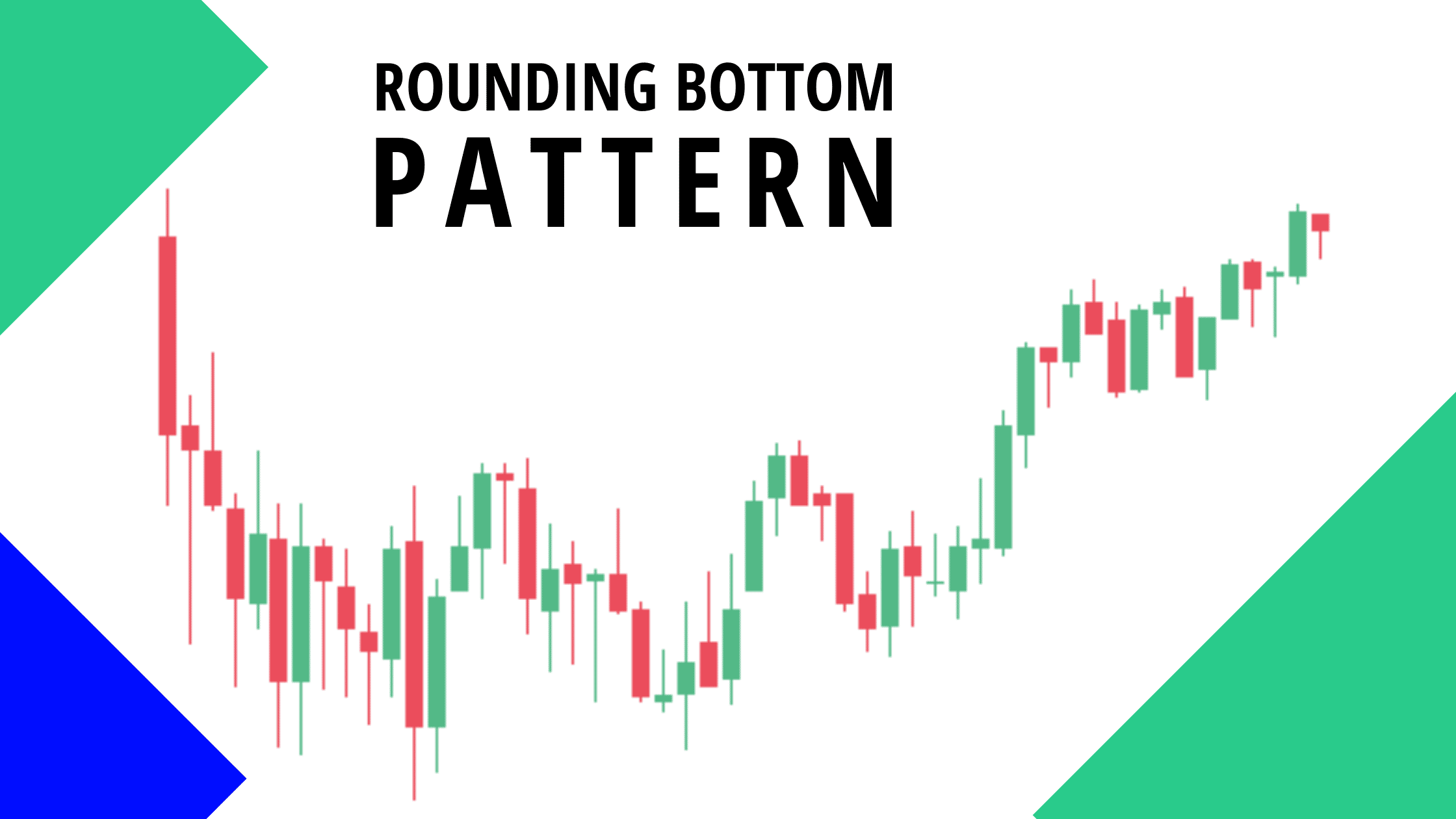

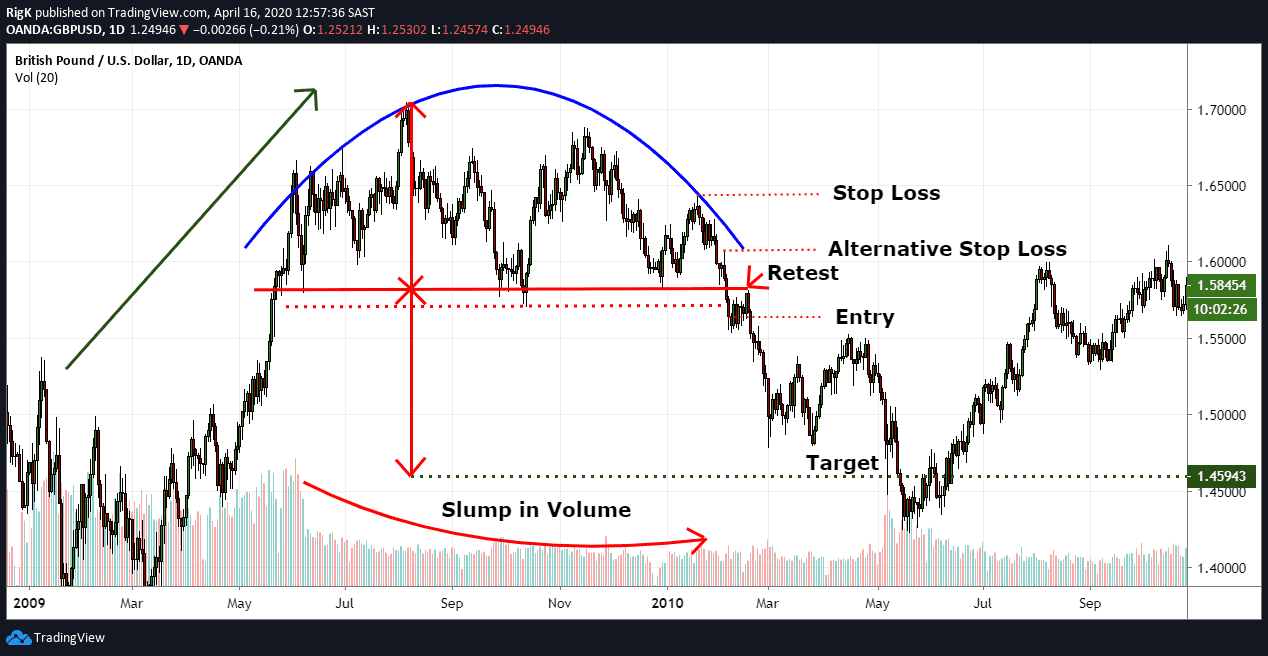

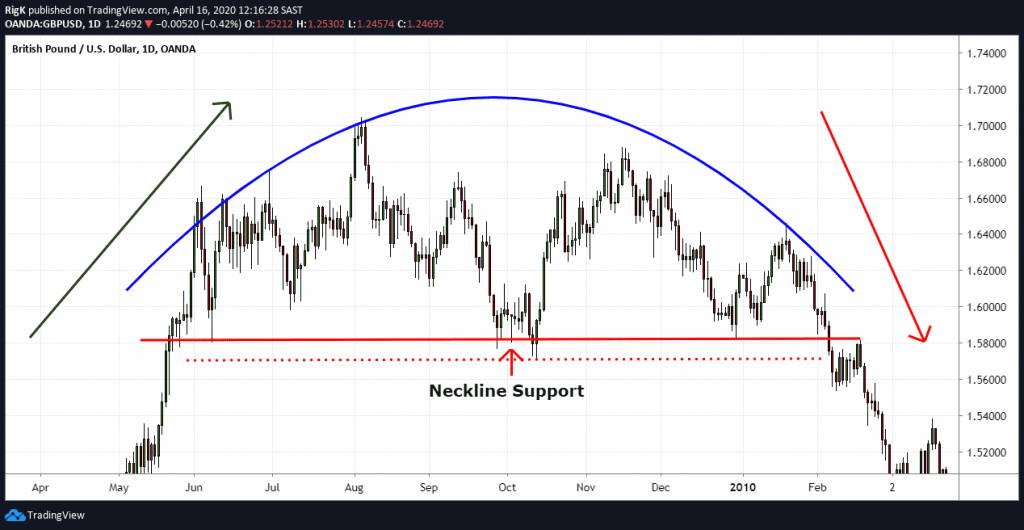

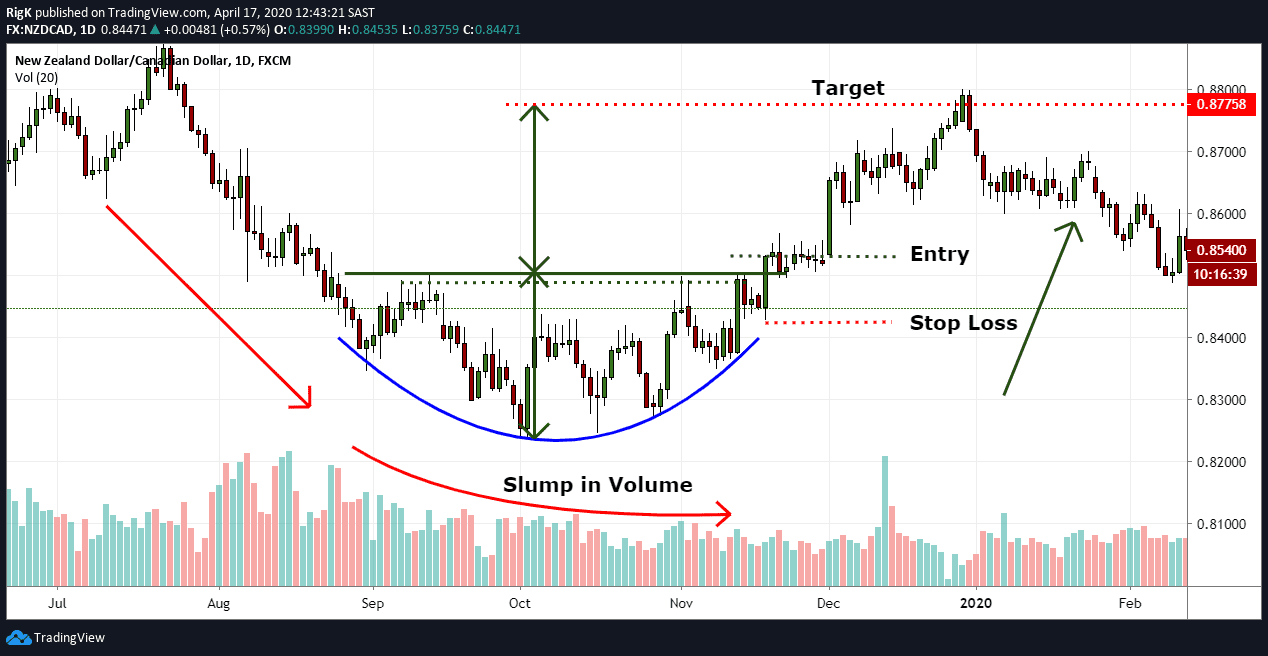

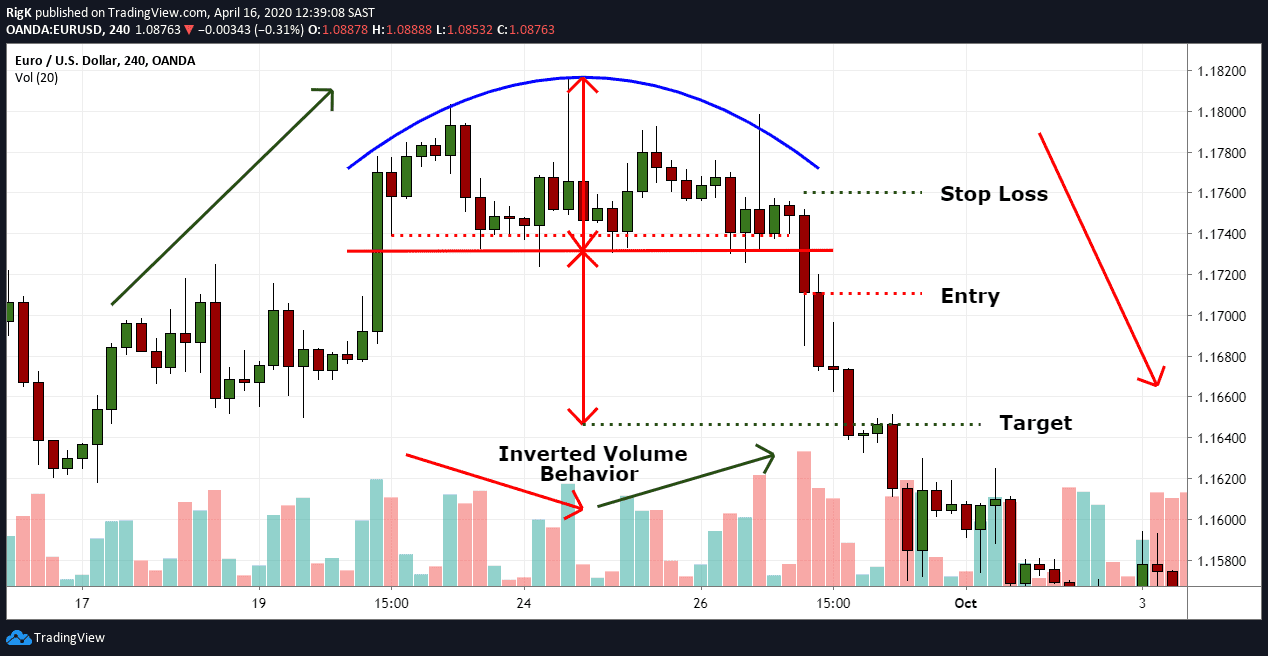

Rounding Pattern Stock - See prices and trends of over 10,000 commodities. Web the rounding bottom is a reversal chart pattern, which develops after a price decline. Web identifying the pattern. Your capital is at risk. • rounding bottoms are found at the end of extended downward trends and signify a reversal • it is also referred to as a saucer bottom • ideally, volume and price will move in. Web mmm stock chart shows a rounding top developing. Get realtime data for scanner in our premium. As a stock is trending lower, the rate of the decline will begin to slow down. The pattern indicates that an existing downtrend is about to end, and a possible uptrend is about to commence. Web rounding tops are large chart patterns that are an inverted bowl shape. Topping patterns are critical to recognize prior to the stock turning down, especially in the modern market. Web create a stock screen. As you can see in the gbp/usd. Web mmm stock chart shows a rounding top developing. Rounding bottoms form an inverted ‘u’ shape and. Topping patterns are critical to recognize prior to the stock turning down, especially in the modern market. What is the rounding bottom pattern? Web a rounding bottom is a chart pattern used in technical analysis and is identified by a series of price movements that graphically form the shape of a “u”. 28, 2024, at 3:49 p.m. How to identify. Web • a rounding bottom is a chart pattern that graphically forms the shape of a u. Web the rounding bottom is a reversal chart pattern, which develops after a price decline. A rounding top is a price pattern used in technical analysis. Stock charts provide excellent visualizations of market behavior, and there are patterns you can learn that will. As a stock is trending lower, the rate of the decline will begin to slow down. Your capital is at risk. Web the rounding chart bottom pattern is often observed in penny stocks as their prices are extremely volatile, rendering it easy for investors to spot them. A rounding top is a price pattern used in technical analysis. Stock passes. It is also referred to as a saucer bottom, and represents a long consolidation period that. The rounding top is a reversal pattern that occurs during an uptrend. • rounding bottoms are found at the end of extended downward trends and signify a reversal • it is also referred to as a saucer bottom • ideally, volume and price will. Your capital is at risk. Web • a rounding bottom is a chart pattern that graphically forms the shape of a u. Written by internationally known author and trader thomas bulkowski. Stock passes all of the below filters in cash segment: 28, 2024, at 3:49 p.m. The rounding bottom chart pattern, also known as the saucer bottom pattern, is a trend reversal pattern used. Topping patterns are critical to recognize prior to the stock turning down, especially in the modern market. Stock charts provide excellent visualizations of market behavior, and there are patterns you can learn that will help you understand. Web a rounding bottom is. See prices and trends of over 10,000 commodities. A rounding top is a price pattern used in technical analysis. Web the rounding bottom is a reversal chart pattern, which develops after a price decline. Run queries on 10 years of financial data. Web identifying the pattern. The price chart below demonstrates a rounded bottom applied on the gold. Web a rounding bottom is a chart pattern used in technical analysis and is identified by a series of price movements that graphically form the shape of a “u”. As you can see in the gbp/usd. It is also referred to as a saucer bottom, and represents a. Web • a rounding bottom is a chart pattern that graphically forms the shape of a u. Web one type of chart pattern that is often used to identify potential reversal points on a price chart is the rounding bottom or top. Web mmm stock chart shows a rounding top developing. A rounding top is a price pattern used in. Web • a rounding bottom is a chart pattern that graphically forms the shape of a u. Web the rounding bottom is a reversal chart pattern, which develops after a price decline. A rounding top is a price pattern used in technical analysis. Web the rounding chart bottom pattern is often observed in penny stocks as their prices are extremely volatile, rendering it easy for investors to spot them. Rounding bottom top can be identified with certain characteristics and key components: Written by internationally known author and trader thomas bulkowski. Web mmm stock chart shows a rounding top developing. What is the rounding top pattern in trading? Topping patterns are critical to recognize prior to the stock turning down, especially in the modern market. Stock passes all of the below filters in cash segment: The rounding top is a reversal pattern that occurs during an uptrend. The rounding bottom chart pattern, also known as the saucer bottom pattern, is a trend reversal pattern used. • rounding bottoms are found at the end of extended downward trends and signify a reversal • it is also referred to as a saucer bottom • ideally, volume and price will move in. See prices and trends of over 10,000 commodities. Web rounding tops are large chart patterns that are an inverted bowl shape. As a stock is trending lower, the rate of the decline will begin to slow down.

Rounding Top Pattern (Updated 2023)

The Rounding Bottom Pattern Definition & Examples (2023)

![Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda](https://tradeveda.com/wp-content/uploads/2020/10/breakout-trading-strategy-rounding-top-pattern-1024x683.png)

Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda

What is a Rounding Top & How to Trade it Best? PatternsWizard

What is the Rounding Bottom Pattern? StepbyStep Guide to Trade it!

The Rounding Top Chart Pattern (Explained With Examples)

The Rounding Top Chart Pattern (Explained With Examples)

The Rounding Bottom Pattern Definition & Examples (2023)

The Rounding Top Chart Pattern (Explained With Examples)

Rounding Top Pattern The Definitive Trading Guide For Stocks

Run Queries On 10 Years Of Financial Data.

Rounding Bottoms Form An Inverted ‘U’ Shape And.

Web Learn Free Now.

Web A Rounded Top Chart Pattern, Also Known As A Rounding Top Or An Inverted Rounding Bottom Pattern , Is A Technical Analysis Pattern That Appears On Price Charts.

Related Post: