Rounded Top Pattern

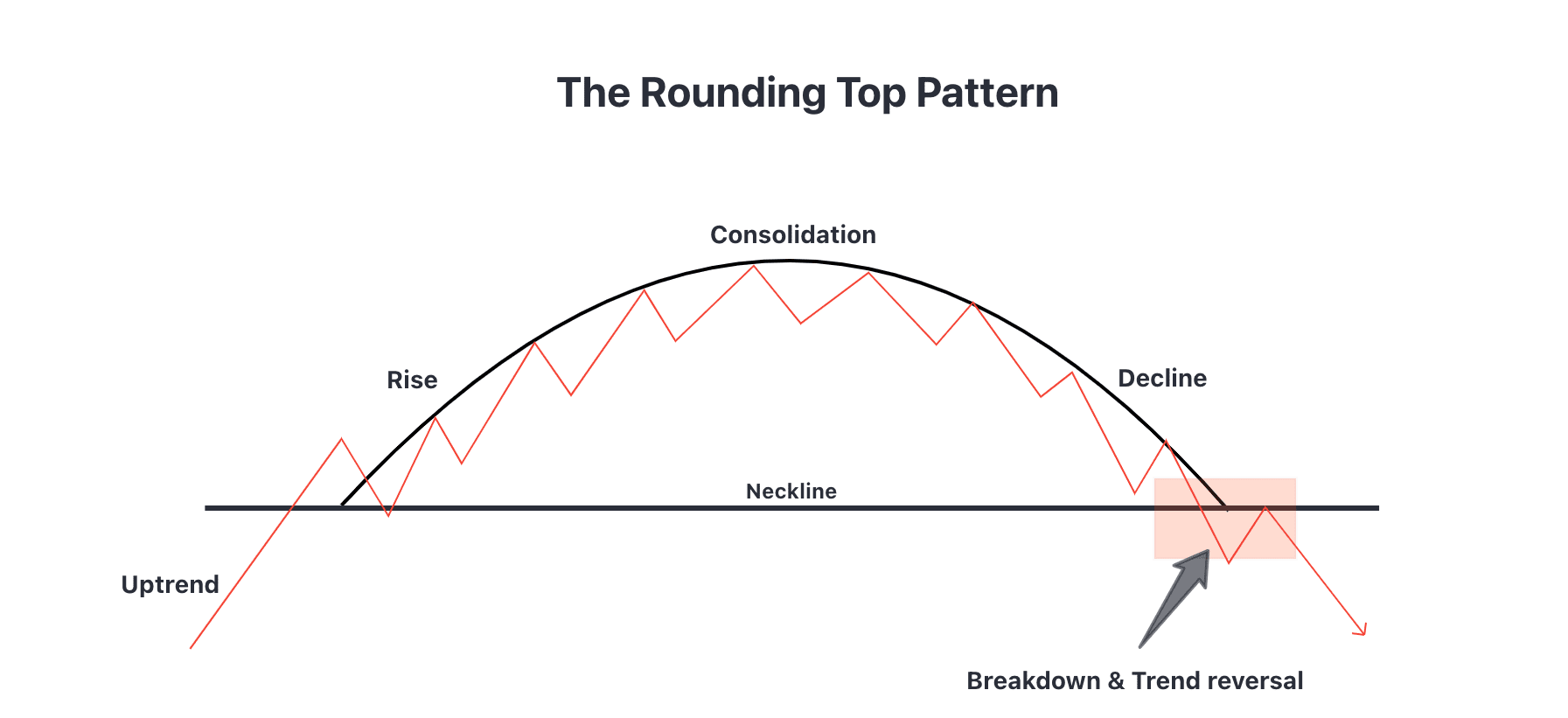

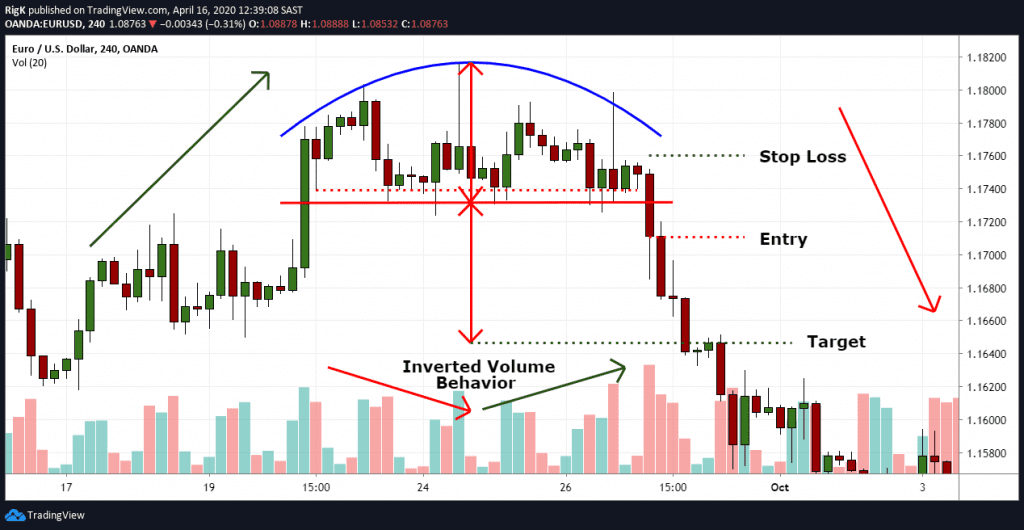

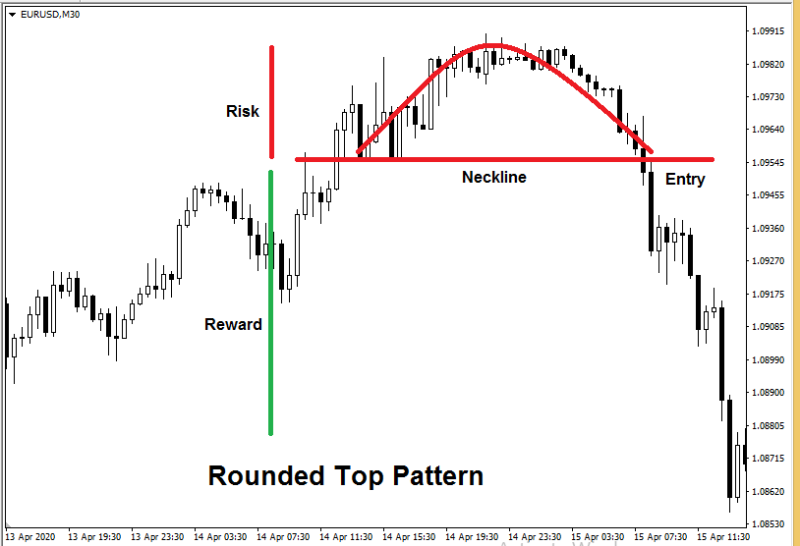

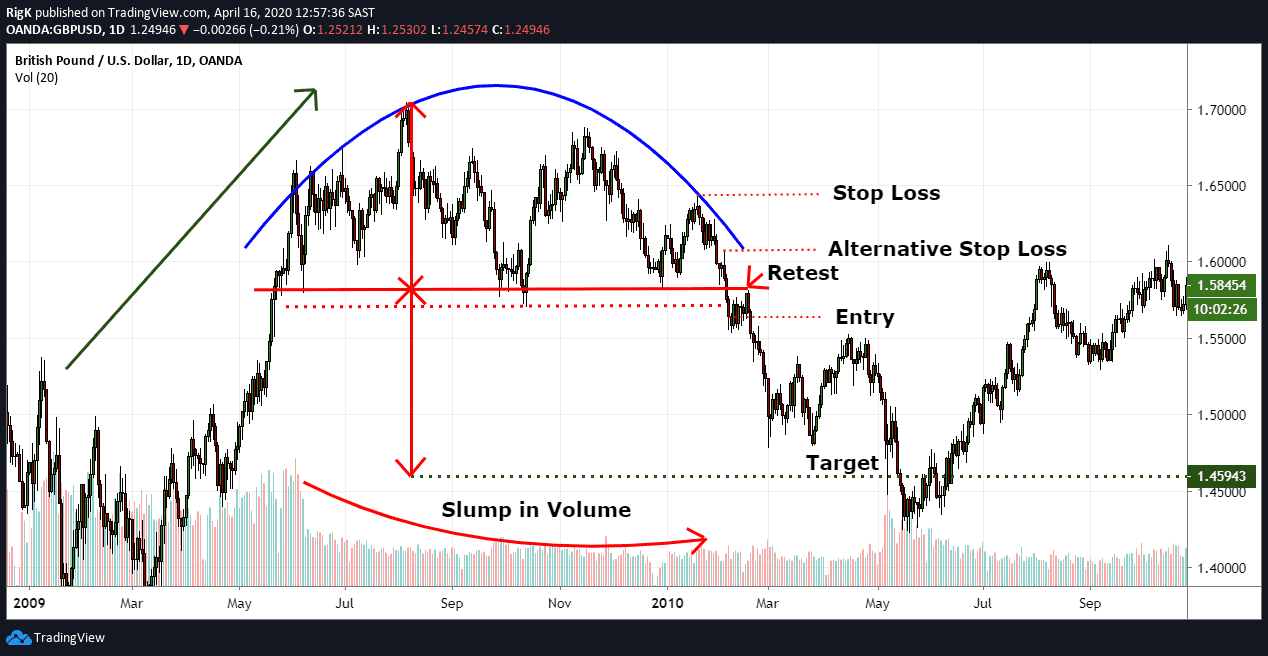

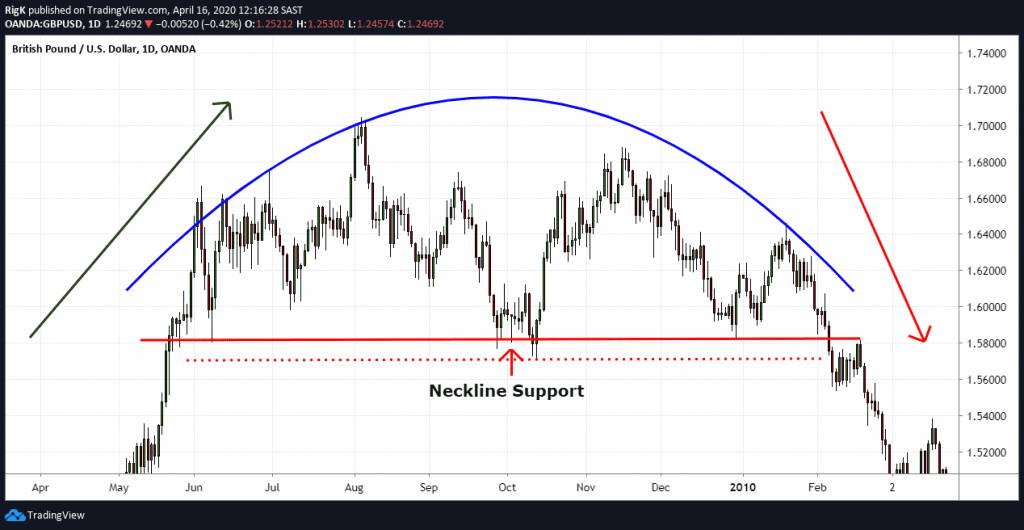

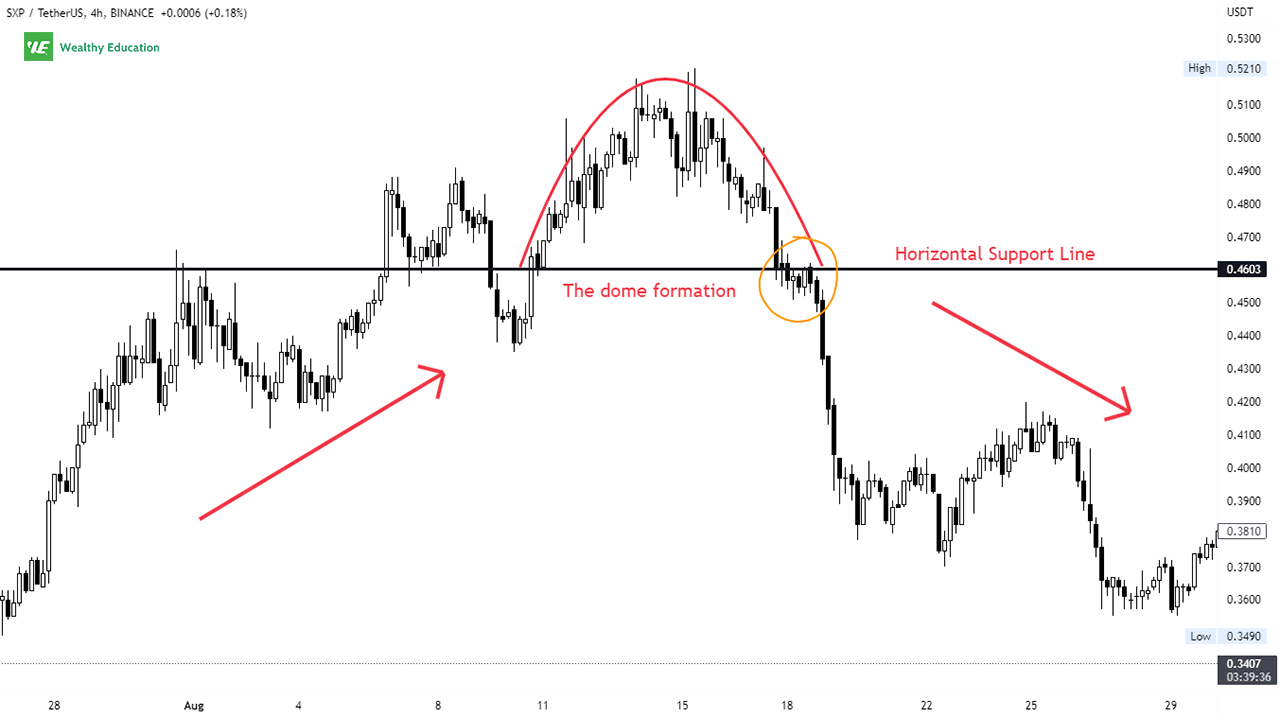

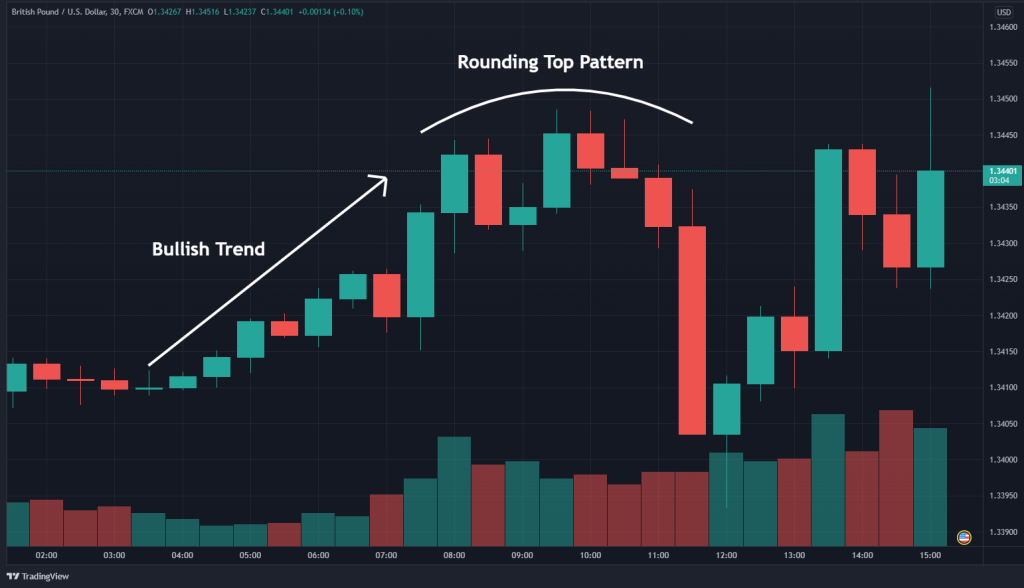

Rounded Top Pattern - The pattern is often seen as a potential reversal signal, as it indicates that buying pressure is gradually being replaced by selling pressure resulting in a bearish trend. The pattern is confirmed when the price breaks down below its moving average. It then stabilizes for an elongated duration, creating a rounded top. The neckline of the pattern is constructed by the lowest point before the formation. A chart pattern used in technical analysis, which is identified by a series of price movements that, when graphed, form the shape of a u. It signals the end of an uptrend and the possible start. To do this, you need to draw a horizontal line across the top of the bearish and bullish sides of the rounding bottom pattern. It typically indicates a shift from an upward trend to a downward trend. Web identify the pattern. Teams are all over the board on george, but his shooting, playmaking and feel at his size make him a. Rounding bottoms are found at the end. It signals the end of an uptrend and the possible start. Web after you identify the pattern, you need to draw the neck line. The break below $170, coupled with the increased volume, was a clear signal: Pick player team rookie contract; It then stabilizes for an elongated duration, creating a rounded top. The stop loss location for the rounding top chart pattern is above the final periodic high in the pattern. Draw the neckline (support) enter a sell order beneath the neckline. Jokic wins nba’s mvp award, his 3rd in 4 seasons. Web after you identify the pattern, you need to. A rounding top may form at the end of an. The rims of the inverted bowl bottom near the same price, but 58% of the time the end is slightly higher than the start. Web what is a rounding top? ” the top is rounded with a flat top. A chart pattern used in technical analysis, which is identified by. Web rounded top and bottom. The rounding top can take weeks or even months to form, and traders interpret the pattern as a sign of a shift in market sentiment from bullish to bearish. Web after you identify the pattern, you need to draw the neck line. This limits risk and helps maintain an. The rounding top chart pattern is. Web the rounded top chart pattern, also known as the rounded reversal top or simply the rounded top, is a bearish chart pattern that suggests a potential trend reversal in crypto markets. This limits risk and helps maintain an. The rounded top chart pattern shows. It signals the end of an uptrend and the possible start. Rounding bottoms are found. It then stabilizes for an elongated duration, creating a rounded top. Web the rounding top pattern explained. — and jokic has had better years in each of those categories — but he was the only player to rank in the nba’s top 10 in points, rebounds and assists per game this season. ” the top is rounded with a flat. Rounding tops are large enough to appear on the weekly or daily chart. It typically indicates a shift from an upward trend to a downward trend. Parts of a rounding top: Web identify the pattern. The rims of the inverted bowl bottom near the same price, but 58% of the time the end is slightly higher than the start. • a rounding top is a chart pattern that graphically forms the shape of an inverted u. The pattern is characterized by a gradual upward slope. Web the rounding top, also known as a saucer top, is a bearish reversal pattern that typically emerges at the end of an uptrend. The rims of the inverted bowl bottom near the same. Prices form a gentle curve, a half moon shape. Web a rounded top chart pattern, also known as a rounding top or an inverted rounding bottom pattern , is a technical analysis pattern that appears on price charts. The rounding top can take weeks or even months to form, and traders interpret the pattern as a sign of a shift. Look for a series of higher highs and higher lows on the price chart, indicating a bullish trend. A chart pattern used in technical analysis, which is identified by a series of price movements that, when graphed, form the shape of a u. The rims of the inverted bowl bottom near the same price, but 58% of the time the. Web a round top chart pattern, often referred to as a “rounding top,” is a reversal pattern seen in stock charts. To come to this conclusion, i used a series of backtesting data and. Teams are all over the board on george, but his shooting, playmaking and feel at his size make him a. A rounding top chart can be. The rounded top pattern appears as an inverted 'u' shape and is often referred to as an ‘inverse saucer’ in some technical analysis books. Web rounded top and bottom. It typically occurs after a prolonged uptrend and you can spot it on various chart timeframes, making it a versatile tool. The rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart. Rounding tops are large enough to appear on the weekly or daily chart. The formation of a rounding top indicates that buying pressure is gradually being replaced by selling pressure, ultimately leading to a reversal in the trend. The neckline of the pattern is constructed by the lowest point before the formation. Web the rounding top, also known as a saucer top, is a bearish reversal pattern that typically emerges at the end of an uptrend. 24 pick, they selected miami's kyshawn george in espn's latest mock draft. • rounding tops are found at the end of an uptrend trend and signify a reversal • it is also referred to as an inverted saucer. Web the rounding top pattern is characterized by a gradual curve in the price action that looks like a rounded top, hence the name. It then stabilizes for an elongated duration, creating a rounded top.![Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda](https://tradeveda.com/wp-content/uploads/2020/09/rounding-bottom-rounding-top-pattern-examples-1024x683.png)

Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda

Rounding top chart pattern Best guide with 2 examples!

The Rounding Top Chart Pattern (Explained With Examples)

The 28 Forex Patterns Complete Guide • Asia Forex Mentor

Rounding Top Pattern How To Trade it in a Few Simple Steps [Forex

The Rounding Top Chart Pattern (Explained With Examples)

The Rounding Top Chart Pattern (Explained With Examples)

The Rounding Top Chart Pattern (Explained With Examples)

Rounding Top Pattern (Updated 2023)

How To Trade The Rounding Top Chart Pattern (in 3 Steps)

Web Here’s How To Correctly Identify The Rounded Top Pattern On The Price Chart:

One Of The Key Features Of The Rounding Top.

The Pattern Is Characterized By A Gradual Upward Slope.

Pick Player Team Rookie Contract;

Related Post: