Reverse Hammer Pattern

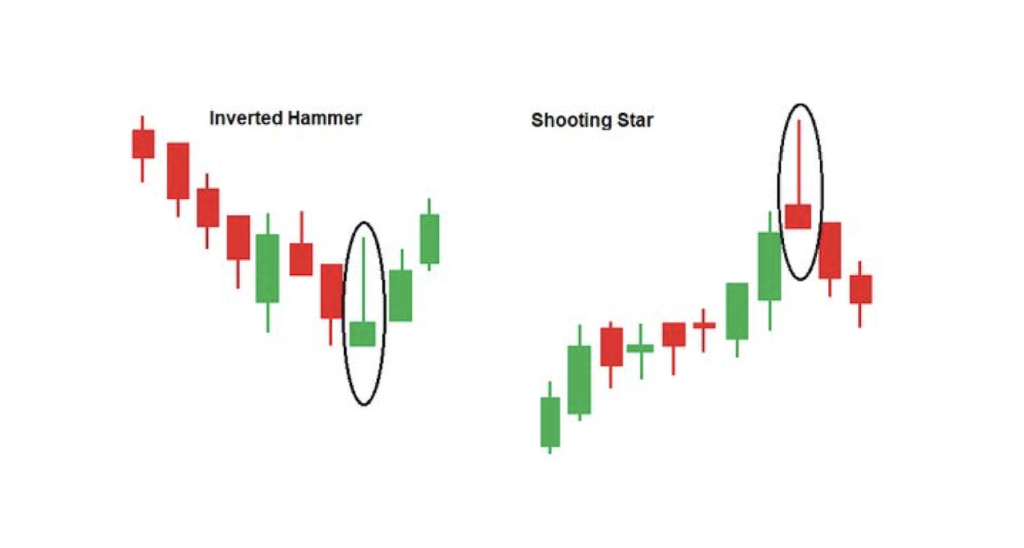

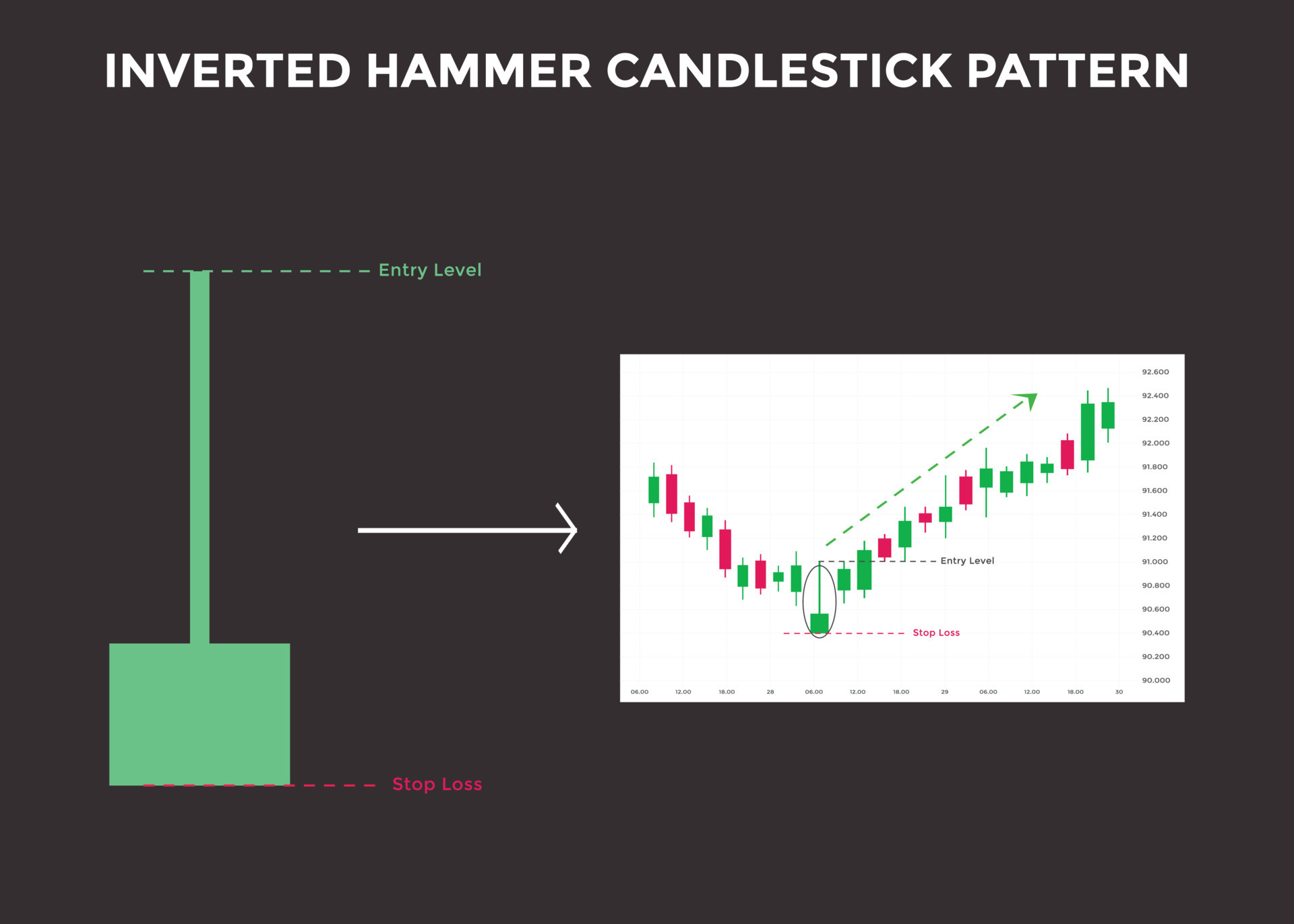

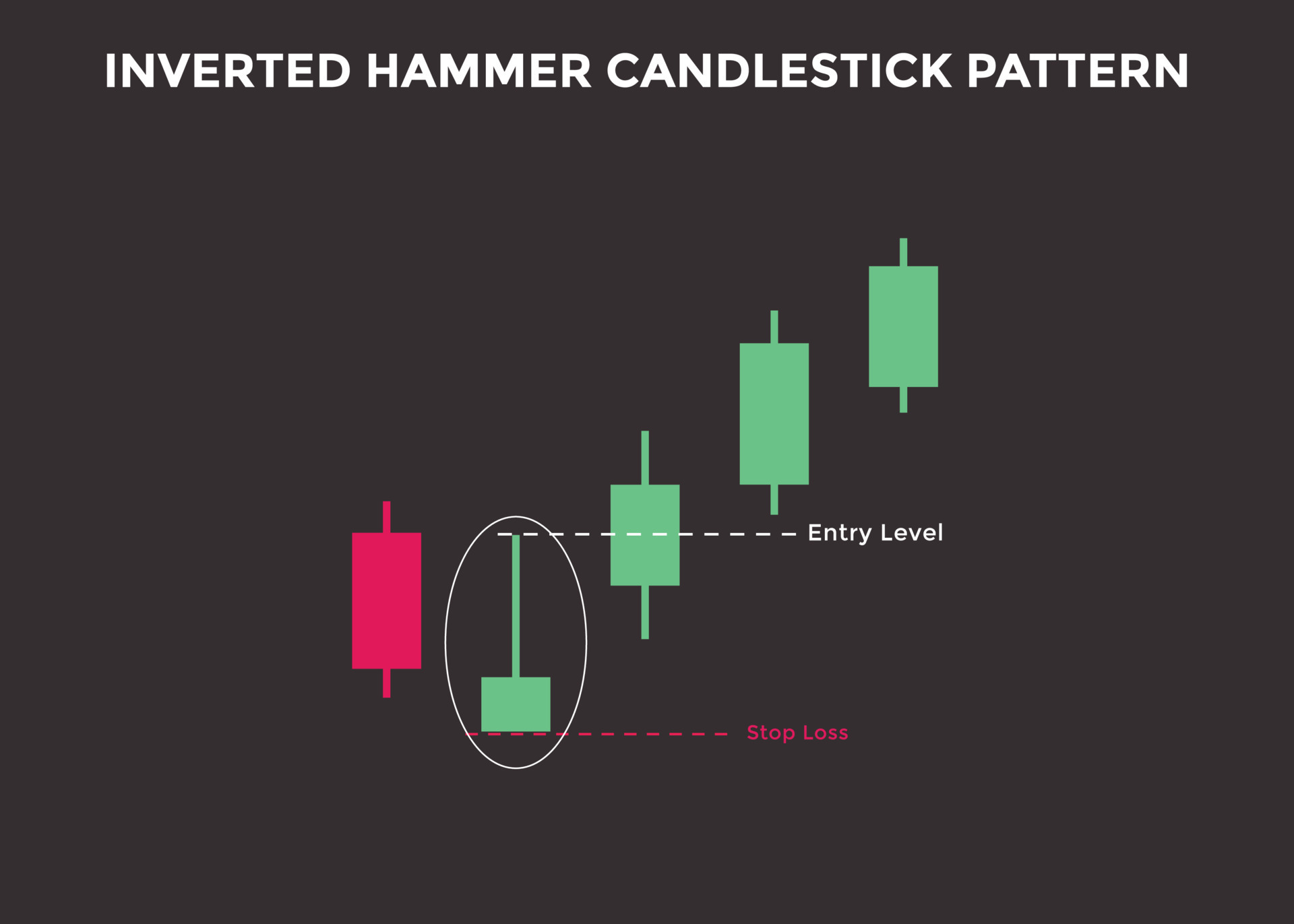

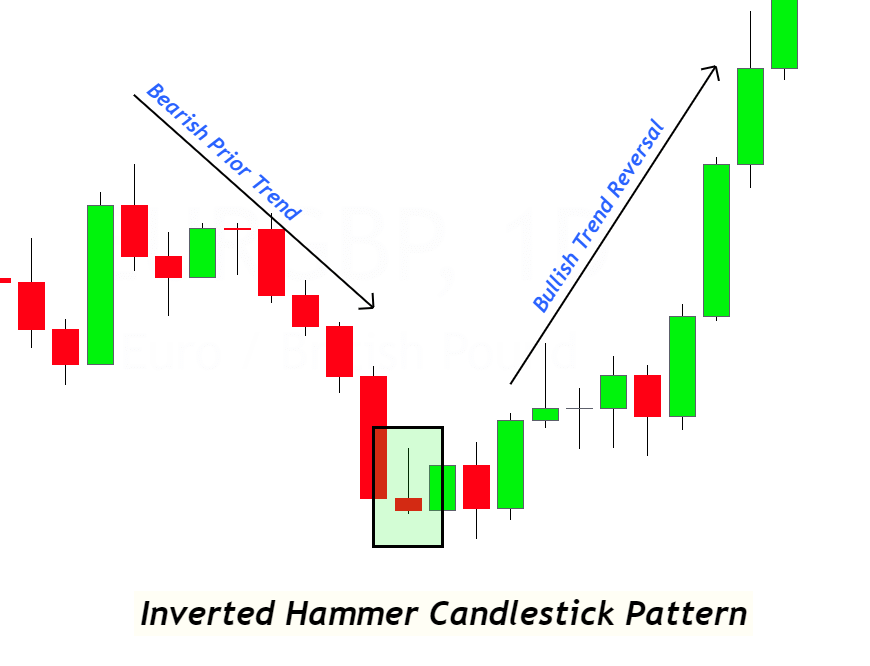

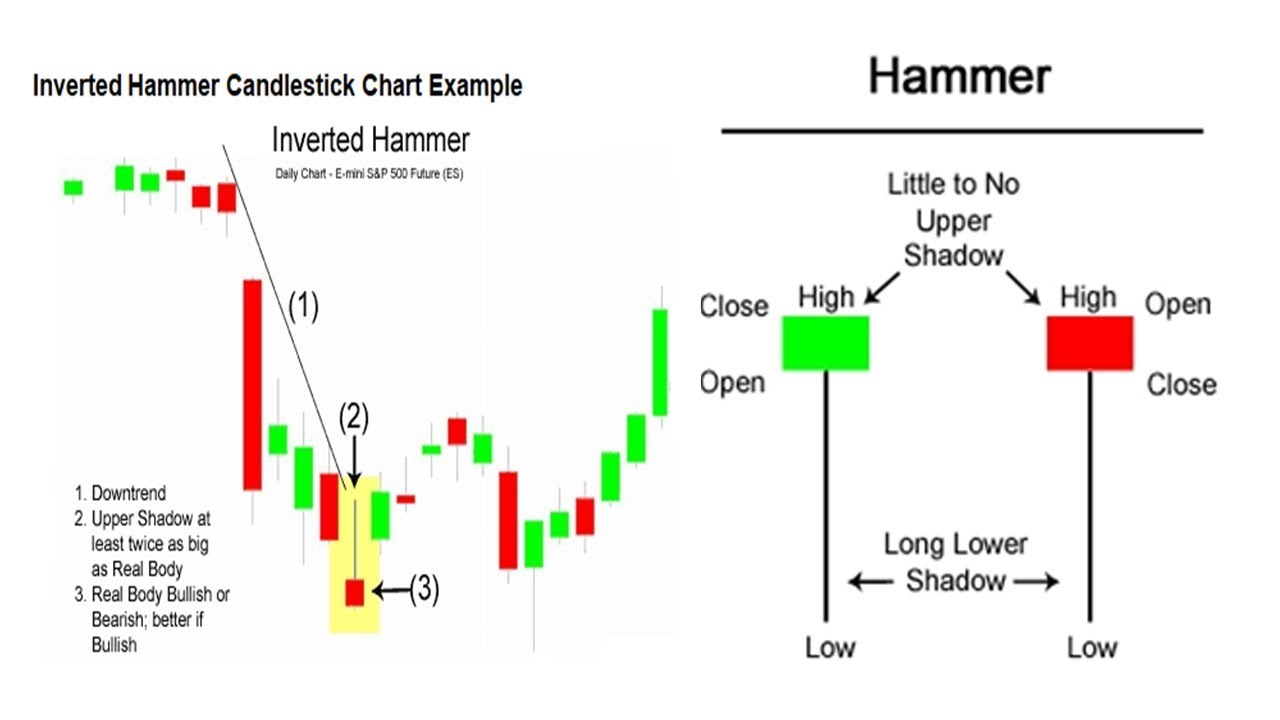

Reverse Hammer Pattern - Both are reversal patterns, and they occur at the bottom of a downtrend. It shows that the buyers are gaining momentum. Web some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. Web the polar vortex circling the arctic is swirling in the wrong direction after surprise warming in the upper atmosphere triggered a major reversal event earlier this month. Web the inverted hammer is a reversal pattern at the end of a downtrend. The opening price, close, and top are. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. Web tyrese haliburton did a little bit of everything with 20 points, six rebounds and five assists as one of six pacers to score in double figures. Web with the broader trend still weak, traders can keep an eye on the high of the bullish reversal hammer. Web considered a bullish pattern during a downtrend. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Both are reversal patterns, and they occur at the bottom of a downtrend. It is one of the most. Web the polar vortex circling the arctic is swirling in the wrong direction after surprise warming in the upper atmosphere triggered a major reversal. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. The pattern shows the return of a positive trend as it is formed at the end of a downtrend. This candlestick pattern gets its name from an. Web the inverted hammer candlestick pattern is a unique stock chart pattern that showcases a trend reversal. Island reversal in both stock trading and financial technical analysis, an island reversal is a candlestick pattern with compact trading activity within a. Web a downtrend has been apparent in definitive healthcare corp. Web inverted hammer is a single candle which appears when. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. As such, the market is considered to initiate a bullish trend after forming the pattern. Island reversal in both stock trading and financial technical analysis, an island reversal is a candlestick pattern with compact trading activity within a.. Both are reversal patterns, and they occur at the bottom of a downtrend. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. This is a reversal candlestick pattern that appears at the bottom of a downtrend and signals a potential bullish reversal.. It is often referred to as a bullish pin bar, or bullish rejection candle.at its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. The opening price, close, and top are. The hammer helps traders visualize where support and demand are located. Web tyrese haliburton did a. It signifies a shift in market sentiment from bearish to bullish and potential. The opening price, close, and top are. The inverted hammer pattern indicates that the bears initially pushed the price lower, but the bulls managed to regain control and push the price higher. Web considered a bullish pattern during a downtrend. The inverted hammer candle is green in. The pattern shows the return of a positive trend as it is formed at the end of a downtrend. Web the inverted hammer candlestick pattern appears on a chart when buyers exert pressure to drive up an asset's price, typically at the bottom of a downtrend, indicating a potential bullish reversal. The inverted hammer candle is green in colour, and. The selling pressure was strong enough to reverse the uptrend. As to its appearance, the inverted hammer has a small body that’s found in the lower half of the range, with a long wick to the upside. This candlestick pattern gets its name from an inverted hammer in real. It often appears at the bottom of a downtrend, signalling potential. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. The bullish hammer pattern hints at a potential reversal of a downtrend. Web bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. It shows that the buyers are gaining momentum. Web identifying the hammer candlestick. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. Boost your trading knowledge by learning the top 10 candlestick patterns. The hammer helps traders visualize where support and demand are located. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. As such, the market is considered to initiate a bullish trend after forming the pattern. It is one of the most. A close above it will confirm the reversal pattern and a close below it will negate the pattern. To identify the hammer candlestick pattern, consider the following points: It often appears at the bottom of a downtrend, signalling potential bullish reversal. Web the inverted hammer candlestick pattern is a unique stock chart pattern that showcases a trend reversal. This is a reversal candlestick pattern that appears at the bottom of a downtrend and signals a potential bullish reversal. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Wait until the price reverse and combine other technical. It shows that the buyers are gaining momentum. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks.

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

Inverted Hammer Candlestick Pattern (Bullish Reversal)

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Bullish Inverted Hammer Candlestick Pattern ForexBee

Inverted Hammer Candlestick Pattern Quick Trading Guide

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

Inverted Hammer Candlestick How to Trade it ForexBoat Trading

The Inverted Hammer Pattern Gets Its.

The Inverted Hammer Candlestick Pattern—Or Inverse Hammer—Forms When There Is Pressure From Buyers To Push An Asset’s Price Up.

The Inverted Hammer Candlestick Pattern (Or Inverse Hammer) Is A Candlestick That Appears On A Chart When There Is Pressure From Buyers To Push An Asset’s Price Up.

Web The Bearish Hammer Sometimes Hints That Buying Pressure Is Waning And The Uptrend Could Be Ending.

Related Post: