Reverse Flag Pattern

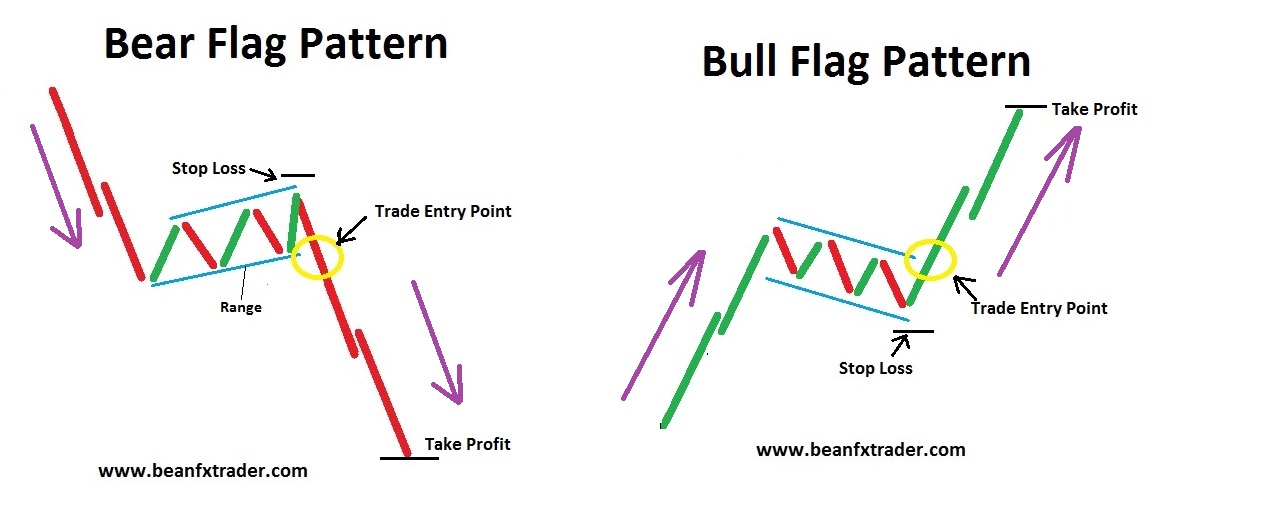

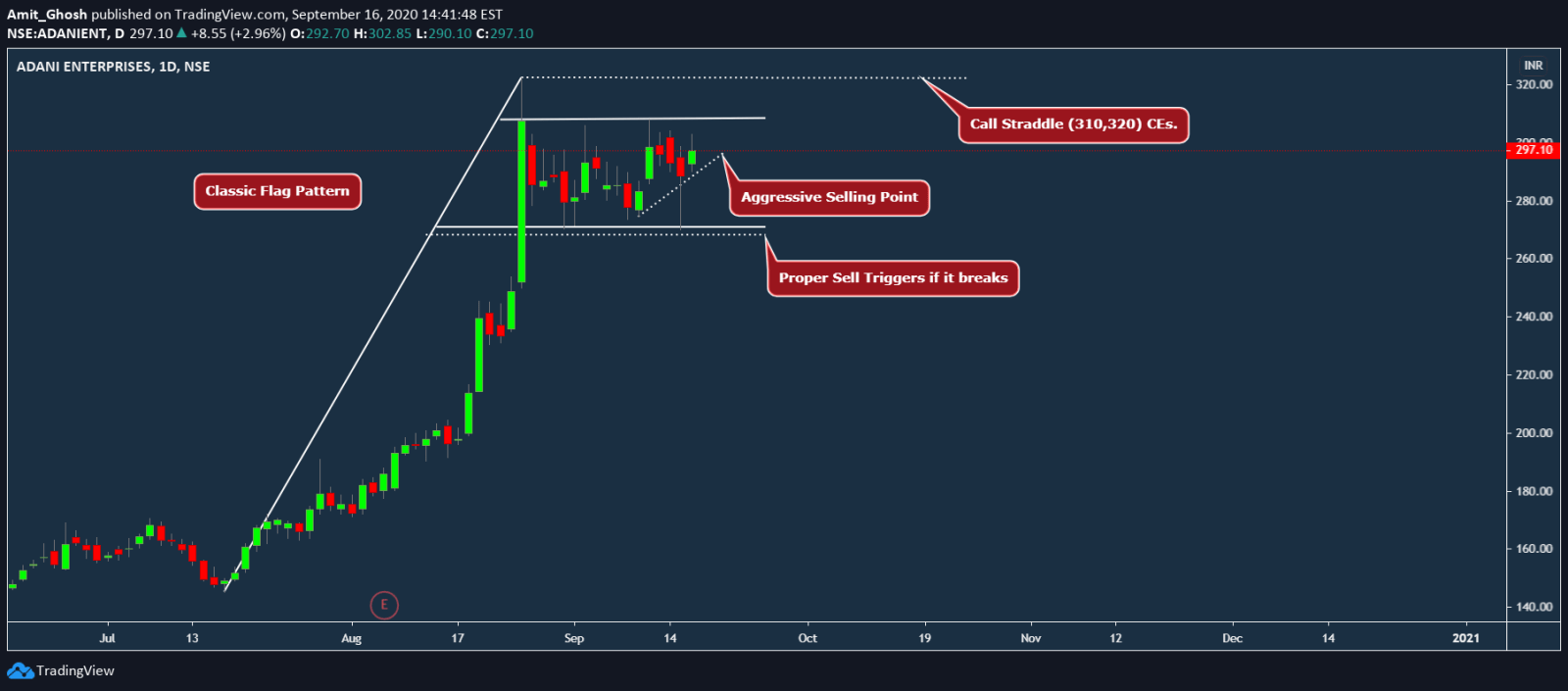

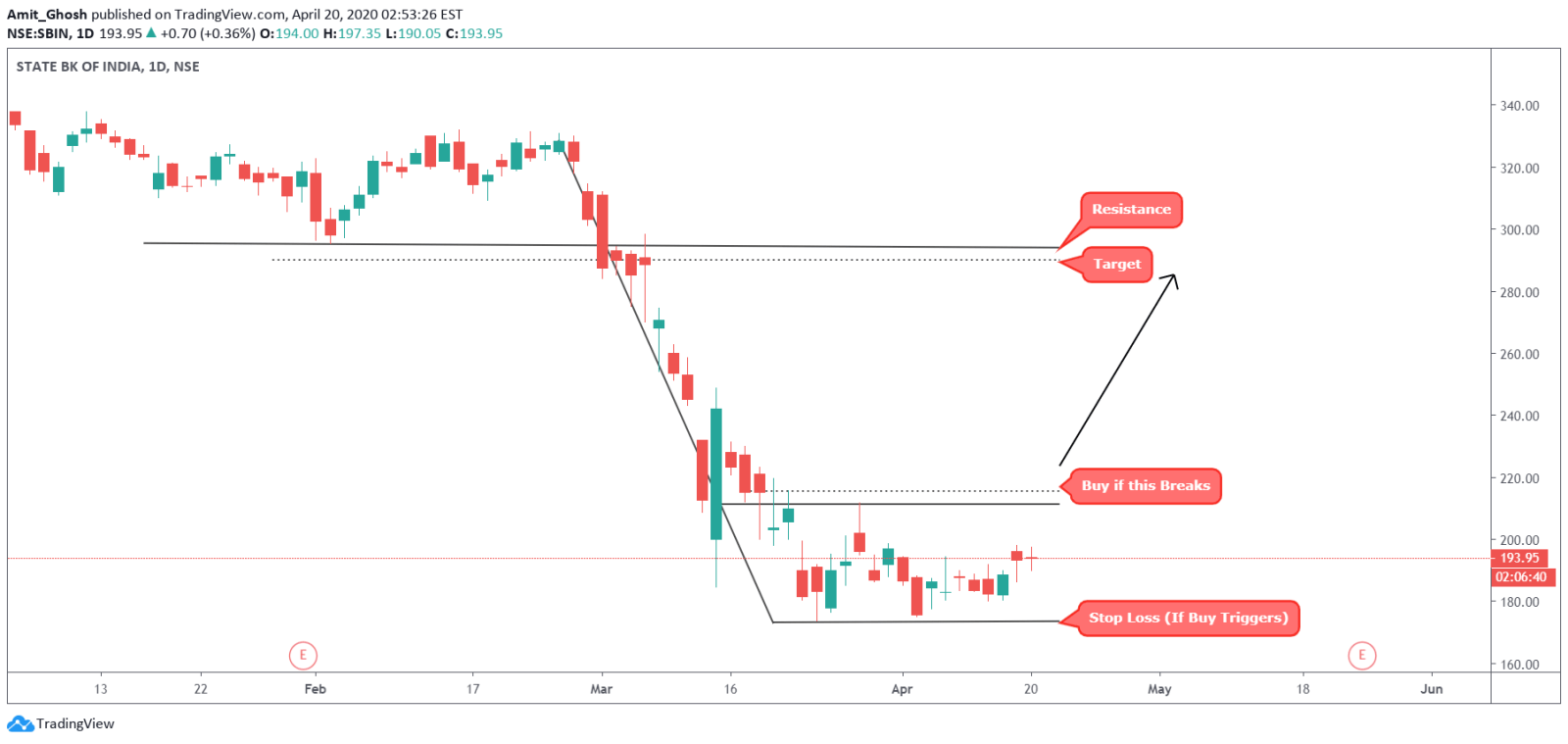

Reverse Flag Pattern - Calculate the number of bars in the trend versus the trend reversal pattern. The trend reversal pattern is 3:1 so…. And as you can see: This kobe 6 protro takes a coveted colorway from 2010 and reverses it. The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. Web the flag pole is the first component of the flag chart pattern. Web the flag pattern is a powerful pattern used in technical analysis. Web the flag and pennant patterns are commonly found patterns in the price charts of financially traded assets ( stocks, bonds, futures, etc.). Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. Web a bullish flag appears like an upright flag on a price chart, with a rectangular price pattern marking the flag itself. These patterns are also referred to as reverse flag patterns. And as you can see: T he bearish activity prevails after the buying is complete. The bear flag pattern, which emphasizes downtrends, is the reverse of this pattern. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web bear flag patterns work in the same way as bull flag patterns, just in reverse. In the various forms of the pattern, the appearance is that of a flag post held upside down. This kobe 6 protro takes a coveted colorway from 2010 and reverses it. Web a flag pattern is a trend continuation pattern, appropriately named after it’s. This kobe 6 protro takes a coveted colorway from 2010 and reverses it. It's fitted with a flexible zoom air unit and. They use trading patterns to streamline the market and break down information into repeatable, visual patterns. Calculate the number of bars in the trend versus the trend reversal pattern. Web the flag pattern is a continuation formation that. Web the flag pole is the first component of the flag chart pattern. Web the flag pattern is a type of price pattern in bullish trends. Any trending move can transition into a flag, meaning that every trend impulse can appear to be a flag pole. Web the flag pattern is a continuation formation that can appear during a brief. The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. Sleek and scaly, the bright crimson upper goes bold with electric green highlights and a snake pattern inspired by kobe's black mamba nickname. And as you can see: Sleek and scaly, the bright crimson upper goes bold with electric green highlights and a snake. Web a flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. Web bullish reversal chart patterns: The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. A flag pattern is a technical analysis chart pattern that can be observed in the price charts of. Its visual resemblance to a flag and a pole led to its naming. A technical charting pattern that looks like a flag with a mast on either side. The characteristic of this pattern is a sharp reverse trend that is opposite to the previously analyzed price trend within a specific timeframe. The origin of this term is due to price. The characteristic of this pattern is a sharp reverse trend that is opposite to the previously analyzed price trend within a specific timeframe. It is a continuation pattern and it also represents consolidation. Flag patterns can be bullish or bearish. The price bars preceding the flag appear similar to the flag post. The flagpole is the distance from the first. It is a continuation pattern and it also represents consolidation. The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. The upper trend line, known as the flag resistance, is typically drawn by connecting the high points, while the lower trend line, known as the flag support, is formed by joining the low points.. Web a flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. Web bear flag patterns work in the same way as bull flag patterns, just in reverse. The tighter. It shows a trend impulse on the chart. Flag patterns can be bullish or bearish. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers, then a bounce that has parallel upper and lower trendlines, which form the flag. Web a bear flag or reverse bull flag occurs in a downtrend and can be identified with two upward sloping trendlines, where the upper line connects higher highs while the lower goes through higher lows. The tighter the flag, the better the signal is said to be. Web these patterns are bearish flag patterns. In the various forms of the pattern, the appearance is that of a flag post held upside down. A line extending up from this break to the high of the flag/pennant forms the flagpole. Web bull flag patterns are one of many chart patterns that traders investigate in the markets. A flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web bullish reversal chart patterns: Sleek and scaly, the bright crimson upper goes bold with electric green highlights and a snake pattern inspired by kobe's black mamba nickname. These signal possible trend tops and reversals lower. Web a bear flag is a bearish chart pattern that’s formed by two declines separated by a brief consolidating retracement period. As the flag pattern emerges, you will see a large impulse move, commonly known as the flag pole. Web the flag pattern is a type of price pattern in bullish trends.

FLAG PATTERNS FX & VIX Traders Blog

Flag Patterns Part I The Basics of Flag Pattern Unofficed

INVERTED BEARISH FLAG PATTERN EQSIS PRO

EURGBP REVERSE FLAG PATTERN for FXEURGBP by MbaliAcademy — TradingView

How to use the flag chart pattern for successful trading

Trading Flags and Pennants Formations

Reverse flag pattern for now! for BITSTAMPBTCUSD by WoodLandSprite

Inverted Flag & Pole Pattern Explained stockmarkets YouTube

Flag Patterns Part I The Basics of Flag Pattern Unofficed

FLAG PATTERNS. Flag patterns are a popular technical… by Princeedesco

These Patterns Are Also Referred To As Reverse Flag Patterns.

The Price Bars Preceding The Flag Appear Similar To The Flag Post.

An Understanding Of Pattern Psychology May Help Traders Grasp The Concept In A Straightforward Way.

The Trend Reversal Pattern Is 3:1 So….

Related Post: