Reversal Trading Patterns

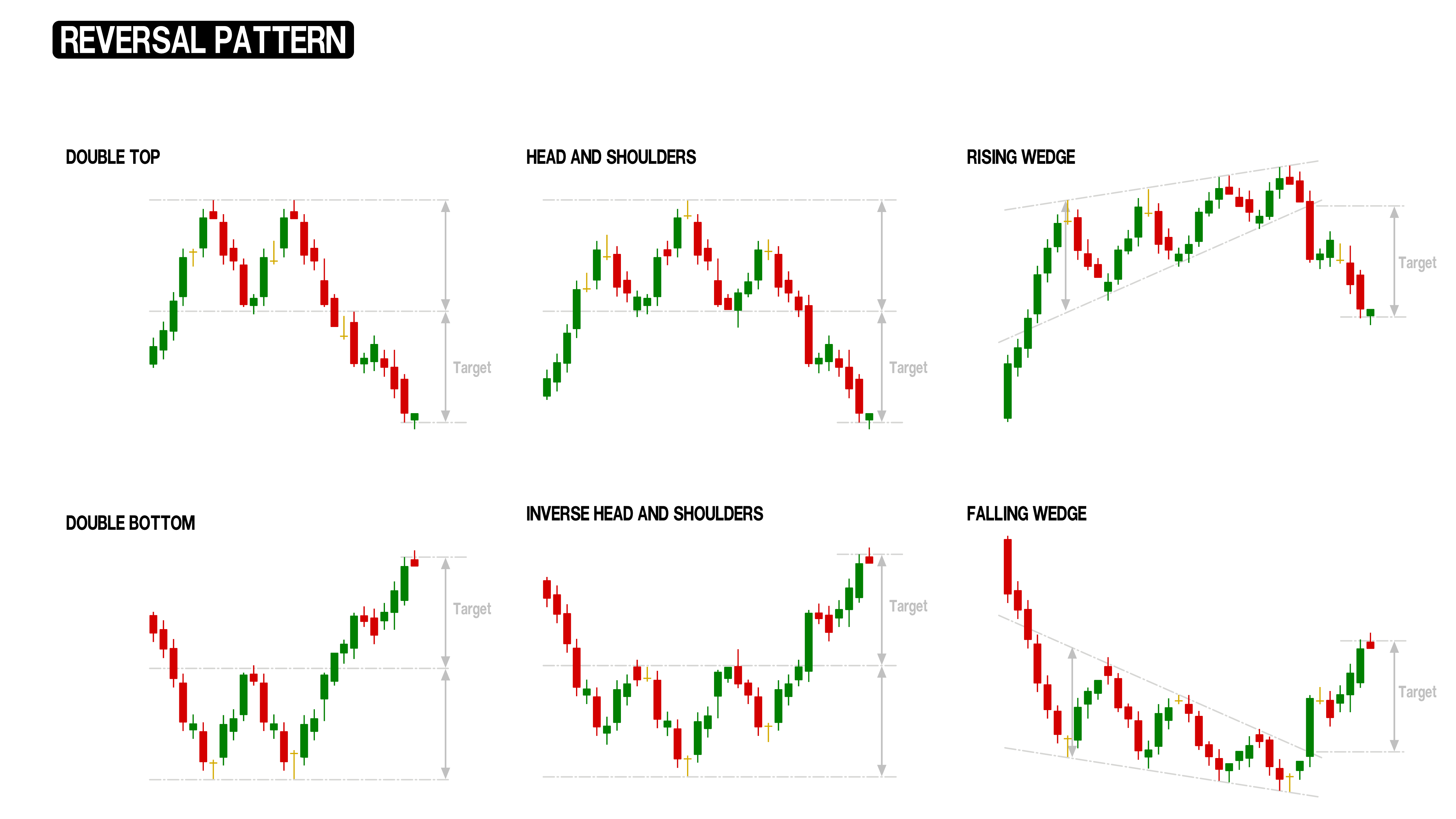

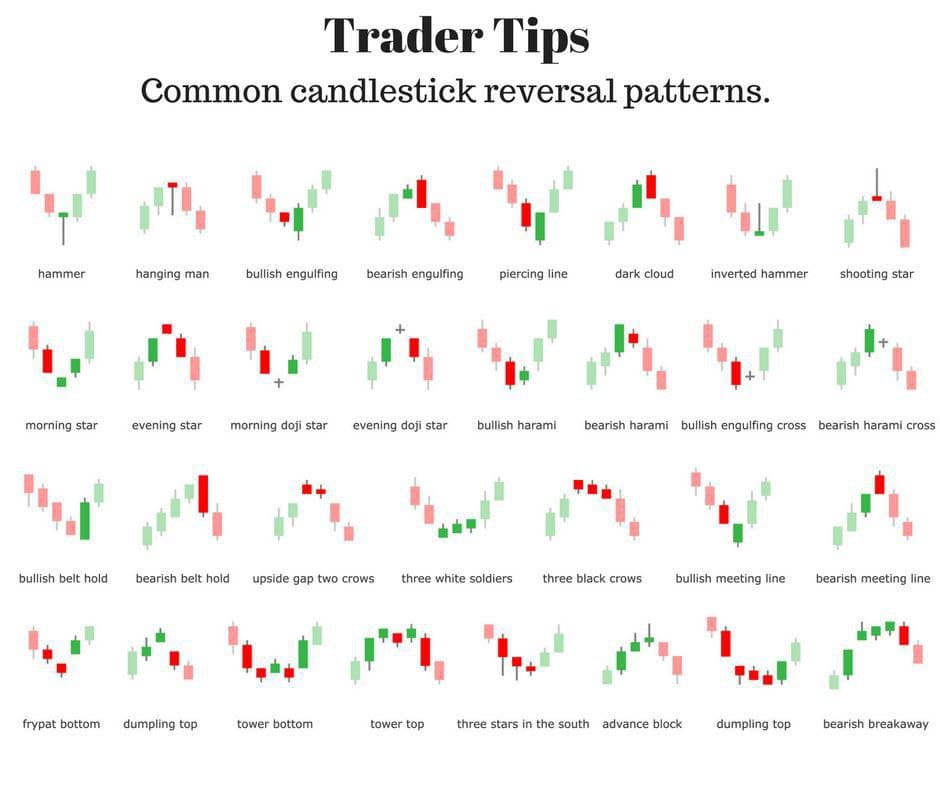

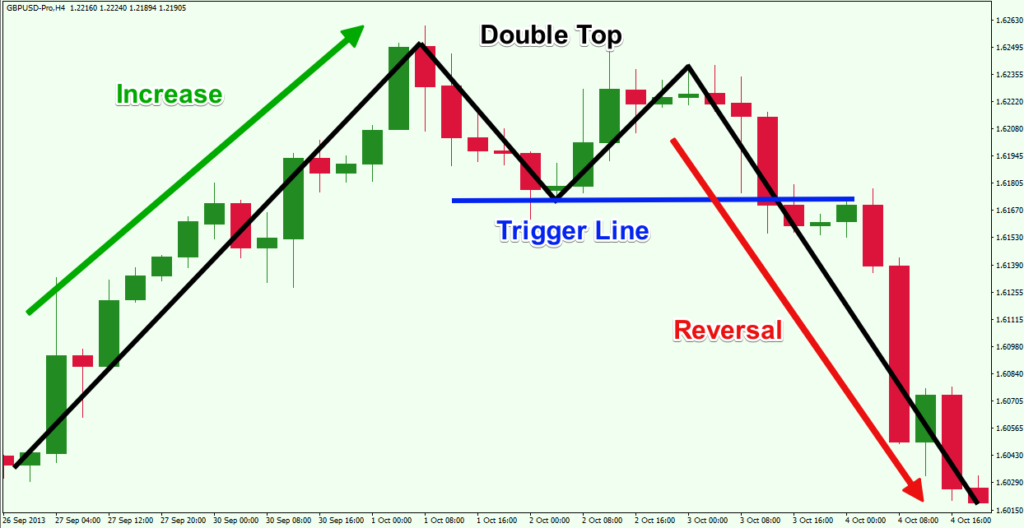

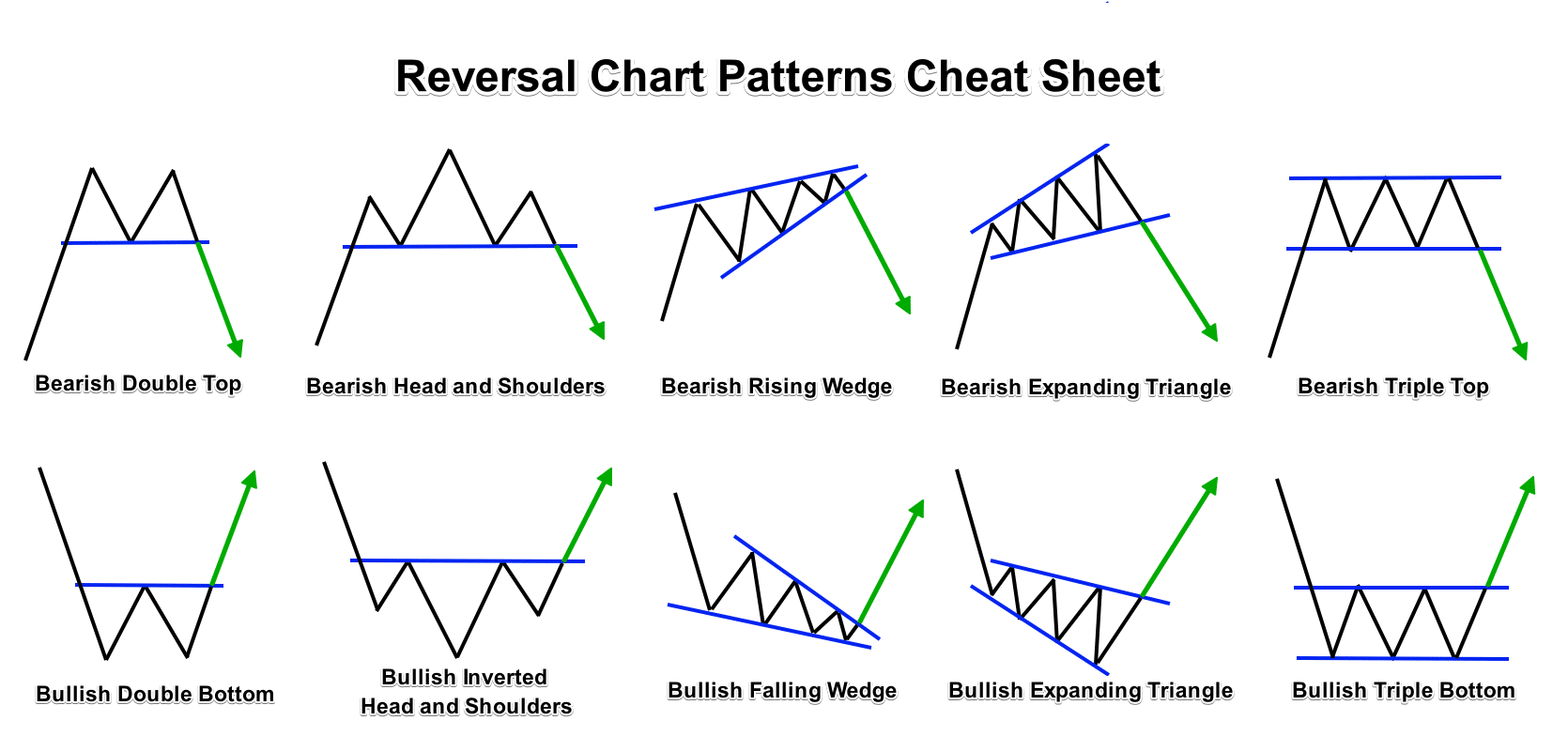

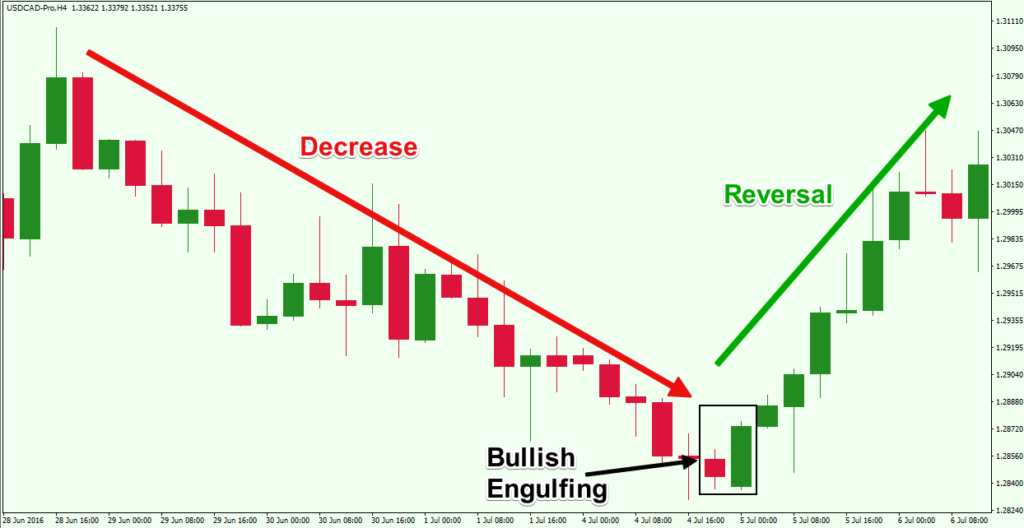

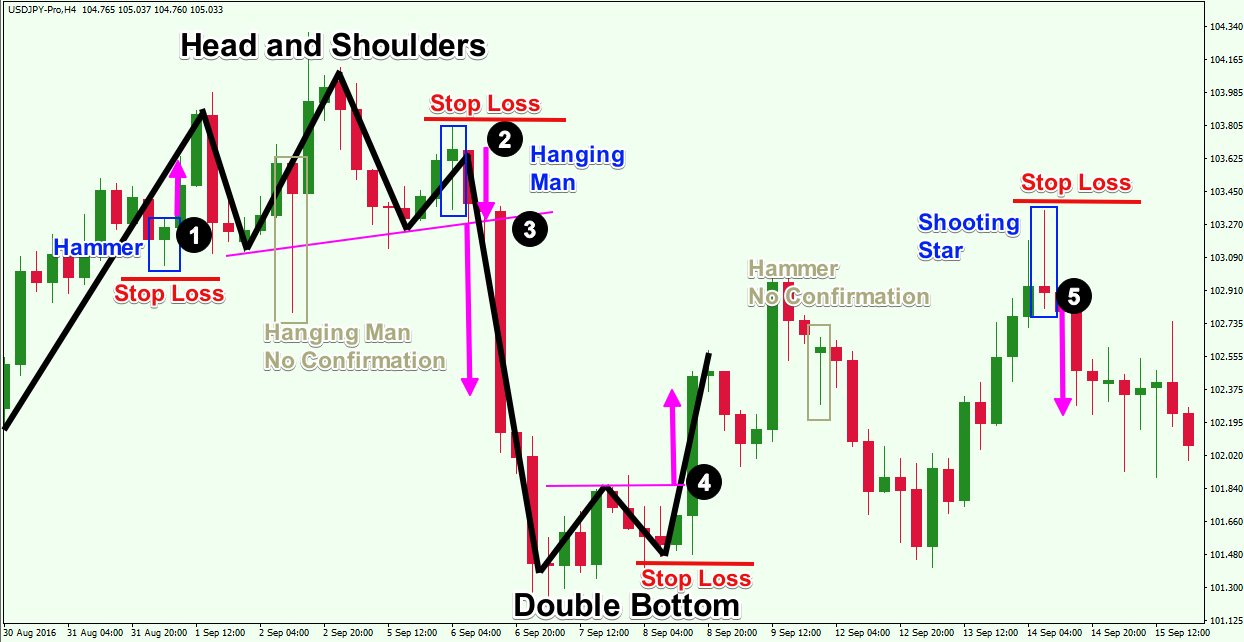

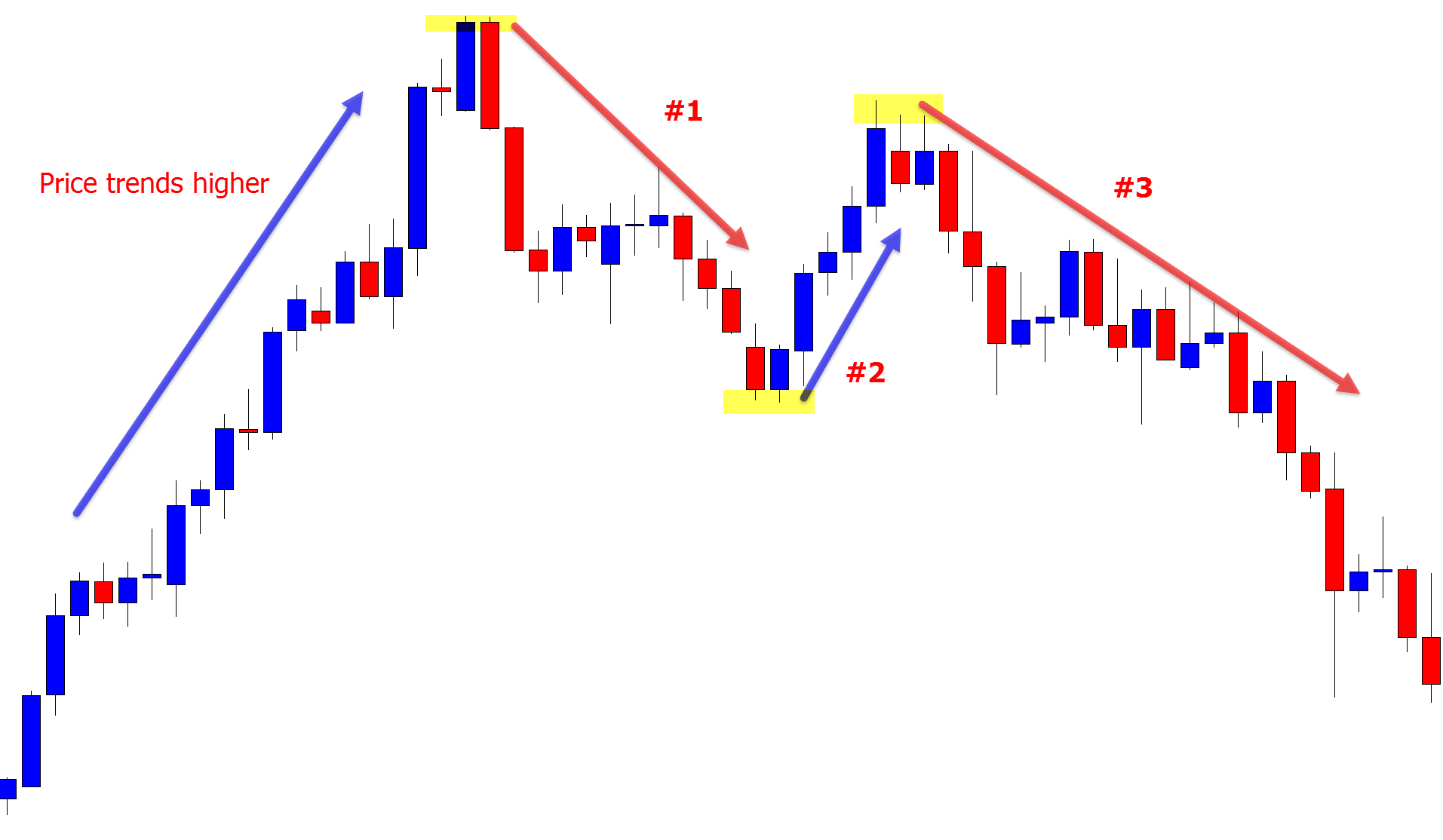

Reversal Trading Patterns - Never catch a falling knife or trade the first pullback of a downtrend. A trend reversal signals the end of one trend. While the latter signal that the prevailing trend is likely to continue after a temporary pause is finished. Web rounding bottom is one of the conventional trading patterns that investors use in anticipating bullish market movements. Web reversal patterns refer to chart arrangements that happen before a chart starts a new trend. Understand the 4 stages of the. Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. It is formed by three price swings or waves with three swing. Fisher defines the sushi roll reversal pattern as a period of 10 bars in which the first five (inside bars) are confined within a narrow range of highs and lows and the second five (outside bars) engulf the first five with both a higher high and lower low.the pattern is similar to a bearish or bullish engulfing pattern,. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a potential change in the direction of a trend. Web rounding bottom is one of the conventional trading patterns that investors use in anticipating bullish market movements. A trend reversal signals the end of one trend. Web reversal patterns refer to chart arrangements that happen before a chart starts a new trend. The reversal pattern in trading penny stocks is a crucial signal that denotes a potential change in. Web a reversal candlestick pattern is a bullish or bearish reversal pattern formed by one or more candles. Web in this trend reversal trading strategy guide, you’ve learned: Look no further than the hanging man candlestick pattern! While the latter signal that the prevailing trend is likely to continue after a temporary pause is finished. 14, 2021 15 min read. Web rounding bottom is one of the conventional trading patterns that investors use in anticipating bullish market movements. Web what are candlestick reversal patterns? Though, there is a wide variety of reversal price action patterns. Understand the 4 stages of the. If a reversal chart pattern forms during an. Web natural gas futures are trading slightly lower on monday after confirming friday’s potentially bearish closing price reversal top. Web common trading reversal patterns include one or multiple candlestick pattern forms like hammers, engulfing bars, morning and evening star candlestick. This pattern helps in understanding that a. Web want to identify potential trend reversals with ease? Web a reversal candlestick. Web the break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market. Web double top and bottom. Web want to identify potential trend reversals with ease? By using this technical tool in. Web natural gas futures are trading slightly lower on monday after confirming friday’s potentially bearish closing price reversal top. Though, there is a wide variety of reversal price action patterns. It is formed by three price swings or waves with three swing. Three factors to consider before trading reversal patterns:. Web the break of structure (breakout of the trend line. Web the abcd pattern is a prominent technical analysis tool utilized by traders to identify potential price movements in financial markets. Web what are candlestick reversal patterns? Web common trading reversal patterns include one or multiple candlestick pattern forms like hammers, engulfing bars, morning and evening star candlestick. It consists of four distinct. It is formed by three price swings. Web a reversal candlestick pattern is a bullish or bearish reversal pattern formed by one or more candles. Three factors to consider before trading reversal patterns:. These patterns not only provide insights into potential market. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market. When a major trend line is broken, a. By using this technical tool in conjunction with. The chart pattern does not mean. Usd/cad reversal off technical resistance now testing 2024 uptrend; The last method is to use trend lines. Web a trend reversal is when the price direction of an asset has changed, and the change can be to the upside or downside. In this post, we will. Web rounding bottom is one of the conventional trading patterns that investors use in anticipating bullish market movements. Understand the 4 stages of the. This pattern helps in understanding that a. The analyst explains that btc is in a “wait and see” phase, where a. Web common trading reversal patterns include one or multiple candlestick pattern forms like hammers, engulfing bars, morning and evening star candlestick. Web in this trend reversal trading strategy guide, you’ve learned: Web understanding and identifying reversal trading patterns is crucial for anyone looking to excel in the forex market. Web rounding bottom is one of the conventional trading patterns that investors use in anticipating bullish market movements. Three factors to consider before trading reversal patterns:. Web what are candlestick reversal patterns? Web reversal patterns are the opposite of continuation candlestick patterns. Though, there is a wide variety of reversal price action patterns. Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. Web the coinbase premium is currently riding a downtrend, but it’s yet to dip into negative territory. The last method is to use trend lines. If a reversal chart pattern forms during an. By using this technical tool in conjunction with. For example, a bullish reversal pattern will typically happen during a. Web want to identify potential trend reversals with ease? 14, 2021 15 min read.

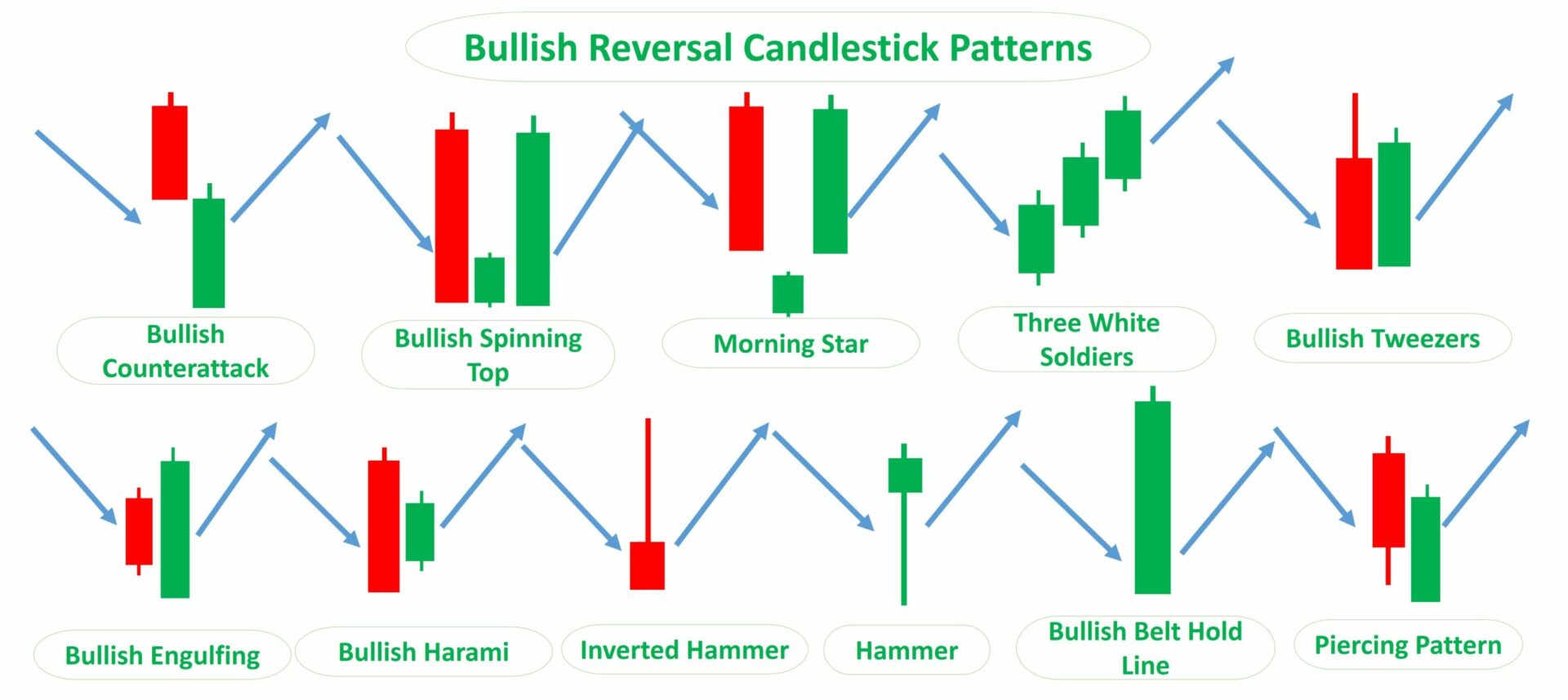

Top Reversal Candlestick Patterns

📚Reversal Patterns How To Identify & Trade Them 📚 for FXEURUSD by

Building Blocks of Technical Analysis Price Formations and Patterns

Trader Tips Common candlestick reversal patterns Profit Myntra

Top Forex Reversal Patterns that Every Trader Should Know Forex

Trading Forex With Reversal Candlestick Patterns » Best Forex Brokers

How Important are Chart Patterns in Forex? Forex Academy

Top Forex Reversal Patterns that Every Trader Should Know Forex

Top Forex Reversal Patterns that Every Trader Should Know Forex

How to Find and Trade the 123 Trend Reversal Pattern

When A Major Trend Line Is Broken, A Reversal May Be In Effect.

How To Trade Reversal Patterns?

These Patterns Not Only Provide Insights Into Potential Market.

Never Catch A Falling Knife Or Trade The First Pullback Of A Downtrend.

Related Post: