Reversal Flag Pattern

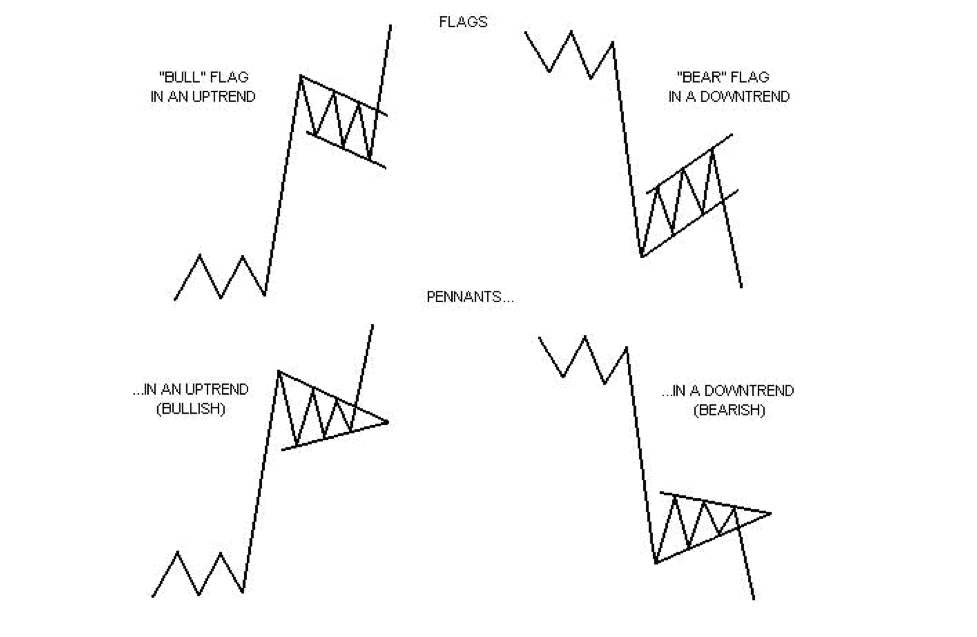

Reversal Flag Pattern - Web all reversal chart patterns like the hammer, hanging man, and morning/evening star formations. Web trend reversal patterns (inverse head and shoulders, cup and handle, double bottom) offer insights into potential trend changes. Web a bear flag pattern consists of a larger bearish candlestick (going down in price), which forms the flag pole. Share the reversal chart patterns cheat sheet pdf for easy reference. A reversal pattern occurs when price ‘reverses’ its current direction. For a complete list of bearish and bullish reversal patterns, see greg. Today we will discuss one high probability continuation chart formation known as the flag pattern. Web in trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend. The break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. The us dollar is virtually unchanged into the start of the week with dxy. Web when a price pattern signals a change in trend direction, it is known as a reversal pattern; Web reversal patterns are often seen at the end of a trend when the market is about to change direction. Web there are 3 main types of forex chart patterns: Web below are some of the key bullish reversal patterns with the. Web the total crypto market cap (total) is noting a slowdown from the breakout from the descending triangle reversal pattern. Components of the flag pattern. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations. How to trade reversal patterns? Web reversal patterns are often seen at the end of a. It is formed when the price of an asset experiences a sharp decline, called the pole, followed by a period of consolidation, which is commonly referred to as the flag. Web continuation patterns, which include triangles, flags, pennants and rectangles, provide some logic on what the market may potentially do. A reversal pattern occurs when price ‘reverses’ its current direction.. Wedge chart patterns can be both continuation and reversal patterns, depending on whether there is a bullish or bearish trend. Web below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. Web all reversal chart patterns like the hammer, hanging man, and morning/evening star formations. Web 20 min read. Web final flag reversals. Bitcoin’s (btc) price is testing resistance, continuing its run within the flag pattern and aiming at a breakout above $63,000. The following material will teach you how to recognize and trade the bearish and the bullish flag pattern like a pro. It is formed when the price of an asset experiences a sharp decline, called the pole, followed by a. Dogwifhat (wif) price took the biggest hit of. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” The break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. Followed by at least three or more smaller consolidation candles,. A significant change in the trend chart compared to period 2. Today we will discuss one high probability continuation chart formation known as the flag pattern. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations. Components of the flag pattern. Triple top and triple bottom pattern; One of the most popular reversal patterns in forex trading is the head and shoulders pattern. This pattern consists of three peaks, with the middle peak being the highest. Web sushi roll reversal pattern. Web continuation patterns, which include triangles, flags, pennants and rectangles, provide some logic on what the market may potentially do. With these candlestick patterns price will. Fisher defines the sushi roll reversal pattern as a period of 10 bars in which the first five (inside bars) are confined within a narrow range of highs and lows and. The break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. These patterns are characterized by a series. Web below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. It refers to patterns where the price direction reverses like the double top or bottom, the head and shoulders or triangles. Confirms the price movement in the same direction. Web there are dozens of bearish reversal patterns. Wedge chart patterns can be. During their early development phase, both these patterns look alike, but the insights that they provide on the potential future price movement is very different. For a complete list of bearish and bullish reversal patterns, see greg. I'll explain what each reversal pattern indicates, with visual chart examples. Web reversal patterns are often seen at the end of a trend when the market is about to change direction. One of the most popular reversal patterns in forex trading is the head and shoulders pattern. The us dollar is virtually unchanged into the start of the week with dxy. Confirms the price movement in the same direction. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. Web in trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend. Dogwifhat (wif) price took the biggest hit of. The following material will teach you how to recognize and trade the bearish and the bullish flag pattern like a pro. A reversal pattern occurs when price ‘reverses’ its current direction. An example of a reversal trade setup often used with candlesticks is the pin bar or engulfing bar. Bitcoin’s (btc) price is testing resistance, continuing its run within the flag pattern and aiming at a breakout above $63,000. Bullish engulfing (2) piercing pattern (2) bullish harami (2) hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Triple top and triple bottom pattern;

Flag Pattern Full Trading Guide with Examples

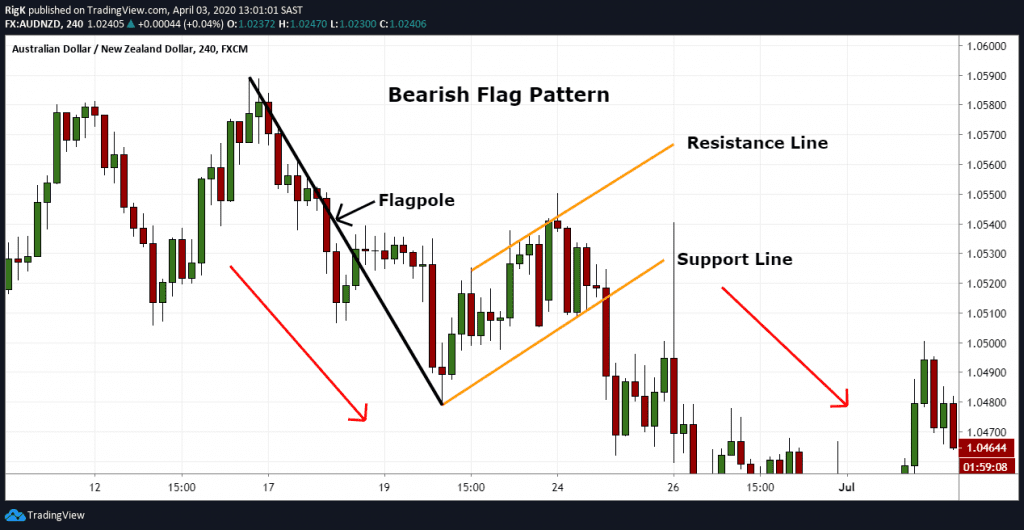

How to Trade Bear Flag Pattern Bearish Flag Chart Pattern

What Is Flag Pattern? How To Verify And Trade It Efficiently

What Is Flag Pattern? How To Verify And Trade It Efficiently

Stock Trading Training Flag Patterns

What Is Flag Pattern? How To Verify And Trade It Efficiently

How to use the flag chart pattern for successful trading

Introduction to Trading the Flag Pattern Action Forex

Flag Pattern Forex Trading

What Is Flag Pattern? How To Verify And Trade It Efficiently

Web When A Price Pattern Signals A Change In Trend Direction, It Is Known As A Reversal Pattern;

Web Robinhood Stock Is On Track To Have A Base With A 20.55 Buy Point, The Marketsmith Pattern Recognition Shows.

Traders Try To Get Out Of Positions That Are Aligned With The Trend Prior.

It Is Formed When The Price Of An Asset Experiences A Sharp Decline, Called The Pole, Followed By A Period Of Consolidation, Which Is Commonly Referred To As The Flag.

Related Post: