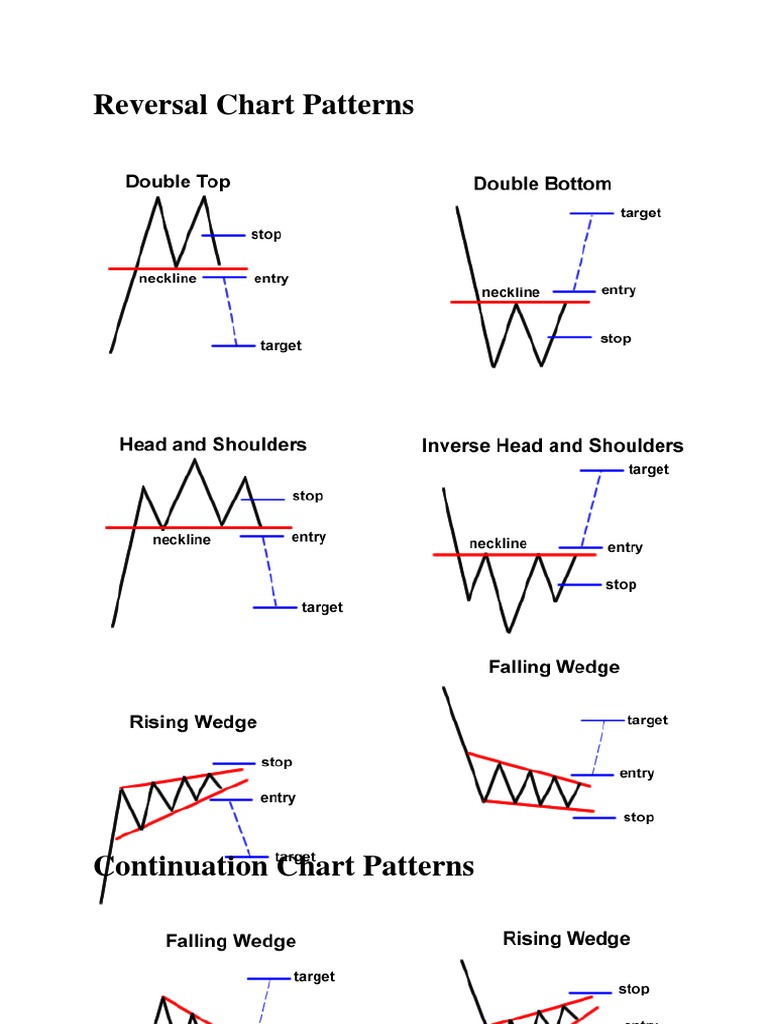

Reversal Chart Patterns

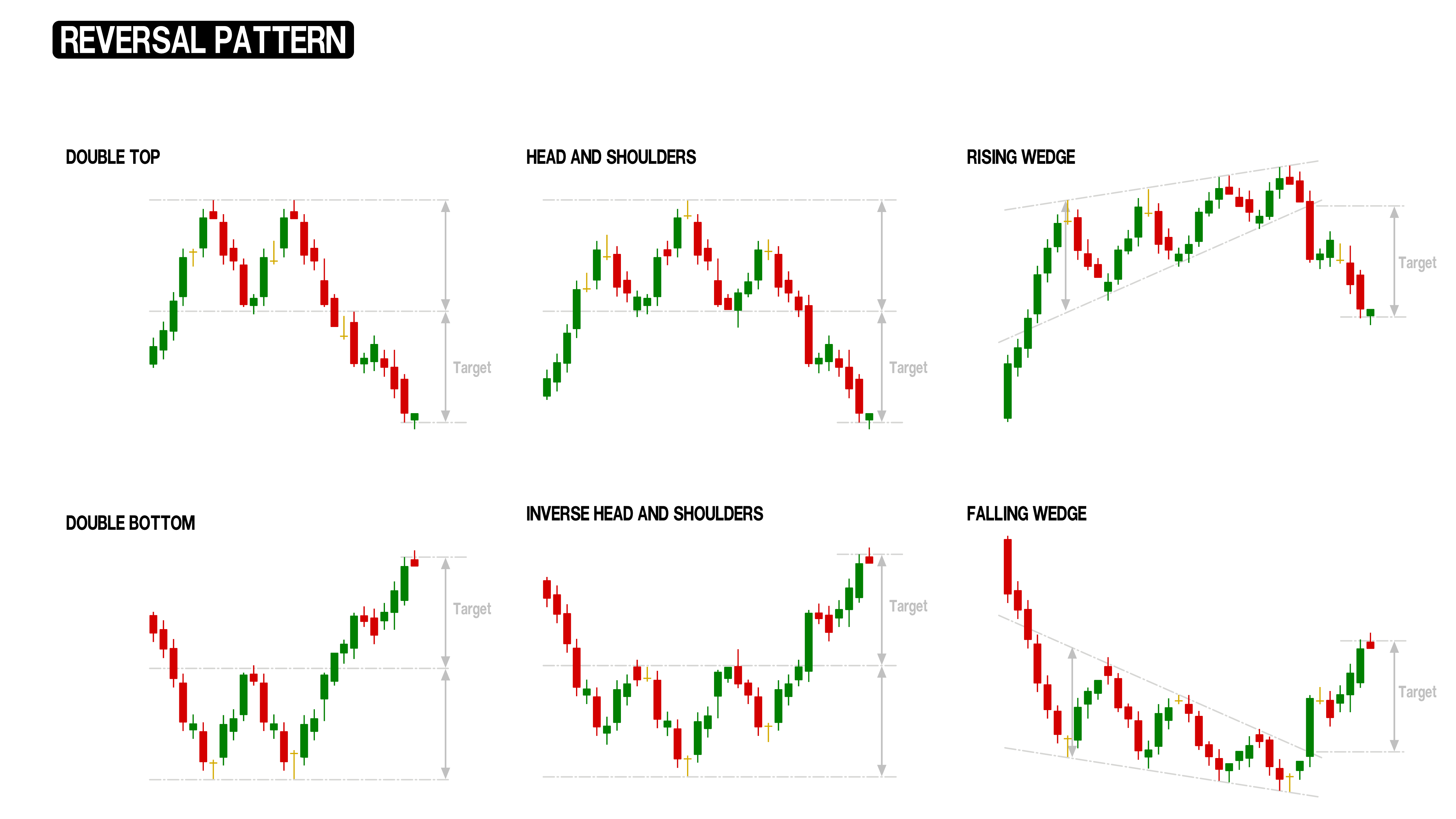

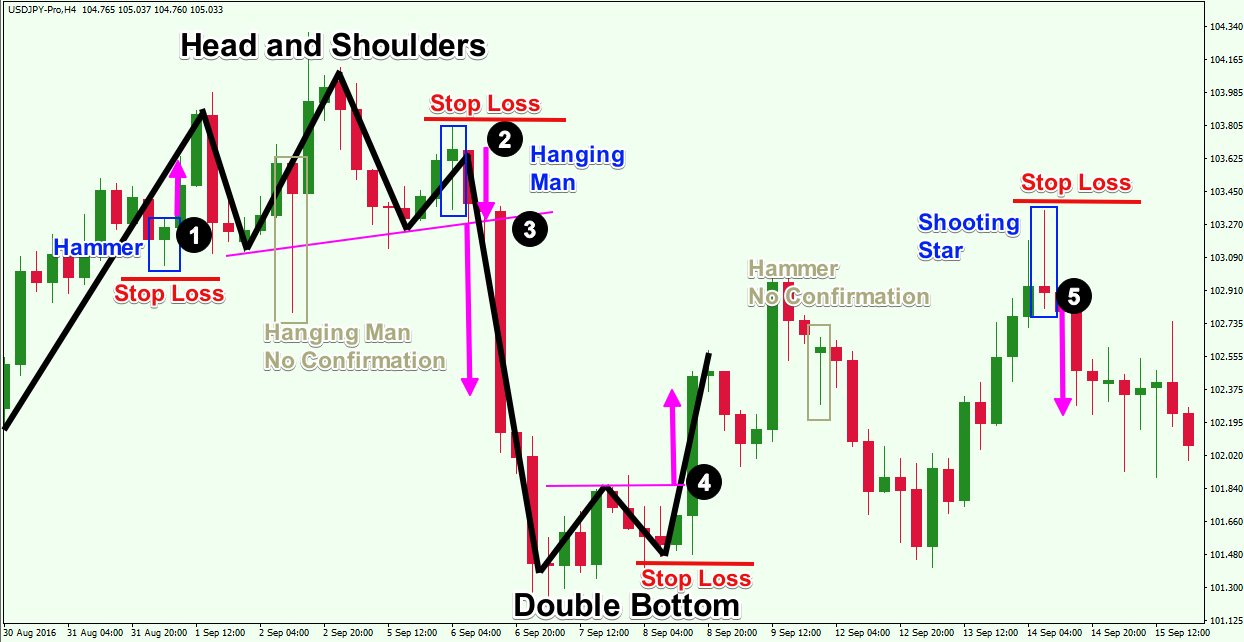

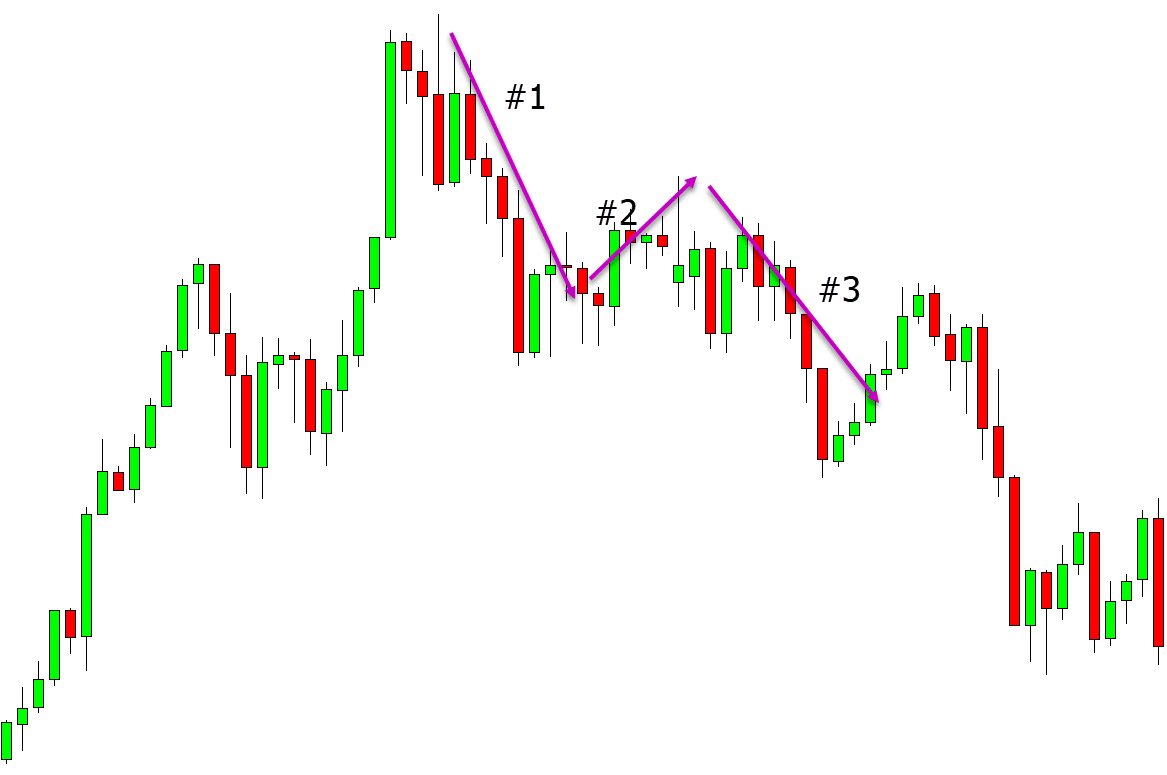

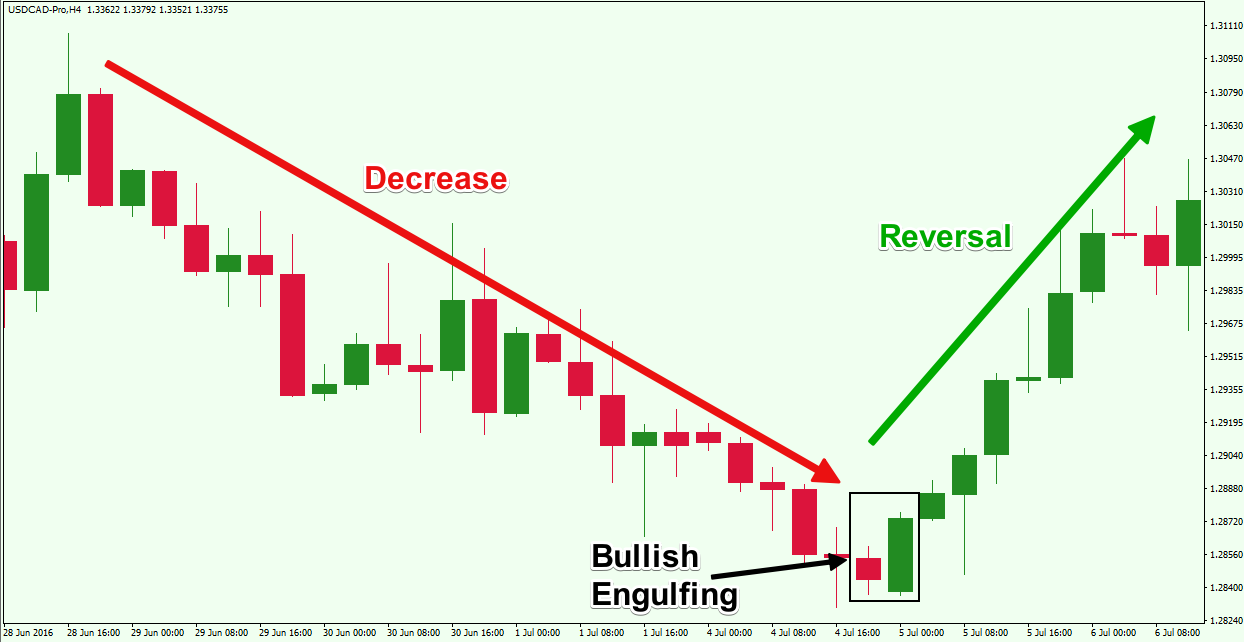

Reversal Chart Patterns - When the market is falling and on the verge of recovery, the rounding bottom pattern gives an idea that reversal may be near. Web it is used as a bullish pattern in technical analysis by conventional traders. Web reversal patterns refer to chart arrangements that happen before a chart starts a new trend. Web here is a list of the reversal chart patterns: An important point you’ve learned today is that trend reversal patterns should not be used in isolation. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a potential change in the direction of a trend. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. And when you learn to spot them on charts, they can signal a potential change in trend direction. What is a chart pattern? Such reversals can often signal the beginning of a. Bullish engulfing (2) piercing pattern (2) bullish harami (2) hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. The reversal pattern in trading penny stocks is a crucial signal that denotes a potential change in the direction of a stock’s price movement. On top. Web what are reversal patterns? How to use those patterns in your trading. Head and shoulders & inverse head and shoulders. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. A head and shoulders pattern is a reversal pattern that indicates the end of an uptrend. We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations. While the latter signal that the prevailing trend is likely to continue after a temporary pause is finished and the breakout is confirmed, reversal patterns are pointing towards an impending change in the trend direction. I'll explain what each reversal pattern. A chart pattern (or price pattern) is an identifiable movement in the price on a chart that uses a series of curves or trendlines. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. On top of that, you saw that: Web what are reversal patterns? It resembles a baseline with three. While the latter signal that the prevailing trend is likely to continue after a temporary pause is finished and the breakout is confirmed, reversal patterns are pointing towards an impending change in the trend direction. In price action analysis, wedges are some of the best reversal patterns in the market. And when you learn to spot them on charts, they. Web reversal patterns are the opposite of continuation candlestick patterns. Some common reversal chart patterns are the inverse head and shoulders, ascending triangle, and double bottom; On top of that, you saw that: These patterns can help you make better decisions about when to enter a trade. We have elected to narrow the field by selecting a few of the. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. A head and shoulders pattern is a reversal pattern that indicates the end of an uptrend. Web this pattern was deemed the rolling inside/outside reversal (rior). Bullish engulfing (2) piercing pattern (2) bullish. The chart pattern does not mean the trend has changed. Web every reversal chart pattern has 3 components to it: Unlike candlesticks that continue the current trend, reversals imply that buyers or sellers are losing control and the price may start moving the opposite way. The reaction lows of each peak can be connected to form support, or a neckline.. Head and shoulders & inverse head and shoulders. Trend reversal patterns (inverse head and shoulders, cup and handle, double bottom) offer insights into potential trend. A price pattern that signals a change in the prevailing trend is known as a reversal pattern. An important point you’ve learned today is that trend reversal patterns should not be used in isolation. Web. Head and shoulders & inverse head and shoulders. An important point you’ve learned today is that trend reversal patterns should not be used in isolation. Web this pattern was deemed the rolling inside/outside reversal (rior). Reversal chart patterns can also be trend continuation patterns—the context is what. Web the head and shoulders pattern is a market chart that crypto traders. Spike (v) rounding (or saucer) bottom. The head and shoulders pattern is one of the most famous and most recognizable of all reversal patterns. How to trade reversal patterns? The head and shoulders pattern is exactly what the term indicates. This pattern is based on the concept of fibonacci ratios, with each point representing significant price levels. And whether you are a beginner or advanced trader, you clearly want to have a pdf to get a view of. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon. Web for example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. Web this pattern was deemed the rolling inside/outside reversal (rior). Unlike candlesticks that continue the current trend, reversals imply that buyers or sellers are losing control and the price may start moving the opposite way. These patterns can help you make better decisions about when to enter a trade. Web here is a list of the reversal chart patterns: The chart pattern does not mean the trend has changed. The shift can be either bullish or bearish. Three factors to consider before trading reversal patterns: We have elected to narrow the field by selecting a few of the most popular patterns for detailed explanations.Reversal Chart Patterns

Chart Patterns Continuation and Reversal Patterns AxiTrader

The Essential Guide To Reversal Chart Patterns TradingwithRayner

The Essential Guide To Reversal Chart Patterns TradingwithRayner

Top Forex Reversal Patterns that Every Trader Should Know Forex

The Best Trend Reversal Indicators and How to Use Them

The Essential Guide To Reversal Chart Patterns TradingwithRayner

What Are Reversal Patterns & How To Trade With Them The Forex Geek

Top Forex Reversal Patterns that Every Trader Should Know Forex

📚Reversal Patterns How To Identify & Trade Them 📚 for FXEURUSD by

When The Market Is Falling And On The Verge Of Recovery, The Rounding Bottom Pattern Gives An Idea That Reversal May Be Near.

Following An Uptrend, A Reversal Would Be To.

It Resembles A Baseline With Three Peaks With The Middle Topping The Other Two.

Web Paypal Share Price Has Formed A Rising Wedge Pattern On The Daily And Weekly Charts.

Related Post: