Quadruple Top Pattern

Quadruple Top Pattern - Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. Double tops and bottoms are the simplest point and figure patterns to identify. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. A triple top pattern is a bearish pattern in technical analysis that signals a price reversal from a bullish trend to a. ( click here to see one of the most powerful price. Web multiple tops are a technical chart pattern observed by traders to identify potential trend reversals. Web ed butowsky, top wealth manager in dallas & managing partner of chapwood investments, shows what a quadruple top is and how it may affect the stock market. Web this quadruple top marked a congestion pattern as prices moved sideways from june (red 6) to december (red c). Updated on march 2, 2022. Over the past 40+ years, a 60/40 portfolio has returned approximately the. Web a bullish catapult forms with an initial breakout, a short pullback and a second breakout. Speaking of stocks and bonds, the 60/40 portfolio continues to push towards new highs. They occur when a security fails to surpass previous highs on two or more. Web this quadruple top marked a congestion pattern as prices moved sideways from june (red 6). Web multiple tops refer to a reversal chart pattern when a security hits a high or an end of an uptrend and fails to break through to new highs on two or more occasions. This is an extension of a triple top buy pattern. The triple top pattern consists of three similar. Web this quadruple top marked a congestion pattern. Consisting of three peaks, a triple top signals that the. While the ideal bullish catapult starts with a triple top breakout, quadruple top. Web the triple top is a type of chart pattern used in technical analysis to predict the reversal in the movement of an asset's price. Web the triple top reversal is a bearish reversal pattern typically found. Web the author explains why triple tops and quad tops are rare and difficult to find in the stock market, and how they are indicative of a rangebound market. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. Speaking of stocks and bonds, the 60/40 portfolio continues to push. Web what is a triple top pattern in technical analysis? The triple top pattern consists of three similar. A triple top pattern is a bearish pattern in technical analysis that signals a price reversal from a bullish trend to a. Web multiple tops refer to a reversal chart pattern when a security hits a high or an end of an. This is an extension of a triple top buy pattern. ( click here to see one of the most powerful price. There are several predefined patterns that you can set as filters for your scan, including candlestick and p&f patterns. Over the past 40+ years, a 60/40 portfolio has returned approximately the. Web the author explains why triple tops and. Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. They occur when a security fails to surpass previous highs on two or more. Web the author explains why triple tops and quad tops are rare and difficult to find in the. Web through the last century, studies of stock prices have supplied traders with valuable tools for evaluating those price patterns. They occur when a security fails to surpass previous highs on two or more. Web what is a triple top pattern in technical analysis? Web the author explains why triple tops and quad tops are rare and difficult to find. ( click here to see one of the most powerful price. The united states has a standard 2.5 percent. Web a bullish catapult forms with an initial breakout, a short pullback and a second breakout. Web ed butowsky, top wealth manager in dallas & managing partner of chapwood investments, shows what a quadruple top is and how it may affect. Web what is a triple top pattern in technical analysis? Double tops and bottoms are the simplest point and figure patterns to identify. Web through the last century, studies of stock prices have supplied traders with valuable tools for evaluating those price patterns. Web the triple top pattern is a reversal chart pattern that is formed when the price of. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. Web a triple top pattern, also called a triple top reversal, is a charting pattern used in technical analysis that signals a potential reversal. They occur when a security fails to surpass previous highs on two or more. For a bull trap to be possible, this breakout. Speaking of stocks and bonds, the 60/40 portfolio continues to push towards new highs. A triple top pattern is a bearish pattern in technical analysis that signals a price reversal from a bullish trend to a. In turn, they form the building blocks of all other patterns. Web what is a triple top pattern in technical analysis? Web multiple tops refer to a reversal chart pattern when a security hits a high or an end of an uptrend and fails to break through to new highs on two or more occasions. Web the double bottom and double top patterns are common and easily recognizable chart patterns, which occur in all timeframes. Web multiple tops are a technical chart pattern observed by traders to identify potential trend reversals. The double bottom appears as two consecutive. ( click here to see one of the most powerful price. Web through the last century, studies of stock prices have supplied traders with valuable tools for evaluating those price patterns. The united states has a standard 2.5 percent. Web the author explains why triple tops and quad tops are rare and difficult to find in the stock market, and how they are indicative of a rangebound market.Trading Stocks and Options! the QUADRUPLE TOP in the

A quadruple top with descending RSI on hourly chart ??? for FXXAUUSD

Topping Patterns Quadruple Top! YouTube

Quadruple Top Pattern DM Ingenio

Quadruple top, yeah I'm going to sell this for 600 pips for FXNZDCAD

Forex technical analysis USDJPY falls to lowest level this month

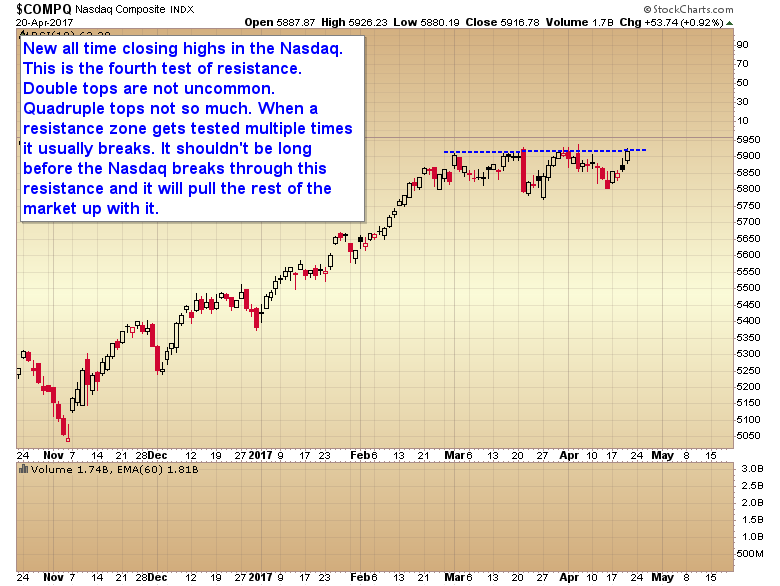

No Such Thing as a Stock Market Quadruple Top The Market Oracle

![Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda](https://tradeveda.com/wp-content/uploads/2020/10/breakout-trading-strategy-rounding-top-pattern.png)

Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda

BTC/USDT Quadruple Top target for BINANCEBTCUSDT by Christians_SKS

Triple Tops Are Rare And Quad Tops Fuggedaboutit All Star Charts

Double Tops And Bottoms Are The Simplest Point And Figure Patterns To Identify.

A Double Top Occurs When The Price Rallies To A High Point, Falls, Climbs To A.

Consisting Of Three Peaks, A Triple Top Signals That The.

Over The Past 40+ Years, A 60/40 Portfolio Has Returned Approximately The.

Related Post: