Quad Top Pattern

Quad Top Pattern - Pattern consists of a rounded bottom (not a “v” bottom), two “lips” at each end, and a “handle” (similar to a flag pattern) from the handle. So stay relaxed from the. A second lesson to be learned here is that anytime there is an obvious chart sell signal, such as a double bottom penetration, after. Trading the double top and triple top reversal chart patterns. Entries, stops, and targets for trading double and triple top patterns. Classic relaxed fit tank top with scoop neckline. Granny square top patterns are a type of top that is crocheted using granny squares. In fact, these five are the exact opposite of the five bullish breakdown patterns. There are five bearish breakdown p&f patterns. Multiple tops occur when a security fails to break through to new highs on two or more occasions. Rounding bottoms form an inverted ‘u’ shape and. Web one type of chart pattern that is often used to identify potential reversal points on a price chart is the rounding bottom or top. Web the pattern on the p&f chart qualified for a quadruple top breakout which is a powerful signal. Multiple tops refer to a reversal chart pattern looked. This trend is interpreted as a signal to sell the particular security. Look at the magnitude of that. Rounding bottoms form an inverted ‘u’ shape and. It doesn’t guarantee success anymore than any other signal but it. In fact, these five are the exact opposite of the five bullish breakdown patterns. Last week, the industry was abuzz with news of hynix's 15nm nand flash memory technology. There are five bearish breakdown p&f patterns. This trend is interpreted as a signal to sell the particular security. This technique involves creating small,. Web ed butowsky discusses what is a quadruple top and why is it considered a negative trend in the stock market. This trend is interpreted as a signal to sell the particular security. It doesn’t guarantee success anymore than any other signal but it. Look at the magnitude of that. Web ed butowsky discusses what is a quadruple top and why is it considered a negative trend in the stock market. Learn how to identify it with us. The area of the peaks is resistance. This technique involves creating small,. Web bubbles are characterized by mass participation of the public. It doesn’t guarantee success anymore than any other signal but it. Web the pattern on the p&f chart qualified for a quadruple top breakout which is a powerful signal. Look at the magnitude of that. So stay relaxed from the. This technique involves creating small,. Web one type of chart pattern that is often used to identify potential reversal points on a price chart is the rounding bottom or top. There are five bearish breakdown p&f patterns. Multiple tops occur when a security fails to break through to new highs on two or more occasions. Web the pattern on the p&f chart qualified for a quadruple top breakout which is a powerful signal. Granny square top patterns are a type of top that is crocheted using granny squares. This usually results in a 100% gain in a. A second lesson to be learned here is that anytime there is an obvious chart sell signal, such as a double bottom penetration, after. Look at the magnitude of that. Web the triple top pattern occurs when the price of an asset creates three peaks at nearly the same price level. Pattern consists of a rounded bottom (not a “v”. This trend is interpreted as a signal to sell the particular security. In fact, these five are the exact opposite of the five bullish breakdown patterns. There are five bearish breakdown p&f patterns. Web ed butowsky discusses what is a quadruple top and why is it considered a negative trend in the stock market. The area of the peaks is. Classic relaxed fit tank top with scoop neckline. So stay relaxed from the. Last week, the industry was abuzz with news of hynix's 15nm nand flash memory technology. This technique involves creating small,. A second lesson to be learned here is that anytime there is an obvious chart sell signal, such as a double bottom penetration, after. Trading the double top and triple top reversal chart patterns. So stay relaxed from the. Web the triple top pattern occurs when the price of an asset creates three peaks at nearly the same price level. In fact, these five are the exact opposite of the five bullish breakdown patterns. Web ed butowsky discusses what is a quadruple top and why is it considered a negative trend in the stock market. Multiple tops refer to a reversal chart pattern looked at by technical traders. Web the quad patterning era begins. Multiple tops occur when a security fails to break through to new highs on two or more occasions. This technique involves creating small,. Web bubbles are characterized by mass participation of the public. Granny square top patterns are a type of top that is crocheted using granny squares. Rounding bottoms form an inverted ‘u’ shape and. A second lesson to be learned here is that anytime there is an obvious chart sell signal, such as a double bottom penetration, after. A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). Last week, the industry was abuzz with news of hynix's 15nm nand flash memory technology. This usually results in a 100% gain in a year or less in at least one of the indexes.

QUAD Quilt PDF Pattern see kate sew

Pin on Maya

Quadruple top, yeah I'm going to sell this for 600 pips for FXNZDCAD

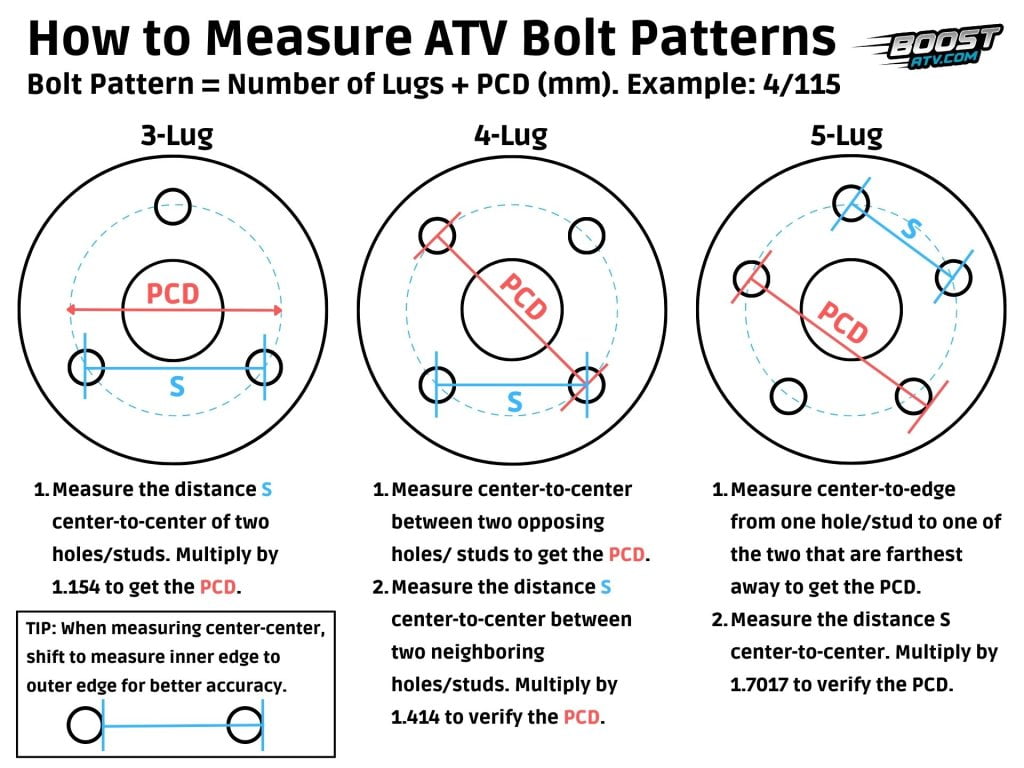

What ATVs Have the Same Bolt Pattern? A Comparision Guide UTV Ride

ATV Wheel Bolt Pattern and Lug Pattern Explained

6 Topology simplifying tips CGTyphoon

Triple Tops Are Rare And Quad Tops Fuggedaboutit All Star Charts

Atv Bolt Pattern Chart

Topology, Surface modeling, Juarez

![Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda](https://tradeveda.com/wp-content/uploads/2020/10/breakout-trading-strategy-rounding-top-pattern-1024x683.png)

Rounding Bottom and Rounding Top Patterns [Trading Guide] TradeVeda

It Doesn’t Guarantee Success Anymore Than Any Other Signal But It.

This Trend Is Interpreted As A Signal To Sell The Particular Security.

The Most Basic P&F Sell Signal Is.

Learn How To Identify It With Us.

Related Post: