Printable 1099 Tax Forms

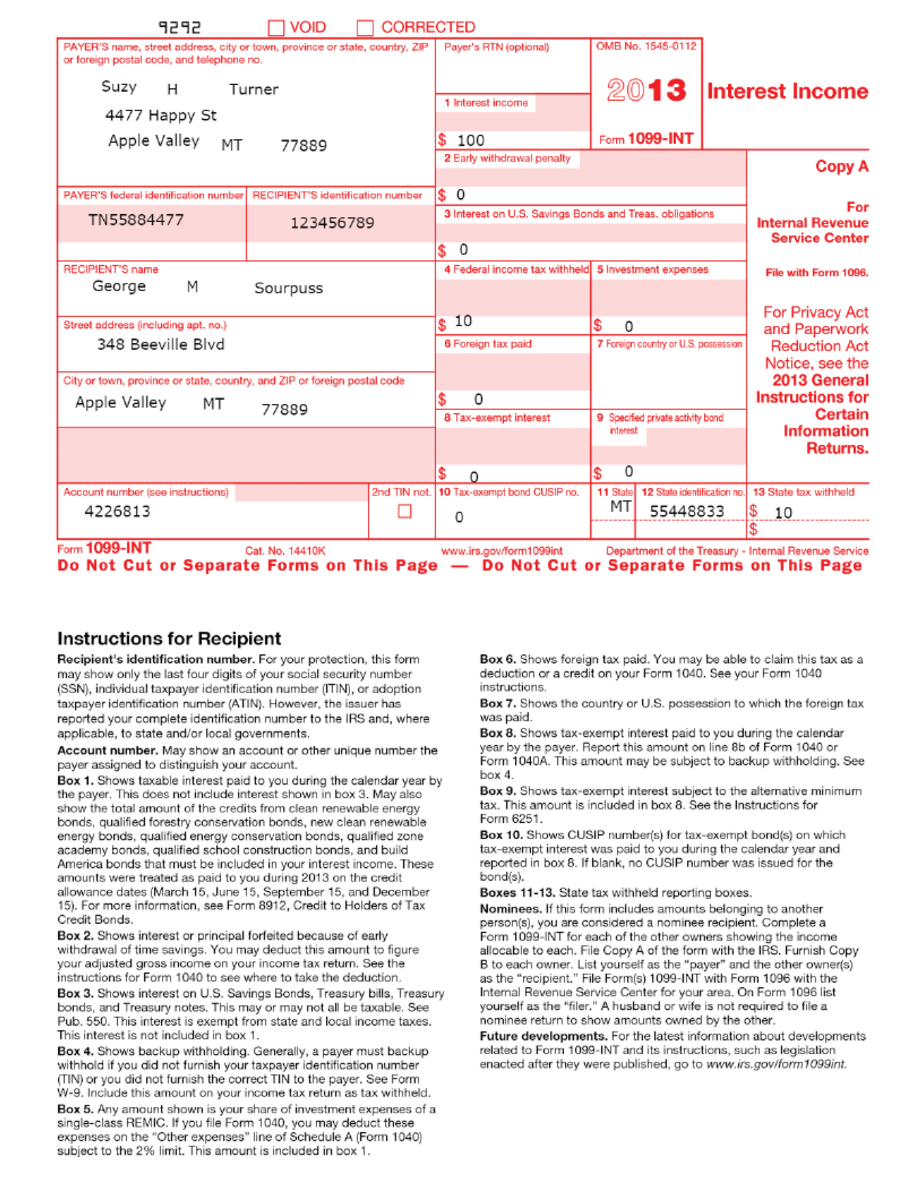

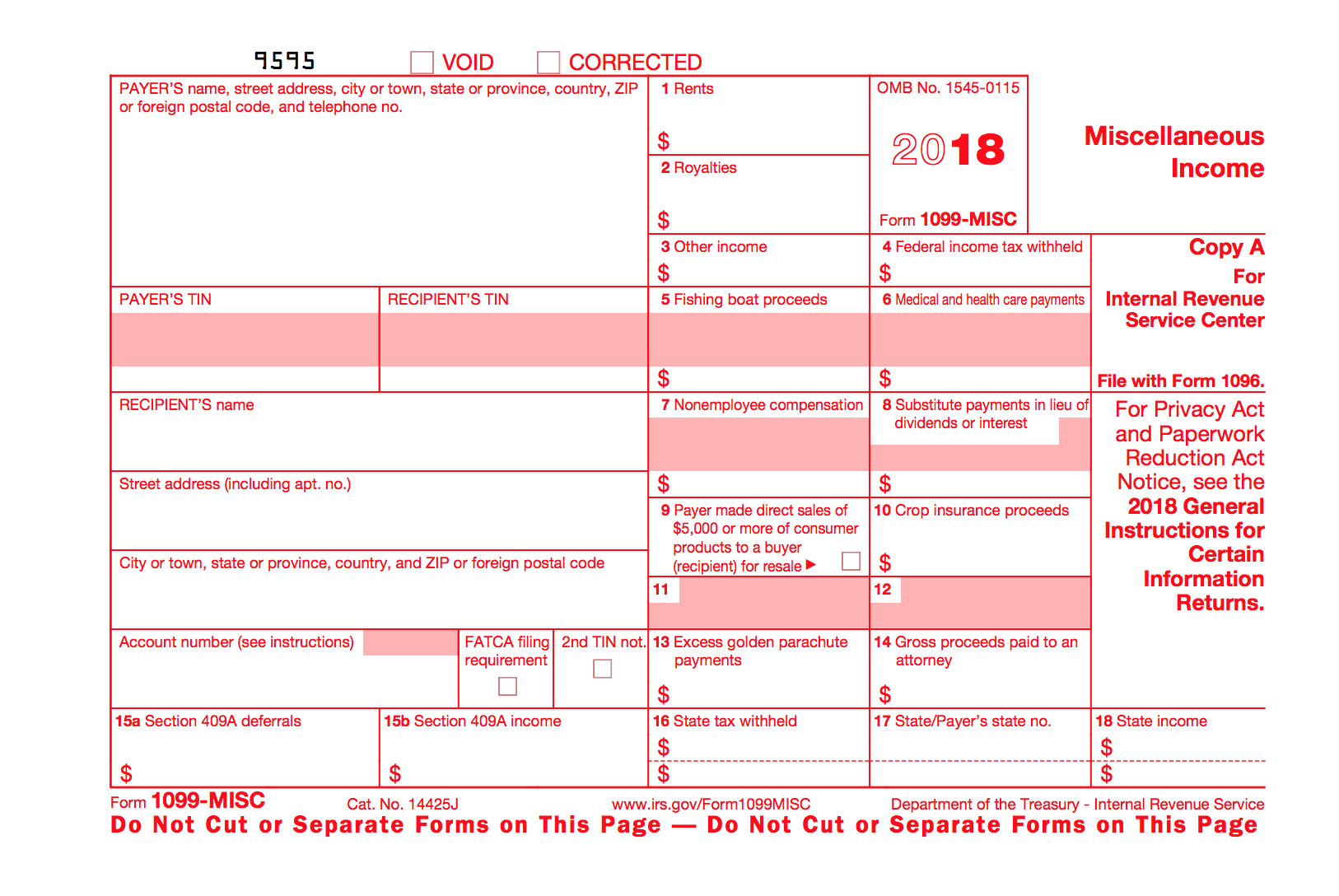

Printable 1099 Tax Forms - Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. File to download or integrate. The business that pays the money fills out the form with the appropriate details and. Washington — the internal revenue service announced today that businesses can now file form 1099 series information returns using a new online portal, available free from the irs. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. Quickbooks will print the year on the forms for you. Web form 1099 reports freelance payments, income from investments, retirement accounts, social security benefits and government payments, withdrawals from 529 college savings plans and health. These “continuous use” forms no longer include the tax year. The list of payments that require a business to file a. Persons with a hearing or speech disability with access to tty/tdd equipment can. The 1099 form is a common irs form covering several potentially taxable income situations. Web page last reviewed or updated: Web updated december 21, 2023. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this. Persons with a hearing or speech disability with access to tty/tdd equipment can. The business that pays the money fills out the form with the appropriate details and. Web updated december 21, 2023. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. The 1099 form is a common. There are several kinds of. Web a 1099 form is used to document income received outside of a permanent salaried job. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Web page last reviewed or updated: Individuals or independent contractors who earn $600 or more in nonemployment income. Who gets a 1099 form? This includes money earned from gig work, interest, a real estate sale or a distribution from a. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Individuals or independent contractors who earn $600 or more in nonemployment. The business that pays the money fills out the form with the appropriate details and. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Any amount included in box 12 that is currently taxable is also included in this box. Because paper forms are scanned during processing, you. Quickbooks will print the year on the forms for you. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings,. Web a 1099 form is used to document income received outside of a permanent salaried job. Quickbooks will print the year on the forms for you. File to download or integrate. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or. The business that pays the money fills. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or. Web updated march 20, 2024. Download your 1099 or 1042s tax form in your social security account. The list of payments that require a business to file a. Washington — the internal revenue service announced today that businesses. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web a 1099. Quickbooks will print the year on the forms for you. File to download or integrate. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web updated march 20, 2024. These “continuous use” forms no longer include the tax year. Persons with a hearing or speech disability with access to tty/tdd equipment can. Written by sara hostelley | reviewed by brooke davis. Furnish copy b of this form to the recipient by january 31, 2022. File copy a of this form with the irs by february 28, 2022. Web updated december 21, 2023. Any amount included in box 12 that is currently taxable is also included in this box. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. The list of payments that require a business to file a. Web the irs 1099 forms are a group of tax forms that document payments made by an individual or a business that typically isn’t your employer. This includes money earned from gig work, interest, a real estate sale or a distribution from a. Your 2023 tax form will be available online on february 1, 2024.

How to Fill Out and Print 1099 MISC Forms

What is a 1099Misc Form? Financial Strategy Center

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

Free Printable Irs 1099 Misc Form Printable Forms Free Online

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

1099 Form Template. Create A Free 1099 Form Form.

1099MISC 3Part Continuous 1" Wide Formstax

![]()

Printable 1099 Form Pdf Free Printable Download

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

1099 Tax Form Printable Printable Forms Free Online

Web Form 1099 Reports Freelance Payments, Income From Investments, Retirement Accounts, Social Security Benefits And Government Payments, Withdrawals From 529 College Savings Plans And Health.

Individuals Or Independent Contractors Who Earn $600 Or More In Nonemployment Income Within A Calendar Year Must Receive A Form 1099.

The Business That Pays The Money Fills Out The Form With The Appropriate Details And.

Web A 1099 Form Is Used To Document Income Received Outside Of A Permanent Salaried Job.

Related Post: