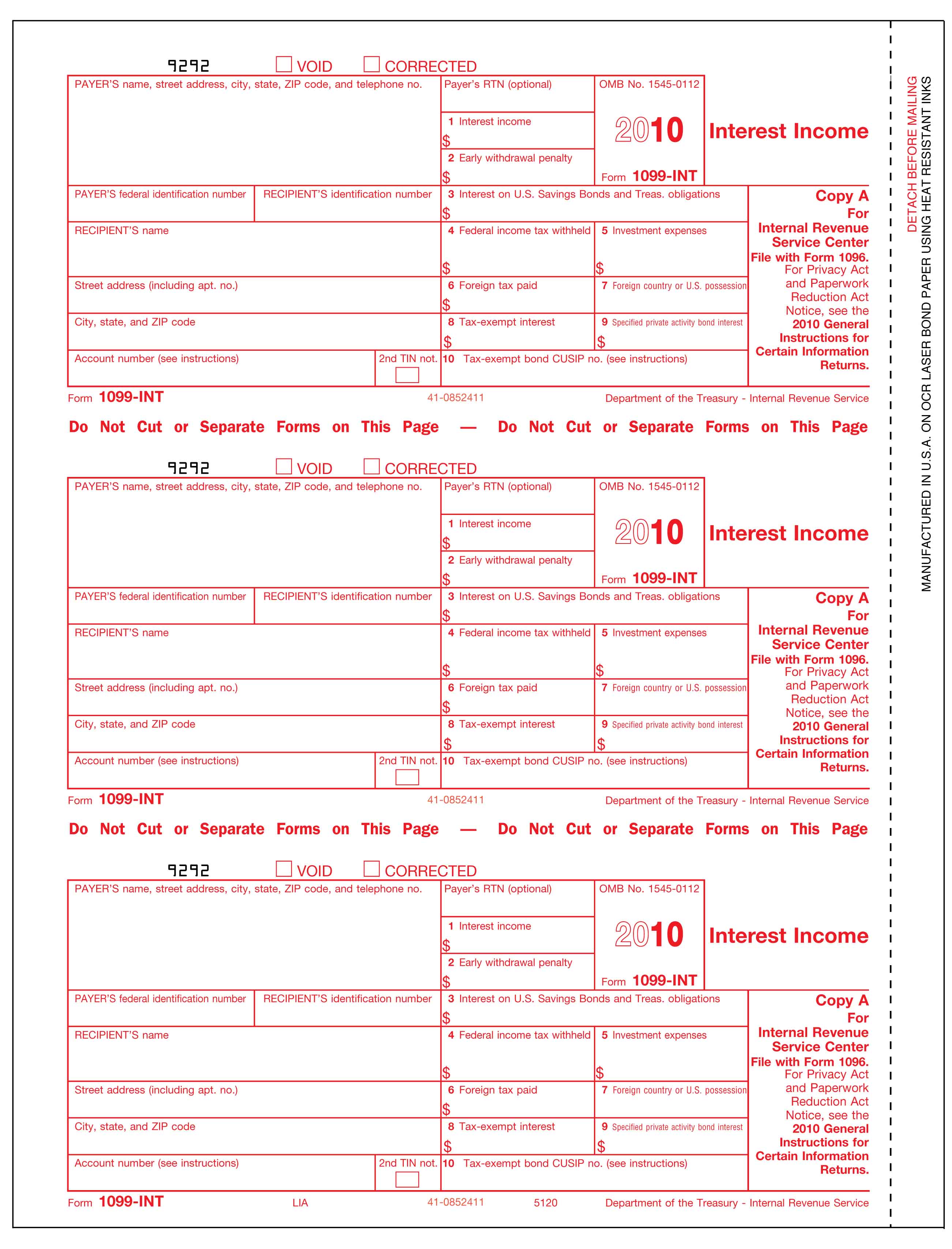

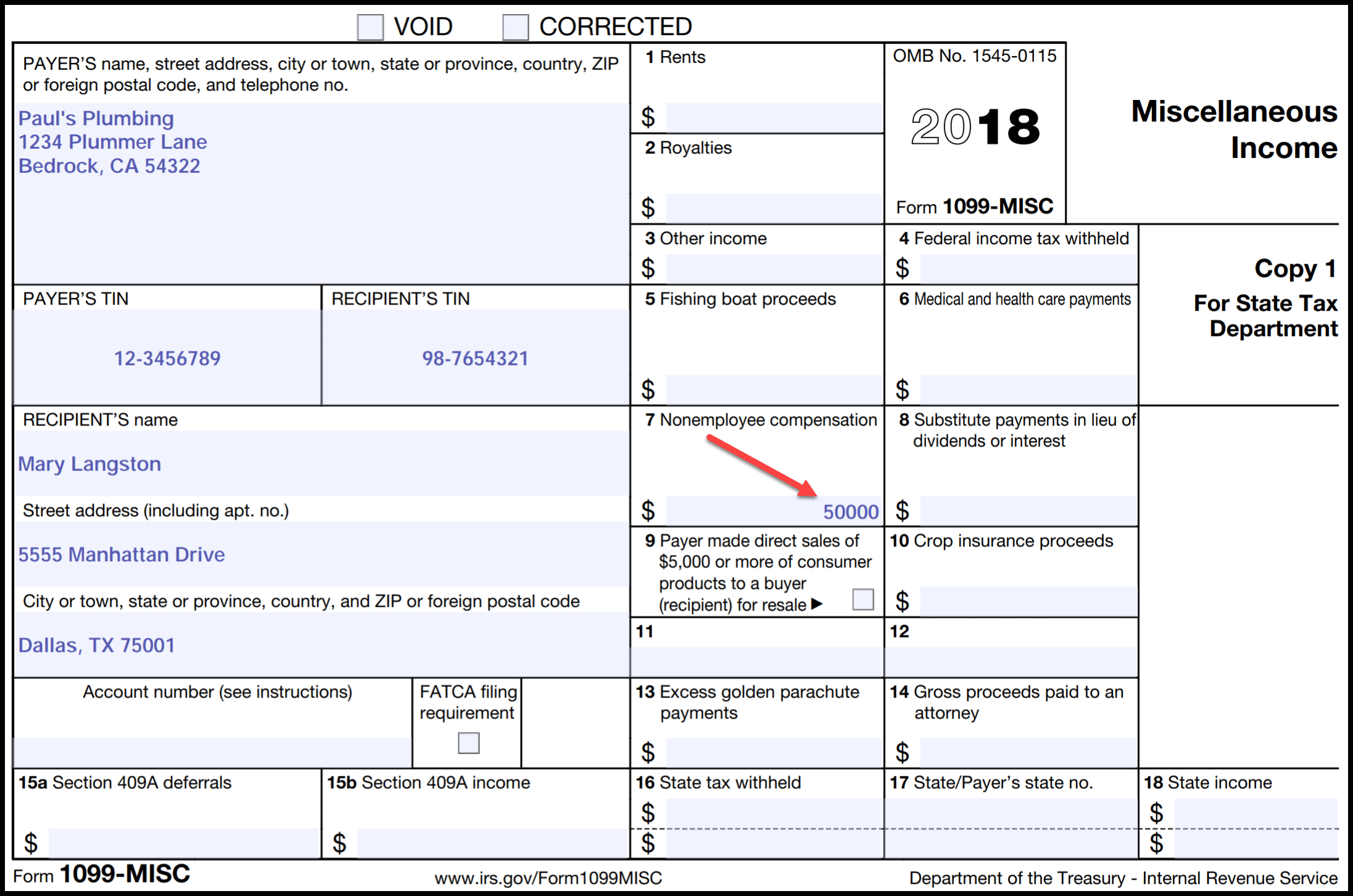

Printable 1099 Form

Printable 1099 Form - The “green book”—released in march 2024—reintroduced a proposal to accelerate form 1099 deadlines by two months. Accelerating form 1099 deadlines, prioritizing taxpayer efficiency. To the irs by february 28, 2024 if filing by mail. There are 20 active types of 1099 forms used for various income types. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). It indicates a way to close an. Note that the $600 threshold that was enacted. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Post the nonemployee compensation and. Two crossed lines that form an 'x'. The philadelphia eagles in brazil on friday night in week 1. Web recipient’s taxpayer identification number (tin). Find out how to get and where to mail paper federal and state tax forms. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). There are 20 active types of 1099 forms used for various income types. For questions or language help call: For your protection, this form may show only. Web updated november 06, 2023. There may also be a qualified disaster retirement plan distributions and/or a 2020 disaster distribution form listed that has to be deleted. There are various types of 1099s, depending on the type of income in question. In 2021, congress amended code section 6045 to define “broker” to include any “person who (for consideration) is responsible. To recipients by january 31, 2024. 1099s fall into a group of tax documents. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Make sure you’ve got the right paper in your printer. For your protection,. The “green book”—released in march 2024—reintroduced a proposal to accelerate form 1099 deadlines by two months. It indicates a way to close an. Web updated november 06, 2023. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. The due date for furnishing a copy to your contractors and vendors. Two crossed lines that form an 'x'. Click “print 1099” or “print 1096” if you only want that form. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings,. For questions or language help call: It indicates a way to close an. However, the payer has reported your complete tin. Select each contractor you want to print 1099s for. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Web if you apply by mail, include: There may also be a qualified disaster retirement plan distributions and/or a 2020 disaster distribution form listed that has. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare. You should issue all other payments to the recipient by. There may also be a qualified disaster retirement plan distributions and/or a 2020 disaster distribution form listed that has to be deleted. To recipients by. Web the nfl will release the full 2024 regular season schedule on wednesday, may 15. Any amount included in box 12 that is currently taxable is also included in this box. Web if you apply by mail, include: 1099s fall into a group of tax documents. Per the green book, the proposal would help the irs detect fraud and foster. Persons with a hearing or speech disability with access to tty/tdd equipment can. It indicates a way to close an. The “green book”—released in march 2024—reintroduced a proposal to accelerate form 1099 deadlines by two months. Select each contractor you want to print 1099s for. There are 20 active types of 1099 forms used for various income types. To recipients by january 31, 2024. There are various types of 1099s, depending on the type of income in question. Web recipient’s taxpayer identification number (tin). Web if you apply by mail, include: Any amount included in box 12 that is currently taxable is also included in this box. Web updated november 06, 2023. Note that the $600 threshold that was enacted. Web the nfl will release the full 2024 regular season schedule on wednesday, may 15. List your company’s taxpayer identification number (tin) as payer’s tin. There may also be a qualified disaster retirement plan distributions and/or a 2020 disaster distribution form listed that has to be deleted. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form.

1099 nec form 2021 pdf Fill out & sign online DocHub

1099 Employee Form Printable

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

What Is a 1099 & 5498? uDirect IRA Services, LLC

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

1099 Contract Template HQ Printable Documents

1099 Format, 1099 Forms, 1099 Tax Forms Print Forms

1099 Form Template. Create A Free 1099 Form Form.

Sample of completed 1099int 205361How to calculate 1099int

Free W9 Forms 2020 Printable Pdf Example Calendar Printable

Make Sure You’ve Got The Right Paper In Your Printer.

Click “Print 1099” Or “Print 1096” If You Only Want That Form.

Irs 1099 Forms Are A Series Of Tax Reporting Documents Used By Businesses And Individuals To Report Income Received Outside Of Normal Salary Or Wages, Such As Freelance Earnings, Interest, Dividends, And More.

The Nfl’s Opener Will Be Between The Super Bowl Champion Kansas City Chiefs And Baltimore Ravens On Thursday Night In Week 1.

Related Post: