Piercing Line Pattern

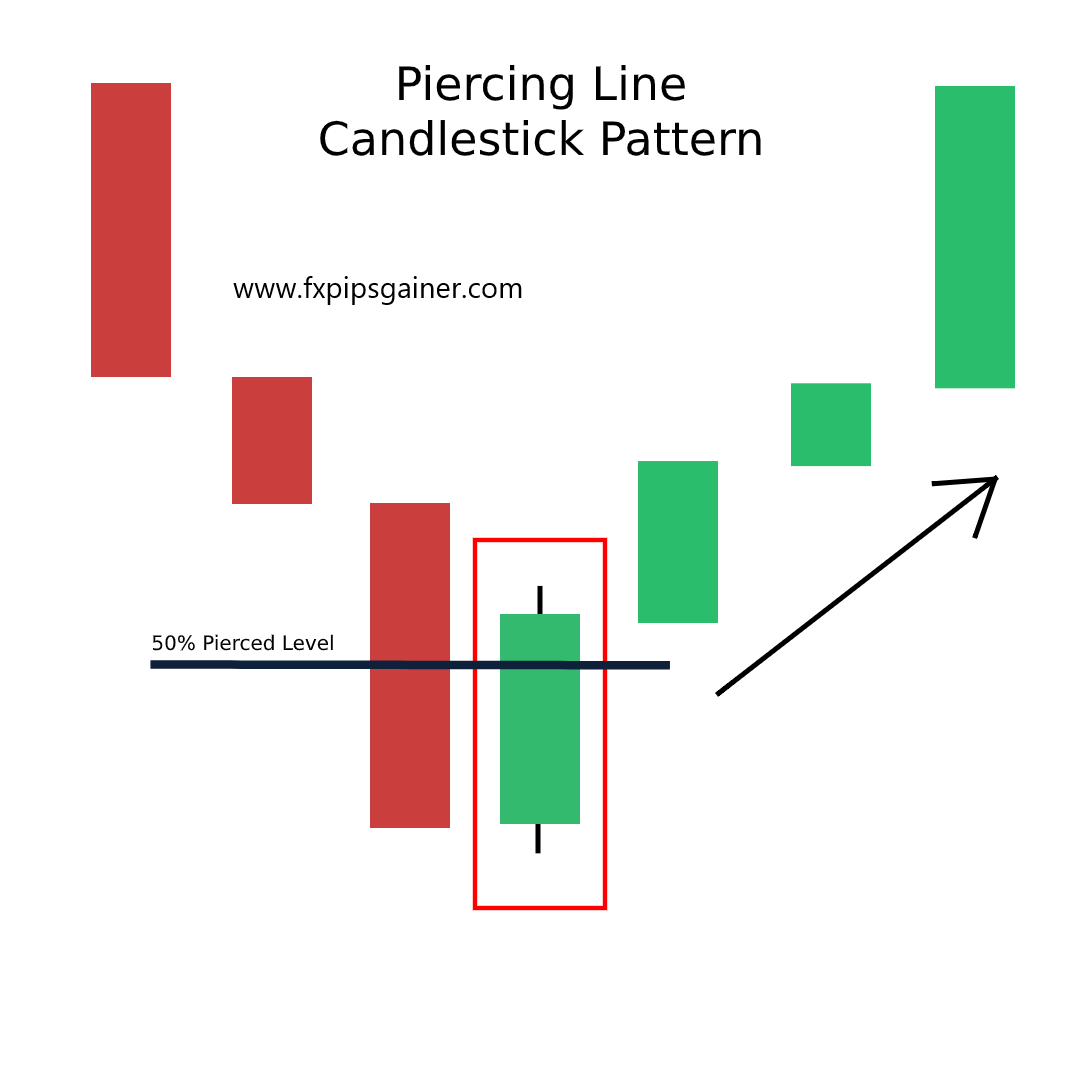

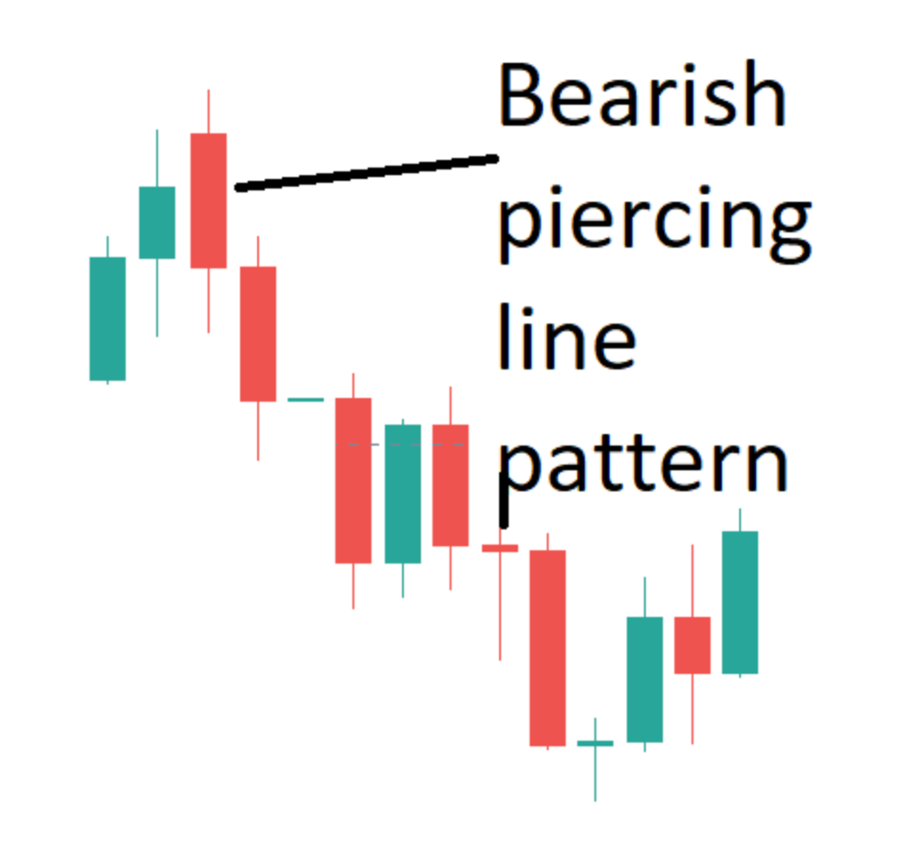

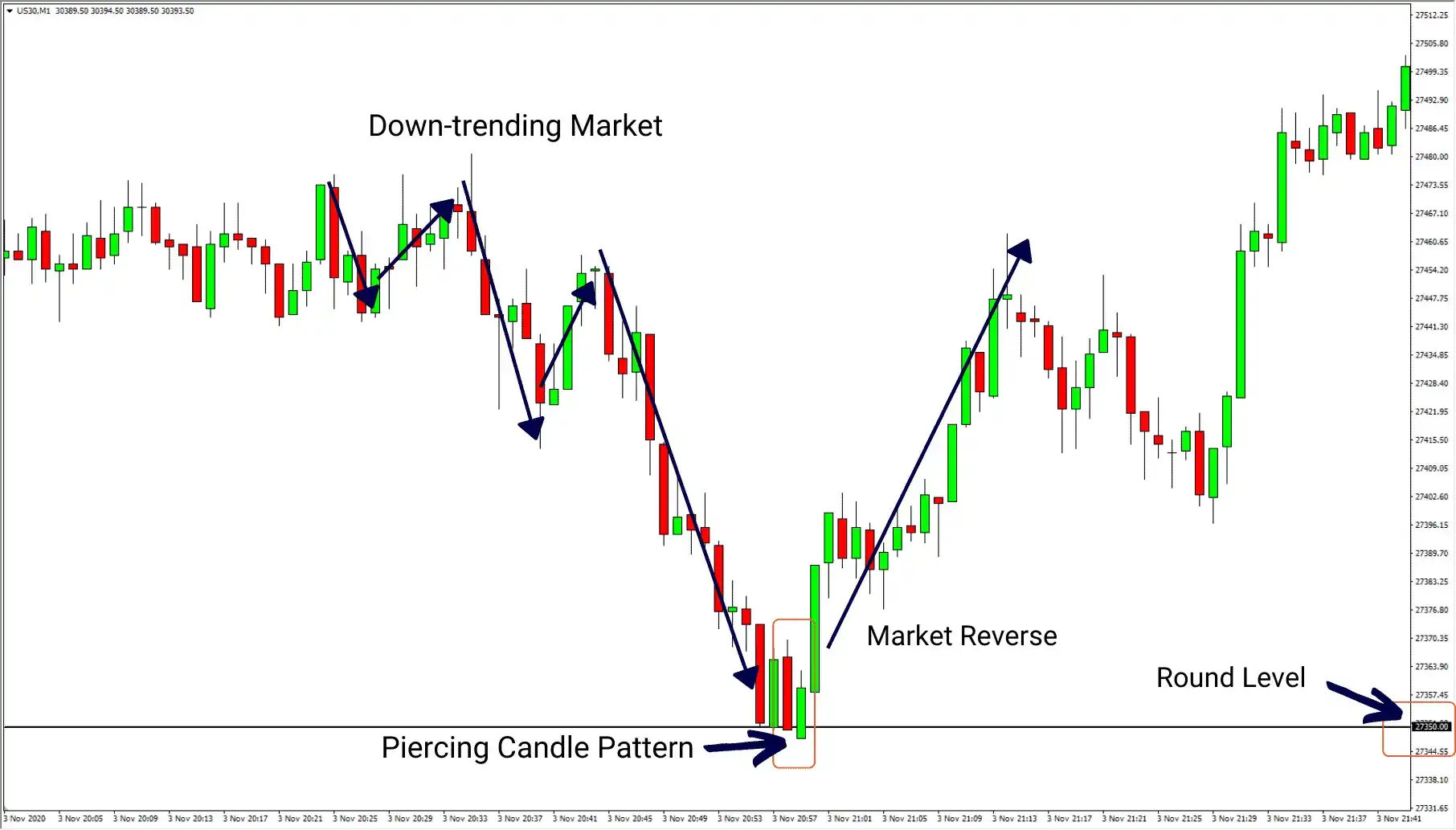

Piercing Line Pattern - This candle indicates that sellers were in control during the session, pushing prices lower. For the pattern to be called ‘piercing line’, the following has to happen: The fact that bulls were able to press further up into the. However, it also tells traders that there could be a bearish continuation when there is a false. The price closes above the midpoint of the bearish candle, i.e. The first candle is bearish. And then closes back above 50% of the previous candle’s body! It frequently prompts a reversal in trend as bulls enter the market and push. The stock has to be in a downtrend. The gap down between the first candlestick’s low and the second candlestick’s open creates a buying opportunity for traders who believe that the trend is reversing. The first candle has to be red (bearish). The second candle is bullish and shows the following: Web so, here’s the definition of a bullish piercing pattern: The piercing line is a bullish reversal candlestick pattern found at the end of a bearish trend that helps traders find potential reversal zones. Being one of the few two candlestick patterns, the. Disguised ad — content designed to look like independent editorial is actually paid promotion of a product or service. Web a piercing pattern happens when a candle gaps down at the open: However, it also tells traders that there could be a bearish continuation when there is a false. The gap down between the first candlestick’s low and the second. It signals a potential short term reversal from downwards to upwards. Well, not so fast, my friend! If you look closely at example #1, you’ll also find a small window right after the piercing line pattern. And then closes back above 50% of the previous candle’s body! The piercing line is a bullish reversal candlestick pattern found at the end. The second candle is bullish and shows the following: In an ongoing bearish trend, 2 consecutive candles are formed such that: Web additionally, the price gaps down on day 2 only for the gap to be filled and closes significantly into the losses made previously in day 1’s bearish candlestick. The gap down between the first candlestick’s low and the. This could be a sign that the supply of shares, which market participants wish to sell, has been somewhat exhausted and that the price has fallen to a point where there is an increase in demand. Web the bullish piercing line is a reversal candlestick pattern that’s formed after a downtrend. Web what is the piercing line candlestick pattern? Web. However, it also tells traders that there could be a bearish continuation when there is a false. The rejection of the gap down by the bulls typically can be viewed as a bullish sign. If it forms during a downtrend, it signals a possible turn towards an uptrend. Web a piercing line indicator tells a trader a number of things.. Piercing line reversal with rsi divergence Web piercing line pattern with indicators. The second candle is bullish and shows the following: Web the piercing line is a bullish pattern. The gap down between the first candlestick’s low and the second candlestick’s open creates a buying opportunity for traders who believe that the trend is reversing. Disguised ad — content designed to look like independent editorial is actually paid promotion of a product or service. (emily smith/cnn) a stunning aurora, caused by a severe geomagnetic storm, is painting the sky shades of pink, purple and green as it spreads into. Well, not so fast, my friend! Piercing line reversal with rsi divergence This candle indicates that. So, because we know this is a bullish reversal pattern, we want to look to identify the pattern at areas where we would expect to find a bullish signal such as a test of support, or a retest of broken resistance, or even a test of a bullish trend line. If you look closely at example #1, you’ll also find. Disguised ad — content designed to look like independent editorial is actually paid promotion of a product or service. Web additionally, the price gaps down on day 2 only for the gap to be filled and closes significantly into the losses made previously in day 1’s bearish candlestick. The piercing pattern depends upon the near high opening prices of. The. If you look closely at example #1, you’ll also find a small window right after the piercing line pattern. Disguised ad — content designed to look like independent editorial is actually paid promotion of a product or service. Web the piercing line pattern is a bullish trend reversal pattern that indicates that there is weakness in the current downtrend, with the implication that the downtrend may be coming to an end. At disney lookout cay, you’ll. This pattern consists of two candlesticks: The sellers dived into freezing waters and immediately jumped back up! Web the piercing line is a bullish pattern. An aggressive trader would take a long position on the open. Web a piercing line indicator tells a trader a number of things. The stock has to be in a downtrend. It is considered a bullish reversal signal, indicating a potential shift in market sentiment from bearish to bullish It begins with a long bearish candlestick, indicating a continuation of the selling pressure. The piercing line pattern can be used by traders as a. This could be a sign that the supply of shares, which market participants wish to sell, has been somewhat exhausted and that the price has fallen to a point where there is an increase in demand. Fake urgency — an artificial time limit or misleading availability that manipulates you into purchasing quicker.; This is followed by buyers driving prices up to close above 50% of the body of the first candle.

Piercing Line Forex Trading

Piercing Line Candlestick Trading Guide With Chart Examples Trading

What Is the Piercing Line Candlestick Pattern? FOR INVEST

What Is the Piercing Line Candlestick Pattern? Forex Training Group

How to Trade with the Piercing Line Pattern

Piercing Candlestick Pattern How to Identify Piercing Line

What Is the Piercing Line Candlestick Pattern? FOR INVEST

Piercing Line Pattern The Complete Guide 2022

How to Trade with the Piercing Line Pattern

Piercing Candlestick Pattern Overview with Trading Setup

10 May 2024, 12:15 Pm Ist.

The Price Closes Above The Midpoint Of The Bearish Candle, I.e.

Web A Piercing Pattern Happens When A Candle Gaps Down At The Open:

The First Is Long And Bearish, Indicating A Strong Sell, While The Second Is Long And Bullish, Indicating A Strong Buy.

Related Post: