Piercing Candlestick Pattern

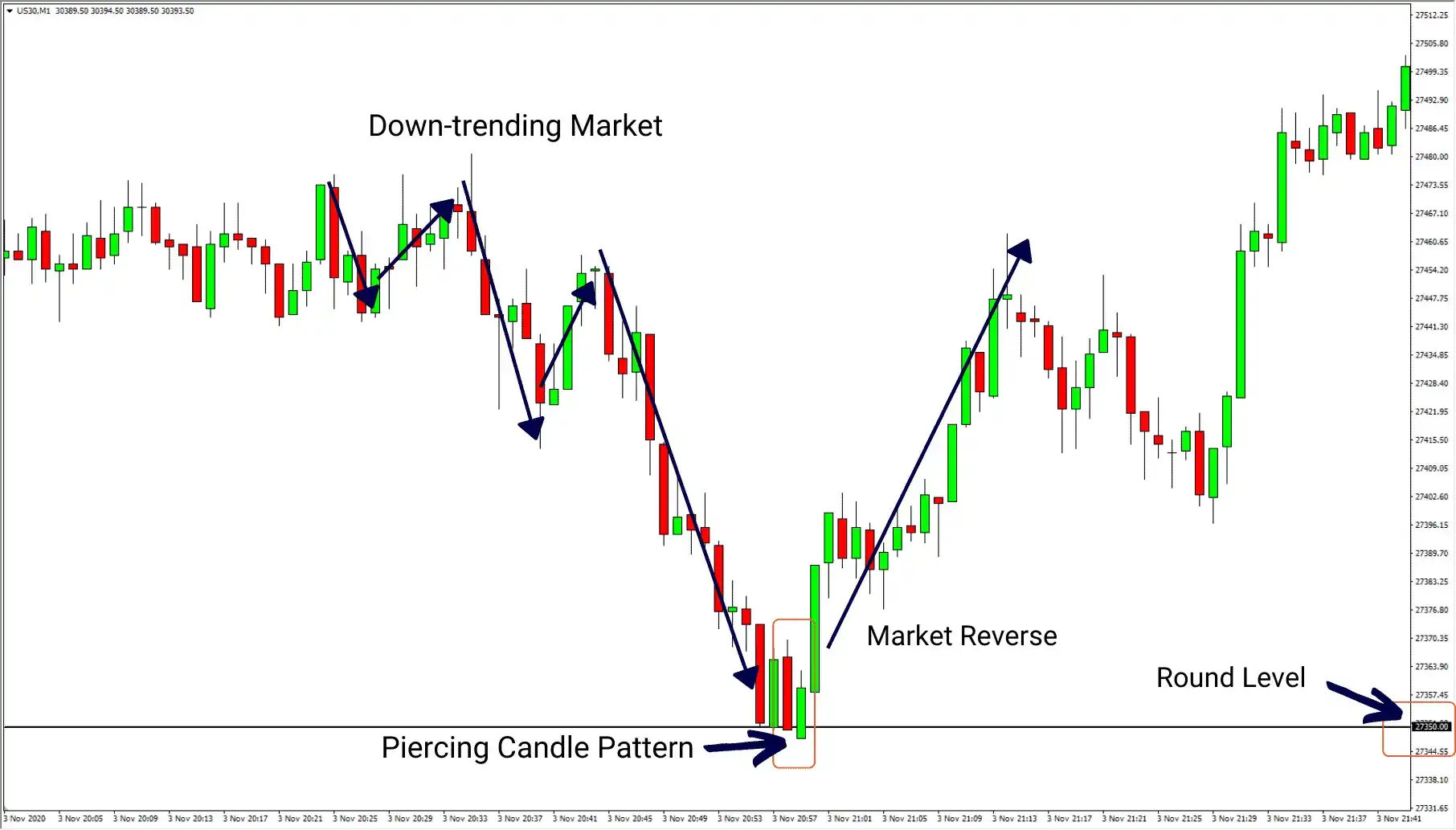

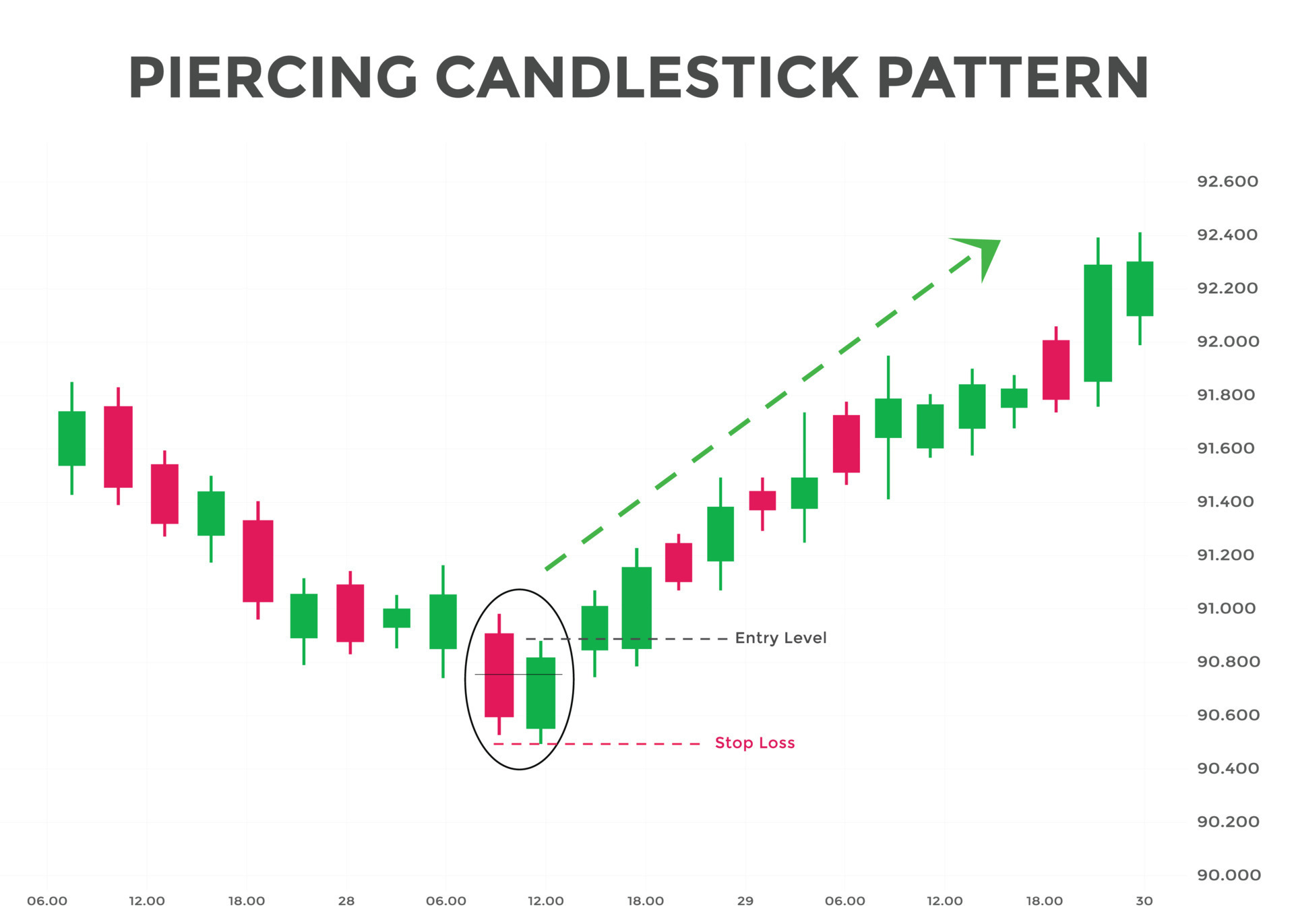

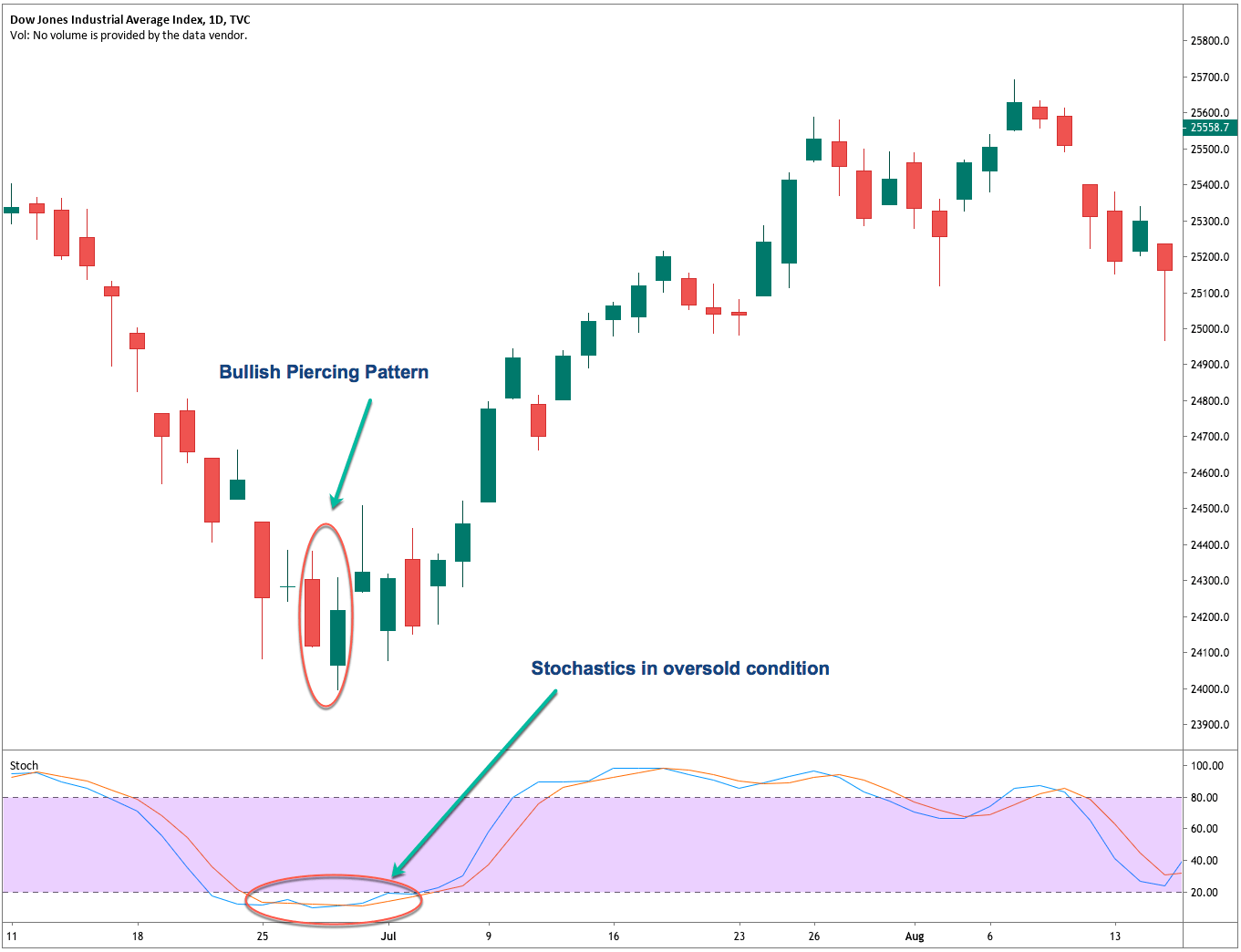

Piercing Candlestick Pattern - In other words, the first line can be one of the following basic candles: It consists of two major components, a bullish candle of day 2 and a bearish candle of day 1. The only difference is that dark cloud cover signals a bearish reversal, whereas a piercing pattern signals a bullish reversal. The fact that bulls were able to press further up into the. Open below the low of the first candlestick; The dark cloud cover pattern is the bearish version of the piercing line. The piercing pattern does best in a bear market, especially after a downward breakout. Before we learn the best piercing trading strategy, let’s learn how to. Web a piercing pattern happens when a candle gaps down at the open: And then closes back above 50% of the previous candle’s body! Web the morning star candlestick consists of 3 candles. It indicates a reversal in an ongoing downtrend, which means the trend will change from down to up when this pattern appears in a continuous downtrend. The piercing line pattern is the opposite of the bearish dark cloud cover. This candlestick pattern is used as an indicator to enter a long. Web the piercing candlestick pattern is a bullish trend reversal pattern, which suggests that there’s weakness in the present downtrend, and it may end soon. In this tutorial, we’re focusing on the piercing line pattern. It consists of two major components, a bullish candle of day 2 and a bearish candle of day 1. Its significance is heightened when it. The piercing pattern consists of two candlesticks, in which bears and bulls fight for price control. It signals a potential short term reversal from downwards to upwards. The rejection of the gap down by the bulls typically can be viewed as a bullish sign. Web the first candlestick is bearish. The sellers dived into freezing waters and immediately jumped back. The piercing pattern does best in a bear market, especially after a downward breakout. Web the piercing pattern involves two candlesticks with the second bullish candlestick opening lower than the preceding bearish candle. Before we learn the best piercing trading strategy, let’s learn how to. The pattern includes the first day opening near the. This candlestick pattern is used as. It signals a potential short term reversal from downwards to upwards. The piercing pattern consists of two candlesticks, in which bears and bulls fight for price control. The piercing is a bullish equivalent pattern of the bearish dark cloud cover. This kind of pattern is formed. The piercing name comes from the second candle piercing into the first. Web a piercing pattern is a candlestick pattern formed near the support levels, and it gives us potential bullish reversal signs. To be valid, it must appear after a move to the downside. The first candle is bearish. The piercing pattern consists of two candlesticks, in which bears and bulls fight for price control. It consists of two major components,. This type of pattern is formed when the bulls and bears both fight to gain control over the prices. The piercing pattern depends upon the near high opening prices of. The data tells us the pattern does produce profits in the stock market trading traditionally, but there’s a better way. It consists of two major components, a bullish candle of. It can indicate a potential reversal from the bearish to a bullish pattern in a downtrend and reversal from bullish to bearish in an uptrend. Its significance is heightened when it appears. The rejection of the gap down by the bulls typically can be viewed as a bullish sign. Web the piercing line is a bullish reversal candlestick pattern found. The data tells us the pattern does produce profits in the stock market trading traditionally, but there’s a better way. Web piercing pattern is a bullish reversal pattern that can be found at the end of a downtrend. Look at the diagram below. The first day of the pattern is a black candle appearing as a long line in a. Interpreting the piercing line pattern. The first candle is bearish. Here are the defining criteria for the piercing line candlestick pattern: Therefore, once the piercing line formation is complete, traders will attempt to go long (buy). This kind of pattern is formed. Web piercing pattern is a bullish reversal pattern that can be found at the end of a downtrend. The second candle opens below the close of the previous bearish candle, and manages to close above the midpoint of the previous candle. Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. The piercing pattern does best in a bear market, especially after a downward breakout. It appears at the bottom of a downtrend and indicates that buyers are starting to overwhelm sellers, pushing prices higher. The data tells us the pattern does produce profits in the stock market trading traditionally, but there’s a better way. Web the piercing pattern is a bullish reversal candlestick pattern. Web a piercing pattern is a candlestick pattern formed near the support levels, and it gives us potential bullish reversal signs. Web the first candlestick is bearish. The piercing name comes from the second candle piercing into the first. Web the piercing pattern acts in theory as it does in reality, as a bullish reversal, ranking 21 out of 103 candlestick patterns where 1 is best. It signals a potential short term reversal from downwards to upwards. The piercing pattern is made up of two candlesticks. The piercing line pattern is the opposite of the bearish dark cloud cover. Therefore, once the piercing line formation is complete, traders will attempt to go long (buy). The first candle is bearish.

Piercing Candlestick Pattern Overview with Trading Setup

Piercing Pattern Candlestick Trading For Beginners InfoBrother

piercing pattern candlestick chart pattern. Bullish Candlestick chart

Powerful Piercing Pattern How to Trade with Piercing Candlestick?2022

Candlestick Patterns The Definitive Guide (2021)

Piercing Line Candlestick Trading Guide With Chart Examples Trading

Piercing Candlestick Pattern How to Identify Piercing Line

How to Trade with the Piercing Line Pattern

Candlestick Reversal Patterns I Overview and The Piercing Pattern

What Is the Piercing Line Candlestick Pattern? FOR INVEST

It’s A Bullish Reversal Pattern, Meaning That It Signs A Potential Reversal To The Upside.

Specifically, The Piercing Pattern Is Made Up Of Two Candlesticks:

To Increase The Accuracy, You Can Trade The Piercing Using Pullbacks, Moving Averages, And Other Trading Indicators.

The Pattern Includes The First Day Opening Near The.

Related Post: