Pennant Patterns

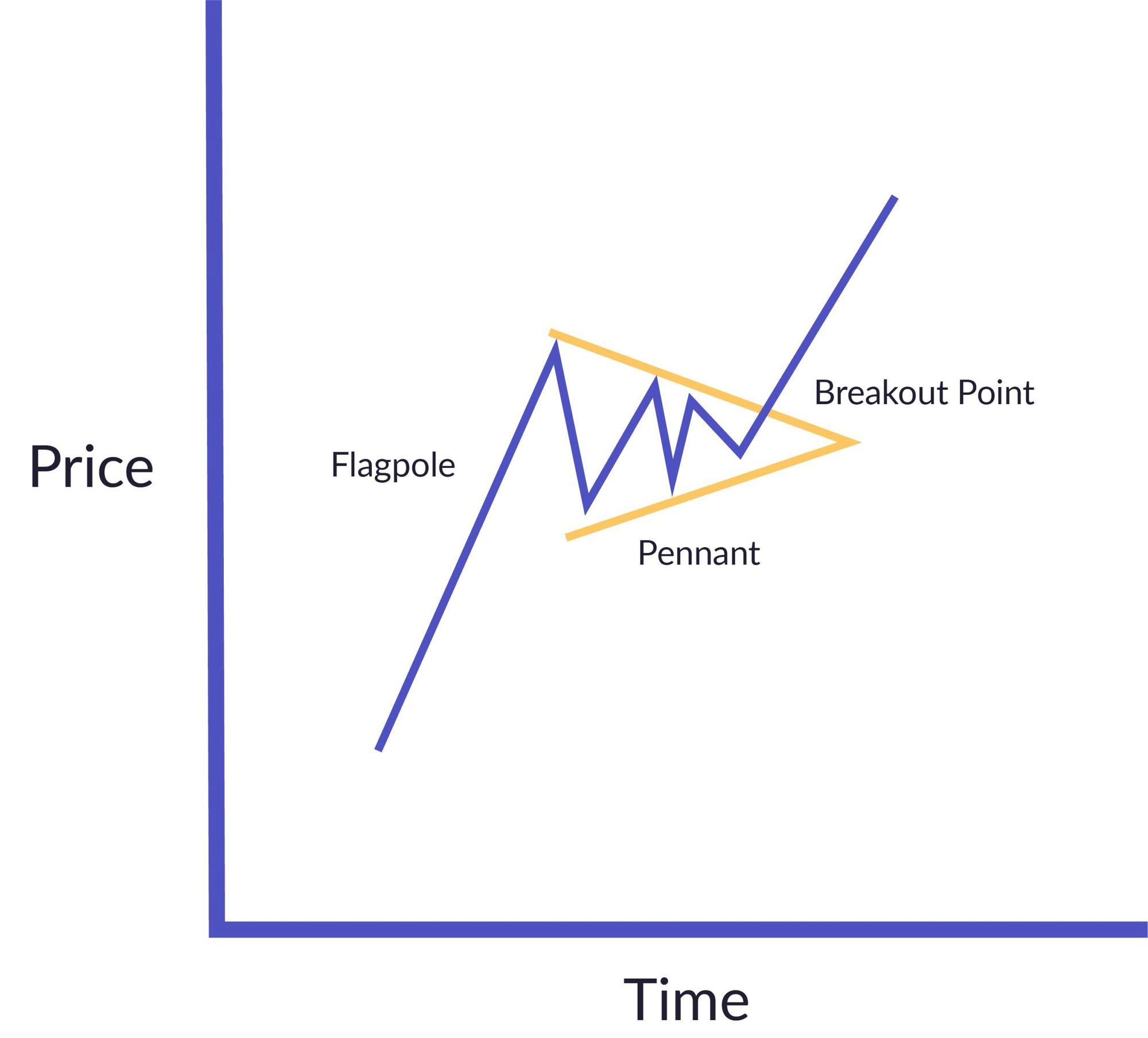

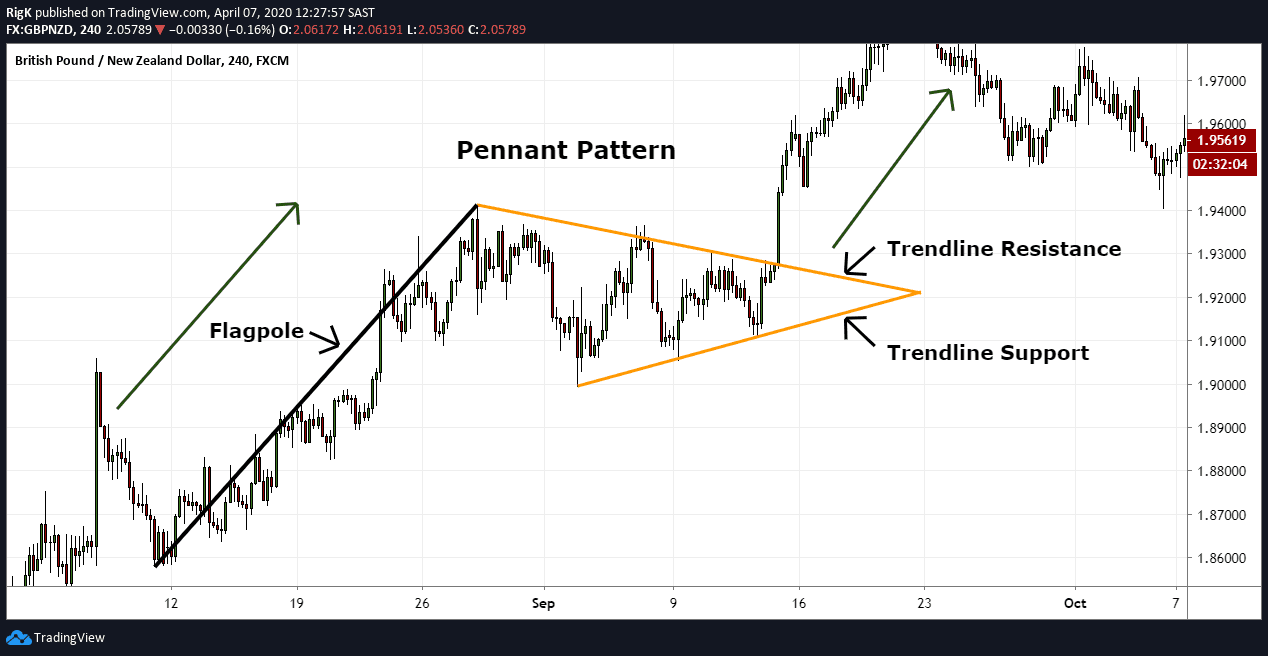

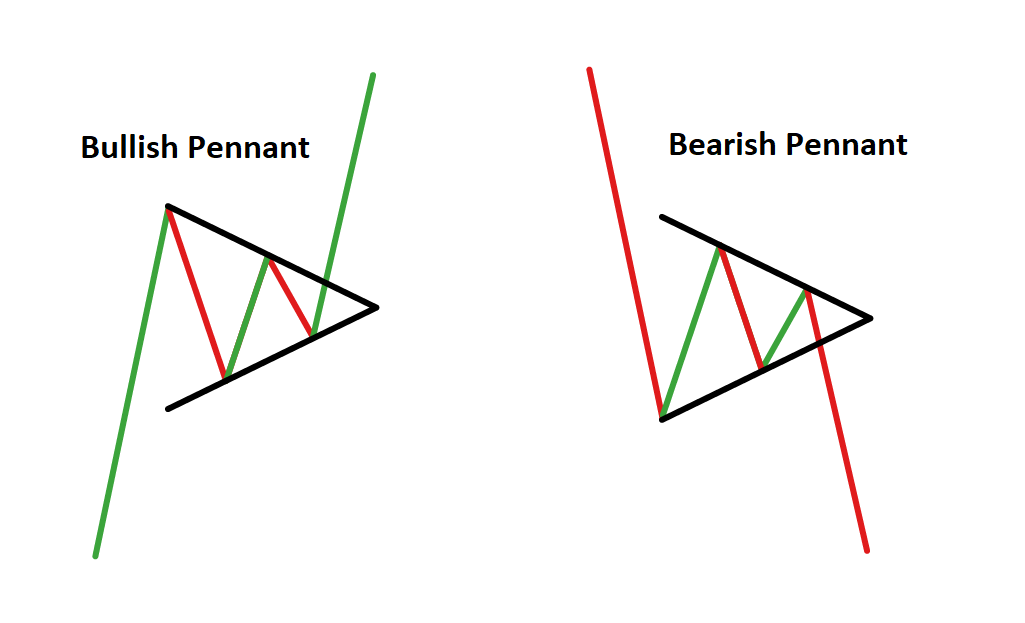

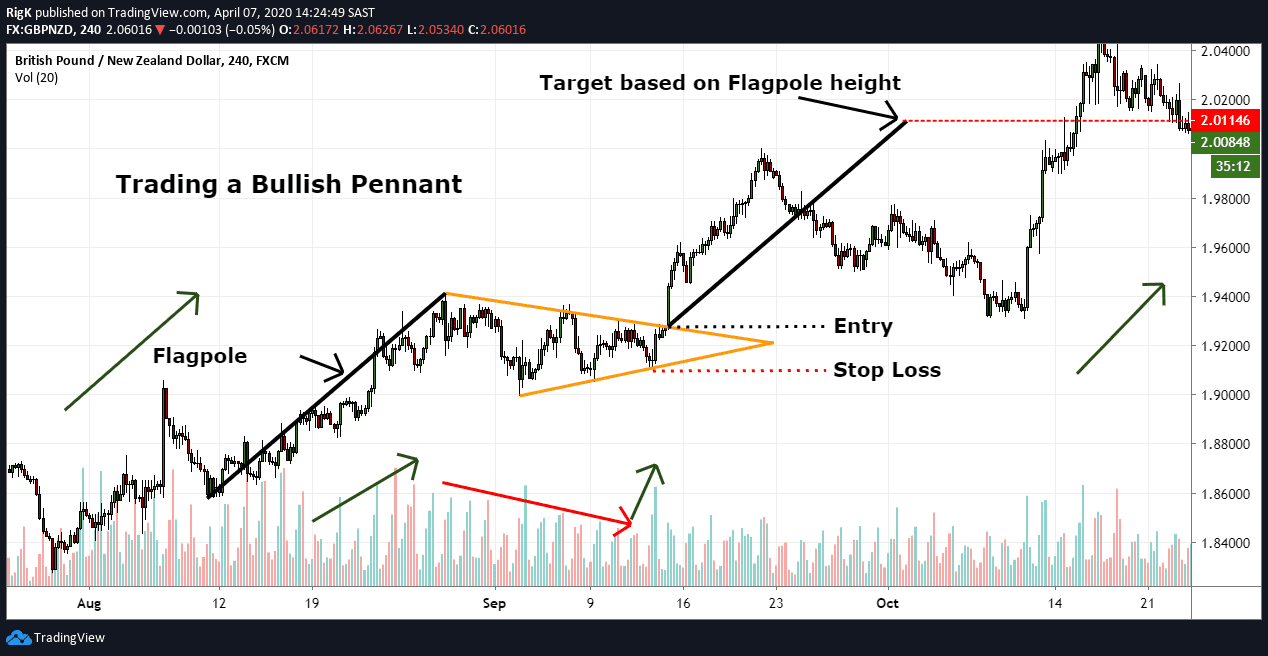

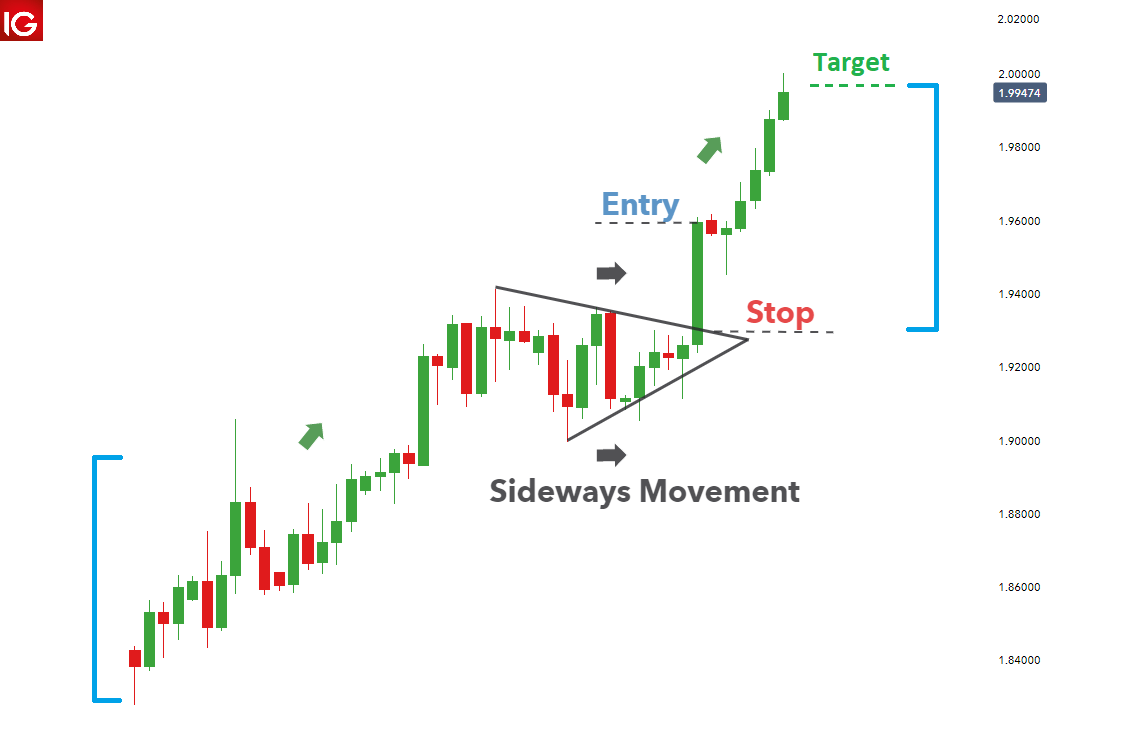

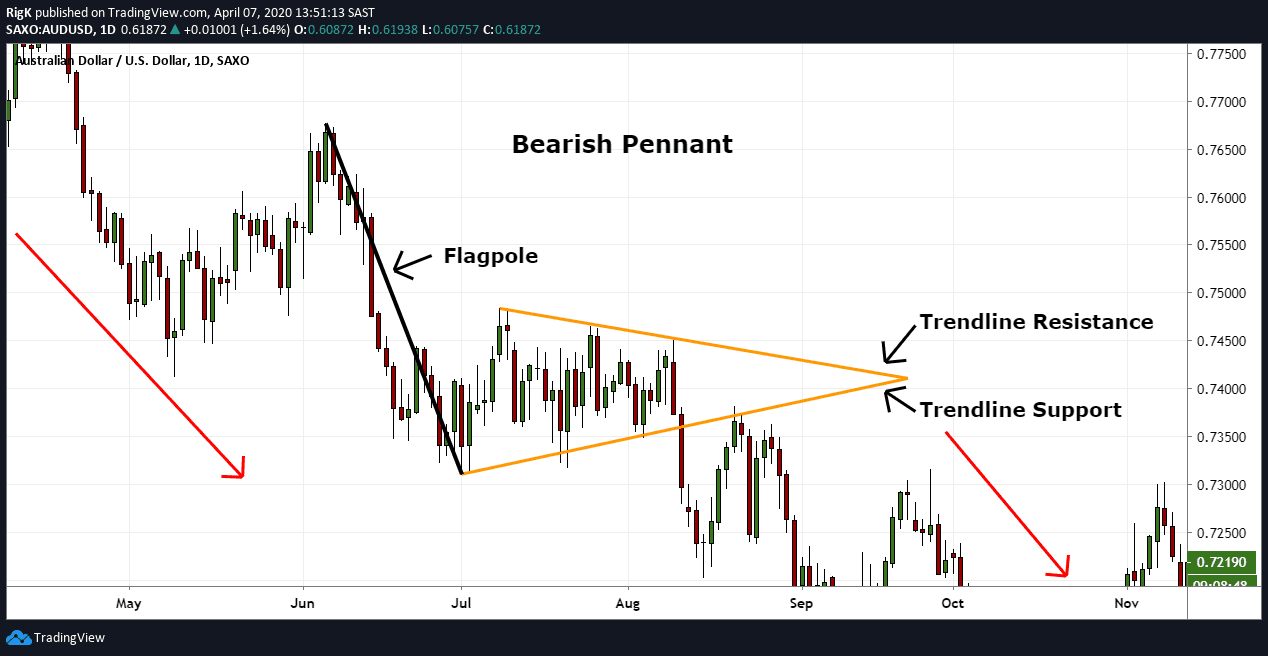

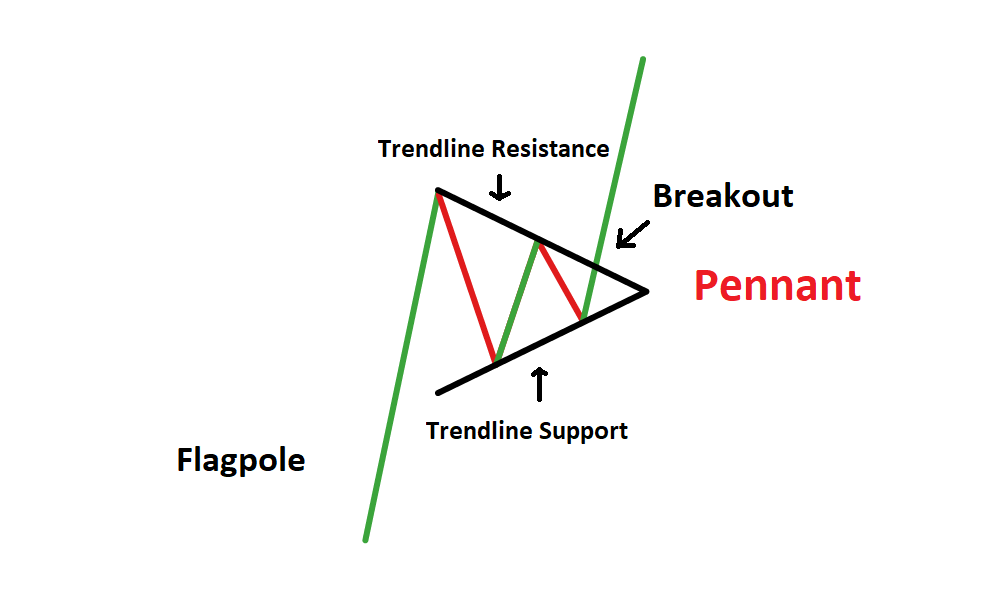

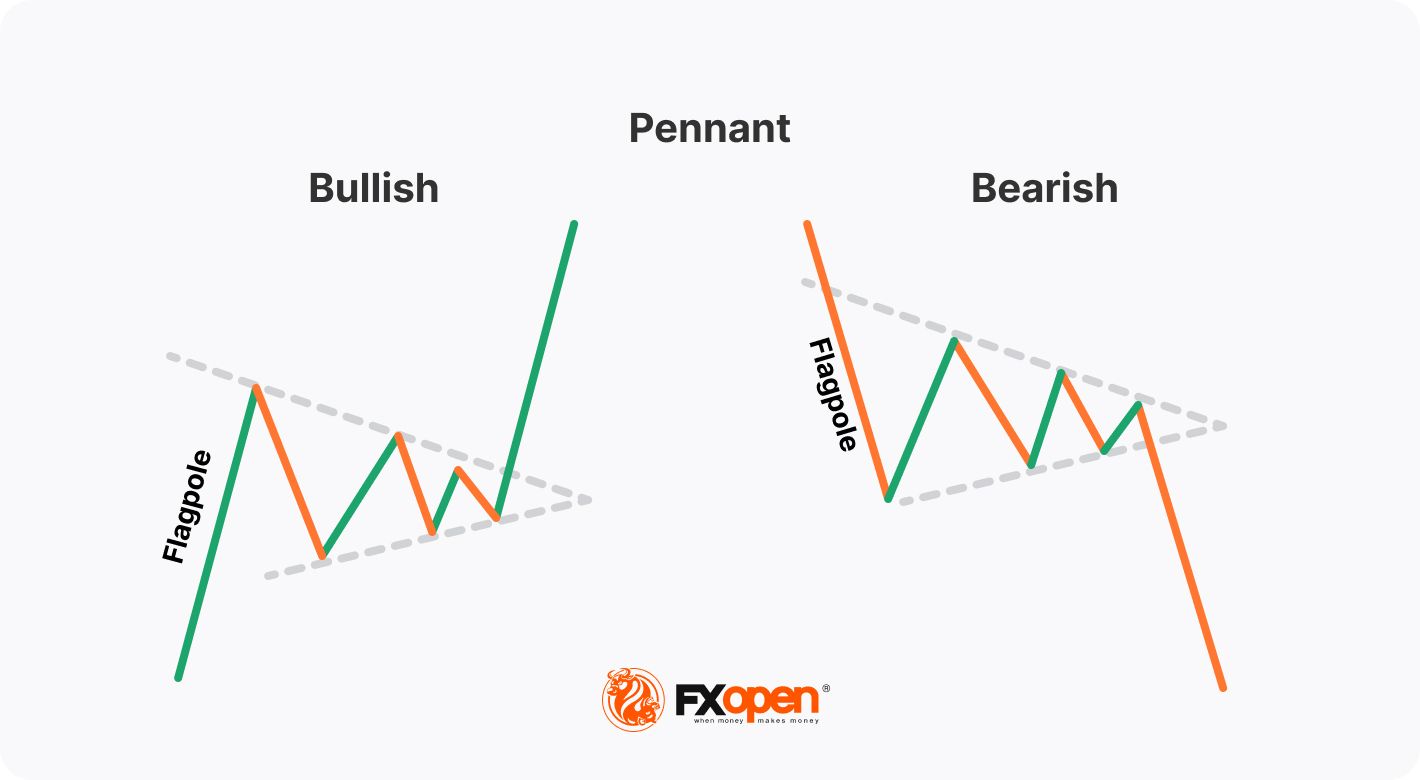

Pennant Patterns - A pennant is a specific chart pattern that indicates a market consolidation followed by a significant price movement. The pattern resembles a flagpole. Web the pennant is a continuation chart pattern that appears in both bullish and bearish markets. A pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief. What is a bullish pennant? The pattern is considered bullish if the price action is moving up towards the apex of the triangle and bearish if it is moving down. Bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend. During the consolidation phase price structure tends to move sideways within a narrowing range before a breakout occurs. They are traded in the same way, but each has a slightly different shape. The terms flag and pennant are often used interchangeably. It’s what traders call a continuation pattern, meaning it suggests the current trend is going to resume after the period of sideways price consolidation. A pennant is a specific chart pattern that indicates a market consolidation followed by a significant price movement. The formation usually occurs after a sharp price movement. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Bearish and bullish are two kinds of pennant chart patterns. When looking at a pennant pattern, one will identify three distinct phases: A bullish pennant is a technical trading pattern that indicates the impending continuation. Web what is a pennant pattern? Web updated december 10, 2023. Web pennant patterns are technical chart patterns that are used by traders to identify potential entry and exit points in the stock market. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. These. The pattern resembles a flagpole. The interest rates are quite higher as compared to the banks making it difficult for loan seekers to avoid mfi loans. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. A flag or pennant pattern forms when the price rallies sharply, then moves sideways. Web pennant pattern refers to a chart pattern that traders can witness when a stock or any other security experiences a significant move to the downside or upside after a consolidation period before it subsequently moves in the same direction. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. Pennants are similar to flag chart patterns in the terms that they have converging lines during. The terms flag and pennant are often used interchangeably. In technical analysis, a pennant is a type of continuation pattern. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend. Web 5 challenges faced. It works in the same manner as a bull flag, with the only difference being that it is a bearish pattern looking to push the price action further lower after the period of consolidation. Bearish and bullish are two kinds of pennant chart patterns. Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Web the pennant is a continuation chart pattern that appears in both bullish and bearish markets. During the. Web the bull pennant is a bullish continuation pattern that signals the extension of the uptrend after the period of consolidation is over. Once the price increases, the currency pair starts trading within a range between its support and resistance levels,. Web flags and pennants are continuation patterns. Web updated december 10, 2023. When looking at a pennant pattern, one. A pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. It works in the same manner as a bull flag, with the only difference being that it is a bearish pattern looking to push the price action further lower after the period of consolidation. Once the price increases, the currency pair starts trading within a range between its support and resistance levels,. Bearish and bullish are two kinds of pennant chart patterns. Web what is a pennant pattern? A classic pattern for technical analysts, the pennant pattern is identifiable by a large price move, followed by a consolidation period and a breakout. How to identify a pennant chart pattern? Web the bull pennant is a bullish continuation pattern that signals the extension of the uptrend after the period of consolidation is over. Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend. Web pennant pattern refers to a chart pattern that traders can witness when a stock or any other security experiences a significant move to the downside or upside after a consolidation period before it subsequently moves in the same direction. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. Web a pennant can be used as an entry pattern for the continuation of an established trend. Web pennants are continuation patterns where a period of consolidation is followed by a breakout. A pennant pattern is preceded by a strong up or down move that resembles a flagpole. Web updated december 10, 2023.

Blog Your guide to stock trading chart patterns United Fintech

Pennant Chart Patterns Definition & Examples

Pennant Chart Patterns and How to Trade them in Forex

How To Identify and Trade Pennant Patterns? Phemex Academy

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

Pennant guide How to Trade Bearish and Bullish Pennants?

How to Trade a Pennant Pattern Market Pulse

The Terms Flag And Pennant Are Often Used Interchangeably.

Web The Bear Pennant Is A Bearish Chart Pattern That Aims To Extend The Downtrend, Which Is Why It Is Considered To Be A Continuation Pattern.

These Patterns Are Usually Preceded By A Sharp Advance Or Decline With Heavy Volume, And Mark A Midpoint Of The Move.

This Chart Pattern Takes One To Three Weeks To Form.

Related Post: