Payroll Chart Of Accounts Example

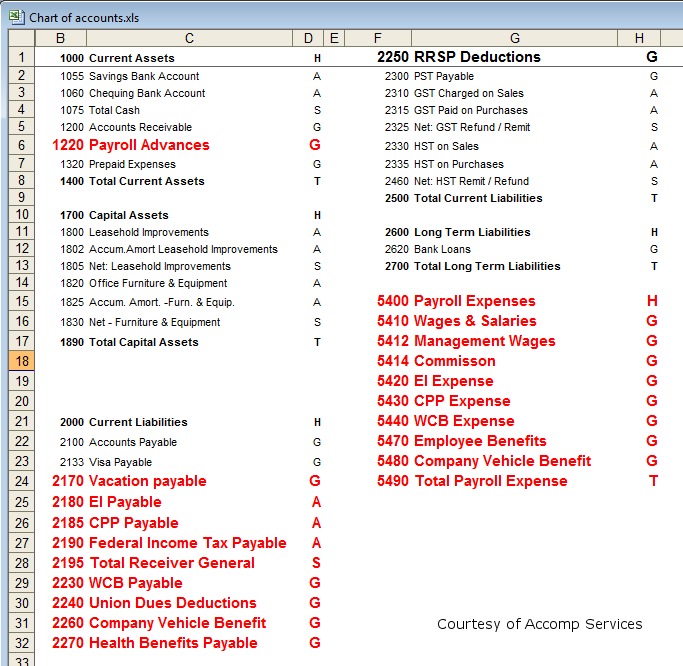

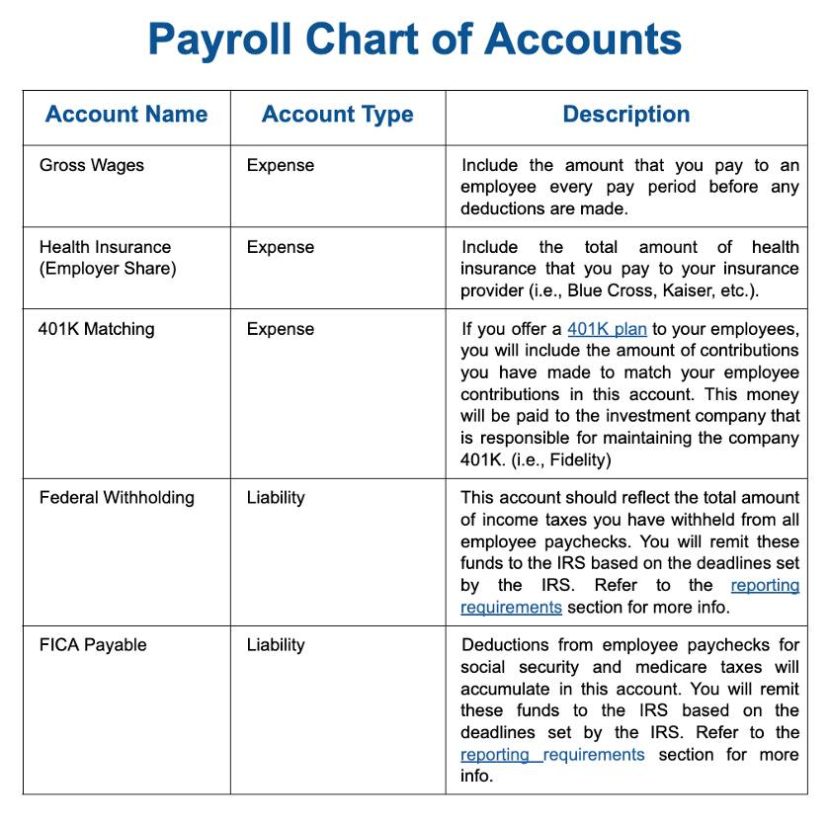

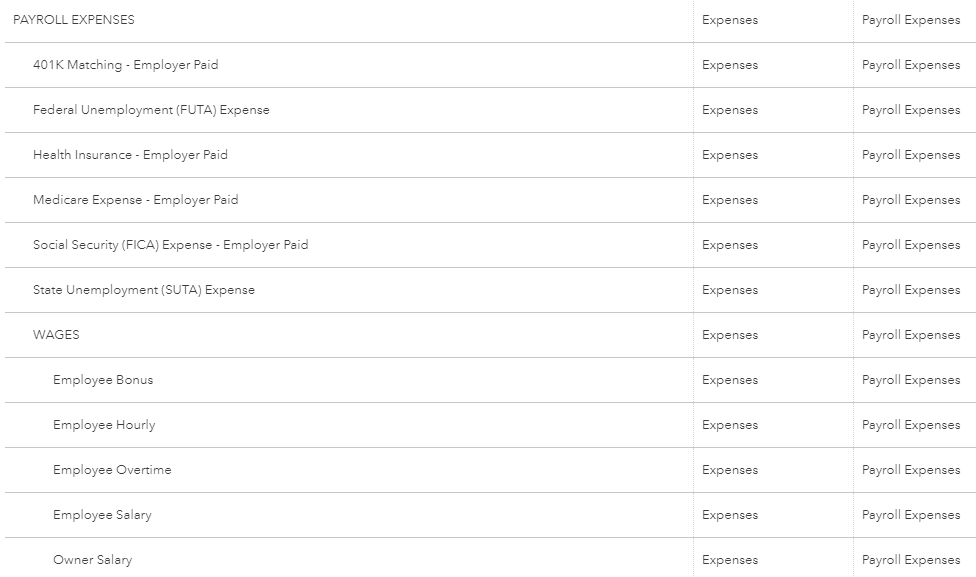

Payroll Chart Of Accounts Example - Best for payroll tax compliance. State income tax withholding payable. If you have tipped employees, make sure you’re using a template designed for that type of workforce. Web to calculate payroll, identify employee wages, complete essential paperwork, calculate gross pay and deductions, set up charts of accounts and pay taxes. This is in a different location to the chart of accounts for quickbooks online: Web the payroll chart of accounts is a list of names and account numbers which are connected with the company. Recording these costs can give small business. Web a guide for small business owners. The chart of accounts is a list of accounts that is used to categorize the financial transactions that your business generates. “the labor in cost of goods sold looks crazy. The chart of accounts often abbreviated to coa, is the foundation of the double entry bookkeeping system. I know we didn’t pay that much in shop labor this month. State income tax withholding payable. Seven steps to building the perfect chart of accounts. Web example chart of accounts. It is basically a listing of all the accounts found in the general ledger that the business will use to code each bookkeeping transaction. The chart of accounts often abbreviated to coa, is the foundation of the double entry bookkeeping system. Web to calculate payroll, identify employee wages, complete essential paperwork, calculate gross pay and deductions, set up charts of. Web the payroll chart of accounts is a list of names and account numbers which are connected with the company. Suggest you start with an account structure/framework and then fill in down to detail level needed. Best for professional employer organization (peo) services. Web the following is an example of some of the accounts you may set up to manage. This is in a different location to the chart of accounts for quickbooks online: Web here are a few examples of different types of accounts in payroll accounting: Web before you can record payroll, you will need to set up payroll accounts on your chart of accounts list. Read on to learn how to create and utilize the chart to. Web payroll accounting is the process of paying and recording employee compensation. Web here are a few examples of different types of accounts in payroll accounting: A chart of accounts helps organize your business’s transactions to reveal where money is coming from and going to. If you have tipped employees, make sure you’re using a template designed for that type. Web payroll chart of accounts. Read on to learn how to create and utilize the chart to keep better track of your business’s accounts. Seven steps to building the perfect chart of accounts. State income tax withholding payable. Web chart of accounts: The chart of accounts helps you do just that. Web payroll chart of accounts. Fica ( federal insurance contributions act) tax payable. This is in a different location to the chart of accounts for quickbooks online: Web what is a chart of accounts and why is it important? A company has the flexibility to tailor its chart of accounts to best suit its needs, including adding accounts as needed. Web sample payroll chart of accounts with numbering coa (chart of accounts) vary by company, system, industry, requirements and preferences. The chart of accounts is a list of accounts that is used to categorize the financial transactions that your. Web payroll chart of accounts. This would be any form of compensation that an employee might receive in. Web the payroll chart of accounts is a list of names and account numbers which are connected with the company. Balance sheet accounts, which record the company’s assets, debts and net worth, and income statement accounts, which record income from all sources. The chart of accounts often abbreviated to coa, is the foundation of the double entry bookkeeping system. A company has the flexibility to tailor its chart of accounts to best suit its needs, including adding accounts as needed. Best for payroll tax compliance. Fica ( federal insurance contributions act) tax payable. Each time you add or remove an account from. Web a chart of accounts is a listing of the names of the accounts that a company has identified and made available for recording transactions in its general ledger. Federal income tax withholding payable. The chart of accounts helps you do just that. Web learn more about how to configure chart of accounts for payroll in quickbooks payroll powered by employment hero. Each time you add or remove an account from your business, it’s important to record it into the correct account. Web sample chart of accounts template. Web the payroll chart of accounts is a list of names and account numbers which are connected with the company. “the labor in cost of goods sold looks crazy. Here’s an example of a chart of accounts: I know we didn’t pay that much in shop labor this month. Web before you can record payroll, you will need to set up payroll accounts on your chart of accounts list. It provides a logical structure to make it easy to record information and to add or remove accounts. It also covers withholding payments to third parties. Web what is a chart of accounts and why is it important? This would be any form of compensation that an employee might receive in. This is in a different location to the chart of accounts for quickbooks online:

download chart of accounts from quickbooks to excel customizablegm

Sample Chart of Accounts Template Double Entry Bookkeeping

Small Business Payroll Software Simply Accounting Tutorial

Chart of Accounts Payroll Tax Taxes

Free Payroll Templates Tips & What To Include

The Chart of Accounts List Builds Your QuickBooks Online Company

MYOB Sample Chart of Accounts (Task 1) Debits And Credits Expense

Chart Of Accounts Payroll

Chart Of Accounts For Payroll In Quickbooks

Chart Of Accounts For Payroll

It Includes All Aspects Of Paying And Calculating Employee Compensation.

Best For Payroll Tax Compliance.

Web The Following Is An Example Of Some Of The Accounts You May Set Up To Manage And Record Your Payroll:

Fica ( Federal Insurance Contributions Act) Tax Payable.

Related Post: