Payroll Accounting Course

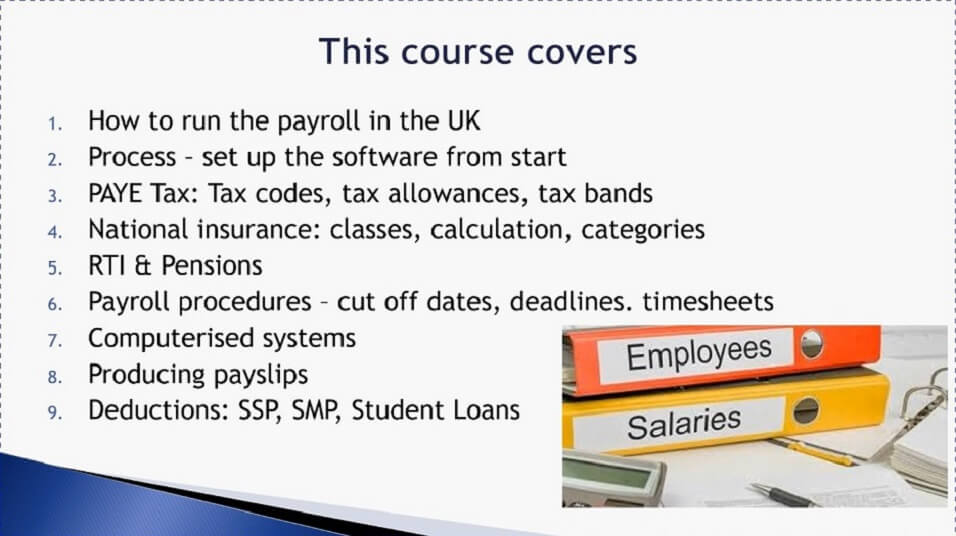

Payroll Accounting Course - Emphasizes applying payroll laws and regulations, computing wages, salaries, and payroll tax liabilities, preparing payroll reports and maintaining payroll records. We then walk through an example of recording journal entries for payroll transactions and accruals for a month. Web course #10101135 type post secondary credits 3.00 subject accounting introduces various payroll laws, payroll accounting systems, and procedures. Introduction to payroll and employees. Web using the pay statement as our roadmap, this course covers the basics of payroll that everyone who receives a paycheck should know. Accounting is the “language of business.”. Micromasters® program in accounting by indiana university (edx) 5. Web some courses of interest to payroll accounting professionals may include: Learn payroll accounting, earn certificates with paid and free online courses from youtube, udemy, study.com, futurelearn and other top learning platforms around the world. Web this course prepares the learner with the basic knowledge needed to administer the accounting for payroll. How to calculate various payroll amounts, including gross and taxable wages, deductions, and certain taxes. Being able to understand this language allows individuals both inside and outside of an organization to join the “conversation” about how the organization is performing and how it can improve future performance. Enrollees also learn how to prepare and file payroll reports. Web learn how. These tasks includes calculating employee wages, withholding taxes, and other deductions. Web in payroll accounting, students learn to manage and process payroll for companies, organizations, and businesses. Web learn payroll accounting today: Accounting is the “language of business.”. Web certification prep to demonstrate your mastery of payroll operations and compliance, earn one of the two payroll certifications payrollorg offers. Web learn how to use payroll accounting to keep track of wages, benefits and taxes in this free online bookkeeping course. Financial accounting focuses on the reports that. Introduction to payroll and employees. These tasks includes calculating employee wages, withholding taxes, and other deductions. The fundamental payroll certification (fpc) signifies a baseline knowledge of payroll while the certified payroll professional. Led by an experienced cpa, this course offers practical examples and valuable insights into the intricacies of payroll processing. We will discuss debits, credits, liabilities, and assets. Federal taxation of individuals & businesses. Find your payroll accounting online course on udemy Fundamentals of accounting specialization by university of illinois (coursera) 4. Meet the educational requirements before you can take the fundamental payroll certification (fpc) exam, you must meet the apa's educational requirements. The calculation, management, recording, and analysis of employees’ compensation. Financial accounting fundamentals by university of virginia (coursera) 3. Putting your procedures into writing Review of the basics and recent developments creating a payroll manual: Learn payroll accounting, earn certificates with paid and free online courses from youtube, udemy, study.com, futurelearn and other top learning platforms around the world. Web home courses accounting & finance training payroll course get an understanding of payroll processes, regulations, and compliance requirements improve your understanding on health insurance, retirement plans, etc learn the crucial intricacies of payroll management with. Federal taxation of individuals & businesses. Web payroll tax and accounting mgmt x 427.13 this course provides a fundamental introduction to the complexities and responsibilities of payroll tax laws, forms, and accounting. This bookkeeping course lays out the fundamentals of payroll accounting. Federal taxation as applied to individuals and businesses. Most payroll clerks will work in the accounting department of. Web payroll accounting courses and certifications. Being able to understand this language allows individuals both inside and outside of an organization to join the “conversation” about how the organization is performing and how it can improve future performance. Web the diploma in bookkeeping and payroll accounting program provides students with an introductory understanding of general and payroll accounting practices and. Learners will develop knowledge in u.s. Web home courses accounting & finance training payroll course get an understanding of payroll processes, regulations, and compliance requirements improve your understanding on health insurance, retirement plans, etc learn the crucial intricacies of payroll management with our payroll course dates & prices download syllabus payroll. Emphasizes applying payroll laws and regulations, computing wages, salaries,. Read reviews to decide if a class is right for you. Introduction to finance, accounting, modeling and valuation (udemy) 6. Web learn how to use payroll accounting to keep track of wages, benefits and taxes in this free online bookkeeping course. This bookkeeping course lays out the fundamentals of payroll accounting. Web certification prep to demonstrate your mastery of payroll. Federal taxation of individuals & businesses. Web home courses accounting & finance training payroll course get an understanding of payroll processes, regulations, and compliance requirements improve your understanding on health insurance, retirement plans, etc learn the crucial intricacies of payroll management with our payroll course dates & prices download syllabus payroll. Web payroll accounting courses and certifications. Web learn how to use payroll accounting to keep track of wages, benefits and taxes in this free online bookkeeping course. Learners will develop knowledge in u.s. Review of the basics and recent developments creating a payroll manual: Led by an experienced cpa, this course offers practical examples and valuable insights into the intricacies of payroll processing. Web payroll tax and accounting mgmt x 427.13 this course provides a fundamental introduction to the complexities and responsibilities of payroll tax laws, forms, and accounting. These tasks includes calculating employee wages, withholding taxes, and other deductions. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Emphasizes applying payroll laws and regulations, computing wages, salaries, and payroll tax liabilities, preparing payroll reports and maintaining payroll records. One of these is earning a high school diploma or general. Fundamentals of accounting specialization by university of illinois (coursera) 4. Starting with your classification as an employee, you'll learn why certain new hire forms are required; This bookkeeping course lays out the fundamentals of payroll accounting. Find your payroll accounting online course on udemy

ACCT 032 Payroll Accounting Simple Book Production

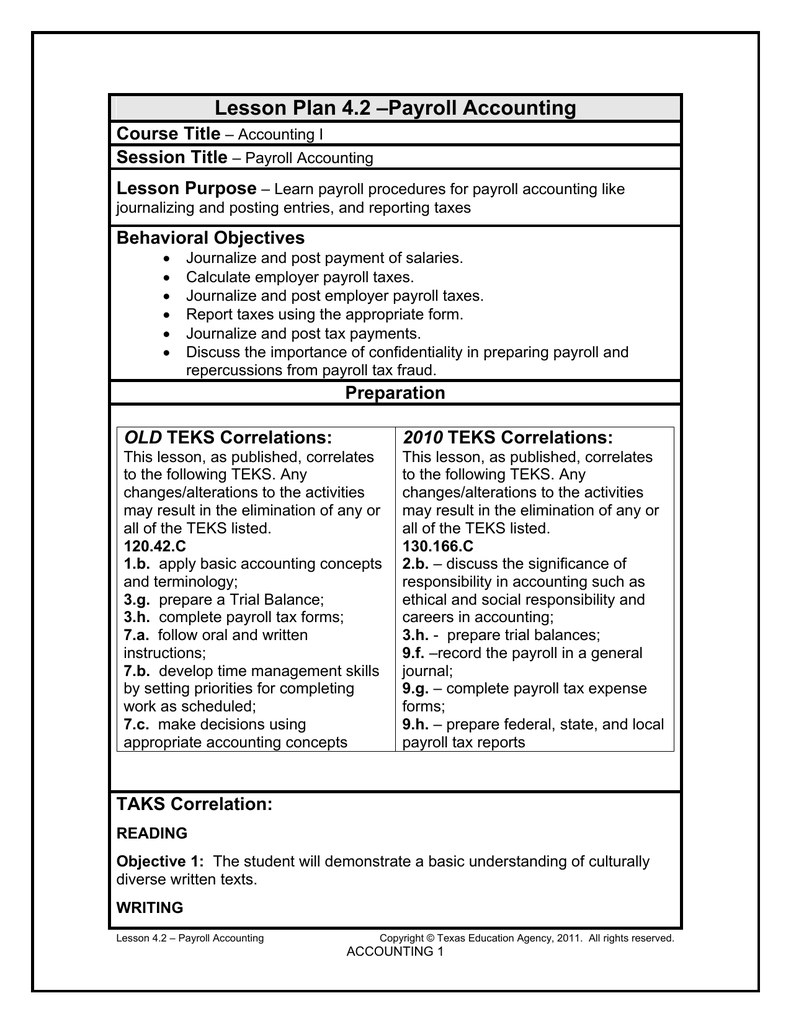

Payroll Accounting Lesson Plan 4.2 Course Title Session Title

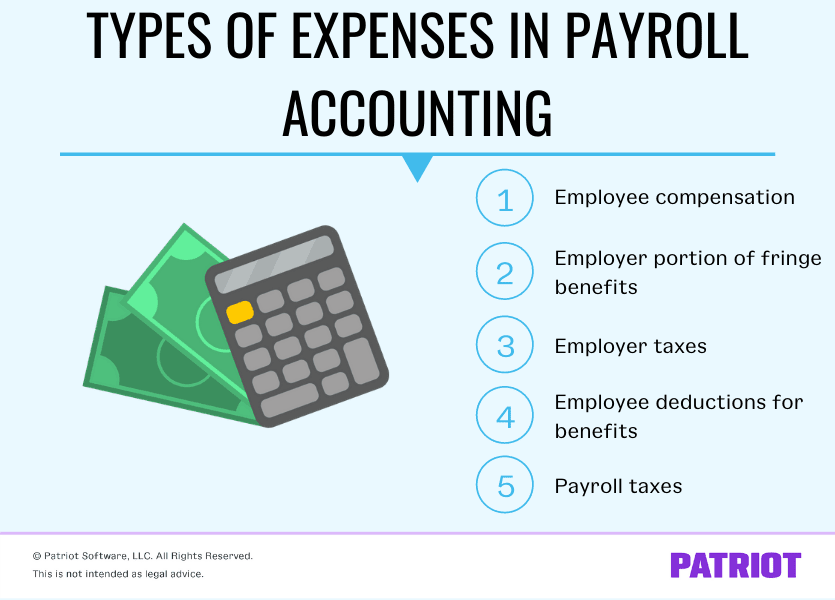

What Is Payroll Accounting? How to Do Payroll Journal Entries

10 Compelling Reasons to Enroll in an Accounting and Payroll Course

Payroll with QuickBooks Online Payroll Training Course NACPB

Accounting for Payroll Course QBOchat

Payroll Accounting Book (Paperback)

Payroll Management Online Course Institute of Accountancy

Payroll Accounting using Xero Learn Now Publications

Payroll Management Online Course Institute of Accountancy

View Course Options Read More About This Course Fall Winter Spring Summer Remote Starting At $855.00 As Few As 11 Weeks 4.0 What You Can Learn.

Web Course #10101135 Type Post Secondary Credits 3.00 Subject Accounting Introduces Various Payroll Laws, Payroll Accounting Systems, And Procedures.

Web Learn Payroll Accounting Today:

Financial Accounting Focuses On The Reports That.

Related Post: