Order Flow Charts

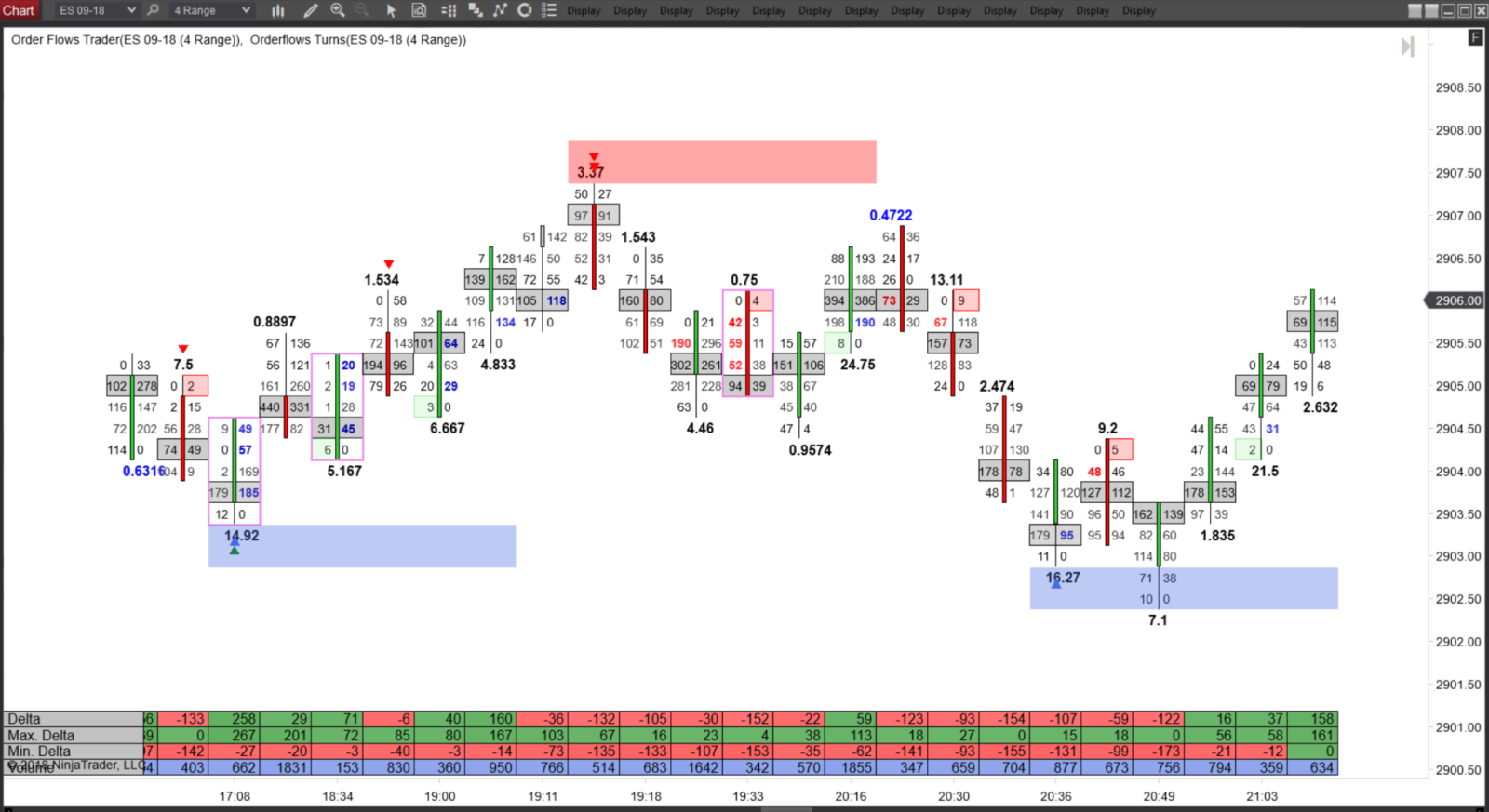

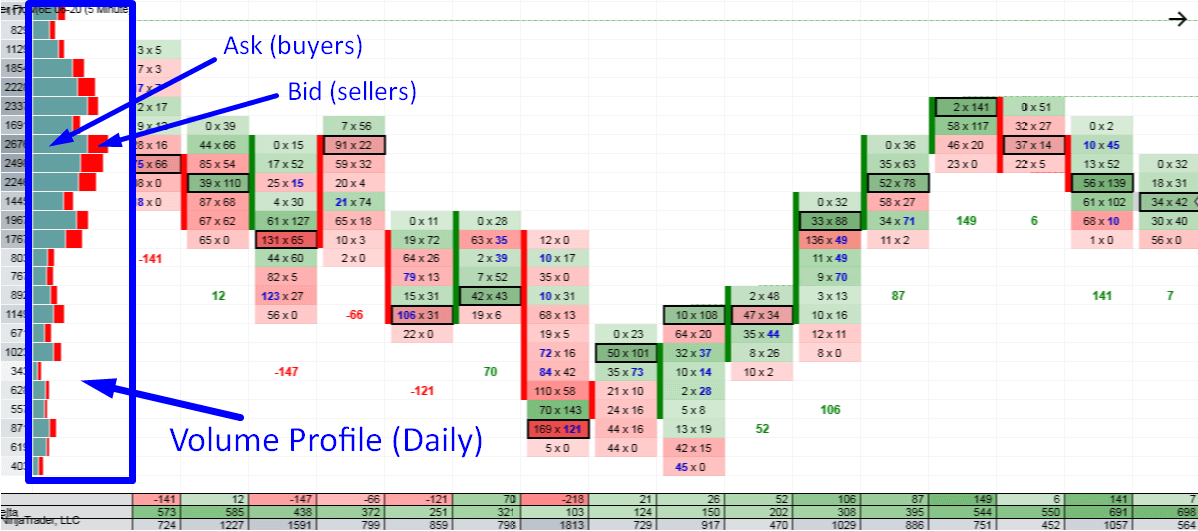

Order Flow Charts - The guide aims to demystify order flow trading, an influential technique that can potentially transform trading approaches. Order flow + studien sind für alle ninjatrader lifetime lizenzkunden enthalten. Supply chain by amazon is a fully automated set of supply chain services that gets your products from manufacturers to customers around the world. Market sentiment refers to the general opinion of investors towards a certain security or financial market. A video explaining orderflow setup in gocharting # Its primary benefit rests in its unique ability to see clearly who is in control of the market based on market generated information as it happens. Web order flow trading is a type of trading strategy where trading edges are defined through the analysis of advertised orders and/or executed orders. They can help traders identify areas of support and resistance, as well as potential buying or selling pressure. How everyone always focuses on price in forex? Let’s take a look at the main ones and how they can be used. They help traders identify patterns, such as absorption or exhaustion of buying or selling pressure, to make effective trading decisions. Web discover the best online brokerage account in 2024. Analysis of the orders being placed, their volume, and how they interact with the current market depth are all part of this process. This innovative tool is designed to enhance your. → 400+ footprint configurations based on volume, delta, trades, bid x ask data; Web the three most common types of order flow charts are total volume order flow, bid x ask order flow (footprint), and delta order flow. Web order flow trading is a strategy that bases trading decisions on an analysis of the flow of buy and sell orders. The study gives idea about the type of trade, direction of trade and the impact of the stock movement on price. “what’s price doing right now: Identify buying and selling pressure to confirm market movement in a specific direction as the trading action unfolds through visualization of the order flow. Web the three most common types of order flow charts. Web order flow trading is the process of analysing the flow of trades being placed by other traders on a specific market. A video explaining orderflow setup in gocharting # In other words, the order flow analysis allows you to see how other market participants are trading (buying or selling). Market sentiment refers to the general opinion of investors towards. Order flow trading is a strategy that offers traders an edge by providing valuable market insights. They can help traders identify areas of support and resistance, as well as potential buying or selling pressure. Identify buying and selling pressure to confirm market movement in a specific direction as the trading action unfolds through visualization of the order flow. This innovative. A video explaining orderflow setup in gocharting # It is suitable for any trading instrument that has enough volume to create a true supply and demand driven market. Web order flow trading is a type of trading strategy where trading edges are defined through the analysis of advertised orders and/or executed orders. Identify buying and selling pressure to confirm market. You are free to use this image on your website, templates, etc, please provide us with an attribution link. It is suitable for intraday traders and swing traders alike and can be used for longer term position traders too. Footprint charts come in several different variations. Web order flow trading is a type of trading strategy where trading edges are. Web atas offers unlimited possibilities for building and customizing charts: They can help traders identify areas of support and resistance, as well as potential buying or selling pressure. Web this advanced charting software enables you to track all trading orders that are processed in the market, giving you the unfair advantage of tracking the big financial institutions and identifying the. The core focus of order flow trading is: This method allows traders to identify key levels and discern strong support and resistance locations. Supply chain by amazon is a fully automated set of supply chain services that gets your products from manufacturers to customers around the world. Identify buying and selling pressure to confirm market movement in a specific direction. The study gives idea about the type of trade, direction of trade and the impact of the stock movement on price. The core focus of order flow trading is: Web use volume profile, order flow vwap and more with the order flow + feature set. → 400+ footprint configurations based on volume, delta, trades, bid x ask data; Web footprint. It is suitable for any trading instrument that has enough volume to create a true supply and demand driven market. How everyone always focuses on price in forex? The guide aims to demystify order flow trading, an influential technique that can potentially transform trading approaches. A video explaining orderflow setup in gocharting # The study gives idea about the type of trade, direction of trade and the impact of the stock movement on price. In other words, the order flow analysis allows you to see how other market participants are trading (buying or selling). It is suitable for intraday traders and swing traders alike and can be used for longer term position traders too. Supply chain by amazon is a fully automated set of supply chain services that gets your products from manufacturers to customers around the world. The bid/ask footprint chart above displays all of market orders that traded on the bid and the ask for every price level. You are free to use this image on your website, templates, etc, please provide us with an attribution link. Web footprint charts are visual representations of order flow and volume at different price levels. This is done by watching the order book and also footprint charts. They can help traders identify areas of support and resistance, as well as potential buying or selling pressure. “what’s price doing right now: Web order flow trading refers to the analysis that traders and investors make in the stock market, primarily by using the order book. → 400+ footprint configurations based on volume, delta, trades, bid x ask data;

Orderflows Turns All In One Order Flow Analysis Tool

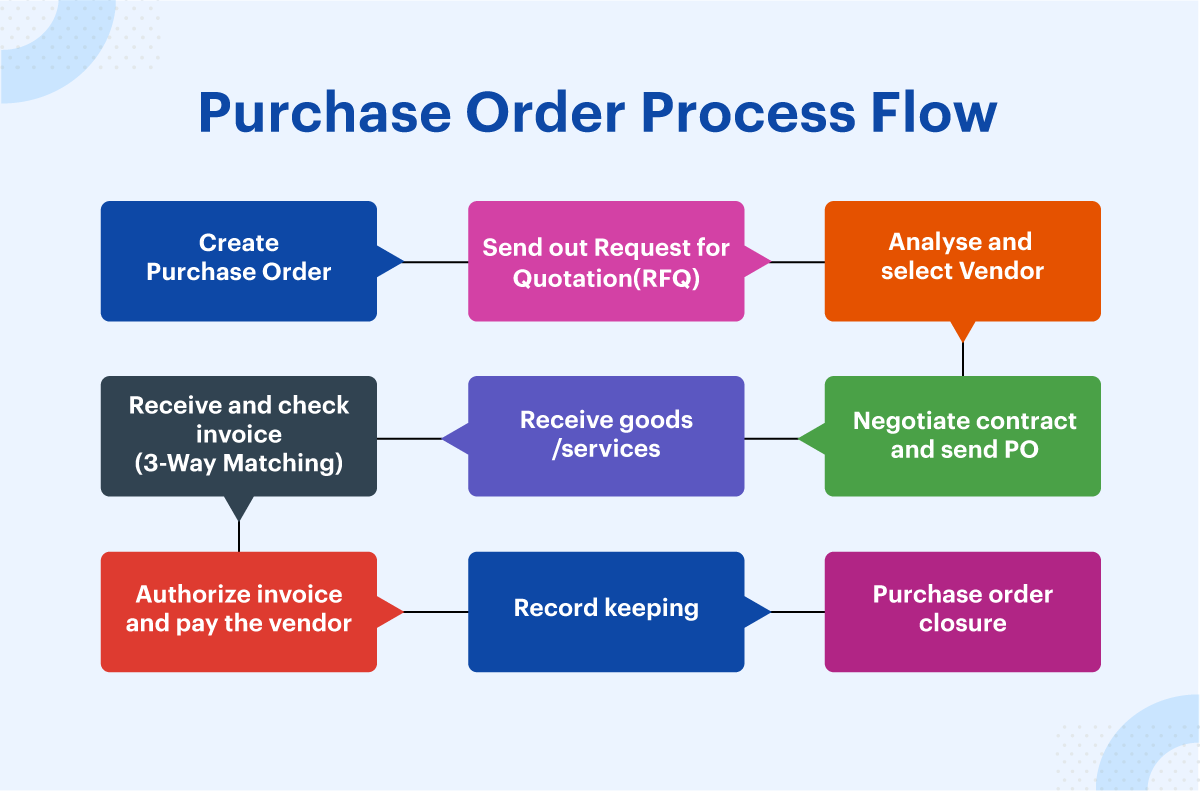

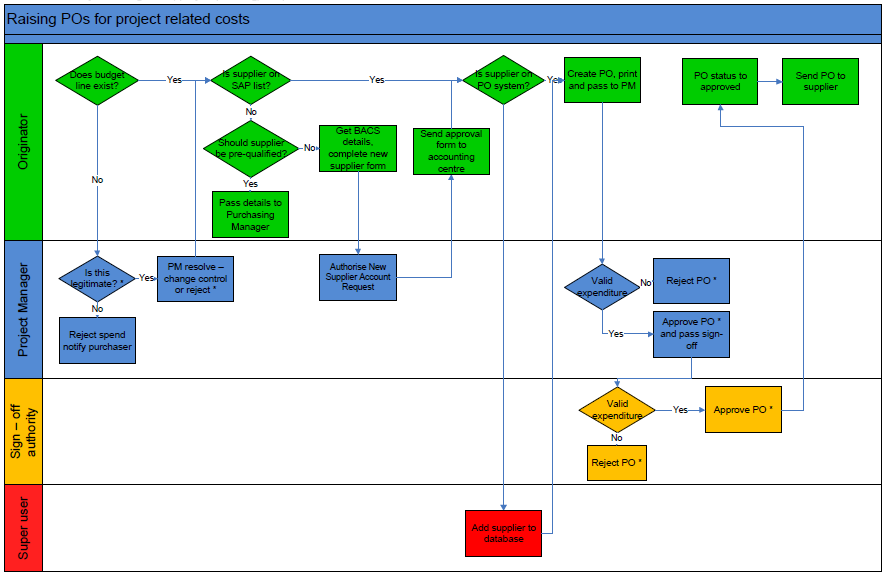

Flowchart For Raising A Purchase Order Flow Chart Process Flow Images

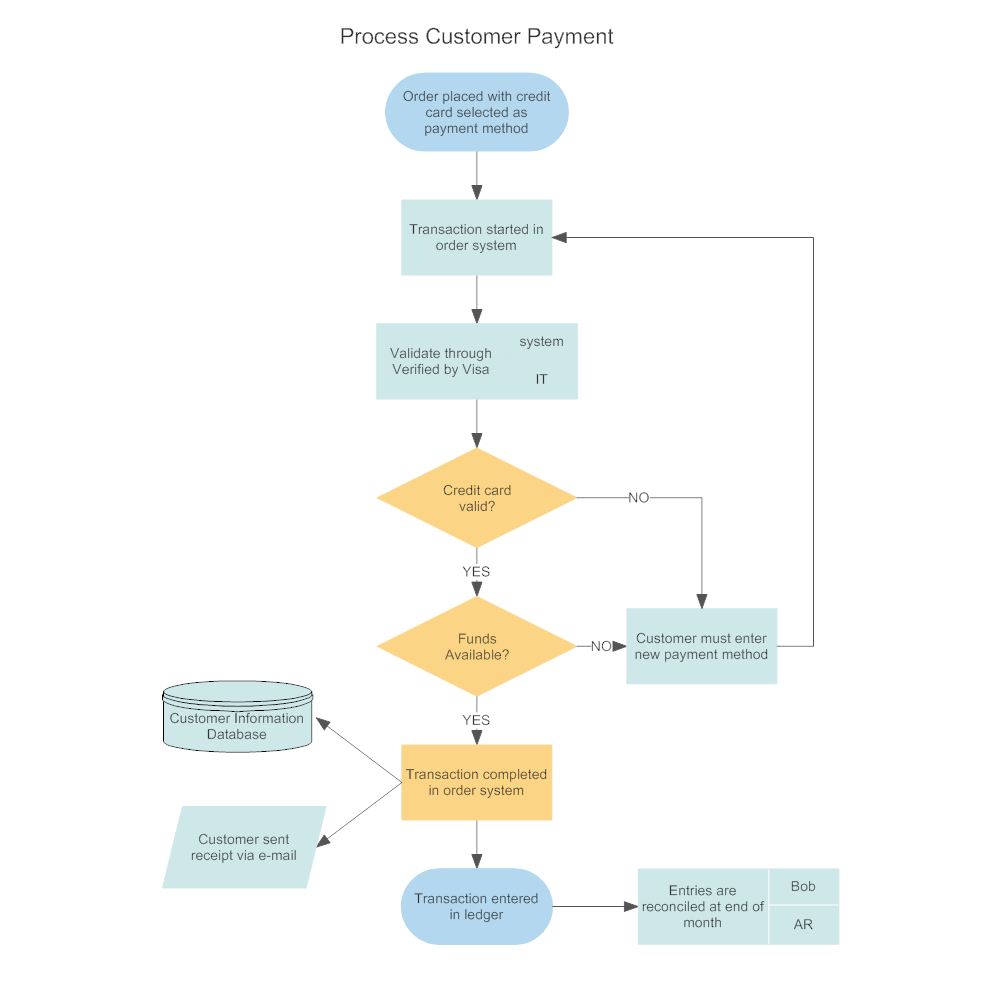

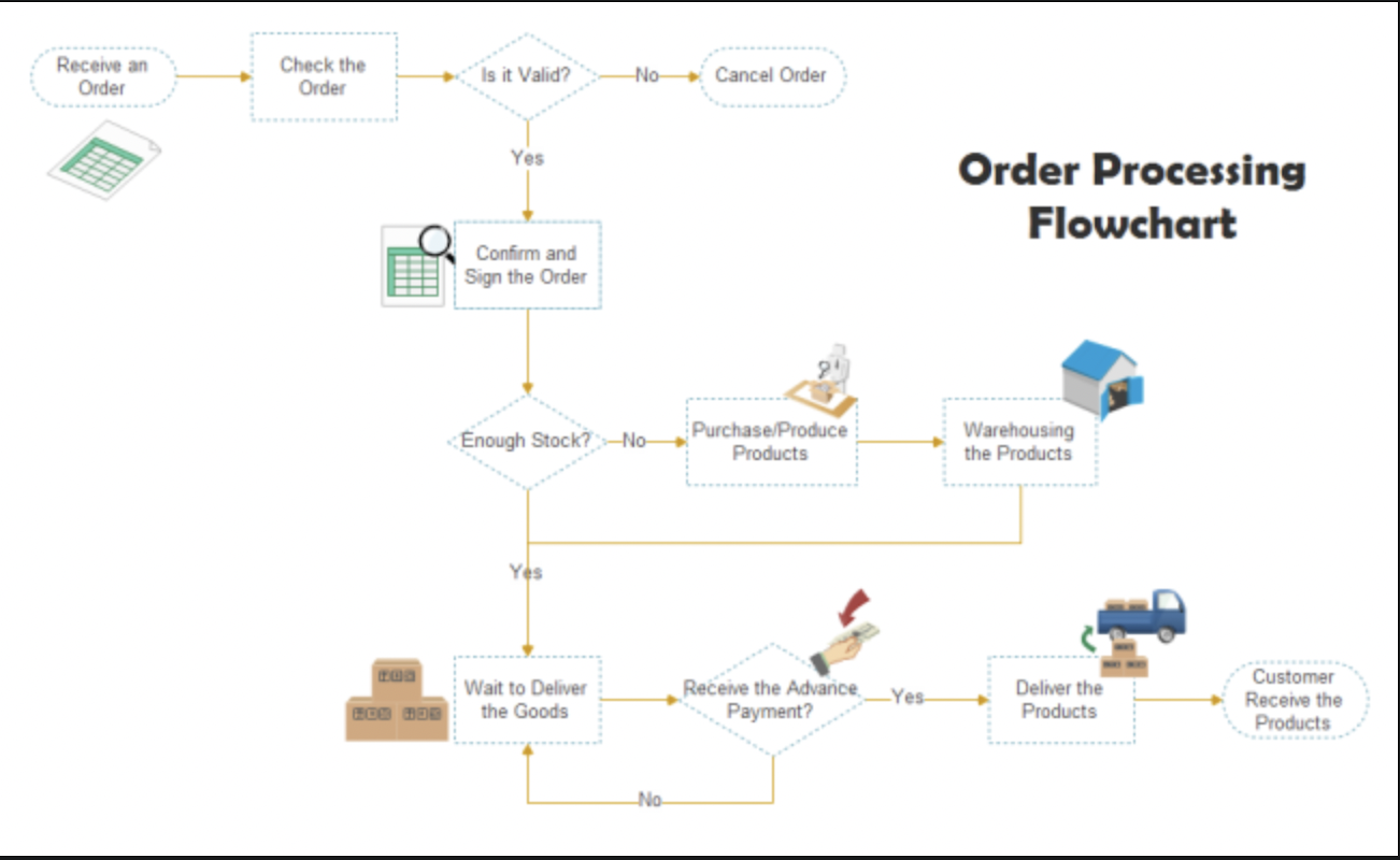

Customer Order Processing Flowchart

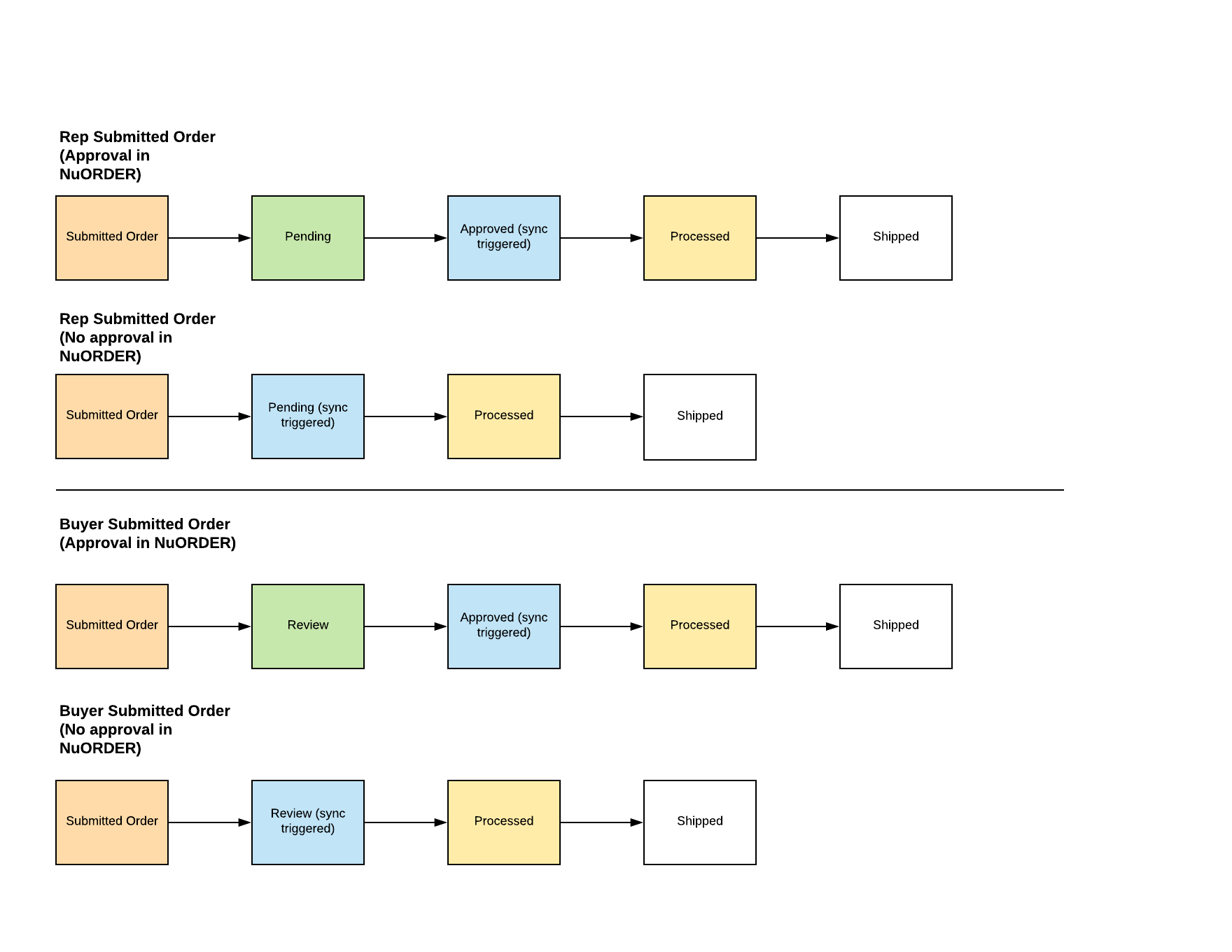

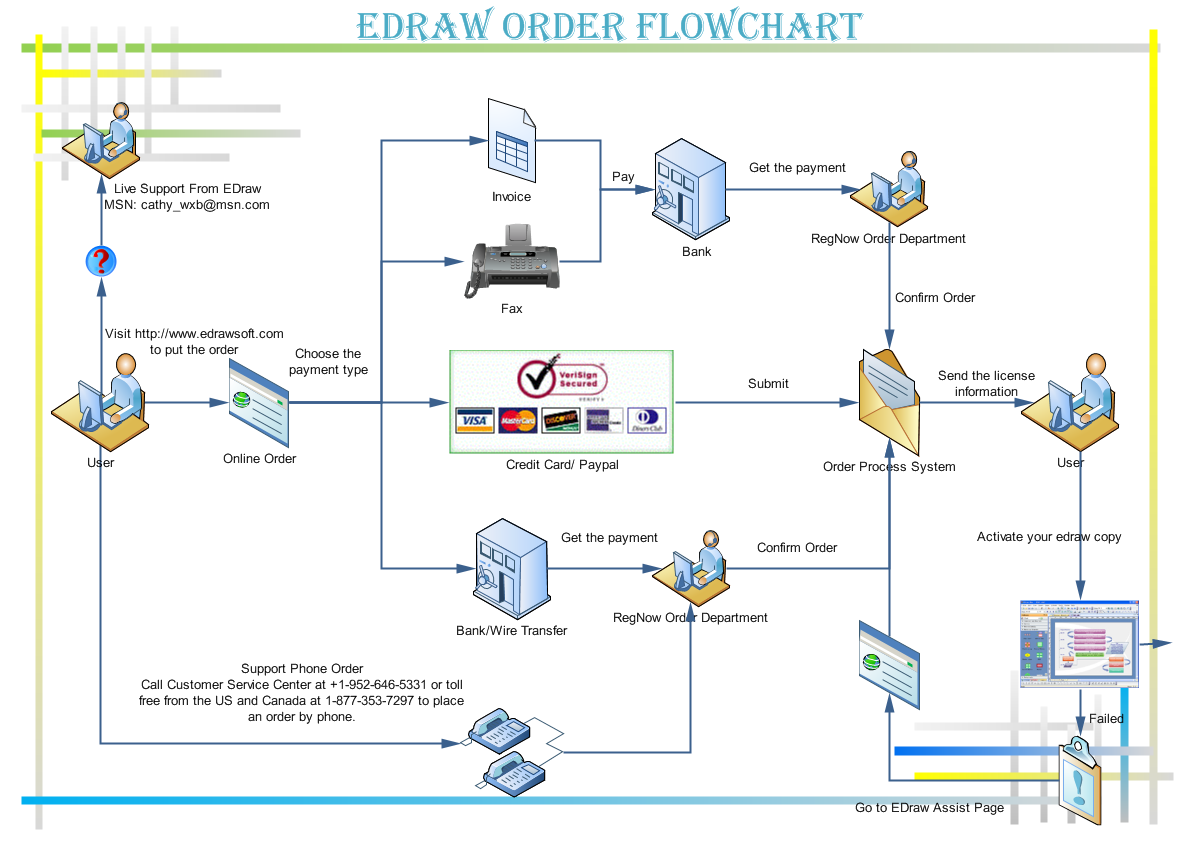

NuORDER Order Flow Chart NuORDER Help Desk Home

Flowchart for raising a Purchase Order

How Order Management Process Workflows and Flow Charts Work

20+ Flow Chart Templates, Design Tips and Examples Avasta

Beginners Guide to Order Flow PART 1 What Is Order Flow?

Order Flowchart how to order the Edraw products

Sales Order Process Flow Diagram

Order Flow Traders Look To Profit By Capitalizing On Market Imbalances.

Web This Advanced Charting Software Enables You To Track All Trading Orders That Are Processed In The Market, Giving You The Unfair Advantage Of Tracking The Big Financial Institutions And Identifying The Strongest Support And Resistance Zones.

Web Orderflows Charts Are For Active Traders With Adequate Risk Capital.

The Understanding Of Other Traders.

Related Post: