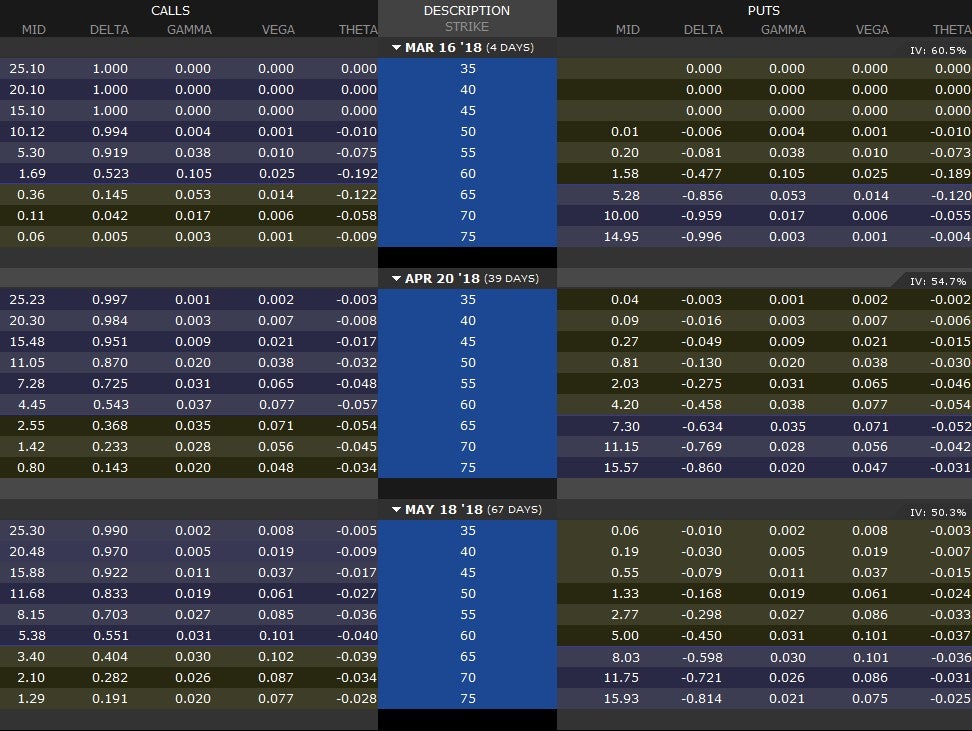

Option Greeks Chart

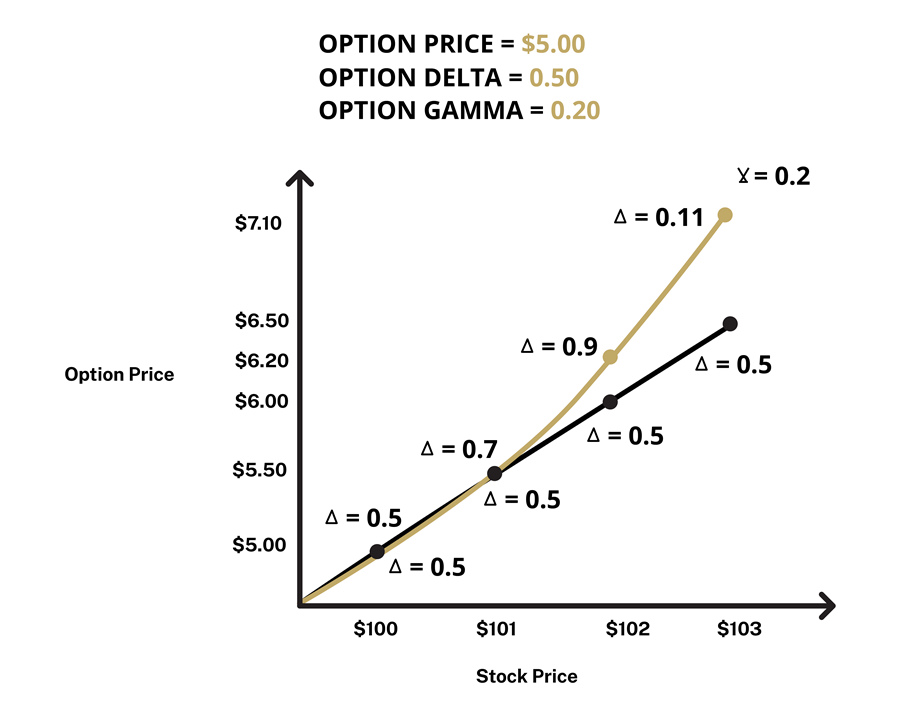

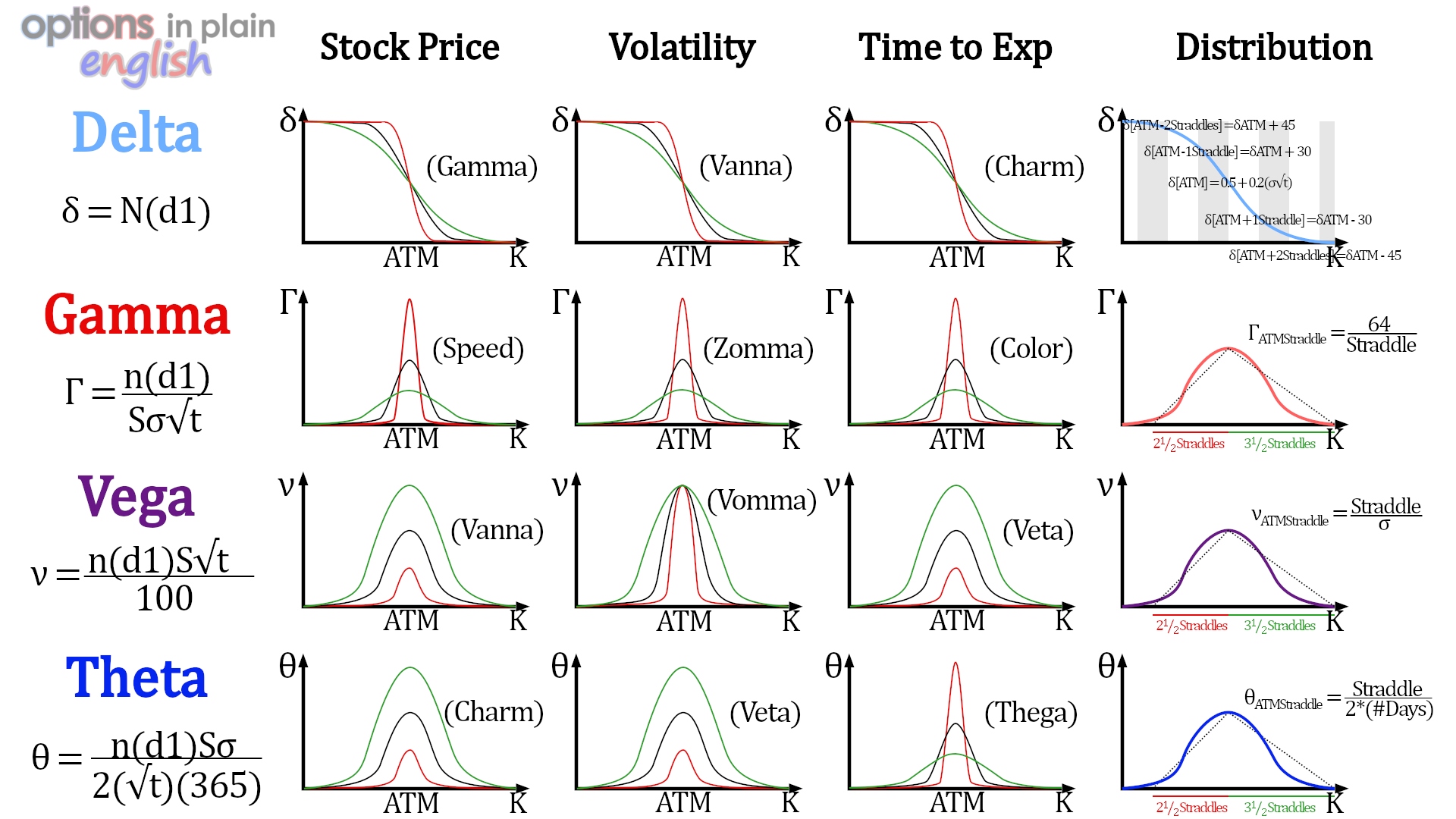

Option Greeks Chart - Web in options trading, there are four major greeks: Web the greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. The greeks factor in various variables such as volatility, time, the price movement of the underlying asset, and interest rates to determine how these factors. Let’s go through each of them one by one. Delta, gamma, theta, and vega. These values help option traders understand various aspects of option price sensitivity and the potential impact of market factors on their positions. Web discover how options greeks such as theta, vega, and delta, and more can help you evaluate the risks and rewards of trading options. These primary option greeks have a greater impact on the sensitivity of options premium than the secondary option greeks. How much will the option price change for every unit of change in the price of the underlying? Web there are more than ten option greeks out there, but in this article we’ll be focusing on the four most important ones: Web these four primary greek risk measures are known as an option's delta, gamma, theta, and vega. Delta, gamma, theta, and vega. Web in simple terms, options greeks are financial calculations that measure the sensitivity of the derivative instrument’s price (the options contract) to the underlying asset. Why should you be able to reap even more benefit than if you. Just ask and chatgpt can help with writing, learning, brainstorming and more. Greek letters delta, gamma, theta, and vega represent those variables. This tool can help users better understand the risk and return characteristics of options, thereby better formulating investment strategies. That’s a little silly when you really think about it. Once you have a clear understanding of the basics,. Greek letters delta, gamma, theta, and vega represent those variables. The option costs much less than the stock. Use oic calculators to estimate option value changes and risks. Web options greeks are dimensions that help options traders gauge the risk associated with an option contract. Below, we examine each in greater detail. These primary option greeks have a greater impact on the sensitivity of options premium than the secondary option greeks. The greeks factor in various variables such as volatility, time, the price movement of the underlying asset, and interest rates to determine how these factors. Web understand options trading with the greeks: Delta, gamma, theta, and vega. If you're looking at. Greek letters delta, gamma, theta, and vega represent those variables. Let’s go through each of them one by one. The greeks factor in various variables such as volatility, time, the price movement of the underlying asset, and interest rates to determine how these factors. Web discover how options greeks such as theta, vega, and delta, and more can help you. What is delta and how is it used? Web the greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. How much will the option price change for every unit of change in the price of the underlying? Web the greeks help to provide important measurements of an option. Greek letters delta, gamma, theta, and vega represent those variables. Explore in detail about greeks & learn in detail about its variables (delta, theta, vega, gamma, & epilogue), at upstox.com. Web there are more than ten option greeks out there, but in this article we’ll be focusing on the four most important ones: If you're looking at an option contract. Web in a nutshell, options greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. These primary option greeks have a greater impact on the sensitivity of options premium than the secondary option greeks. What is delta and how is it used? Let’s go through each of them one by one. Beginning option. Web understand options trading with the greeks: Web the options greeks chart page is a tool for displaying the values of options greek letters, including delta, gamma, theta, vega, and rho. Beginning option traders sometimes assume that when a stock moves $1, the price of options based on that stock will move more than $1. Web in simple terms, options. Web option greeks, denoted by certain greek alphabets, are the parameters that determine how option price varies with the change in external factors like time, volatility, and underlying stock price. Delta, gamma, vega, theta, and rho are the key option greeks. Web in simple terms, options greeks are financial calculations that measure the sensitivity of the derivative instrument’s price (the. Web option greeks, denoted by certain greek alphabets, are the parameters that determine how option price varies with the change in external factors like time, volatility, and underlying stock price. The volatility & greeks view presents theoretical information based on and calculated using the binomial option pricing model. Web understand options trading with the greeks: That’s what delta tells you. Take a deeper look at the greek letters used to represent variables in futures and options trading. These values help option traders understand various aspects of option price sensitivity and the potential impact of market factors on their positions. That’s a little silly when you really think about it. This tool can help users better understand the risk and return characteristics of options, thereby better formulating investment strategies. Web in options trading, there are four major greeks: The greeks factor in various variables such as volatility, time, the price movement of the underlying asset, and interest rates to determine how these factors. Web the greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. The measures are considered essential by many investors for making informed decisions in options trading. Read here for a detailed explanation. Let’s go through each of them one by one. Web there are more than ten option greeks out there, but in this article we’ll be focusing on the four most important ones: In short, the greeks refer to a set of calculations you can use to measure different factors that might affect the price of an options contract.

Using "The Greeks" To Understand Options

What are Option Greeks? Simplify

Calculating Greeks on Option Spreads R YouTube

Option Greeks All Things Stocks Medium

The greeks option trading risk guide vega, gamma, theta, delta

Introduction to Option Greeks Trading Campus

Options Pricing & Option Greeks Explained Trade Options With Me

Options Greeks Cheat Sheet 4 Greeks Delta, Gamma, Theta, Vega

![Options Greeks Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/options-greeks-cheat-sheet-1024x724.png)

Options Greeks Cheat Sheet [FREE Download] HowToTrade

How To Use Option Greeks To Measure Risk Riset

Web These Four Primary Greek Risk Measures Are Known As An Option's Delta, Gamma, Theta, And Vega.

Additionally, They Also Enable Traders To Measure The Sensitivity Of Options To Different Variables That Contribute To Those Risks.

Delta Measures How Much The Options Premium Will Change, Theoretically, With A $1 Move In The Underlying Price.

Delta, Gamma, Vega, Theta, And Rho Are The Key Option Greeks.

Related Post: