Njw4 Wage Chart

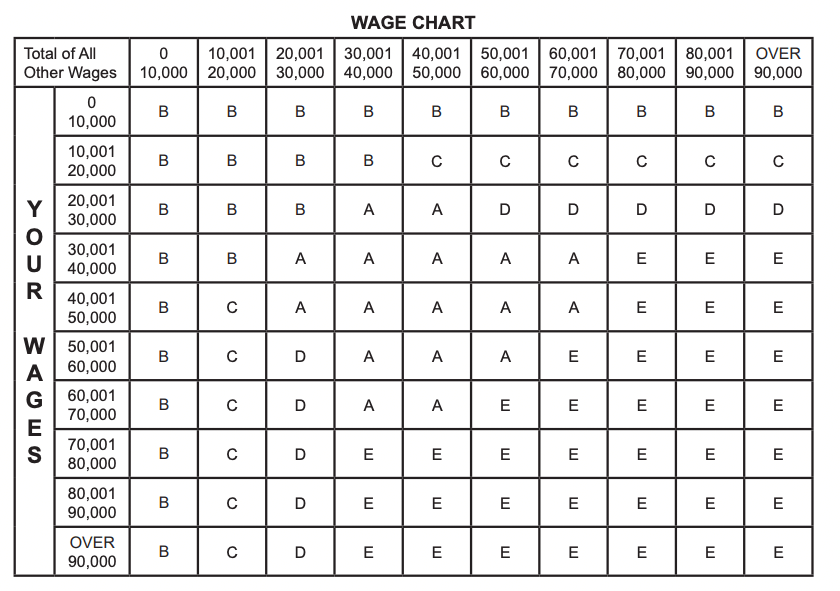

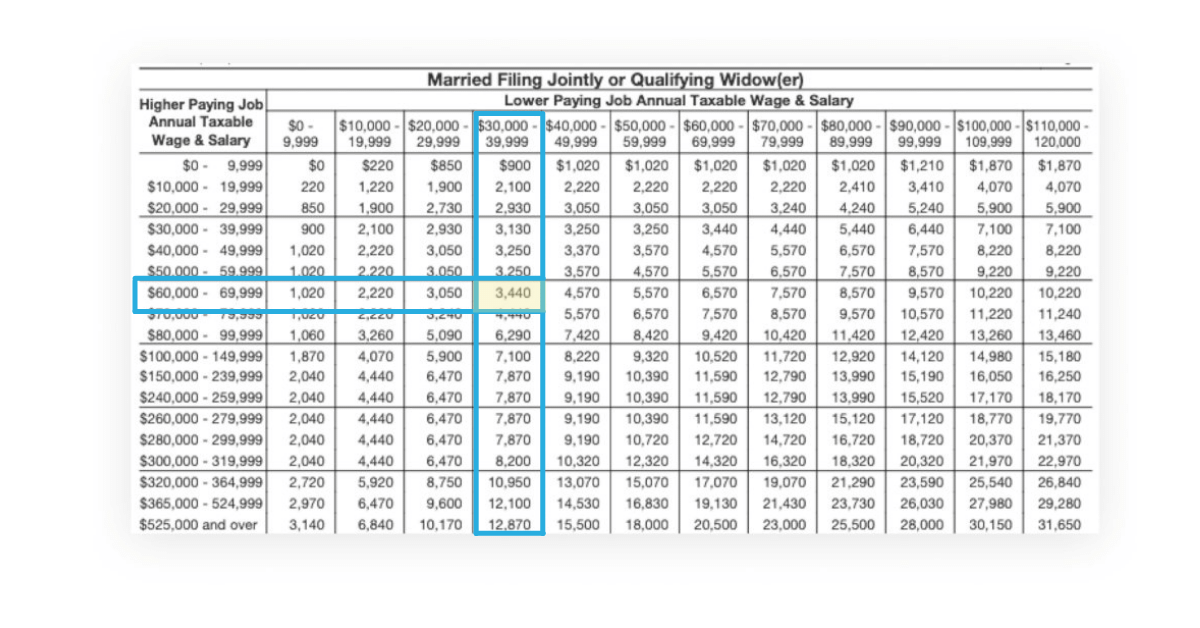

Njw4 Wage Chart - Find the amount of the total for all other wages (including your. We last updated the employee's withholding allowance certificate. Web new jersey issues revised withholding tables effective september 1, 2018; (see the rate tables on the reverse side to estimate your withholding. If you employ new jersey residents working in new jersey, you must. The rate tables listed below correspond to the letters in the wage chart on the front page. Web single or filing separate use rate table a, other filing statuses use rate table b, or you can elect to use the chart on the nj state w4 (which is different then federal withholding). Ex, marginal tax rate 10%. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. Web beginning with wages paid for pay period 4, the national finance center (nfc) will change the income tax withholding tables for the state of new jersey. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. Use these to estimate. If you employ new jersey residents working in new jersey, you must. Web federal w4 changed so allowances are no longer a thing. Applicable to wages, salaries, and commissions paid on and after. How to use the chart. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. We must also provide you with form. Rate tables for wage chart. The new jersey division of taxation has released an updated employer withholding. Find the amount of the total for. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. 2) findthe amountof the totalfor all otherwages (including your spouse's/clvilunion partner's. (see the rate tables on the reverse side to estimate your withholding. How to use the chart. Use these to estimate the. (see the rate tables on the reverse side to estimate your withholding. How to use the chart. Web employee's substitute wage and tax statement: Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Use these to estimate the. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. We last updated the employee's withholding allowance certificate. Tables for percentage method of withholding. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages. Tables for percentage method of withholding. Use these to estimate the. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Web how to use the chart. We must also provide you with form. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. Rate tables for wage chart. Use these to estimate the. 2) findthe amountof the totalfor all otherwages (including your spouse's/clvilunion partner's. Ex, marginal tax rate 10%. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. Rate tables for wage chart. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Web how to use the chart. The rate. Request for copies of previously filed tax returns: Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. Use these to estimate the. Web employee's substitute wage and tax statement: The rate tables listed below correspond to the letters in the. Web employee's substitute wage and tax statement: Use the tax bracket calculator to find out what percent should be withheld to zero out. (see the rate tables on the reverse side to estimate your withholding. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. Applicable to wages, salaries, and commissions paid on and after. Web beginning with wages paid for pay period 4, the national finance center (nfc) will change the income tax withholding tables for the state of new jersey. How to use the chart. Use these to estimate the. Request for copies of previously filed tax returns: The new jersey division of taxation has released an updated employer withholding. Web new jersey issues revised withholding tables effective september 1, 2018; Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Ex, marginal tax rate 10%. If you employ new jersey residents working in new jersey, you must. We last updated the employee's withholding allowance certificate.

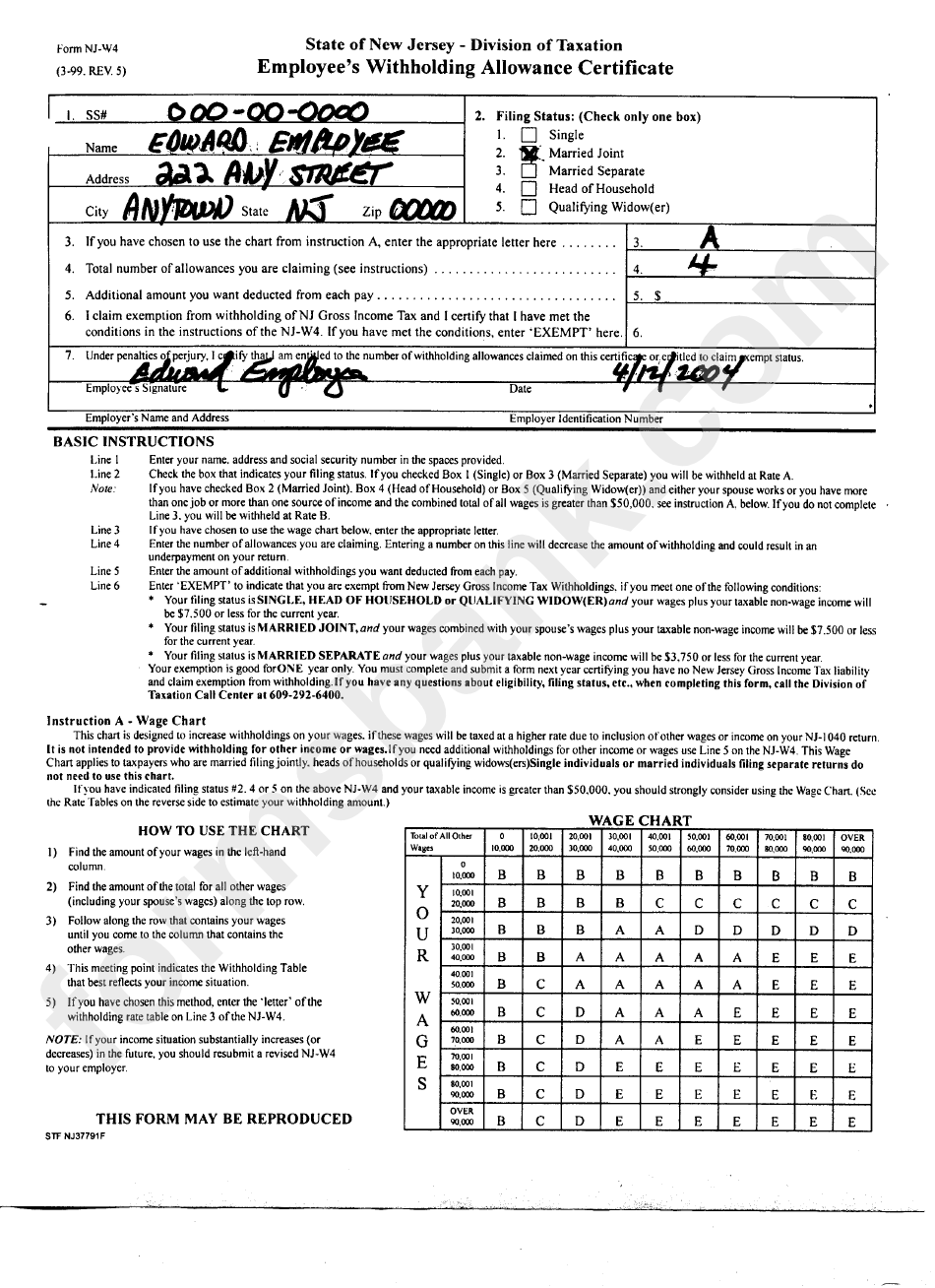

Form NjW4 Example Employee'S Withholding Allowance Certificate New

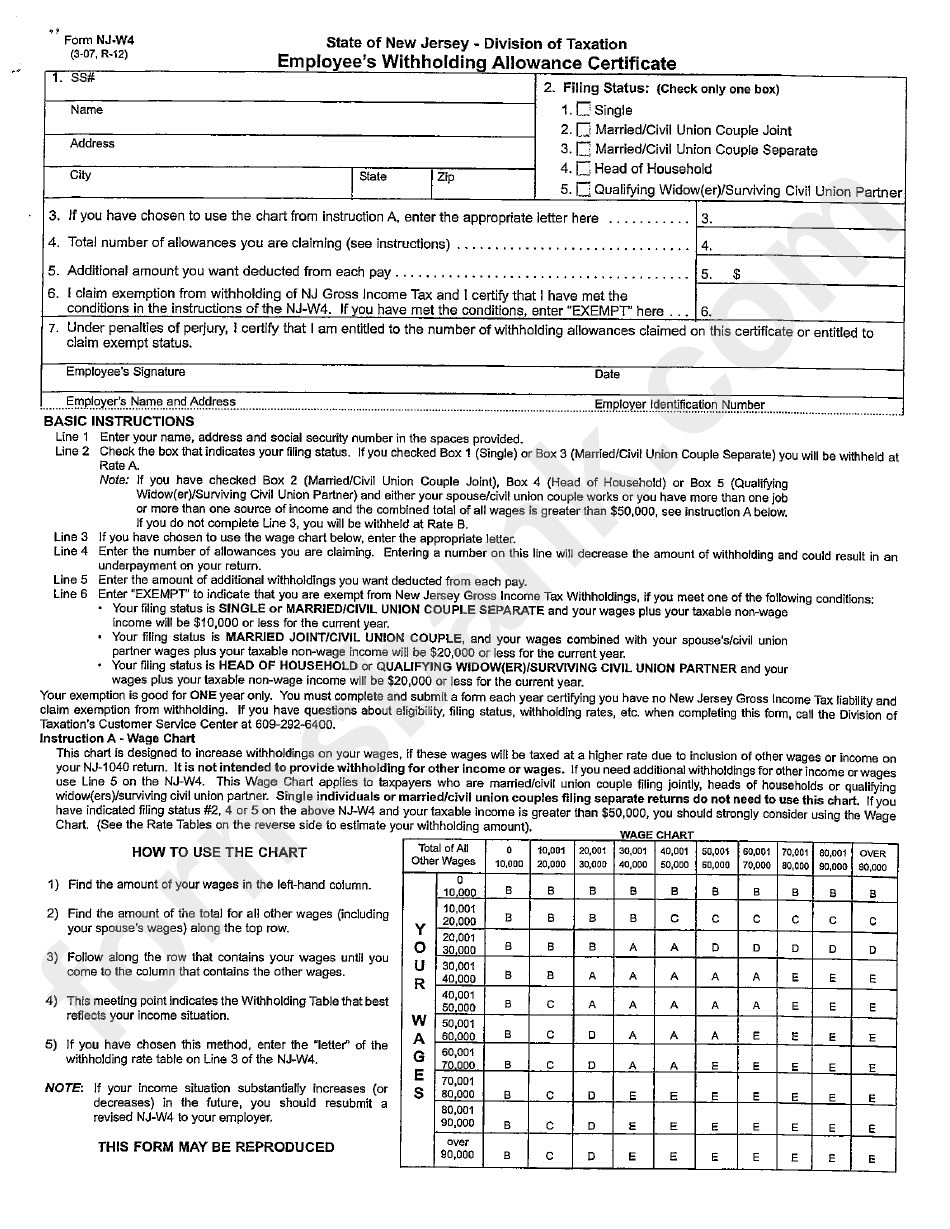

How to Fill Out New Jersey Withholding Form NJW4 in 2023 + FAQs

New Jersey Salaries State Employees AMARYSUMAJ

Employee's Withholding Allowance Certificate New Jersey Free Download

Nj w4 Fill out & sign online DocHub

New Jersey W 4 Form 2022 W4 Form

Fill Free fillable Njw4 Form NJ W4 WT 07 PDF form

Wage Chart On Form Njw4

How Do I Fill Out the 2019 W4 Form? Gusto

PreTax and PostTax Deductions What’s the Difference? APS Payroll

2) Findthe Amountof The Totalfor All Otherwages (Including Your Spouse's/Clvilunion Partner's.

Web How To Use The Chart.

We Must Also Provide You With Form.

Web Federal W4 Changed So Allowances Are No Longer A Thing.

Related Post: