Nc Accountancy Law Course Ethics Principles And Professional Responsibilities

Nc Accountancy Law Course Ethics Principles And Professional Responsibilities - Web the ncacpa course, nc accountancy law course: · public interest when accountants carry out their professional responsibilities, they need to remember the public interest while exhibiting their commitment to professionalism and honoring the public trust. Web nc accountancy law—ethics, principles, & professional responsibilities cpe hours: Web 2015 north carolina accountancy law: Web the north carolina association of cpas (ncacpa) course, nc accountancy law course: Ethics, principles, and professional responsibilities ncacpa Nc accountancy law—ethics, principles, & professional responsibilities cpe hours: Ethics, principles, and professional responsibility for north carolina. Web two courses are currently approved, both of which are available through the north carolina association of cpas (ncacpa): Ethics principles and professional responsibilities, is available in two formats: Eight of the required hours shall be credits derived from a course or examination in north carolina accountancy statutes and rules (including the code of professional ethics and conduct as set forth in 21 ncac 08n contained therein) as set forth in 21 ncac 08f.0504; You’re required to complete the course within one (1) year of applying for your cpa. Ethics principles and professional responsibilities, is available in two formats: Web north carolina’s accountancy rules provide guidance for both new and experienced cpas in obtaining and maintaining a cpa license, recognizing. Web the north carolina association of cpas (ncacpa) course, nc accountancy law course: Web 2015 north carolina accountancy law: Web 21 ncac 08f.0504 candidates’ accountancy law course requirement. 93‑12(9) authorizes the board to adopt. Web the north carolina association of cpas (ncacpa) course, nc accountancy law course: Web two courses are currently approved, both of which are available through the north carolina association of cpas (ncacpa): * this course allows cpas to meet the requirement of 8g.0401(e) cpe requirements for cpas* as part of the annual cpe requirement,. Web two courses are currently approved, both of which are available through the north carolina association of cpas (ncacpa): 93‑12(9) authorizes the board to adopt. Ethics principles and professional responsibilities, is available in two formats: Not acceptable for enrolled agents. You’re required to complete the course within one (1) year of applying for your cpa license. Web 2015 north carolina accountancy law: Eight of the required hours shall be credits derived from a course or examination in north carolina accountancy statutes and rules (including the code of professional ethics and conduct as set forth in 21 ncac 08n contained therein) as set forth in 21 ncac 08f.0504; Web north carolina’s accountancy rules provide guidance for both. * this course allows cpas to meet the requirement of 8g.0401(e) cpe requirements for cpas* as part of the annual cpe requirement, all active cpas shall complete cpe in activities on regulatory or behavior professional ethics and conduct. Professional ethics & conduct (registration link coming soon!) cpe hours: Ethics principles and professional responsibilities, is available in two formats: Not acceptable. Ethics, principles, and professional responsibility for north carolina. Web 2022 professional ethics and conduct objective: Web the rules in this subchapter are the rules of professional ethics and conduct that g.s. Web the north carolina association of cpas (ncacpa) course, nc accountancy law course: Web the ncacpa course, nc accountancy law course: Web before applying for your cpa license, you’ll need to complete nc’s eight (8) hour course on the north carolina accountancy statutes and rules, which includes the rules of professional ethics and conduct. Web nc accountancy law course. · public interest when accountants carry out their professional responsibilities, they need to remember the public interest while exhibiting their commitment to. Web nc accountancy law—ethics, principles, & professional responsibilities cpe hours: Not acceptable for enrolled agents. * this course allows cpas to meet the requirement of 8g.0401(e) cpe requirements for cpas* as part of the annual cpe requirement, all active cpas shall complete cpe in activities on regulatory or behavior professional ethics and conduct. Professional ethics & conduct (registration link coming. 93‑12 (9)(a) through (d) and other provisions of g.s. It addresses the rules of professional ethics for north carolina cpas. Ethics, principles, & professional responsibilities. Web here’re brief descriptions of the key principles you’ll learn by taking north carolina cpa ethics courses. Web nc accountancy law course. Ethics, principles, & professional responsibilities. Eight of the required hours shall be credits derived from a course or examination in north carolina accountancy statutes and rules (including the code of professional ethics and conduct as set forth in 21 ncac 08n contained therein) as set forth in 21 ncac 08f.0504; Web nc accountancy law course. Web the ncacpa course, nc accountancy law course: Professional ethics & conduct (registration link coming soon!) cpe hours: Web before applying for your cpa license, you’ll need to complete nc’s eight (8) hour course on the north carolina accountancy statutes and rules, which includes the rules of professional ethics and conduct. Web 21 ncac 08f.0504 candidates’ accountancy law course requirement. 93‑12 (9)(a) through (d) and other provisions of g.s. Ethics principles and professional responsibilities, is a qualified course that is available in two formats: Web nc accountancy law—ethics, principles, & professional responsibilities cpe hours: Web 2022 professional ethics and conduct objective: Web the rules in this subchapter are the rules of professional ethics and conduct that g.s. Web 2015 north carolina accountancy law: Web date 2023 professional ethics and conduct objective: Ethics, principles, and professional responsibilities. Web this is the north carolina law course:![North Carolina CPA Ethics Exam Requirements [2023] SuperfastCPA CPA](https://www.superfastcpa.com/wp-content/uploads/2022/07/North-Carolina-CPA-Ethics-Exam-Requirements.png)

North Carolina CPA Ethics Exam Requirements [2023] SuperfastCPA CPA

5 Reasons Why Ethics Is Important in Accounting for Business

Accounting Ethics A Practical Approach (Paperback)

PPT ACCOUNTING ETHICS PowerPoint Presentation, free download ID4675582

8 Basic Principles of Professional Ethics in Accounting Financial Treat

PPT ACCOUNTING ETHICS PowerPoint Presentation, free download ID4675582

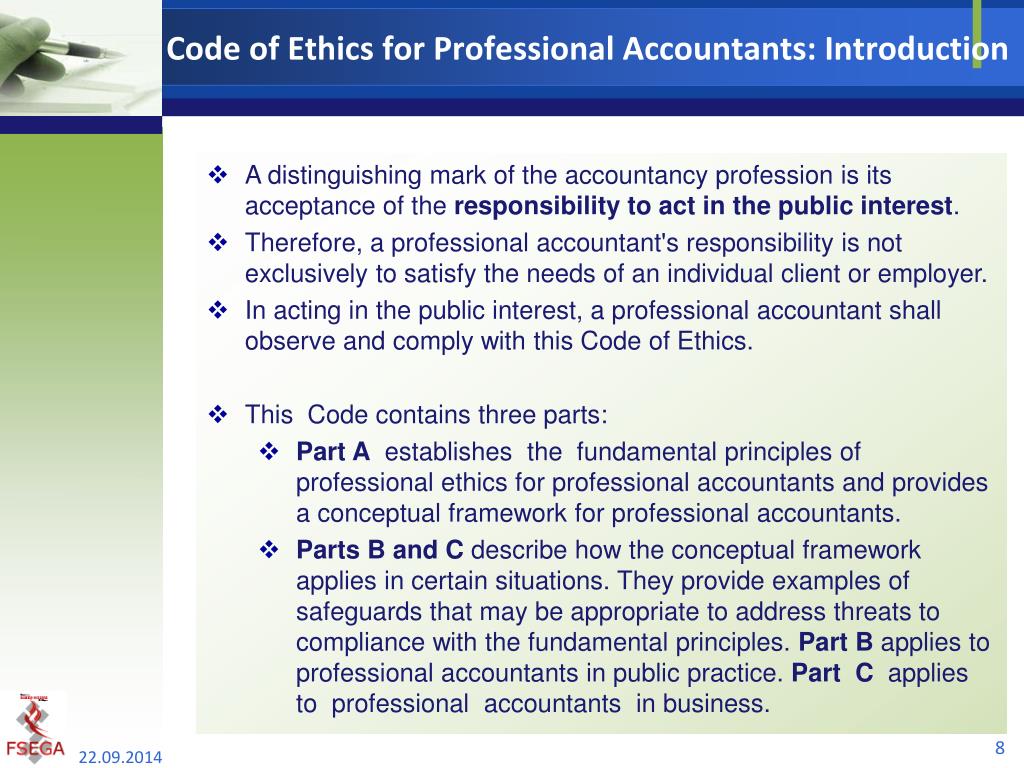

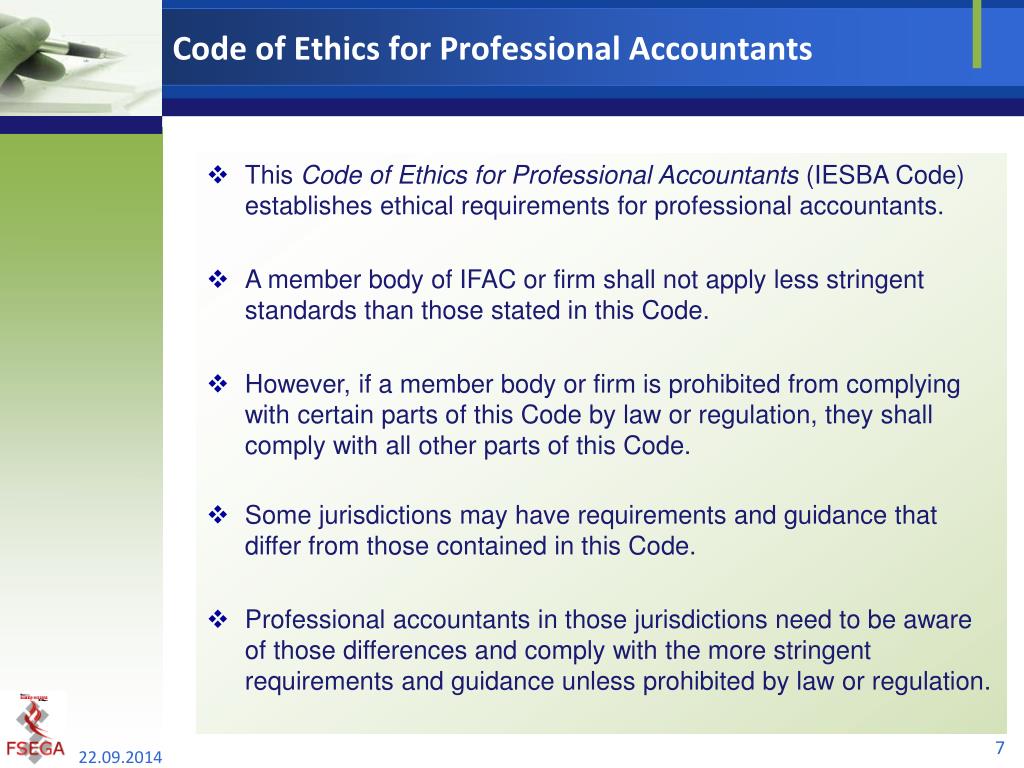

PPT Code of Ethics for Professional Accountants PowerPoint

Professional Ethics for the Accountancy Profession Notes Study Material

Accounting Ethics Examples and Importance of Accounting Ethics

PPT Code of Ethics for Professional Accountants PowerPoint

Web Two Courses Are Currently Approved, Both Of Which Are Available Through The North Carolina Association Of Cpas (Ncacpa):

Not Acceptable For Enrolled Agents.

· Public Interest When Accountants Carry Out Their Professional Responsibilities, They Need To Remember The Public Interest While Exhibiting Their Commitment To Professionalism And Honoring The Public Trust.

Web Our Ethics Courses Prepare You To Make The Most Moral Decisions By Helping You Gain Perspective On The Wide Breadth Of Issues Facing Cpas.

Related Post: