Nc 1099 Form Printable

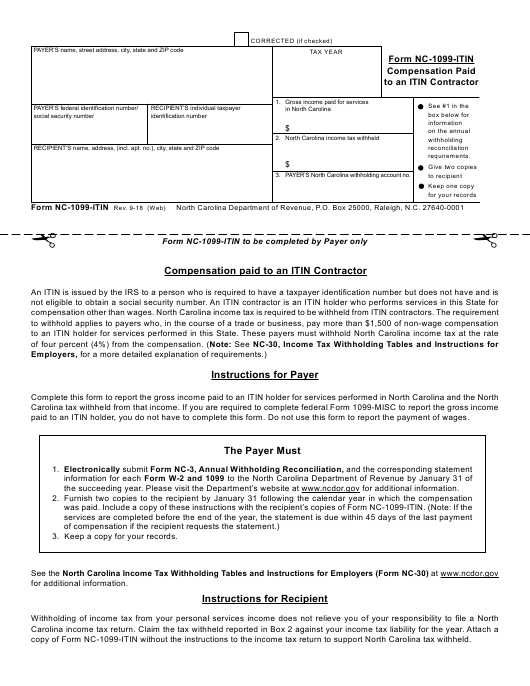

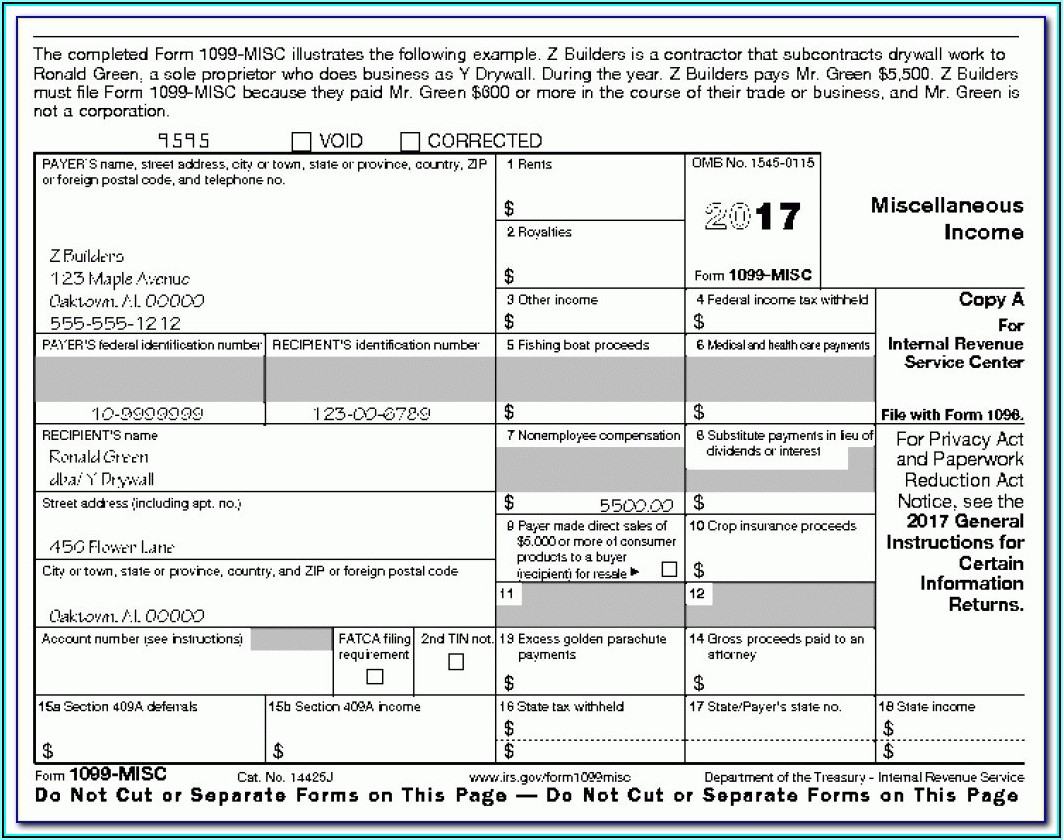

Nc 1099 Form Printable - In this example, we will use nc 1099 misc report. Web complete this form to report the gross income paid to a nonresident individual, corporation, partnership, or limited liability company for personal services performed in north carolina and the north carolina tax withheld from that income. This page provides answers to questions about 1099s with the wrong address, as well as situations where the provider is deceased or no longer with the organization. Web to print 1099s, you will need a basic knowledge of ncxcloud. This section reflects answers to frequently asked questions (faqs) regarding provider 1099s, in four topic. Web you may print out a 1099 from your orbit account. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web ncdor has recently redesigned its website. Select and expand the appropriate report folder you would like to print. Sign it in a few clicks. In this example, we will use nc 1099 misc report. Find the file format requirements, testing instructions, and examples for each type of 1099 report. After this date, the 1099 forms will be available for printing by the agencies in the ncxcloud software using the pdf overlay instructions provided by osc. This section reflects answers to frequently asked questions (faqs). Web faqs for 1099s with wrong address, deceased / separated provider. Below is a complete list of all original or corrected 1099 information reports that are required to be filed with the north carolina department of revenue in an electronic format: You may also have a filing requirement. Edit your 1099 form online. Web here's how it works. See your tax return instructions for where to report. Edit your 1099 form online. Share your form with others. Web learn how to file multiple 1099 forms with the department of revenue in an electronic format using the enc3 application. If you want to download a tax form, use the navigation above, search the site, or choose a link below: Web learn how to file multiple 1099 forms with the department of revenue in an electronic format using the enc3 application. Edit your 1099 form online. If you are unfamiliar with this product, please refer to the introduction documentation located at: Web here's how it works. Web ncdor has recently redesigned its website. If you are unfamiliar with this product, please refer to the introduction documentation located at: Type text, add images, blackout confidential details, add comments, highlights and more. See your tax return instructions for where to report. Web as indicated in the 1099 form processing schedule, osc will create the 1099 print file and the electronic irs file on january 14,. You may also have a filing requirement. Web here's how it works. After this date, the 1099 forms will be available for printing by the agencies in the ncxcloud software using the pdf overlay instructions provided by osc. Send printable 1099 form via email, link, or fax. Reports listed in the tax reports folde r are displayed. Web learn how to print 1099 forms in the north carolina financial system (ncfs) with this quick reference guide. In this example, we will use nc 1099 misc report. Sign it in a few clicks. Type text, add images, blackout confidential details, add comments, highlights and more. Web here's how it works. See the instructions for form 8938. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Select and expand the appropriate report folder you would like to print. Web you may print out a 1099 from your orbit account. Edit your 1099 form online. Web complete this form to report the gross income paid to a nonresident individual, corporation, partnership, or limited liability company for personal services performed in north carolina and the north carolina tax withheld from that income. This page provides answers to questions about 1099s with the wrong address, as well as situations where the provider is deceased or no longer. Sign it in a few clicks. If you are unfamiliar with this product, please refer to the introduction documentation located at: Web learn how to print 1099 forms in the north carolina financial system (ncfs) with this quick reference guide. Web faqs for 1099s with wrong address, deceased / separated provider. This page provides answers to questions about 1099s with. Ncfs help documents, ncfs accounts. Web to print 1099s, you will need a basic knowledge of ncxcloud. This section reflects answers to frequently asked questions (faqs) regarding provider 1099s, in four topic. After this date, the 1099 forms will be available for printing by the agencies in the ncxcloud software using the pdf overlay instructions provided by osc. Web you may print out a 1099 from your orbit account. Compensation paid to a payee. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Type text, add images, blackout confidential details, add comments, highlights and more. Web learn how to file multiple 1099 forms with the department of revenue in an electronic format using the enc3 application. In this example, we will use nc 1099 misc report. Below is a complete list of all original or corrected 1099 information reports that are required to be filed with the north carolina department of revenue in an electronic format: Reports listed in the tax reports folde r are displayed. Sign it in a few clicks. See your tax return instructions for where to report. New 1099 form for 2020. If you are unfamiliar with this product, please refer to the introduction documentation located at:

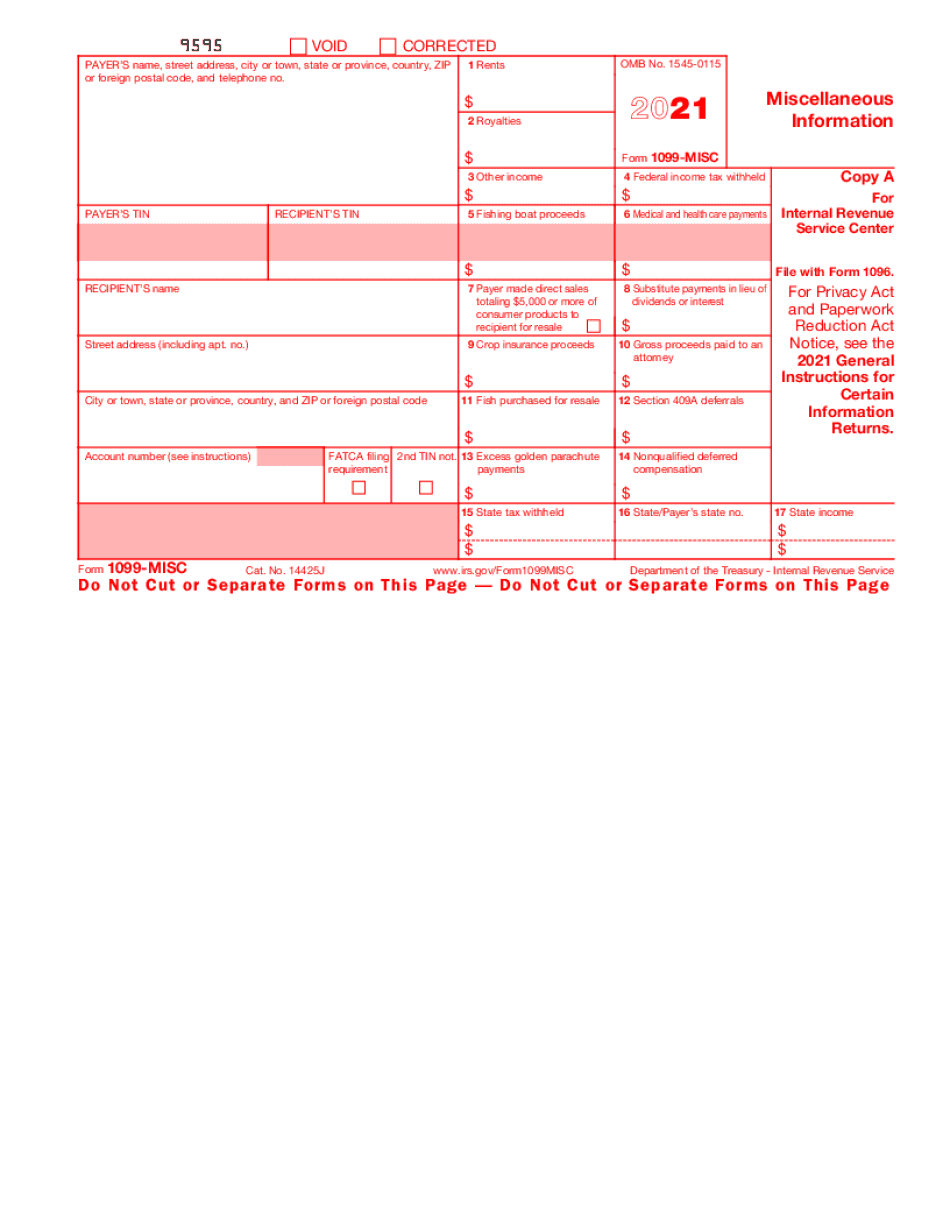

1099 Tax Form Printable Printable Forms Free Online

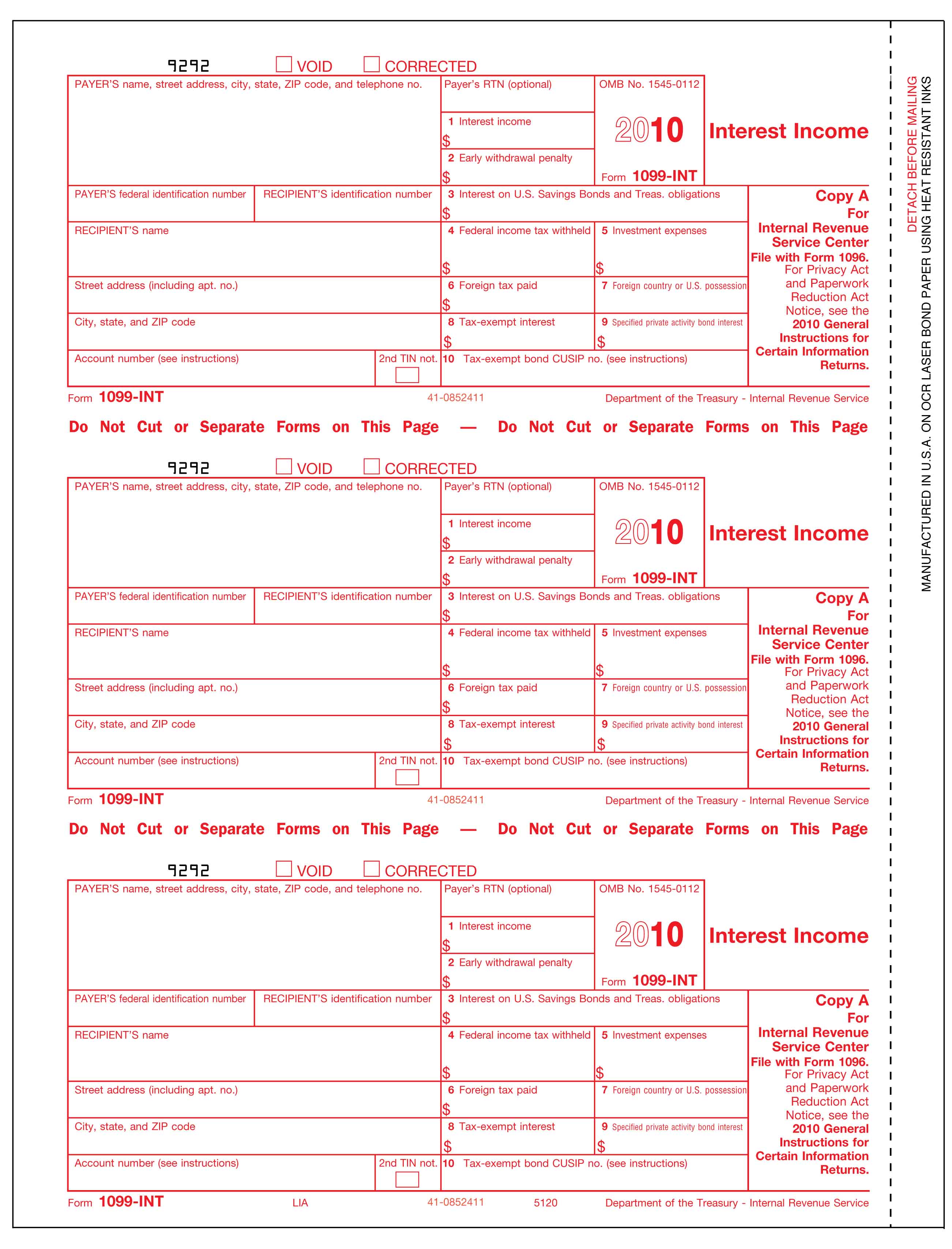

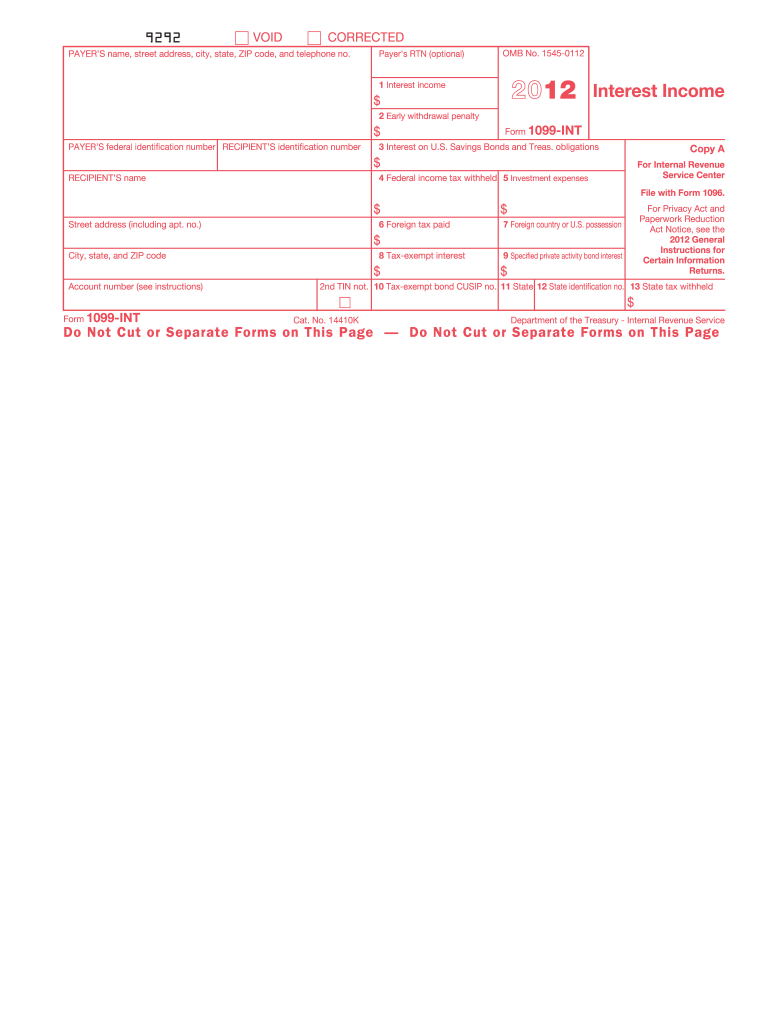

1099 Format, 1099 Forms, 1099 Tax Forms Print Forms

![]()

Printable 1099 Form Pdf Free Printable Download

Nc 1099 Form Printable Printable Form 2021

How To Fill Out A 1099 Form For Employees Fill Out And Sign Printable

Free Fillable And Printable 1099 Forms

1099 reporting

Nc 1099 Form Printable

Nc 1099 Form Printable Printable Forms Free Online

Nc 1099 Form Printable

Web Here's How It Works.

See The Instructions For Form 8938.

Web As Indicated In The 1099 Form Processing Schedule, Osc Will Create The 1099 Print File And The Electronic Irs File On January 14, 2022.

Share Your Form With Others.

Related Post: