Multi Candlestick Patterns

Multi Candlestick Patterns - It is made of 3 candlesticks, the first being a bearish candle, the second a doji and the third being a bullish candle. P1 is a red candle in a bullish engulfing pattern, and p2 is a blue candle. It appears at the bottom end of a downtrend. ☆ research you can trust ☆. This can be either a continuation or reversal pattern. In a single candlestick pattern, the trader needed just one candlestick to identify a trading opportunity. Let’s look at a single candle pattern named the bullish closing marubozu. A candlestick must meet the following. Web in the previous video, we looked at single candlestick patterns. Multiple candlestick patterns (part 3) the morning star and the evening star are the last two candlestick patterns we will be studying. The hammer is a bullish reversal pattern, which signals that a. Web the first candle must be bearish. Web we managed to find 75 different candlestick patterns that are not duplicate (see the full list below). In this video, we look at multiple candlestick patterns and how to analyse them when trading. The color of the second candle doesn’t matter. A candlestick must meet the following. They can also form reversal or continuation patterns. The morning star is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal. (study the chart below) a doji star in a downtrend can be a signal for a bottom being formed. However, when analyzing multiple candlestick patterns, the trader. Web this is a candlestick pattern search indicator that informs you when any candlestick pattern occurs in any time frame with its settings. However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. This means the trading opportunity evolves over a minimum of 2 trading. Where one candle overtakes another, signaling. In this lesson, we cover how to. Here are some of the most popular candlestick charts, explained: Web multiple candlestick patterns evolve over two or more trading days. The morning star is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal. However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3. This is known as the evening doji star pattern. The body of the bullish doji lies completely outside that of the surrounding candles, indicating market indecision. Web multiple candlestick patterns evolve over two or more trading days. Web we managed to find 75 different candlestick patterns that are not duplicate (see the full list below). The color of the second. Dive into the intricacies and variations of engulfing patterns to. Here are some of the most popular candlestick charts, explained: A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. In a single candlestick pattern, the trader needed just one candlestick to identify a trading opportunity. The engulfing patterns (bullish engulfing pattern. Web each candlestick pattern has a distinct name and a traditional trading strategy. It is similar in appearance to the advance block pattern, the deliberation or stalled pattern, and the ladder bottom pattern that are all triple candlestick patterns.the tower pattern, on the other hand, consists of at least four candlesticks of which the first is a relatively. However, when. Dive into the intricacies and variations of engulfing patterns to. (study the chart below) a doji star in a downtrend can be a signal for a bottom being formed. Here are some of the most popular candlestick charts, explained: This can be either a continuation or reversal pattern. This is known as the evening doji star pattern. This can be either a continuation or reversal pattern. Candlestick patterns can be made up of one candle or multiple candlesticks. A doji star at an uptrend can be a signal of a top being formed. Let’s look at a single candle pattern named the bullish closing marubozu. They can also form reversal or continuation patterns. (study the chart below) a doji star in a downtrend can be a signal for a bottom being formed. Engulfing pattern, piercing pattern & dark cloud cover patternin t. The first candle shows the continuation of the downtrend. They can also form reversal or continuation patterns. Web we managed to find 75 different candlestick patterns that are not duplicate (see. Web what are thestrat candlestick patterns? This can be either a continuation or reversal pattern. It appears at the bottom end of a downtrend. Engulfing pattern, piercing pattern & dark cloud cover patternin t. Web learn how to identify and trade the island reversal, kicker, hook reversal and three gap advanced candlestick patterns. Web we managed to find 75 different candlestick patterns that are not duplicate (see the full list below). Here are five of the main patterns: They can also form reversal or continuation patterns. Web this is a candlestick pattern search indicator that informs you when any candlestick pattern occurs in any time frame with its settings. In this video, we look at multiple candlestick patterns and how to analyse them when trading. The body of the bullish doji lies completely outside that of the surrounding candles, indicating market indecision. This is known as the evening doji star pattern. Candlestick patterns can be made up of one candle or multiple candlesticks. A candlestick must meet the following. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. The hammer or the inverted hammer.

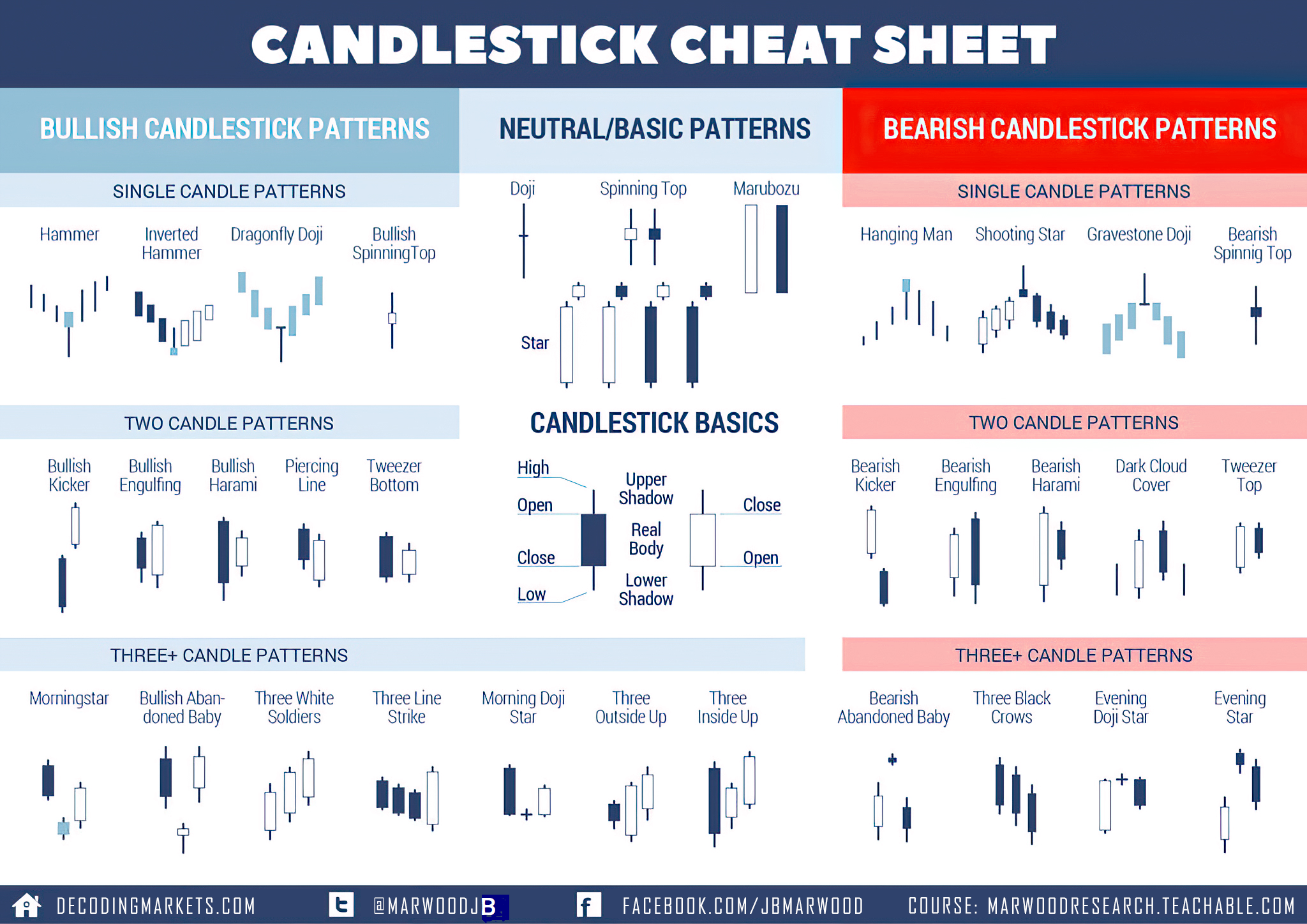

What Are Candlestick Patterns? Understanding Candlesticks Basics

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Candlestick Patterns The Definitive Guide New Trader U

Understanding Candlesticks Multi Candle Patterns Trade Brains

Multiple Candlestick Patterns How to Identify Them? Espresso Bootcamp

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

How to read candlestick patterns What every investor needs to know

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

Candlestick patterns cheat sheet Artofit

Candlestick Patterns The Definitive Guide (2021)

Web In The Previous Video, We Looked At Single Candlestick Patterns.

(Study The Chart Below) A Doji Star In A Downtrend Can Be A Signal For A Bottom Being Formed.

Web Multiple Candlestick Patterns Evolve Over Two Or More Trading Days.

The Third Candle Must Be Bullish.

Related Post: