Morning Star Candlestick Pattern

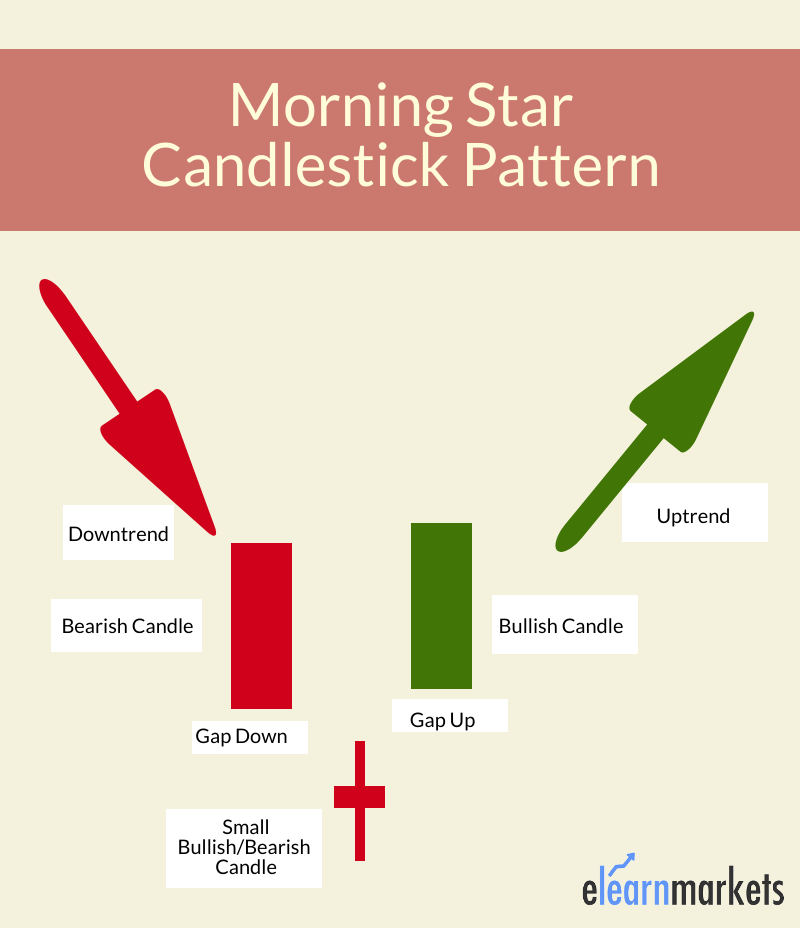

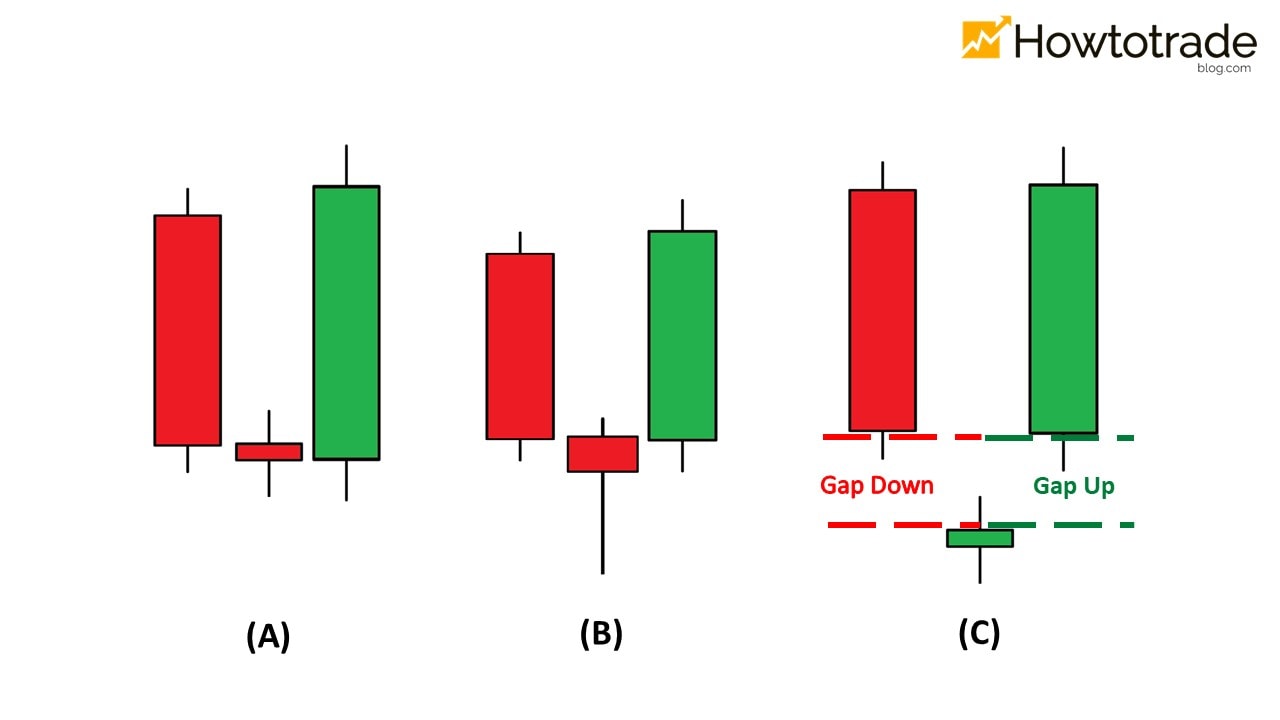

Morning Star Candlestick Pattern - The morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a. Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu. The first line is any black candle appearing as a long line in an uptrend: A morning star forms following a downward trend and it. It consists of three candlesticks: The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. A big red candle, a small doji, and a big green candle. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. The morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web a. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. Web illustration of the morningstar pattern. Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend.. The first line is any black candle appearing as a long line in an uptrend: This pattern reverses the downtrend to the uptrend. It consists of three candlesticks: Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. The morning star is a pattern seen in a candlestick chart, a popular. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a. Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu.. Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu. A big red candle, a small doji, and a big green candle. The first line is any black candle appearing as a long line in an uptrend: Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. This pattern reverses the downtrend to the uptrend. Web the morning star candlestick pattern is easily recognizable. This pattern reverses the downtrend to the uptrend. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts.. Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. Web illustration of the morningstar pattern. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks.. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. A big red candle, a small doji, and a big green candle. It consists of three candlesticks: A morning star forms following a downward trend and it. The morning star is a pattern seen in a candlestick chart, a popular type. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Long black candle, black candle, black marubozu,. It consists of three candlesticks: Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu. This pattern reverses the downtrend to the uptrend. It reveals a slowing down of downward momentum before a large. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. A morning star forms following a downward trend and it. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. The morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend.

Understanding The Morning Star Candlestick Pattern InvestoPower

Morning Star Candlestick Pattern definition and guide

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Best candlestick patterns morning star candlestick pattern

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick? Formation & Uses ELM

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

Morning Star Candlestick Pattern How To Trade and Win Forex With It

What Is Morning Star Candlestick Pattern? How To Use In Trading How

A Big Red Candle, A Small Doji, And A Big Green Candle.

Web Illustration Of The Morningstar Pattern.

The First Line Is Any Black Candle Appearing As A Long Line In An Uptrend:

Related Post: