Medicaid Annuity Life Expectancy Chart

Medicaid Annuity Life Expectancy Chart - Web updated life expectancy and distribution period tables used for purposes of determining minimum required distributions. Web life expectancy death probability a number of lives b life expectancy; Social security life expectancy calculator: If the owner outlives that life expectancy, the contract terminates, and. The annuity income must be used for care. Learn about the single premium immediate annuity (spia). Medicaid compliant annuities base their payment schedule on the estimated life expectancy of the annuitant rather than. Web medicaid annuities pay a monthly income for a fixed amount based on the owner’s life expectancy. The medicaid agency for the. Equal payments the annuity must provide equal monthly. Web maximizing medicaid benefits can be complex, but understanding annuities and life expectancy charts can help. You can purchase an annuity from an insurance. Web we know that mrs. The 2024 asset limit is. Learn about the single premium immediate annuity (spia). Age male life expectancy female life expectancy age male life expectancy female life expectancy. Web the annuity must be actuarially sound, which means it cannot exceed the life expectancy of the individual receiving annuity payments. Web the term of monthly payments must be less than the life expectancy of the community spouse, according to social security life expectancy tables. Web. Web maximizing medicaid benefits can be complex, but understanding annuities and life expectancy charts can help. Web medicaid annuities pay a monthly income for a fixed amount based on the owner’s life expectancy. Age male life expectancy female life expectancy age male life expectancy female life expectancy. Web 2023 life expectancy table. The annuity income must be used for care. Buying an annuity in this price range can help the applicant get under. Annuities convert assets into income streams, meeting. 0 74.12 79.78 30 45.86 50.79 1 73.55. Web all mca contracts must be for a fixed term (meaning no life contingencies) that is equal to or less than the life expectancy of the proposed annuitant. Based on social security. An annuity is a financial product that converts a lump sum of money into a stream of income. Web life expectancy death probability a number of lives b life expectancy; Web the term of the annuity must be fixed and equal to or shorter than the owner’s medicaid life expectancy. Annuities convert assets into income streams, meeting. Web the term. Medicaid compliant annuities base their payment schedule on the estimated life expectancy of the annuitant rather than. Age male life expectancy female life expectancy age male life expectancy female life expectancy. Web updated life expectancy and distribution period tables used for purposes of determining minimum required distributions. You can purchase an annuity from an insurance. Equal payments the annuity must. Web 2023 life expectancy table. Web maximizing medicaid benefits can be complex, but understanding annuities and life expectancy charts can help. Web medicaid annuities pay a monthly income for a fixed amount based on the owner’s life expectancy. An annuity is a financial product that converts a lump sum of money into a stream of income. The medicaid agency for. The 2024 asset limit is. Web the term of the annuity must be fixed and equal to or shorter than the owner’s medicaid life expectancy. The annuity income must be used for care. Another requirement for an annuity to be considered ‘medicaid compliant’ is that it must provide equal payments in regular intervals (often monthly) over. 0 74.12 79.78 30. Web life expectancy death probability a number of lives b life expectancy; The medicaid agency for the. Web 2023 life expectancy table. Web the term of the annuity must be fixed and equal to or shorter than the owner’s medicaid life expectancy. Social security life expectancy calculator: Social security life expectancy calculator: While many states allow annuities to be shorter than the life expectancy of the. The medicaid agency for the. Web the annuity must be actuarially sound, which means it cannot exceed the life expectancy of the individual receiving annuity payments. Web when a potential medicaid recipient purchases an annuity, the single premium immediate annuity (spia). Web the term of the annuity must be fixed and equal to or shorter than the owner’s medicaid life expectancy. 0 74.12 79.78 30 45.86 50.79 1 73.55. Based on social security actuarial tables, this simple calculator estimates your lifespan based on your current. Web the estimate of life expectancy is based on the ssa’s (social security administration) life expectancy table, or depending on the state, another eligibility table specific to its medicaid program. Web when a potential medicaid recipient purchases an annuity, the single premium immediate annuity (spia) promises to give the annuitant a steady and predictable income. Web maximizing medicaid benefits can be complex, but understanding annuities and life expectancy charts can help. Web lifetime annuities are not medicaid compliant. The medicaid agency for the. The annuity income must be used for care. Social security life expectancy calculator: You can purchase an annuity from an insurance. The 2024 asset limit is. Equal payments the annuity must provide equal monthly. Web 2023 life expectancy table. A rule by the internal revenue service on 11/12/2020. An annuity is a financial product that converts a lump sum of money into a stream of income.

Life Expectancy Tables 2024 Dacie

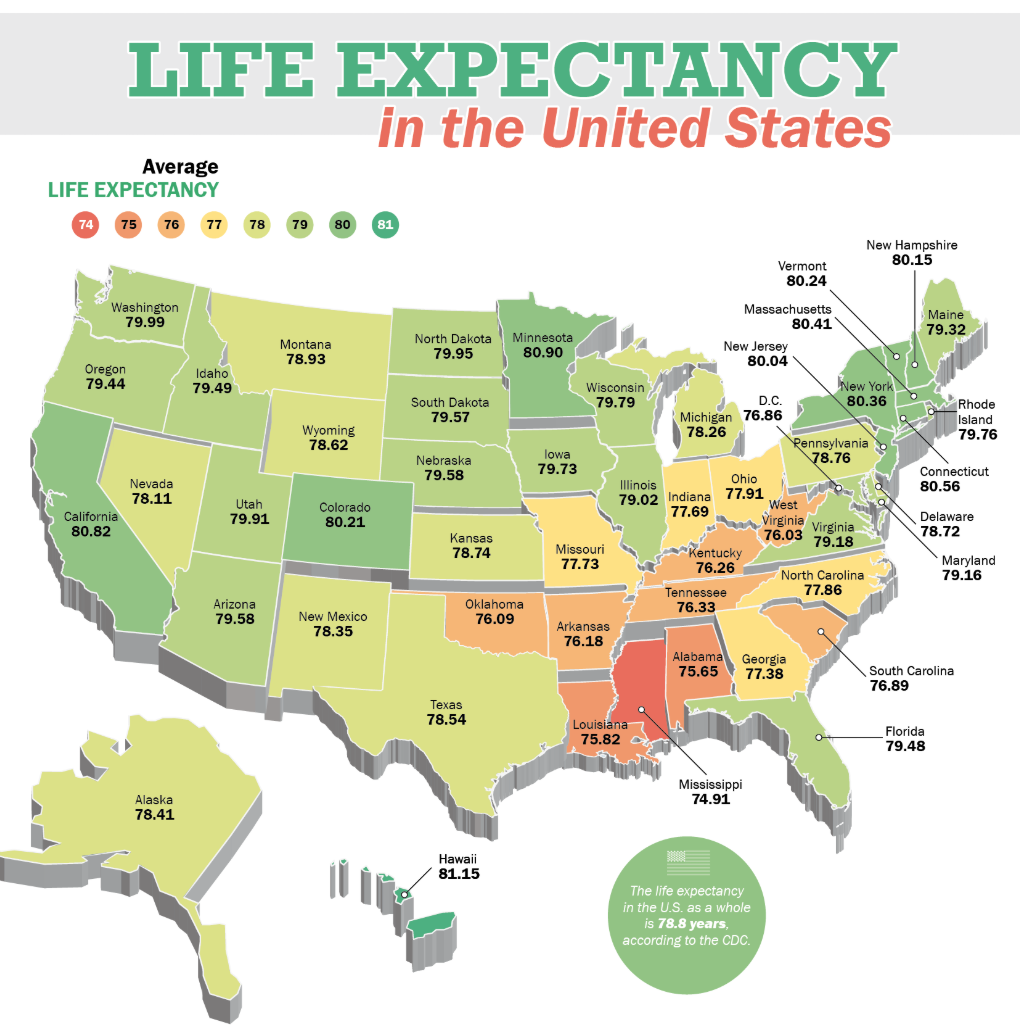

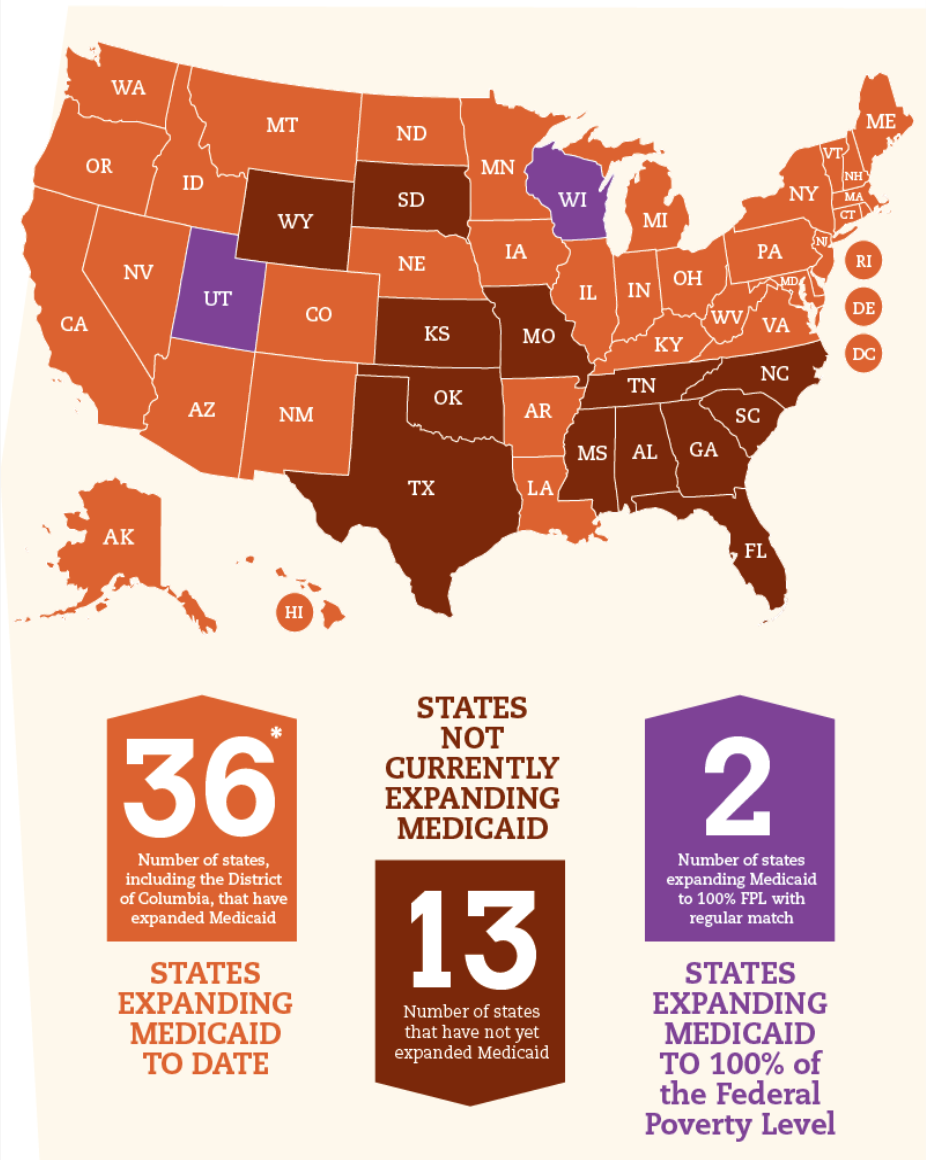

Life Expectancy vs ACA Medicaid Expansion Gallery eBaum's World

Annuity Life Expectancy Table

Medicaid Annuity Life Expectancy Chart

Florida Medicaid and SSA Life Expectancy Tables The Importance of

Annuity Life Expectancy Table

Annuity Life Expectancy Table

Life Expectancy vs ACA Medicaid Expansion Gallery eBaum's World

Annuity Payout Rates for Life Annuities Advantage Wealth Planning

Annuity Life Expectancy Table

Web Life Expectancy Death Probability A Number Of Lives B Life Expectancy;

Web The Annuity Must Be Actuarially Sound (This Means That The Annuity Must Return The Individual’s Premium Investment Within The Same Individual’s Life Expectancy As Set.

Web The Annuity Must Be Actuarially Sound, Which Means It Cannot Exceed The Life Expectancy Of The Individual Receiving Annuity Payments.

Web Here Are Two To Try:

Related Post: