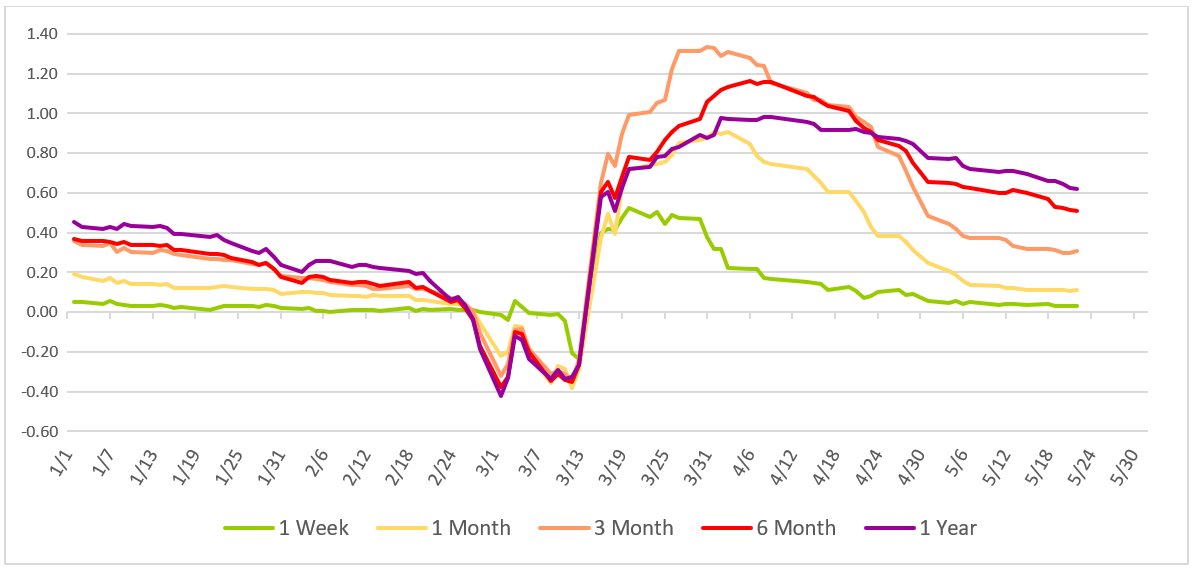

Libor Vs Sofr Chart

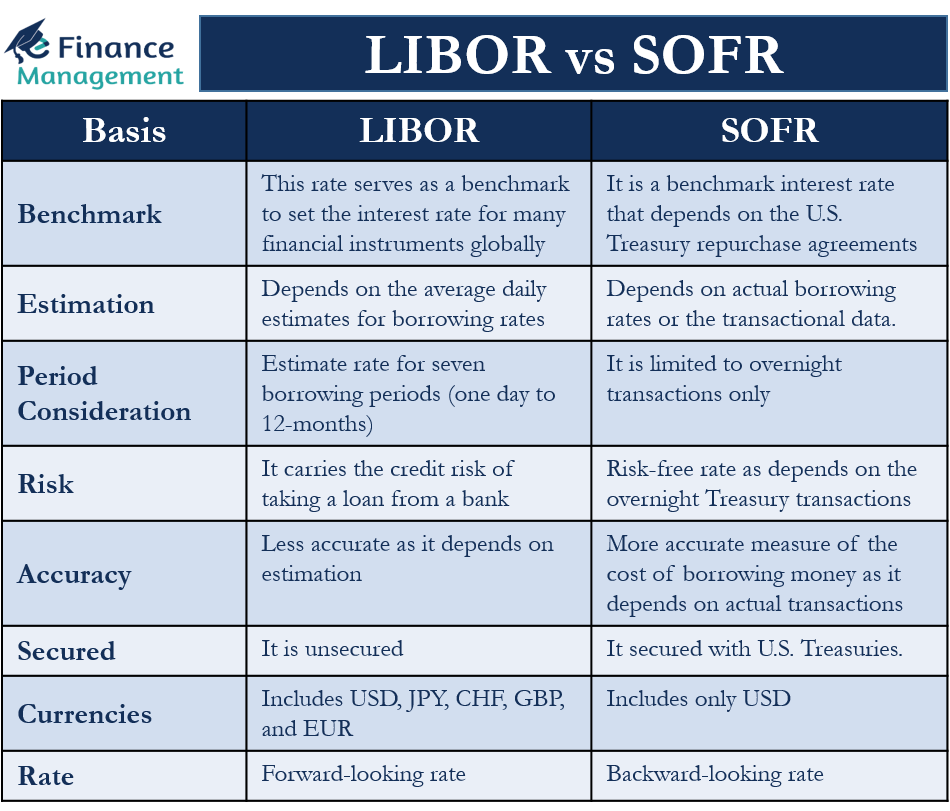

Libor Vs Sofr Chart - Treasury repurchase agreements data, reflecting borrowing cost in overnight borrowing collateralized by u.s. Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. Morgan’s preferred alternative to usd libor. Bis juli 2023 für ausgewählte usd libor laufzeiten sollten alle verbleibenden abhängigkeiten zu. As its name indicates, sofr is an overnight rate. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. To be fair, the transition away from libor could be challenging, since the arrc’s recommended alternative reference rate (arr) — the secured overnight financing rate (sofr) — differs from libor in some key ways. While libor was based on panel bank input, sofr is a broad measure of the cost of borrowing cash overnight collateralized by u.s. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. There are three major differences between sofr and usd libor. Web the main difference between sofr and libor is how the rates are produced. Bis juli 2023 für ausgewählte usd libor laufzeiten sollten alle verbleibenden abhängigkeiten zu. Bis anfang des jahres 2022 bzw. Morgan’s preferred alternative to usd libor. Treasury repo market was able to weather the global financial crisis and the arrc credibly believes that it will remain active. Treasury repo market was able to weather the global financial crisis and the arrc credibly believes that it will remain active enough in order that it can reliably be produced in a wide range of market conditions. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a. While libor was based on panel bank input, sofr is a broad measure of the cost of borrowing cash overnight collateralized by u.s. Web there are some key differences between libor and sofr. Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. Department of the treasury’s office of. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Morgan’s preferred alternative to usd libor. The secured overnight financing rate (sofr) is the benchmark rate derived from transactions observed in the treasury “repo” market and is anticipated. The transaction volumes underlying sofr regularly are over $1 trillion in. The transaction volumes underlying sofr regularly are over $1 trillion in daily volumes. Web the federal reserve board on friday adopted a final rule that implements the adjustable interest rate (libor) act by identifying benchmark rates based on sofr (secured overnight financing rate) that will replace libor in certain financial contracts after june 30, 2023. Web sofr is based on. While libor was based on panel bank input, sofr is a broad measure of the cost of borrowing cash overnight collateralized by u.s. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. Web the federal reserve board on friday adopted. Why is libor being replaced? Web the secured overnight financing rate (sofr) is j.p. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Sofr is produced by the federal reserve bank of new york (frbny) for the public good; In. What is sofr rate today? For example, sofr is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web the main difference between sofr and libor is how the rates are produced. Bis anfang des jahres 2022 bzw. Sofr is produced by the federal reserve bank of new. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. While libor was based on panel bank input, sofr is. Web the london interbank offered rate (libor) was a global interest rate benchmark used to determine interest rates for various financial instruments. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. In singapore, sor and sibor were also widely used. Web sofr is a much more resilient rate than libor was because of how it is produced and the depth and liquidity of the markets that underlie it. As its name indicates, sofr is an overnight rate. Treasury repo market was able to weather the global financial crisis and the arrc credibly believes that it will remain active enough in order that it can reliably be produced in a wide range of market conditions. Web the federal reserve board on friday adopted a final rule that implements the adjustable interest rate (libor) act by identifying benchmark rates based on sofr (secured overnight financing rate) that will replace libor in certain financial contracts after june 30, 2023. • it is a rate produced by the federal reserve bank of new york for the public good; For example, sofr is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. What is sofr rate today? In singapore, sor and sibor were also widely used for various sgd denominated financial instruments. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Bis juli 2023 für ausgewählte usd libor laufzeiten sollten alle verbleibenden abhängigkeiten zu. While libor was based on panel bank input, sofr is a broad measure of the cost of borrowing cash overnight collateralized by u.s. Treasury repurchase agreements data, reflecting borrowing cost in overnight borrowing collateralized by u.s. Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. Web the main difference between sofr and libor is how the rates are produced. Web die umstellung von libor auf alternative risikofreie zinssätze, wie €str und sofr, muss in einem engen zeitrahmen erfolgen: As an overnight secured rate, sofr better reflects the way financial institutions fund themselves today.

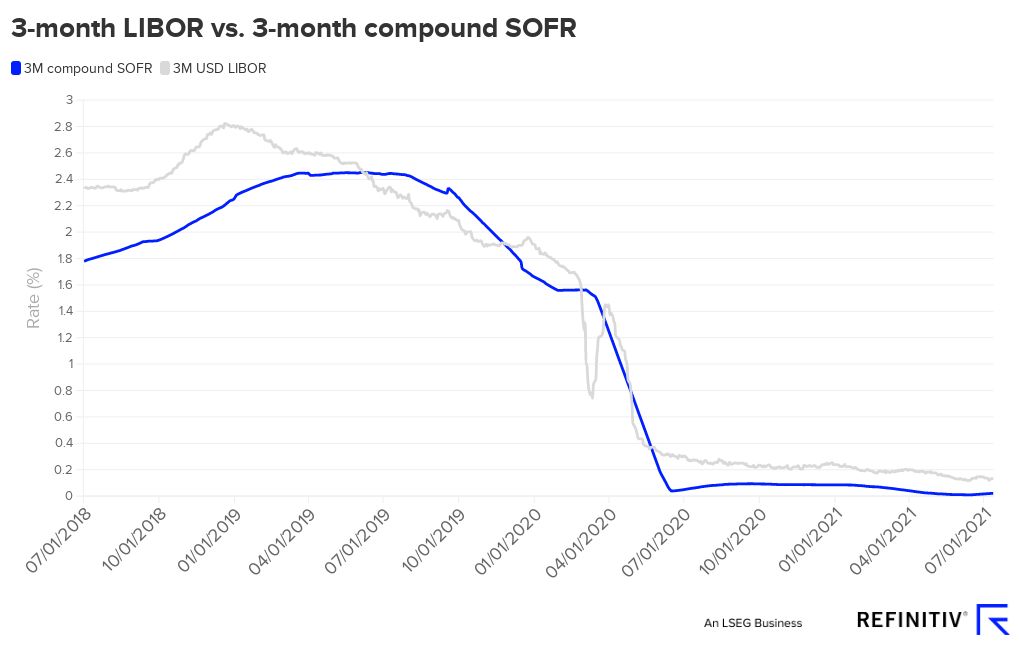

3month LIBOR vs. 3month compound SOFR Flourish

The LIBOR Transition Mission Capital

The impact of Reference Rate reform Transition from LIBOR to SOFR

Libor To Sofr Spread

Libor Vs Sofr Rate Chart 2023

The LIBOR Transition, Part 2 Challenges Associated with SOFR

Comparing LIBOR, BSBY & SOFR Curves LSTA

LIBOR vs SOFR Meaning, Need, and Differences

Flooring It! LIBOR vs. SOFR LSTA

LIBOR to SOFR Are You Ready?

To Be Fair, The Transition Away From Libor Could Be Challenging, Since The Arrc’s Recommended Alternative Reference Rate (Arr) — The Secured Overnight Financing Rate (Sofr) — Differs From Libor In Some Key Ways.

Web Sofr Is Based On Transactions In The Treasury Repurchase Market And Is Preferable To Libor Since It Is Based On Data From Observable Transactions Rather Than Estimated Future Borrowing Rates.

Web The Secured Overnight Financing Rate (Sofr) Is J.p.

Web Sofr Vs Libor The Secured Overnight Financing Rate Is Seen As An Alternative To The London Interbank Offered Rate, Which Is A Benchmark For $200 Trillion Of U.s.

Related Post: